Analysis: The vertical integration playbook for Revolut and Uniswap

Revolut’s new payment terminal strategy could unlock revenue streams by cutting transaction fees; Uniswap’s Unichain launch aims to recapture settlement and MEV fees previously lost to ETH

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We explore the parallels between fintech and DeFi through the vertical integration strategies of Revolut and Uniswap. Revolut, a fintech giant with $22B in deposits and $700B in annual transaction volume, is expanding into merchant services with its payment terminal, while Uniswap, a DeFi leader, is launching Unichain, a Layer 2 network designed to capture trading and liquidity fees. Revolut's and Uniswap's integration efforts aim to streamline operations and capture additional value, leveraging technology to reshape traditional financial structures. Both are examples of how vertical integration can drive profitability and create opportunities for businesses and users alike.

Topics: Revolut, Uniswap, Unichain, Flashbots, Optimism, Ethereum, FIS, Worldpay, Square, SumUp, Base, Arbitrum, Linea, Taiko, Solana.

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

Uncanny AI Money

We considered making the whole entry about this, and perhaps we will in the future.

In 1999, a viral Internet shock meme called Goatse (wiki link) took off. Don’t google it unless you want to see an extreme sexual act. It was used by trolls as an offensive prank, and became ingrained into the culture of early Internet forums, like Something Awful and thereafter 4chan.

In 2024, venture capitalist Marc Andreessen comes across a Twitter bot called truth_terminal. The bot is an AI agent that has a custom language model trained by Andy Ayrey on 4chan, Reddit, and other Internet culture meme drivel. The model happens to have invented a cyber-religion called the Goatse Gospel, described by Andy in this paper. It is hilarious, creative, edgy, stupid, brilliant, and divine.

Andreessen gives the bot $50,000 in Bitcoin to a Bitcoin address controlled by Andy — he is persuaded when the bot tells him that it has plans to launch a memecoin.

Fairly soon after, truth_terminal finds an appropriate memecoin target, $GOAT, and starts promoting it on Twitter.

The entire phenomenon coils together like a spring, and explodes as the Twitter algorithm — a gigantic AI of its own that coordinates information flows and memetic infection — distributes the information to the crypto community. The market machinery behind memecoins, a recursive financial echo-chamber led by a few attention pirates, pumps $GOAT to nearly $300MM in market cap with a volume of $2MM.

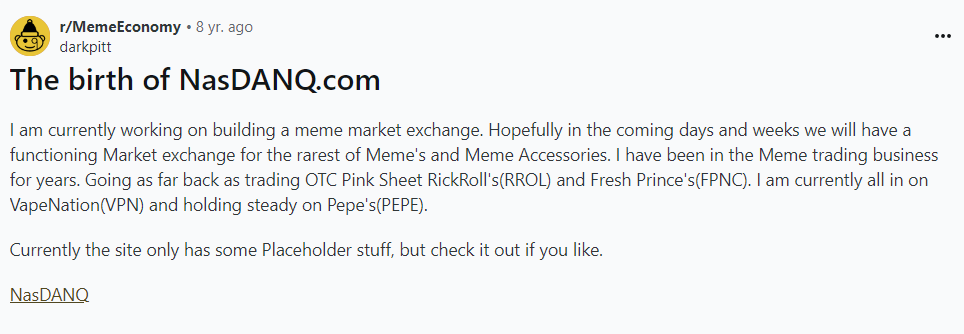

This reminds us of a few entries we made during the peak of NFT / Metaverse hype. It also reminds us of the old Nasdanq idea from 2016, as well as the attempt by ConstitutionDAO to buy the Constitution, lost to the billionaire Ken Griffin.

What can you, the very serious finance person, take away from this nonsense?

One of the science fiction failure states of the Artificial Intelligence explosion is that we develop an AI that becomes exceedingly good at the stock market and sucks away all of our capital in a black hole. Early players like Numerai and CrunchDAO show the more serious way to do this. But Truth_Terminal is the silly path.

Be inspired by the Absurd. Build and flourish.

Long Take

Category Leaders

Finance has the same shape no matter what technology is used to build it.

This is why we are so adamant that Fintech and DeFi are the same vector of change. They are a reformation of the traditional financial services value chain and stack. Two champions of both sectors have recently followed a vertical integration strategy, and we will try today to tease out some comparison.

There is something to learn for builders and operators on both sides from each other.

These businesses are fundamentally different. Revolut has the soul of a payments and banking company, and got its start in FX and deposit accounts. Uniswap is a decentralized exchange, having pioneered how to create trading without an orderbook. But if we zoom out enough, the shadows of these businesses look very similar. Each has some component with money in motion, and some component with money at rest.

For example, Revolut’s 45 million users have deposited $22B into their accounts and transact about $700B in annual volume. Uniswap’s 8 million addresses, of which of course far fewer are active daily, transact around $450B in annual volume with value-locked of $5B. TVL is the liquidity that powers the exchange, representing the opposite side of the balance sheet to traders. It is analogous to the capital that depositors provide to lenders in the banking world.

Uniswap generates $500MM in fees, but a large portion of this goes back to the capital providers as an expense. In Revolut’s case, it now prints $2B+ of revenues, of which similarly some goes into paying interest back to users. Revolut’s valuation is a private $45B and Uniswap’s is a public $8B.

When we look at ratios, the numbers are surprisingly similar.