Analysis: Our 2025 Market Overview & Investment Outlook

Bitcoin, NVIDIA, and MicroStrategy lead Asset rally as USD devalues

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: In this article, we analyze macroeconomic, crypto, AI, and fintech trends through Q2 2025. High interest rates persist despite inflation fears, but rising debt levels and political shifts suggest continued fiat debasement, benefiting Bitcoin and stablecoins. In crypto, Web3 integration by fintechs like Stripe and Robinhood has revived tokenized securities, while memecoins and high-FDV altcoins fade amid regulatory and market exhaustion. AI remains a growth engine, with infrastructure and application players seeing rapid revenue gains and M&A activity, though neocloud debt issues could pose risks. Fintechs are maturing into software-driven super apps and increasingly adopting blockchain infrastructure, with 12–24 months of strong IPO and M&A activity expected.

Topics: NVIDIA, BTC, ETH, MicroStrategy, Trump, Circle, Coreweave, Robinhood, Stripe, Coinbase, Revolut, Aave, Uniswap, Hyperliquid, Bridge, Privvy, BlackRock, Franklin Templeton, Van Eck, Bittensor, Virtuals, Anthropic, OpenAI, Google, Meta, SoFi, Chime, Public, Ramp, Brex, Altruist, Synapse, Evolve

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

AI & Finance Comment

Before we hop into the main content today, I want to highlight two developments from large AI companies that stuck out. While there is a trend of industry-focused companies going after niches, like seeing a risk-focused or underwriting company use AI to improve workflows, the much larger trend is when Big Tech AI companies pivot into finance and lock everything down. And that’s what is starting to happen.

Anthropic, the $60B Open AI competitor with a focus on developers and B2B, has launched “Claude for Financial Services”. Financial-related inference accuracy is still bad — about 40-50% according to their own benchmarking, but firms are able to wrap the intelligence in workflows and data that make it useful.

The use cases span financial data analysis and research, compliance and underwriting, investment banking workflows, and software development automation. A few big names, like Morningstar, Pitchbook, Deloitte, Bridgewater, and AIG are involved. Since Anthropic is also the layer for Modern Context Protocol, a lot of the integrations can be off-the-shelf. Financial Services is a large lever for Claude and I expect they will continue to push forward here aggressively.

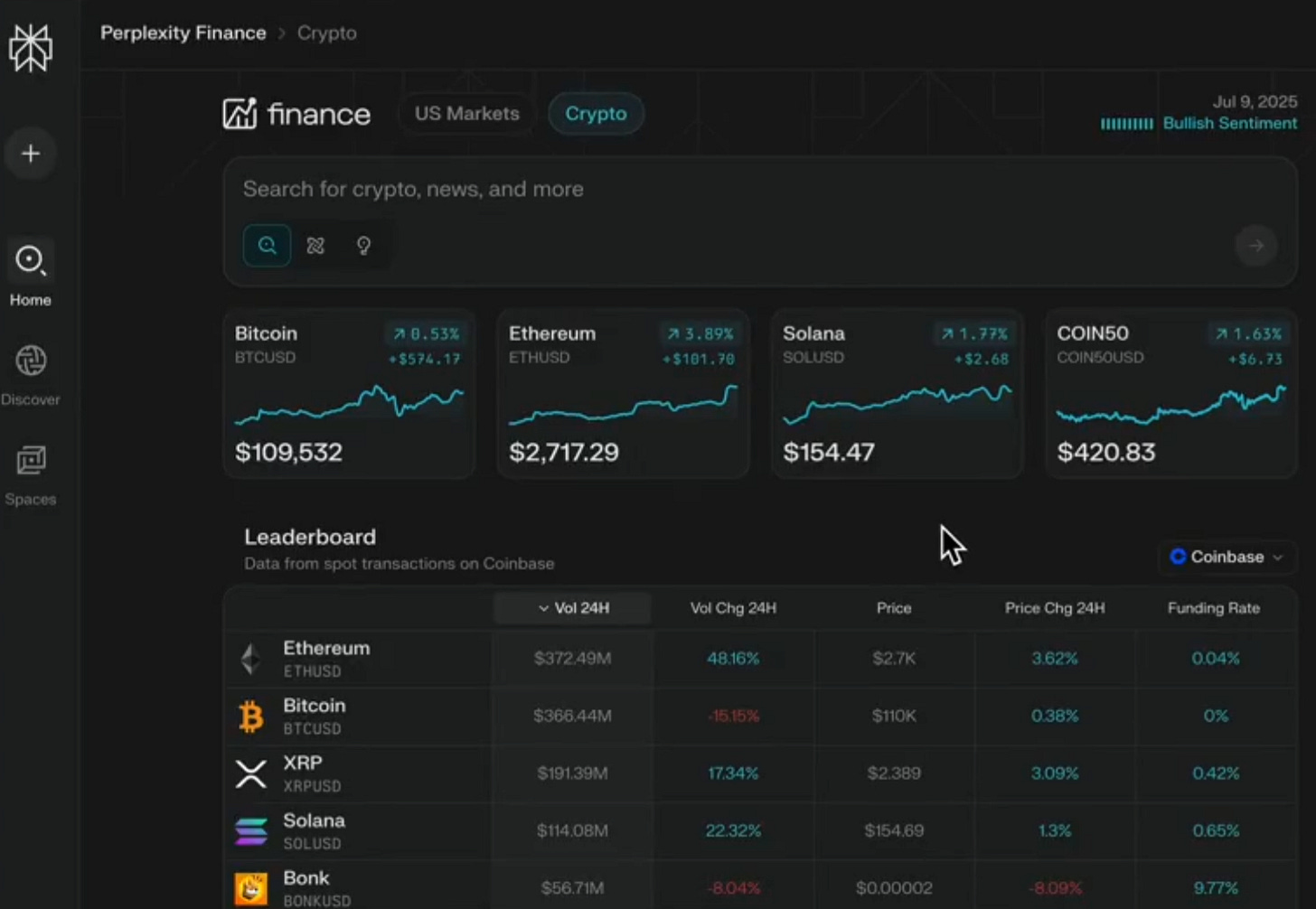

The second development comes from Perplexity, the AI wrapper company. Its biggest news is the launch of Comet, an agentic browser to take on Chrome. But specific to Fintech, the company announced a partnership with Coinbase where Perplexity ingests crypto data from the exchange to power up the below dashboard.

The next steps for integration would be to move from “read only” to connecting to wallets and executing transactions. In my mind, Comet reminds me of the Brave Browser, which had built-in crypto capabilities and paid you for browsing in a particular way. Perhaps Perplexity can make the browser itself better, and as a result, earn the right to also be the financial wallet underneath.

2025 Investment Outlook

I recently shared the below market analysis and investment outlook with our supporters at Generative Ventures, and it should be of interest to you as well. We cover macroeconomics, fintech, AI, and crypto developments as a survey up to Q2 of 2025.

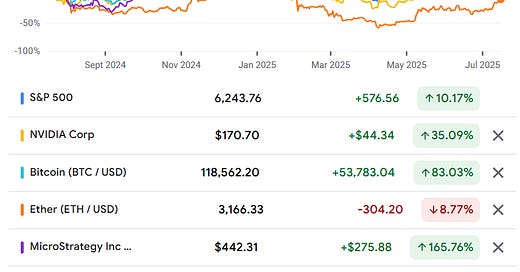

Above, we show performance over the last year for equity markets (+10%), NVIDIA as an AI proxy (+35%), BTC (+85%), ETH (-10%), and Microstrategy as a proxy for crypto in equity markets (+165%). The macro correlation between all these risk-on assets is plain to see.

Earlier in the spring, Trump’s tariffs and subsequent spending bill revealed that the tech libertarian wing of US politics has lost control, and we are back on the debt and fiat debasement path. AI has managed to recover from its confidence crisis, although financial engineering problems remain bundled in. The most surprising positive news for us has been the adoption of Web3 by Fintechs, a trend that is likely to provide fundamental support for the next 9-12 months.

We unpack these ideas below and discuss our outlook on each sector.