Analysis: THORChain’s ride from $90B in Swaps to $200MM in bad debt

THORChain’s RUNE-backed lending scheme collapsed, wiping out $3B in value.

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: THORChain, a decentralized cross-chain liquidity protocol, saw its market cap crash from $3.5B to $500M due to risky financial engineering in its lending and savings programs. The introduction of THORFi's lending mechanism, which burned RUNE upon loan issuance and minted new RUNE upon repayment, created a price-dependent debt spiral that became unsustainable as liabilities grew to $200M. How did the project recover from this poor financial engineering? We discuss the collapse as a cautionary tale about using volatile native tokens as collateral, reinforcing the importance of sustainable financial design in DeFi.

Topics: THORChain, RUNE, Aave, THORFi, TCY, Cosmos, Tendermint, BlockScience, JP Morgan, Bank of America, Wise, Western Union, Terra/Luna, FTX.

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

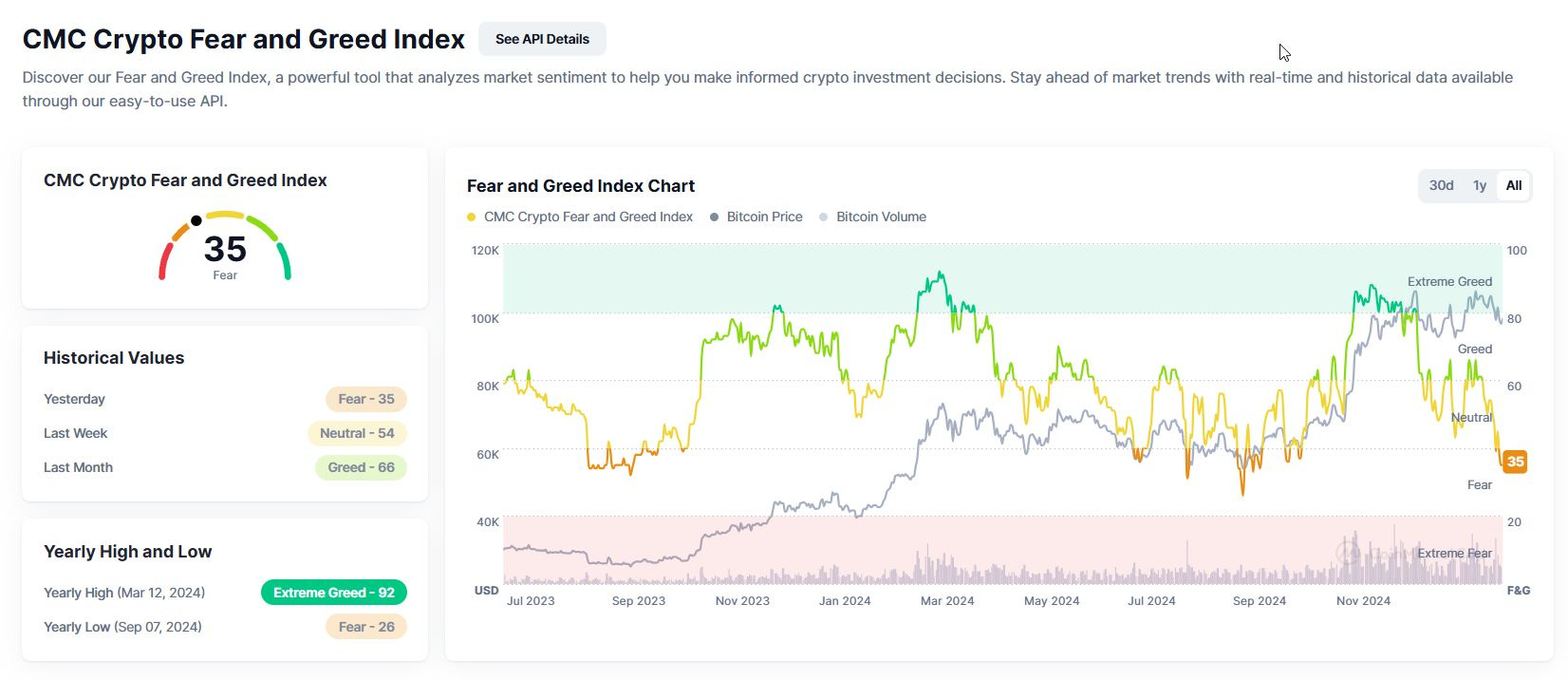

Market Comment

The beatings will continue until morale improves.

While Bitcoin is holding sort of steady, the Web3 economy has again been completely decimated with 90% drawdowns. Why?

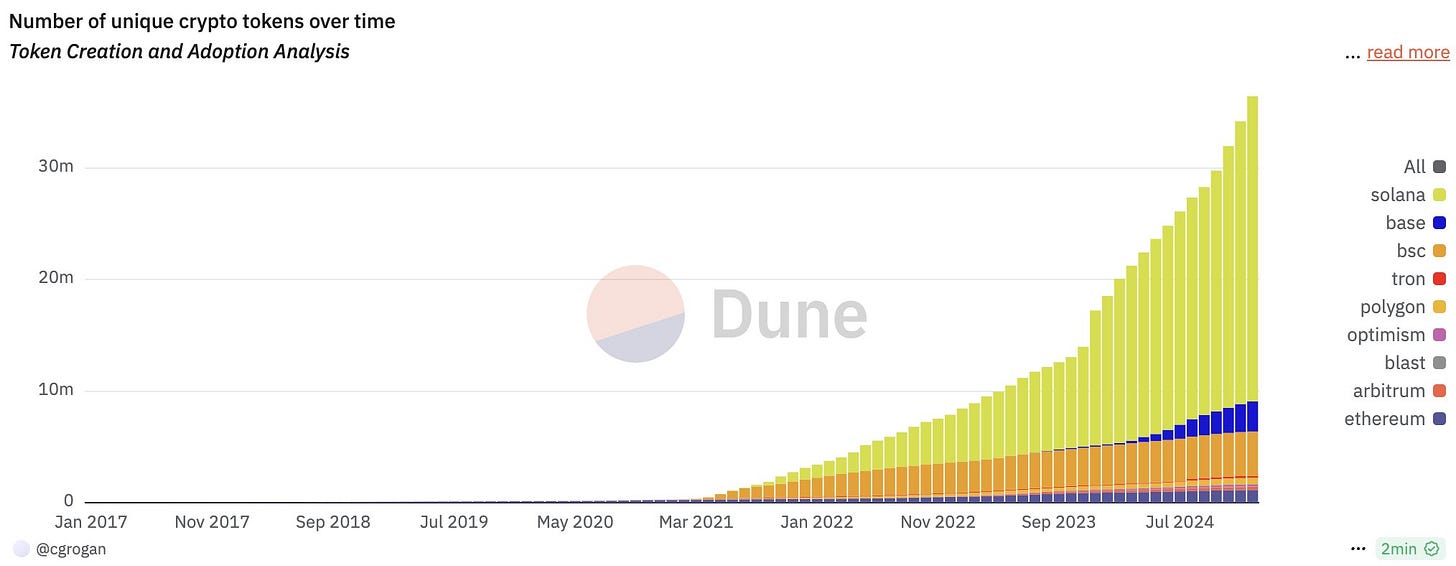

I used to say that Crypto is user-generated finance.

Well now it actually is. There are millions of tokens being made every month. Good luck SEC — but actually no more SEC oversight!

Look, this is still like Youtube videos versus big movie franchises.

Star Wars, Harry Potter, The Avengers are multi-billion dollar brands that last decades.

But a 15-year-old uploading their video-game streaming YouTube video will get 2 minutes of attention and then nothing. And YouTube is the big success story of the internet, not some movie studio.

The same with tokens. They are not some special shareholder-rights stocks of $100MM EBITDA companies. They are little financial videos worth 2 weeks of attention and speculation.

Get used to the financial YouTube, with millions of these assets getting issued and expiring.

Mark to market.

Analysis

Cross-chain Lessons

Here’s a chart of a project called THORChain and its token Rune.

It used to be the case that THORChain was worth $4.5B in marketcap.

And then 2022-2024 happened — specifically, the collapse of the crypto industry due to tokens like Terra/Luna and FTX wiping out their “equity”, and thereby creating a leverage liquidation cascade across all venues where those tokens were used as collateral. Still, the project persevered, rising back up to $3.5B in value earlier last year.

Only to collapse again another 80% down to $500MM after losing $200MM in lending collateral. Why?

For context, here is Aave — the most resilient of the original DeFi protocols. We can see that THORChain’s performance is distinctly bad recently in comparison.

While under pressure, Aave has held up very well considering. The project is, in effect, a $20B fixed-income asset management firm, which has gotten slightly repriced as DeFi multiples have come down.

So what is THORChain, ridiculously named as it is, and what can we learn from its recent financial engineering shenanigans?