Analysis: Rewiring the money stack with MetaMask Dollars

The stablecoin stack is going modular, breaking up issuance, infrastructure, and UX

Gm Fintech Architects —

We have a treat for you today.

Luca Prosperi, a good friend of the publication and founder of the $300MM stablecoin issuer platform m0, is authoring today’s analysis on a groundbreaking collaboration between MetaMask, Bridge, and his company.

Summary: We explore how the launch of mUSD, a new stablecoin collaboration between MetaMask, Bridge (a Stripe company), and M0, signals a major shift in digital money architecture. Rather than relying on vertically integrated models, mUSD separates the stack into three layers: MetaMask controls user experience, Bridge acts as the regulated issuer, and M0 provides infrastructure for interoperability, accounting, and liquidity. This modular approach challenges legacy banking’s monolithic structure and allows for scalable, transparent, and non-custodial digital money systems. We argue this model will define the future of programmable, user-focused money infrastructure.

Topics: MetaMask, M0, Bridge, Stripe, mUSD, Linea, Consensys

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

Our Ecosystem: AI Venture Fund | AI Research | Lex Linkedin & Twitter | Sponsors

MetaMask Dollars

Rewiring The Money Stack

Author: Luca Prosperi

Money, I often joke, is the most complex mass-adopted product there is.

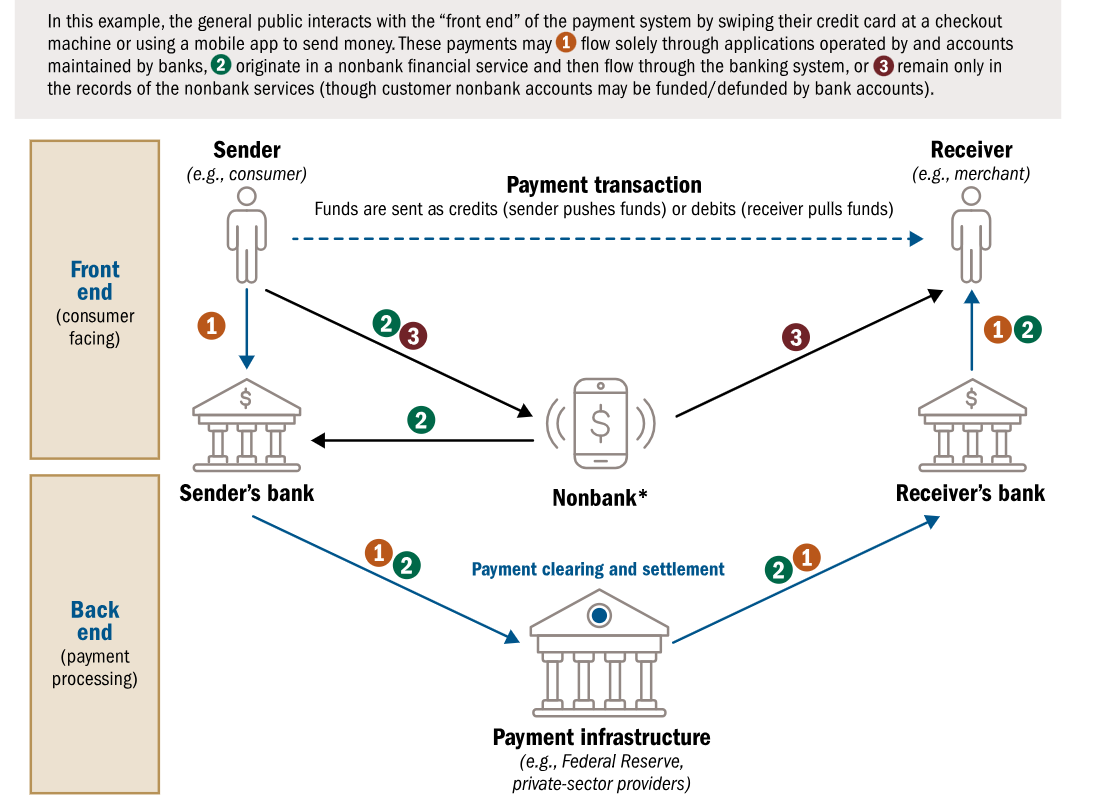

Everyone uses it, yet very few understand what powers that abstraction in practice. The separation between hard measurable reality and the idea of value has been simmering for so long that most of us have stopped noticing it. Most people ignore, or are uninterested in, the reality: that behind the dollar balance we see on a PDF statement, or in Venmo, Revolut, or a stablecoin wallet, rather than some measurable certainty, there is simply a system of checks and balances designed to ensure that, most of the time — but not always, the money (or value) will be there when we ask for it.

This complex and multilayered system ultimately connects the creditworthiness of lending institutions, facilitates deposits by storing the value we create, and enables digital applications to build entire dictionaries of product features on top. In this sense, money is not really a product at all. It is infrastructure.

The monetary system as we know it today was shaped in the wake of the Bretton Woods system’s collapse in 1971, resting on an intricate and tightly interwoven relationship between the state treasury, the central bank, and (often national) commercial banks — a framework that has since defined the contours of global finance and economic policy. Over time, however, the system has revealed its critical limitations, from geographical balkanization to poor risk management and governance inefficiency, as well as its inability to meet the demands of an increasingly digitally native economy.

As a result, users are increasingly turning to digital financial applications, where technology companies mediate interactions, shaping user experience and education. Today, when managing their finances, consumers engage primarily with productized front ends rather than directly with the financial institutions authorized to store and manipulate the underlying financial aggregates.

It is actually way messier than that. Behind these often global, hyper-efficient technological realities sit antiquated, fragmented, and technologically barren financial custodians — institutions bloated by legacy systems and inertia. They do not add much value, and instead absorb enormous rents from their position as gatekeepers.

The Premises of M0

Rooted in the early innovations of decentralized money, the foundation of M0 was based on a few fundamental convictions:

Money infrastructure is undergoing its deepest transformation in a century, driven by distributed ledgers, for both money issuance and money movement.

Money is a network asset, and like all network assets, it thrives on interoperability and shared liquidity.

Money’s future is non-custodial: fintech apps will evolve into frontends that connect to non-custodial rails behind the scenes. The future is wallet-centric.

Money issuance and money movement will unbundle: the power to issue and the ability to distribute will no longer sit inside the same black box.

Some of those convictions are difficult to grasp, given that we are still conditioned by the monolithic financial structure of the past.

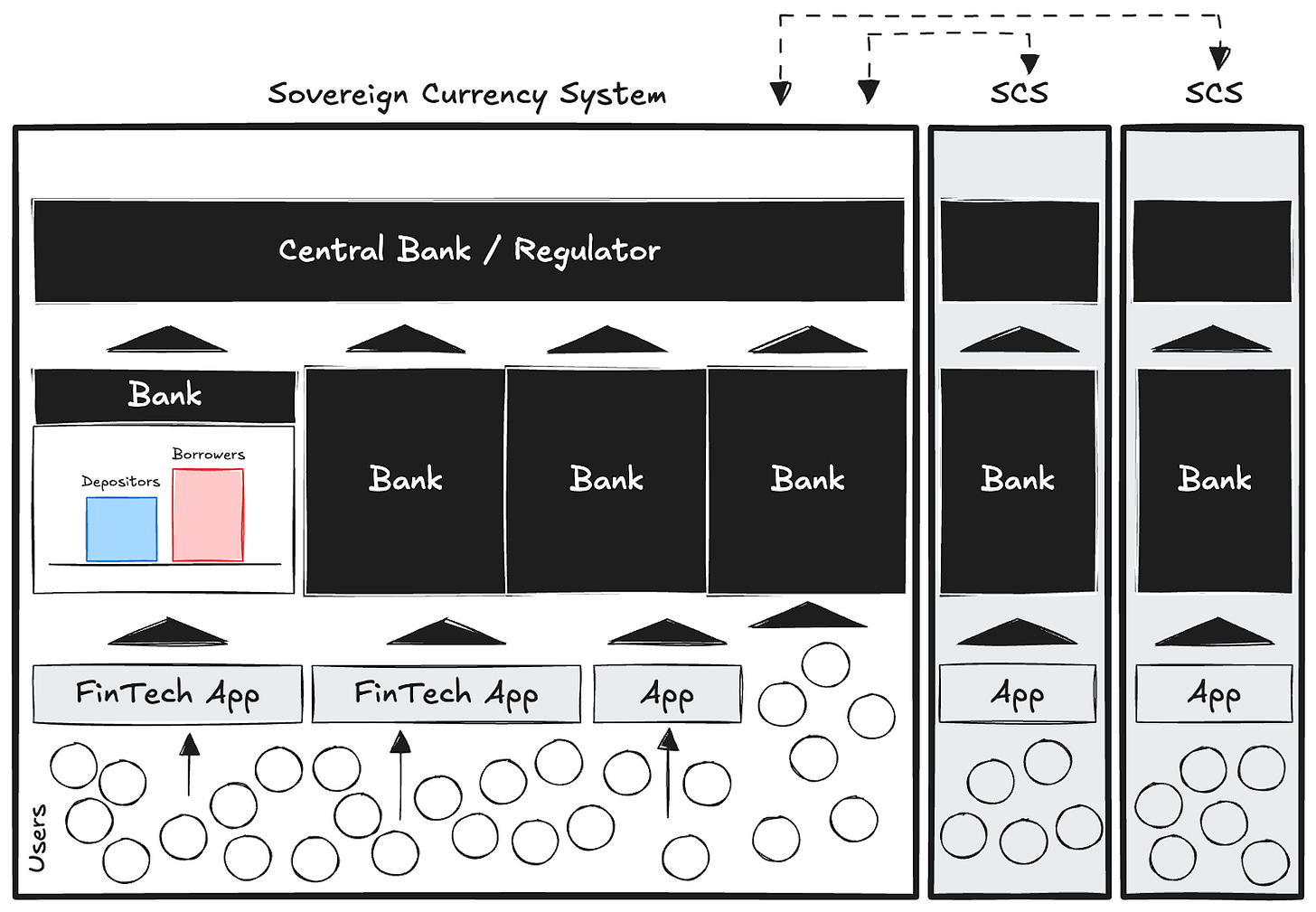

For most of our lifetimes, commercial banks enjoyed a monopoly both on monetary creation (powering the ephemeral balances in our accounts) and on distribution—providing financial products. That monopoly has already been unbundled for institutions, but retail finance resisted disruption.

First-generation fintech focused on peripheries (payments, exotic transfers, trading, etc.) rather than on the monetary core—the balance between assets and liabilities. Stablecoins, as disruptive as they are, remain in this context simply the necessary continuation, and acceleration, of a long-running process.

From Monolith to Network

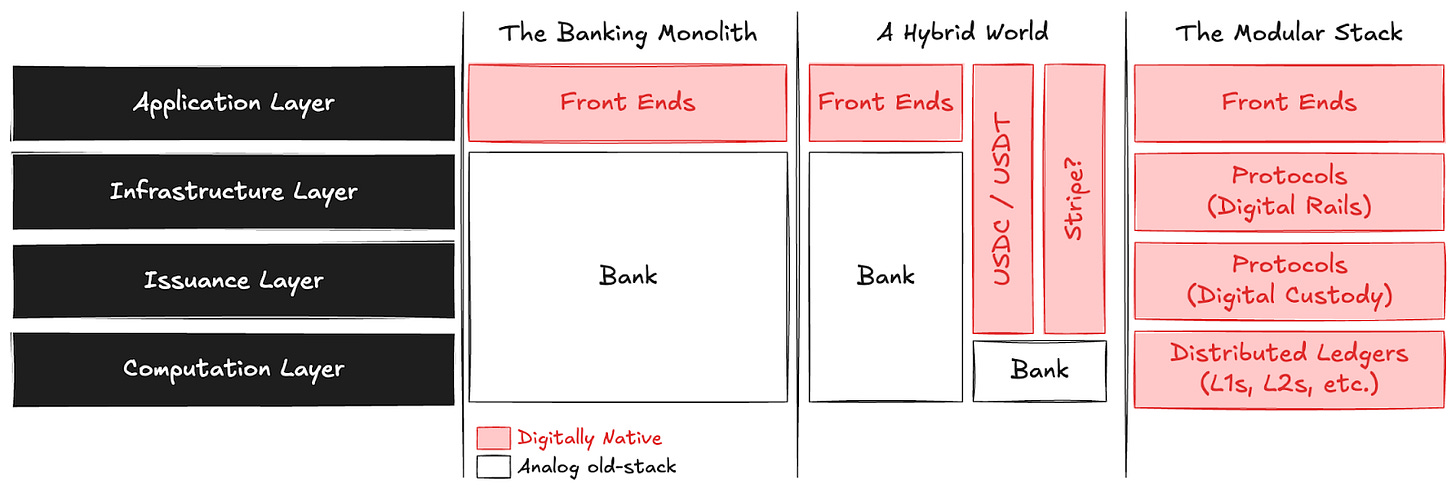

The truth (uncomfortable for incumbents) is that there is no intrinsic need, beyond regulatory inertia, to keep everything locked inside the banking monolith. Market forces are already shaping regulatory innovations — see GENIUS, and with enough ingenuity, we can already imagine money creation that bypasses the old rails.

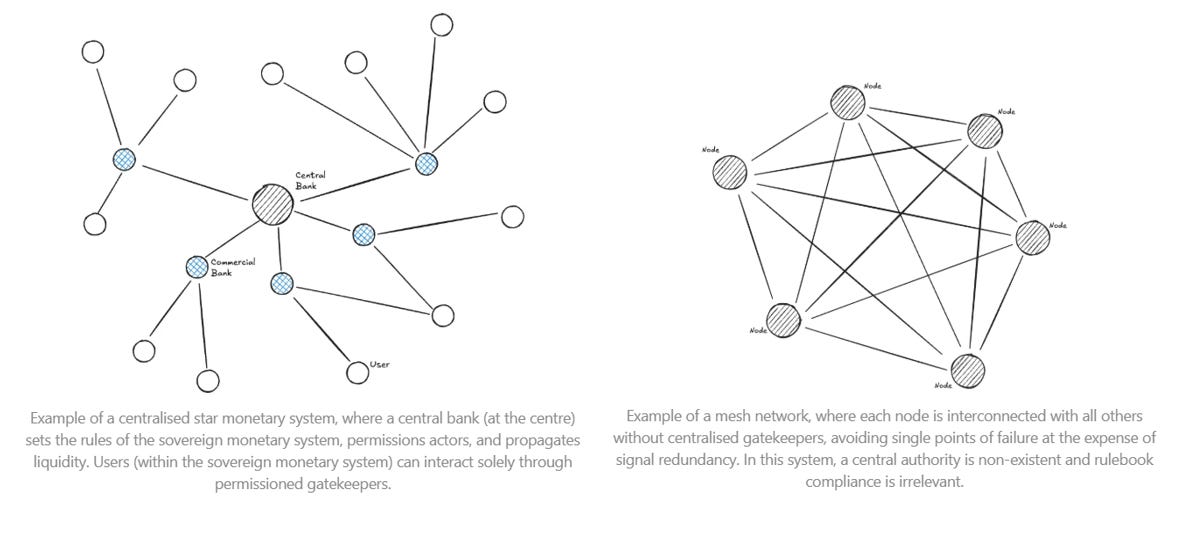

The future of money is not predetermined, but shaped by competing forces that reshape the very topology of monetary trust networks. As I argued in an essay on monetary topology, money draws its value not from some inherent property, but from the network of mutual confidence that sustains it.

And the shape of that network matters. A topology dominated by hubs and bottlenecks allows for control points, where value accrues to those who stand between flows. A topology that is flatter and more distributed distributes trust more evenly, but struggles to resist the gravitational pull of efficiency and liquidity that markets reward.

At M0, our vision of the monetary system of the future is that of a non-dystopian, open-architecture, layered network that is powered by common standards, global access, and seamless composibility:

Issuance layer: often-regulated players holding reserves (collateral) and the licensing authority to bring to life (issue) digital money pegged to a sovereign currency system.

Application layer: builders of user-facing products, like deposit accounts, payment tools, trading instruments, insurance wrappers, gaming wallets, agent-ready rails, etc. — the interfaces through which people experience money.

Infrastructure layer: the middleware connecting issuance and application, and ensuring access, coherence, feature standardization, interoperability, shared liquidity.

Stacked together, these layers transform money from a messy and opaque monolith into a modular, truly global, network.

MetaMask <> Bridge <> M0

Over the past weeks, Consensys, Bridge, and M0 came together to launch mUSD, a new dollar-pegged asset designed specifically for the MetaMask ecosystem. The significance here goes well beyond the distribution power of what is arguably the largest wallet infrastructure in crypto, with tens of millions of monthly active users. What matters is the visible abandonment of the monolith and the collaboration of distinct entities, each operating at a different layer of the stack.

So, how does it work?

Application layer. MetaMask controls the smart contracts and all user touchpoints. It decides the brand, behavioural features, yield-distribution logic, and can add its desired compliance requirements. In other words, it owns the user relationship and their dollar experience. Yet, rather than building a vertically integrated issuance system, it relies on M0 for the infrastructural heavy lifting. The trade-off is clear: MetaMask focuses on user acquisition and UX, while outsourcing the complexity of stablecoin infrastructure and regulated issuance.

Issuance layer. Bridge (a Stripe company) acts as the issuer of record for mUSD. It holds the reserve assets, mints and redeems mUSD, and ensures that all legal and compliance obligations are met. In short: it is the regulated entity backing the unit of account.

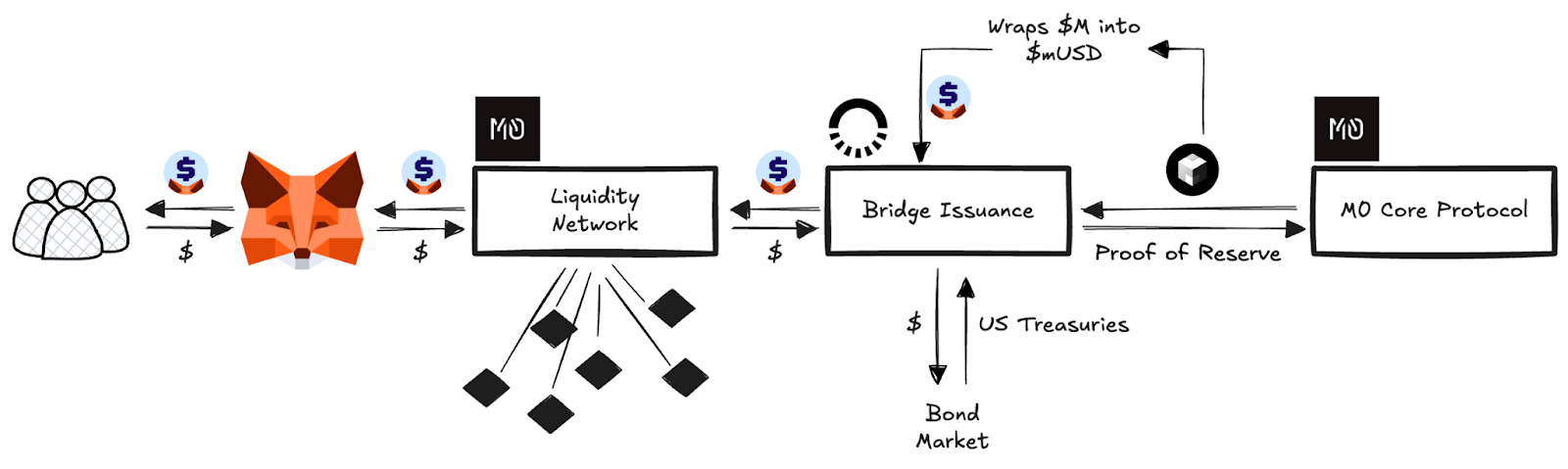

Infrastructure layer. M0 provides the connective tissue. The protocol and its adjacent smart contracts enforce security, permissioning, accounting, liquidity delivery, and yield distribution. It is the shared standard that ensures interoperability, aligns economics, and allows issuers (Bridge) and distributors (MetaMask) to integrate seamlessly without collapsing into a monolithic structure. The functional flows can be described, at a high level, in the chart below.

Users can acquire mUSD through traditional swap engines or permissionless liquidity pools, exchanging other stablecoins for entry. These pools (live both on Ethereum mainnet and on Linea L2) are continuously balanced by market makers. Bridge can onboard some of these actors as counterparties, empowering them to purchase newly minted mUSD when required.

On the issuance side, Bridge interacts with the M0 protocol to expand or reduce supply — the minting process occurs only against verifiable proof of reserves, short-dated U.S. Treasuries held securely. Bridge mints a fully fungible token, $M, which is then wrapped into MetaMask’s specific instance, mUSD. Through M0’s architecture, security of issuance, consistency of the monetary base, and distribution of protocol-led yield are all ensured — see M0 documentation.

This architecture is not limited to a single issuer or a single application. It is designed as a many-to-many system, avoiding duplication and instead pushing the ecosystem (progressively, and in line with regulation) toward interoperability and shared liquidity. The dynamic nature of this model also matters. Each layer of the stack can specialise: applications on user acquisition and product design, issuers on compliance and reserves, and infrastructure on security and liquidity routing — among other things. As the stack evolves, the outcome for users is a monetary system that is more transparent, modular, programmable, and fair — a network that breaks away from the legacy system, as well as from the natural monopoly of vertically integrated digital dollar issuers.

Crypto’s original impulse was to resist centralisation, and that impulse has not gone away. What we are describing here is simply the unfolding of market logic, combined with technological superiority. We believe that, in the near future, every user will interact with their monetary balances through abstracted frontends, and that those frontends will be built on wallet-centric, non-custodial infrastructure, rather than on a set of antiquated APIs and scraping engines built on top of balkanized core banking systems.

🚀 Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our AI newsletter, the Future Blueprint, 👉 here.

Read our Disclaimer here — this newsletter does not provide investment advice