Analysis: Why Intercontinental Exchange invested $2B in Polymarket

ICE-backed Polymarket turns probabilistic bets into a new financial medium.

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We explore how Polymarket has broken through years of regulatory resistance and early prediction market failures to raise funding at a $9B valuation from Intercontinental Exchange (ICE), signaling a major inflection point in the financialization of information. With 300,000 monthly active users and $1.3B in onchain monthly volume, Polymarket is reframing itself as both a trading venue and media property, drawing comparisons to DraftKings while benefiting from the open, composable infrastructure of Web3. This success highlights how prediction markets are emerging as critical interfaces for AI and human decision-making, providing price signals on probabilistic future events.

Topics: Polymarket, Intercontinental Exchange (ICE), DraftKings, Augur, Gnosis, ChatGPT, Claude, MetaMask, Kalshi, Pump.fun, Worldcoin

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

Our Ecosystem: AI Venture Fund | AI Research | Lex Linkedin & Twitter | Sponsors

Long Take

On Picking Winners

Erosion doesn’t happen all at once.

Little by little, water comes in and out in waves, undermining soil, rock, and stone. Sometimes the waves are quiet and gentle. Sometimes they are warm or cold. And sometimes they are strong and harsh.

But the important thing isn’t any one wave. Rather, it is the continued application of stress and pressure on the structure over time. The process can take years, even centuries, until one day it all gives way.

Mountains crack and fall into rivers.

The glacier that used to blot out the sky has become a lake, and we sail through.

In investing, we can call this an *inflection point*.

For years, start-ups attack the same spot over and over again, only to die after years of attempts. Companies will suffocate without demand, fail to find revenue, and starve. Or they will bash their heads into different corners of the opportunity, finding nothing but dead ends in each corner.

And then one day, there will be a crack.

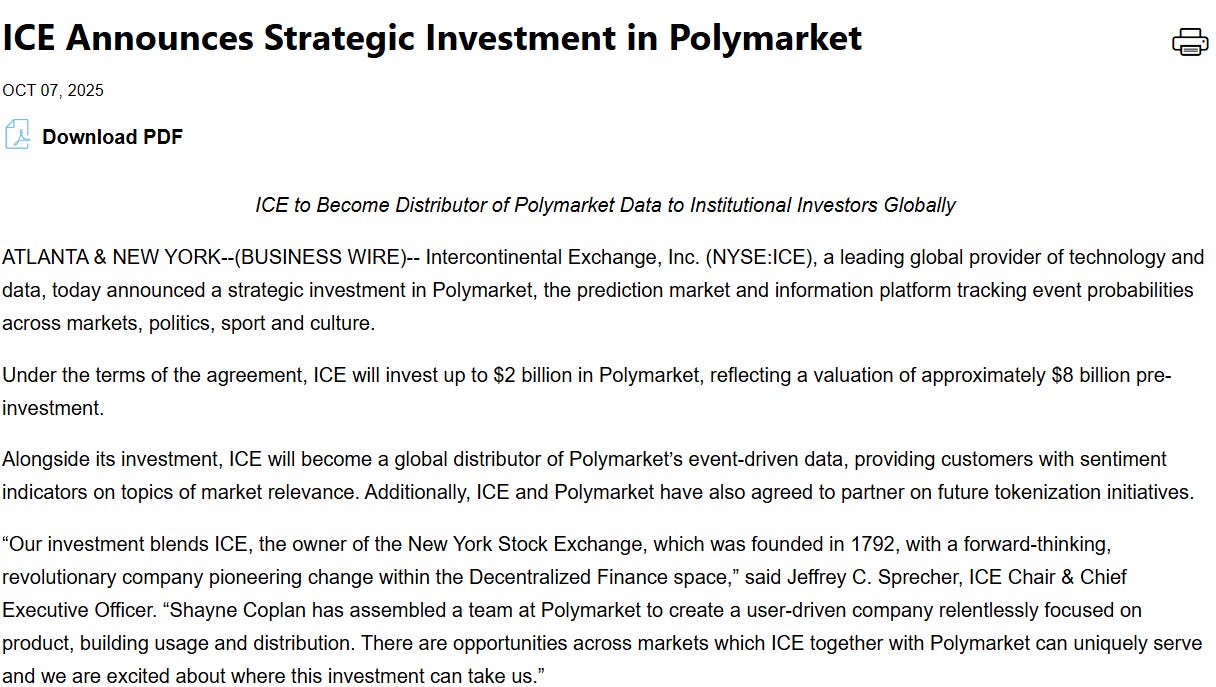

And a company like Polymarket will raise $2B from the $90B Intercontinenal Exchange group, get a Trump on the advisory board, and launch in the United States after years of being chased around by law enforcement.

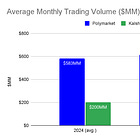

We covered Kalshi and Polymarket a few months ago, as the two are the primary contenders for the crown of dominant prediction markets today. At the time, Kalshi was worth $2B.

Today, Polymarket’s valuation has skyrocketed to $9 billion post-money.

This is a very chunky valuation.

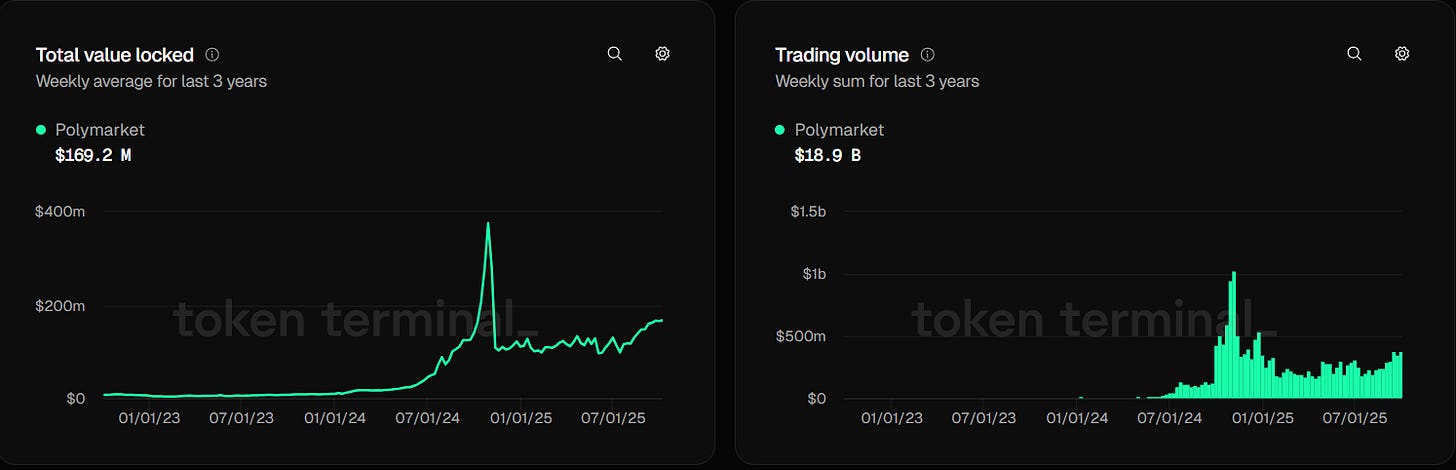

It says far more about cultural relevance and positioning of ICE for future growth than it does about the current business operations of Polymarket. Here are the high-level operating metrics.

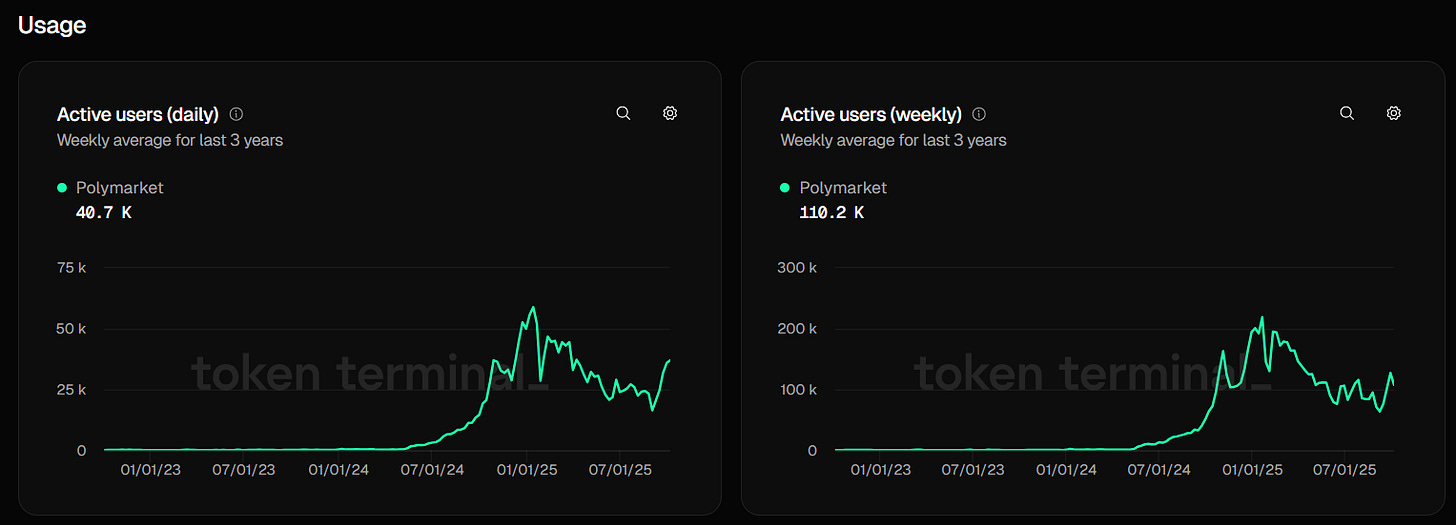

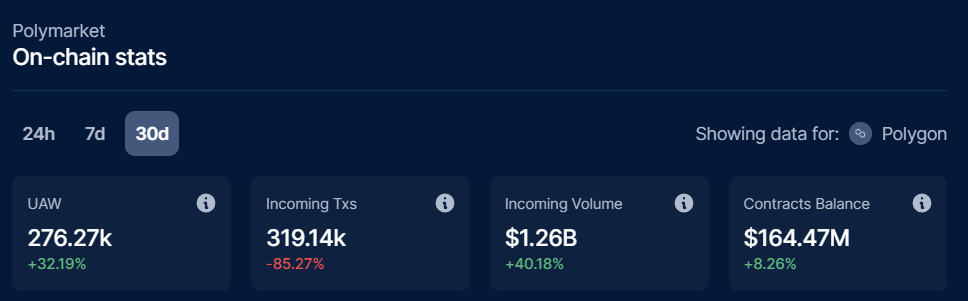

Token Terminal suggests that there are about 40,000 daily active users or 300,000 monthly active users. These users have locked $170MM of value onchain, which trades roughly $1 billion per month. We can cross-validate these numbers on DappRadar, which shows $165MM in assets, with 275,000 users in the last 30 days, and $1.3B of volume last month. All of this activity is on a blockchain — on EVM-based Polygon, in fact — and is therefore verifiable.

At 300,000 transacting users and $9B in valuation, the company is now valued at $3,000 per user. We cannot find any reliable revenue figures, so we assume there is no material monetization. There is an argument that Polymarket is not just a trading platform, but has become a news site and cultural phenomenon. Therefore, transacting users are a small portion of the millions of people who consume Polymarket content. While true, this is a re-framing of the top-of-funnel strategy to grow volume, which is to grab attention and monetize it through betting.

Let’s compare Polymarket to an established betting platform like DraftKings.

DraftKings is a public company with $16B in market capitalization.

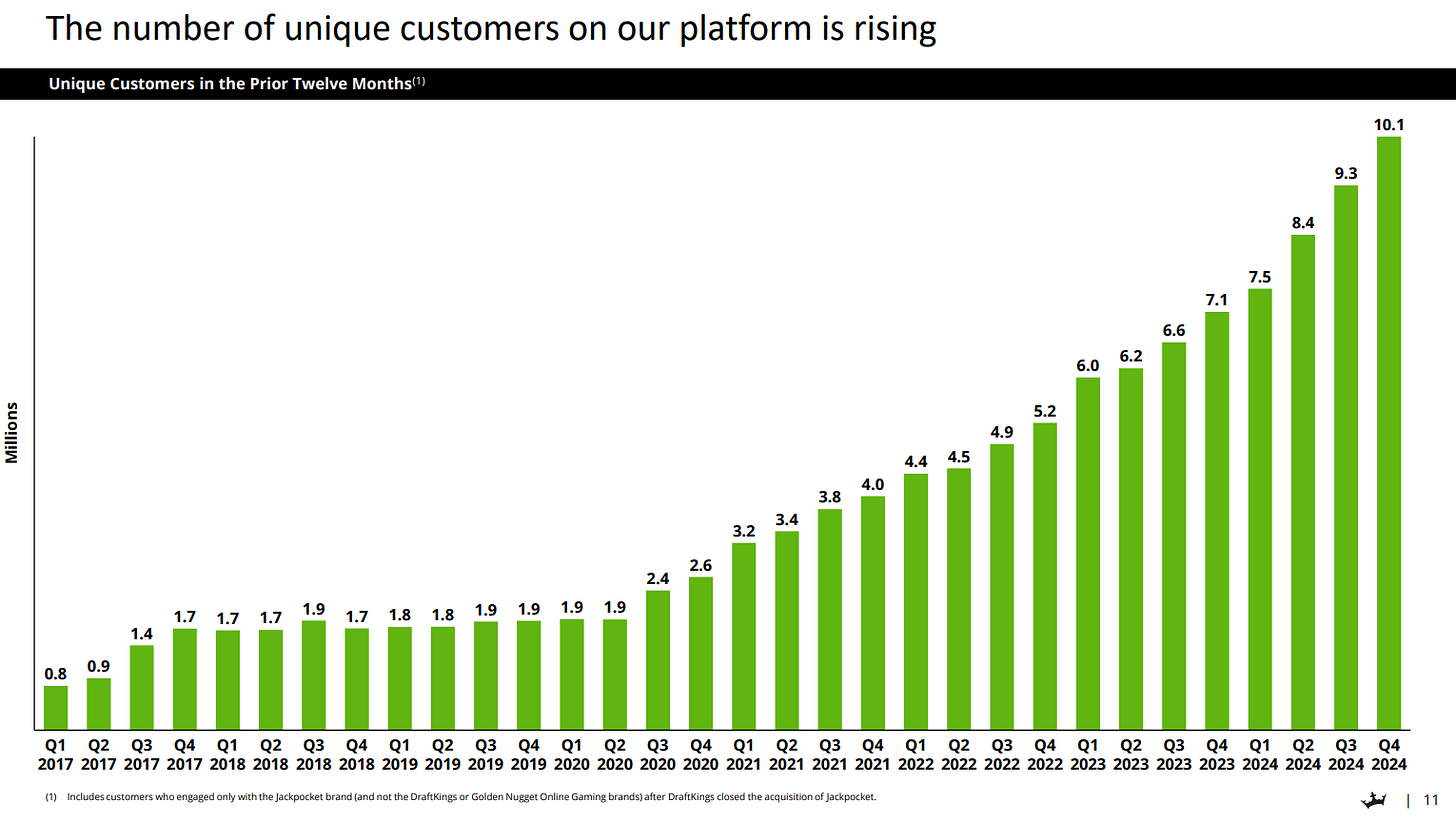

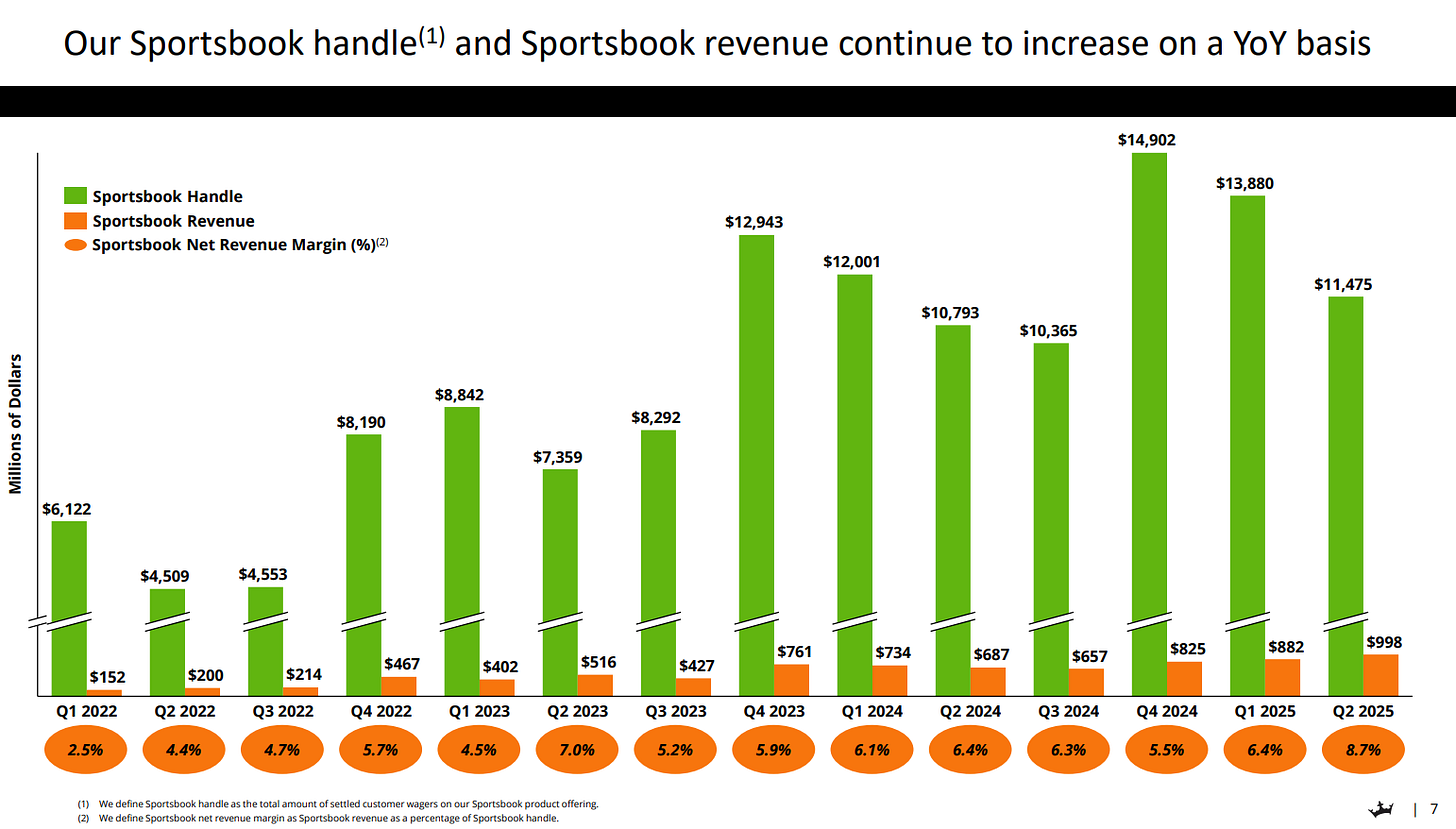

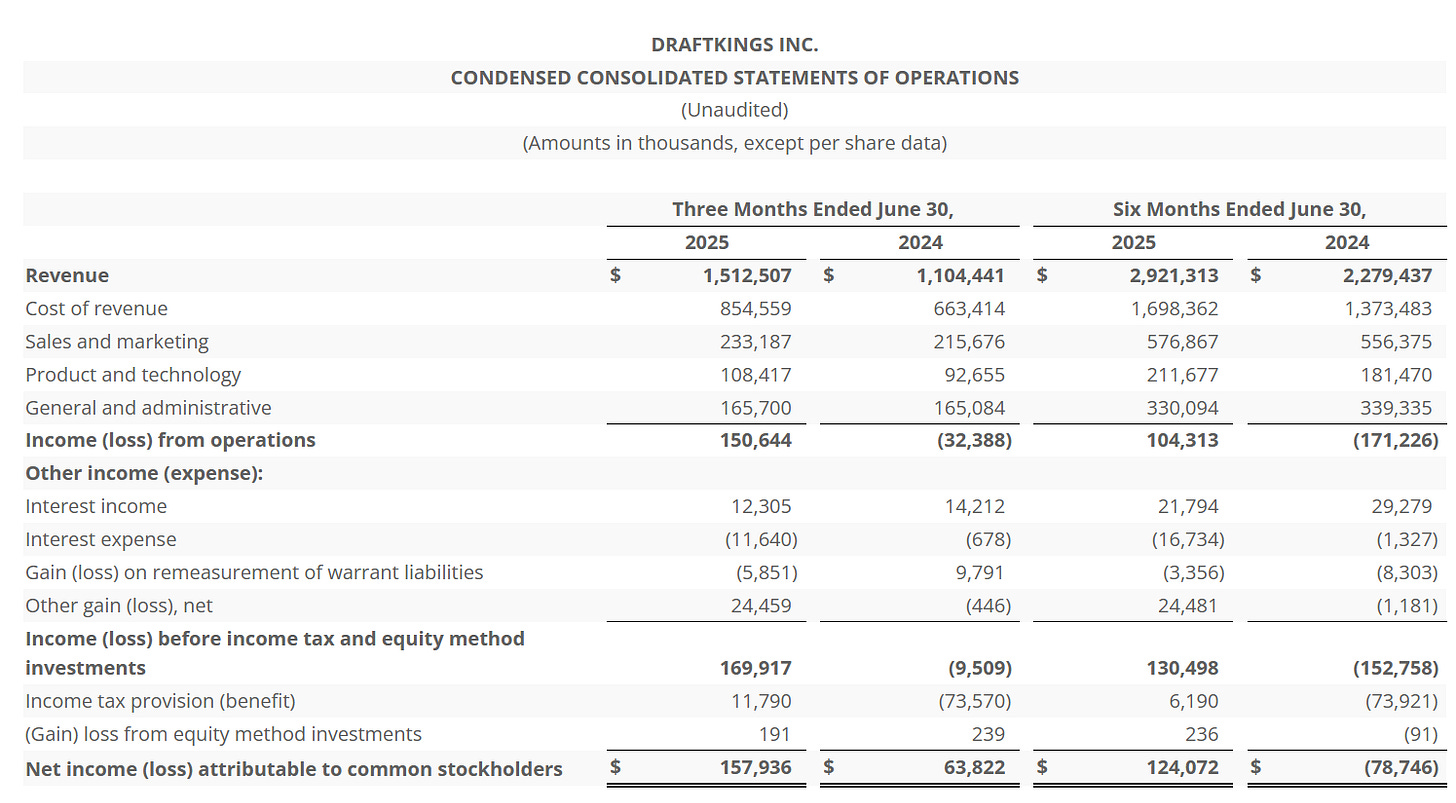

It generates about $5B of revenue per year and around $200-500MM of net income on that revenue. To generate the revenue, it appears to take about 2-8% of its wagers as fees, suggesting $100B or so of betting volume. DraftKings reports 10 million users, up sharply from 2 million users a few years back, before some key acquisitions.

On a user basis, DraftKings has probably 10x-50x more users, depending on definitions. On a volume basis, it has 8x more volume. Their valuation, however, is only 2x larger.

So what’s going on?