Analysis: Will Fintech, TradFi, or DeFi win the $170B stablecoin market?

The battle for stablecoin dominance is expanding into fintech and traditional finance.

Gm Fintech Architects —

It’s the last week of August and I am on holiday with the family. But the world is not slowing down. It feels instead like everything is speeding up. Let’s see what insights we can discover today.

Summary: We explore the resurgence and evolution of stablecoins, highlighting Tether's extraordinary profitability due to rising interest rates and a lack of competition. The stablecoin market has rebounded to $170 billion, driven by use cases in capital markets, value storage, and payments, particularly in regions like South America, Africa, and Asia. Despite regulatory fears and market consolidation favoring Tether, new entrants like PayPal's PYUSD and projects like Ethena and MakerDAO's Sky ecosystem are innovating in the space. The future of stablecoins lies in their integration with various venues, from crypto exchanges to fintech platforms, and their potential to capture a larger share of global financial assets.

Topics: Tether, Circle, PayPal, Solana, MakerDAO, Sky, Ethena, Binance, Coinbase, Robinhood, SoFi, Public, Revolut, JP Morgan, Goldman Sachs, BlackRock, Franklin Templeton.

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

Long Take

Money Market Fit

A few weeks ago we wrote about the absurd financial performance of the company behind USDT. Put aside all prior baggage about Bitfinex.

Here are the key charts:

The only other recent economic miracle akin to Tether is NVIDIA, printing $15 billion in quarterly profit. But the company has 30,000 employees. Tether is selling an Instagram to Facebook every single quarter.

Key to Tether’s massive profitability is the drastic rise in interest rates, from 50bps to 500bps in the span of just a few years. That is a 10x improvement in business model provided freely by the Federal Reserve.

The other gift has been fear of regulation. In a competitive market, interest rates would be passed to consumers as more and more firms enter to provide a commodity product. However, onchain stablecoins have not been a competitive market, because providers are terrified of securities regulation and appearing to be selling a bond or money market fund.

The lucky externality of this is capturing huge profits by companies that are willing to take a gamble and receive the occasional Wells notice. Tether doesn’t have any cost of capital, and it doesn’t need to pay interest out to depositors. There is only interest revenue and no interest expense. People don’t have a choice and are not able to shop around different deposit rates the way you do in traditional banking.

Rather, users take USDT and earn yield on the non-interest-bearing asset through DeFi rehypothecation. Getting cash onchain — access to the dollar — is just that valuable.

This enormous revenue pool is a target on Tether’s head. Its closest competitor, Circle, is waiting for a $10B path to the public markets, having previously gotten almost caught in a SPAC trap.

These days, we expect their numbers to be even better.

Going after the stablecoin use case is one of the key themes of 2024 crypto markets. Net interest is there to fund customer acquisition. Real world asset tokenization, from fiat deposits to eating up treasury bills, is the collateral of choice. The industry has also collectively forgotten about the $40B black hole left in the previous market high by algorithmic stablecoin Terra/Luna.

Yet the prize is too big to ignore.

There are network effects at play for cash equivalents that are reputational and asset-based. Knowing the brand of a stablecoin makes you more likely to trust that it will retain its value. Similarly, having a larger market supply of the stablecoin increases its value as more venues and people are willing to transact in its denomination. The returns are there to scale.

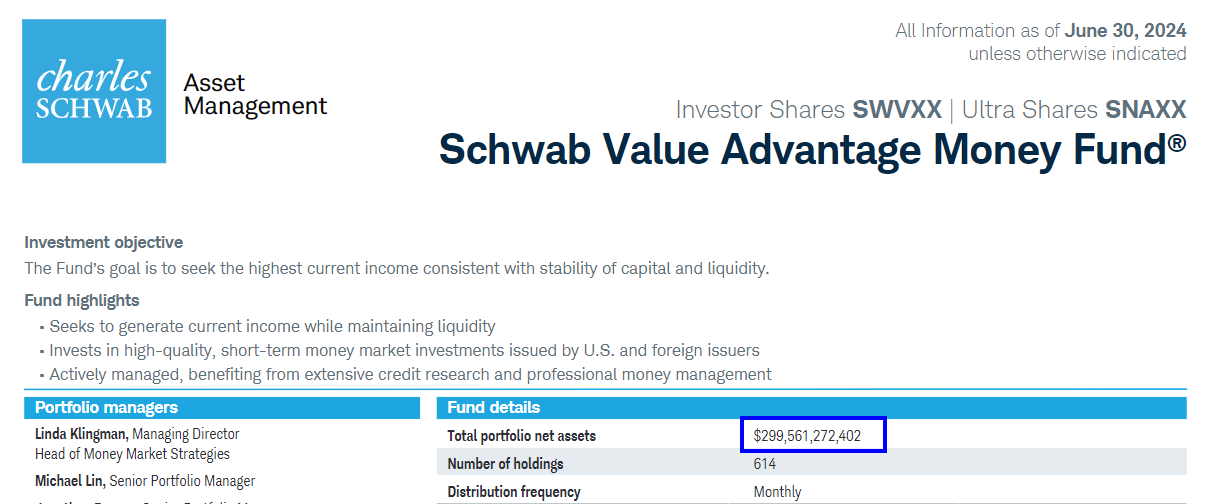

The holy grail is to combine the financial assets with captive distribution. Schwab and Fidelity have done this with their own money market funds, with $300B each respectively.

And famously, Ant Financial ran the world’s largest money market fund — a staggering $1.7 trillion in assets — until it was all broken up by the government.

Did you, crypto reader, think that anything was new under the sun? These are repeating financial patterns over time.

Coinbase has done the same with USDC, bundling it into all trading pairs and the savings offering. Binance and every other exchange in the world think similarly about money at rest.

May the rates stay high enough for Fintech to profit but for valuations to be high!

Can’t have your cake and eat it too, I’m afraid. So which will it be?

The State of Stablecoins

Let’s review the sector at a macro level.