AI: Is CoreWeave’s $35B IPO an AI Hyperscaler or a GPU Debt Trap?

CoreWeave is set to be the most anticipated tech IPO of the last few years as investors prepare for the first pure play AI IPO opportunity available to the market.

Hi Fintech Futurists —

Today’s edition is for premium subscribers as we dissect the Coreweave IPO. Check out the preview and consider upgrading.

AI: CoreWeave IPO highlights industry interdependencies in AI’s Circular Economy

In this article, we discuss CoreWeave’s upcoming IPO, which is projected to raise $4 billion at a valuation of over $35 billion, making it the first major AI cloud provider to go public. The company has grown its revenue from $15.8 million in 2022 to $1.9 billion in 2024, but remains deeply unprofitable due to heavy infrastructure investments and $10 billion in debt financing. CoreWeave's success is intertwined with major industry players like NVIDIA, OpenAI, and Blackstone, forming a circular financial ecosystem where capital and hardware dependencies reinforce each other. However, concerns remain about its reliance on Microsoft, the sustainability of AI infrastructure demand, and competition from hyperscalers like xAI, Amazon, and Google. As the first pure-play AI IPO, CoreWeave’s market performance will set the tone for investor appetite in AI infrastructure businesses in 2025.LONG TAKE: Will Fintech Deregulation make up for a $1.5T Hit to the Economy?

PODCAST: Building a Trustless Supercomputer for Web3 and AI, with Arweave's Founder Sam Williams

CURATED UPDATES: Machine Models, AI Applications in Finance, Infrastructure & Middleware

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options here.

AI: CoreWeave IPO Spotlights Industry Interdependencies In AI’s Circular Economy

One of the most anticipated tech Initial Public Offerings (IPOs) in 2025 is CoreWeave — the first pure play AI IPO opportunity in the market. It will set the pace for a backlog of companies looking to go public in frontier technology.

CoreWeave was originally founded as a cryptocurrency mining entity named Atlantic Crypto, but has pivoted into becoming the leading AI cloud. The IPO is projected to raise $4B at a valuation of over $35B, highlighting the state of the AI economy and how different players are working to support (or prop up) the industry.

The company is generating nearly $2B of revenue, which suggests a P/S ratio of about 18x — somewhat reasonable if you think the revenue is recurring and the losses don’t matter.

The company was founded by Michael Intrator (Chief Executive Officer), Brian Venturo (Chief Strategy Officer), and Brannin McBee (Chief Development Officer). Chen Goldberg joined from Google Cloud as Senior VP of Engineering, with prior experience leading Google’s Kubernetes and serverless operations. The founding team has a background as commodity traders — rather than AI engineers — which gave them an advantage in computational demand forecasting, latency optimisation, and infrastructure funding strategies that were essential to building Coreweave as a financial asset levered against demand for AI compute capacity.

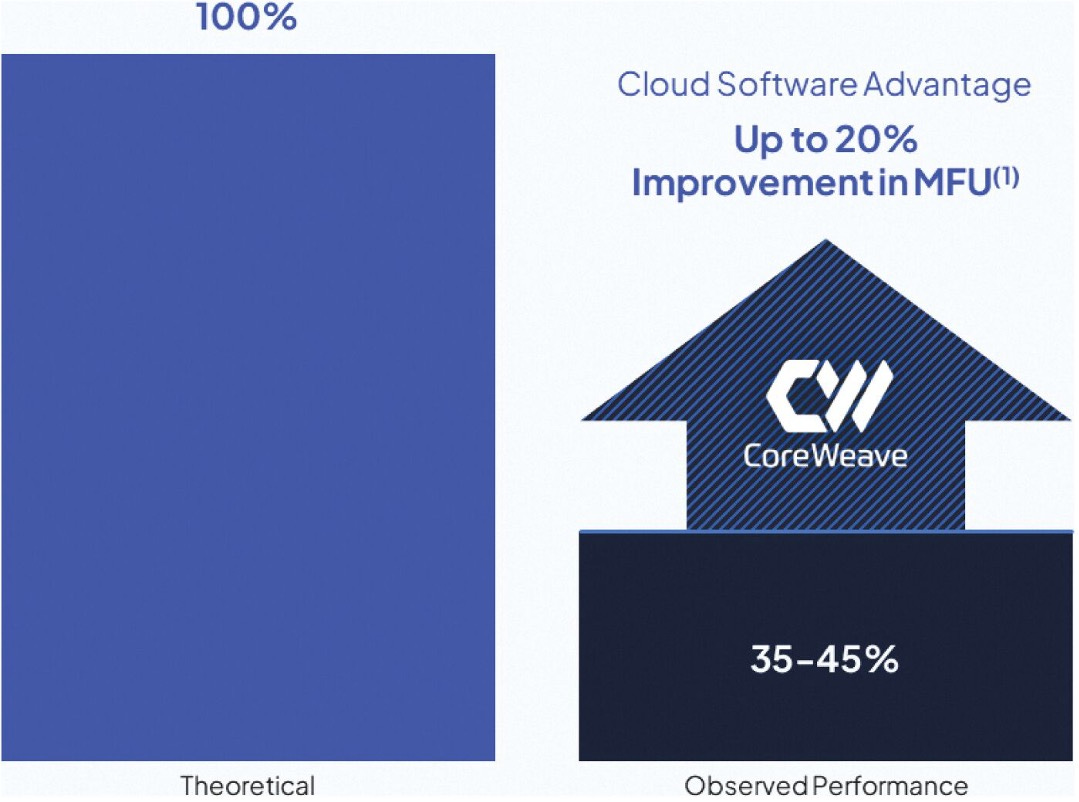

There are technical breakthroughs in order to offer products at such a large scale. CoreWeave found efficiency gains in the way servers and Cloud access for AI is designed, which has led to a 20% improvement in Model FLOPS Utilisation (MFU) — a common metric of efficiency for assessing model training efficiency.

CoreWeave has branded itself as an "AI Hyperscaler," emphasising its focus on GPU-powered cloud computing infrastructure and supporting software designed explicitly for AI-native applications. For example, it uses Containerised Environments, rather than Hypervisors in Virtualised Environments, compared to key competitors such as Amazon Web Services (AWS), Azure and Google Cloud Platform (GCP).

We can see the company highlighting its advantages below as Infrastructure Services, Managed Software Services, and Application Software Services.

The company has recently acquired Weights & Biases, a platform to track and manage machine learning experiments, useful for MLOps and LLMOps for future customers. The Weights & Biases customer and engineer portfolio is also strategic for future customer growth and ongoing tech development by integrating vertically towards AI developers.

Coreweave has 32 data centres across the US and Europe, operating over 250,000 GPUs, the majority of which are NVIDIA Hopper models. It was also among the first cloud providers to deploy high-performance infrastructure with NVIDIA H100, H200, and GH200, and the first cloud provider to make NVIDIA GB200 NVL72-based instances generally available.

To put this into perspective, xAI made headlines in 2024 by creating the world’s largest supercomputer called the Colossus Cluster, which was first built utilising 100,000 NIVIDIA Hopper model GPUs. xAI was recently able to double this number to 200,000 and plans to build out a 1 million GPU computer cluster in the future.

It is unclear whether GPU capacity has any strong network effects in the future.

CoreWeave has also been able to secure power deals with 360 MW of current active power and contracts extending up to 1.3 GW. Even competitors like Microsoft find this challenging.

"I am power-constrained, not chip-constrained... we were definitely constrained in 2024..." – Satya Nadella

Explosive Growth and Financial Health

CoreWeave’s financial trajectory is impressive.