Analysis: Why credit fintech Tally burned through $170MM and still failed

How a promising credit card debt solution met the lending markets

Gm Fintech Architects —

Today we are diving into the following topics:

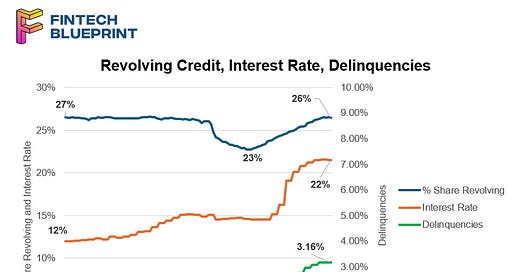

Summary: We examined the rise and fall of Tally, a fintech startup that aimed to help consumers manage and refinance credit card debt. Founded in 2015, Tally raised $172 million and peaked at an $855 million valuation in 2022, but recently shut down due to funding challenges. We analyzed Tally's business model of consolidating credit card debt and offering lower interest rates, highlighting the lending industry's complexities such as underwriting, capital costs, and economic cycle vulnerabilities. We attribute Tally's downfall primarily to market structure challenges, rising interest rates, and increasing consumer credit delinquencies, rather than industry-wide fintech issues.

Topics: Tally, Lending Club, OnDeck, Cross River Bank, SoFi, Funding Circle

If you are thinking about subscribing and haven’t yet, try it out. Get our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries.

Long Take

The Venture Trap

Raising money isn’t a business unless you are an investment bank.

Tally, a fintech for refinancing and clearing out your credit card debt, had raised $172MM since its founding in 2015. It had a marquee cap table, including Andreessen and Kleiner. In 2022, the company peaked at an $855MM valuation.

The company was built on a noble idea. People often get into credit card debt and end up in cycles of revolving their credit at extremely high rates. Why not consolidate all these credit cards and their payment details into a single app, and combine that with a lending product that can refinance everything into a simple, cheaper payment schedule? Enter the first “debt roboadvisor”.

But 9 years later, the company has shut down and laid off its employees. The product reviews tell a sad story.

The company claims it has shut down because the funding environment did not allow it to continue, meaning it was not able to raise money to pay for operations. Earlier this year, Tally had turned off its core B2C product and replaced it with a B2B version of a credit card management system — something that signaled the death knell of the original idea. The markets must have refused to provide lending capital on the card side, and then refused to support a lending issuer that had transformed into an enterprise software provider.

Is Fintech being disproportionately hit by a lack of funding in 2024?

Not really.

When we look at layoffs in technology, Finance is the third most impacted industry, behind healthcare and transportation. Both 2023 and 2022 were more difficult years. In terms of funding, Fintech venture investment is now at $4.8B per month — around the same amount as late 2022, indicating a flat trend with a rebounding number of deals. Within 2024 investments, banking and lending technology ranks as the second most popular category, behind crypto and blockchain.

So we conclude that whatever happened to Tally was specific to Tally, and not to the entire market. What can we learn from Tally’s journey, and were there any warning signs along the way?

The first lesson, which we have repeated this point ad nauseam, is that venture investors mistake underwriting revenues into risky financial instruments (i.e., revolving debt) for recurring SaaS revenues repeatedly — a lesson taught to us by the public markets with Lending Club, OnDeck, and all the rest.

For other conclusions, let’s dig into the research.

The Product of Math

A few months after launching, somewhere in 2016, here is how Tally described itself: