Analysis: Multi-billion mispricing of RWA & Stablecoin projects like Ondo and Provenance

Bitcoin reserves and risk-off moves will make money markets even more relevant

Gm Fintech Architects —

Today is the last Long Take of the 2024 year.

We will resume our usual content schedule in early January. Happy holidays, and we wish the best to you and your families.

Let’s dive into the following topics:

Summary: As Bitcoin investors cash out their winnings, they will put cash into stablecoins and real-world asset (RWA) tokens. We discuss how structured financial products like Ethena's USDe are exploiting crypto's long-bias funding rates to deliver yields up to 25%, while traditional-like fixed-income products wrapped in crypto packaging are gaining traction. Despite the growth, market inefficiencies persist, with projects like Ondo trading at significant premiums, and those like Provenance at significant discounts. These differences reflect pricing discrepancies influenced by geography and investor profiles. We emphasize the potential for arbitrage to address inefficiencies and create opportunities for savvy investors.

Topics: MicroStrategy, PayPal, Visa, Stripe, Revolut, Aave, Morpho, Ethena, Lido, MakerDAO, Provenance, Goldman Sachs BDC, Usual Money, Ondo, Maple Finance, Tether, BlackRock, RWA.xyz.

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

AI-focused Newsletter

We are also building out an AI focused newsletter. Here’s the most recent article.

Google has launched Whisk, an experimental AI tool that reimagines image generation by relying on images, not just text prompts. Part of Google Labs' experimental offerings, Whisk allows users to upload or create images while mixing and matching elements like subject, style, and scene. Google's language model—likely Gemini 2.0 Flash—automatically generates descriptions for the input images, which are then processed through the Imagen 3 model to produce the final visuals. Unlike typical generators, Whisk focuses on creative brainstorming over precise replication, extracting key elements rather than duplicating exact details.

Long Take

Revisiting Cash and Real World Assets

The crypto markets are booming.

This is driven in large part by MicroStrategy's leveraged purchase of Bitcoin, which continues to issue debt and buy Bitcoin. Several nations have also mentioned building a strategic Bitcoin reserve — the US, Brazil, Poland, Japan, and Russia — which is squeezing up the price.

As investors make money, they look to take risk off the table.

This is done by shifting out of risk-on assets, like BTC, and into risk-off assets, like cash, money market funds, fixed income, and in the Web3 world of stablecoins. In addition, stablecoins are finally getting recognized as fintech infrastructure — a way to access bank-like and payments-like functionality onchain without the friction of prior systems.

More and more commercial applications of stablecoins have emerged, with everyone from PayPal, Visa, Stripe, to Revolut exploring new products.

So as the capital appreciation machine winds up, so does the wealth effect and associated spending.

The second thing to note is that there is a momentum effect that results in a desire for long bias and leverage. That means that when things are going well, more people want to participate in the markets. In traditional equities analysis, there is a statistically significant outperformance factor called “momentum”. In Internet degen terms, just think of Gamestop and the Robinhood crowds bidding up memetic assets.

In a brokerage account, you would go on “margin” to borrow more spending capacity. That margin is collateralized by your portfolio. In crypto, you would go to a collateralized lending DeFi protocol, like Aave or Morpho to get the leverage.

Below is a chart showing USDC on Aave. You can see that supplying, or lending, the USD stablecoin provides over 10% in interest. This interest comes from others wanting to borrow USDC in order to, most likely, get leverage.

The other source of leverage in crypto is expressed in something called “funding rates”. For equities, people gamble on prices through the purchase of Options. In crypto, we have Perpetuals, which are options that don’t expire and have a price for going long. That price is the funding rate.

You can see it in the green bars in the above chart — the desire to go long an asset, and the interest an investor is willing to pay to do so. Notably, the pattern of long bias is sticky and consistent. People rarely want to short these assets.

Synthetic dollar structured products, like Ethena’s USDe, exploit this desire to go long by isolating it from the underlying exposure to the asset and bundling it with a USD-pegged derivative. This results in USDe being able to pay out around 25%, instead of just the 15% you see on Aave.

In the chart above, which tracks USDe’s rise in total assets to $4B in barely a year, we see the high interest rate delivered back to the holder. For traditional finance readers, you can think of Goldman Sachs packaging up a derivative instrument like this which incorporates a basis trade, a treasury yield, and some good old-fashioned credit risk.

All this to say, people have new cash as proceeds from crypto capital price appreciation. They are likely to have even more cash within the next 6-12 months. That cash will be derisked into fixed income and money market-like products. Those products could be novel derivative ones in the crypto markets. Or, they could be “real world assets”, which are traditional fixed income products wrapped in various token packaging.

The best analytics dashboard for this stuff continues to be RWA.xyz:

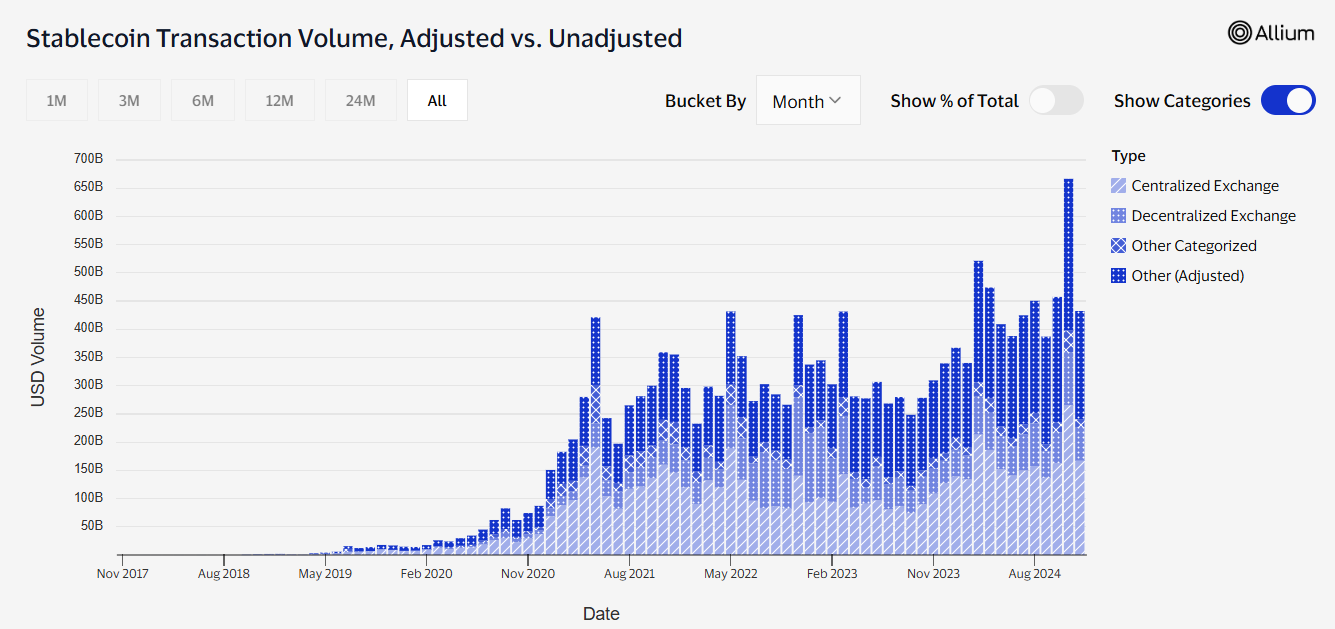

Stablecoins now have over $200B in value, and private credit — the second largest category — is showing around $15B in value.

We think the normal case for these numbers is around $500B by 2025 year-end. The down case is probably back to $100B, and the bull case is $1 trillion.

And yet despite all this attention and asset flow, the space is still highly inefficient and poorly priced on a relative basis. Some people think that regulatory certainty and clear ownership of traditional assets will be the answer. Yet Tether is by far the most successful stablecoin and has no interest in playing by the rules Europe is putting together, nor does it seem to suffer much in its market share. Some onchain projects with a high amount of synthetic assets are competing for mind-share with tokenized version of BlackRock funds, and so on.

There is very little clarity on why and how things are getting priced. And so we wanted to point out a couple of things on a comparative basis to highlight future opportunities.

Non-comparable Comparables

Let’s look at a set of pretty different projects. This will help map the extremes. They are listed below, with some prior relevant coverage:

Lido: A staking protocol that takes ETH and stakes it for a 3-5% return. It has a governance token with limited utility.

Aave: A lending protocol that powers collateralized lending and borrowing, with rates driven by market demand and assets representing loans outstanding.

Provenance: A blockchain that tokenizes the mortgages issued by neo-lender Figure for processing, with yields generated based on the HELOC markets.