Artificial Intelligence: European Union AI Act and its implications for finance

Is it practical? What is the cost of compliance?

Hi Fintech Futurists —

Today we highlight the following:

AI: Understanding the Impact of EU's AI Act on Financial Services

CURATED UPDATES: LLMs and other Machine Models; AI Applications in Finance; Infrastructure & Middleware

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

Join Fintech Meetup (March 3-6), the new BIG event with “the highest ROI” for attendees & sponsors with reasonably priced sponsorships, tickets, and rooms. Ticket Prices go UP at midnight on Friday, January 26th. Room Block is 75% Sold out - Register & Book Room now!

PS. Lex will be speaking at Fintech Meetup. We look forward to seeing you there!

AI: The Impact of EU's AI Act on Financial Services

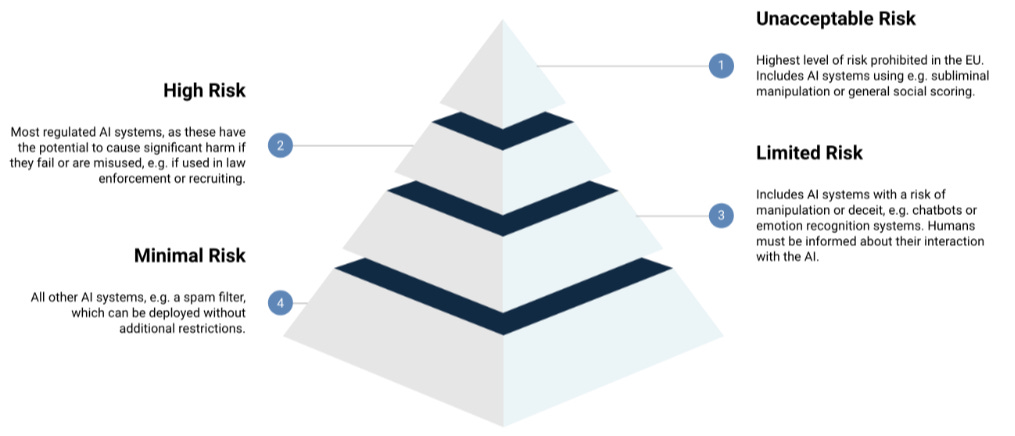

Artificial intelligence will reshape industries in ways we cannot yet fully understand. With this in mind, the European Union AI Act is a regulatory milestone addressing the potential and rapid integration in sectors like financial services. The European Commission first proposed the AI Act in April 2021, with the European Parliament and Council creating a risk-based approach, which attempts to categorize AI systems as “unacceptable,” “high,” “limited,” or “minimal risk.” The full text has been leaked online.

AI systems posing “unacceptable risks” are strictly prohibited under the Act, which includes applications that deploy subliminal techniques to manipulate users, exploit vulnerabilities of specific groups, or enable social scoring by authorities.

“High-risk” systems require the most stringent oversight as flaws could endanger health, safety, and fundamental rights. This encompasses AI applied to law enforcement, biometric identification, and the administration of justice. “Limited risk” systems face custom transparency obligations, such as disclosing the use of AI to users to respect their autonomy in interacting with automated systems rather than humans, whereas minimal risk systems currently avoid heightened regulation but can be reassessed if harms emerge.

For financial services, the Act's focus on transparency, safety, and non-discrimination in AI systems is particularly relevant. The financial sector's escalating reliance on AI for various essential functions underscores the necessity of regulation in this sphere. Financial institutions that fail to comply with the act could see fines of up to €40M, or 7% of global annual turnover for the previous fiscal year. This is comparable to breaches under GDPR.

Many institutions use AI to analyze customer data and determine creditworthiness or investment risks. Under the Act, these systems will require rigorous compliance with transparency and fairness standards. Financial institutions will need to ensure accurate and unbiased decisions that are explainable to both customers and regulators. For example, denying a loan application will mandate clear explanations, diverging from some opaque current AI practices.

Fraud detection systems in banks and financial institutions, which currently leverage AI to identify unusual transactions, will also be impacted. While these systems enhance security, under the AI Act, they would require thorough documentation and human oversight to ensure they do not falsely flag or overlook legitimate transactions. This could mean additional layers of verification and an increase in manual checks to balance AI efficiency with regulatory compliance.

In financial advisory, AI algorithms offering personalized investment or savings guidance will need transparent data processing and recommendation methodologies. Advisors must prove sound, unbiased AI foundations, contrasting some current approaches lacking explainability.

However, more complex AI like Large Language Models (LLMs) pose transparency and trust issues. LLMs are inherently "black boxes," making their decision-making opaque, leading to a lack of clarity about how they interpret patterns, which makes it tough for firms to explain AI choices to customers and regulators. Moreover, training data biases can skew LLM outputs, concerning for the finance sector where fairness is critical. Another issue is false outputs or "hallucinations" — factually incorrect or nonsensical responses. Such errors could lead to misguided, risky decisions in finance that do not comply with the EU’s AI Act.

Complying with EU regulations will require new methods to interpret LLM decision-making, robust data governance, a continuous monitoring of outputs. The EU AI Act compels financial services to evolve from efficiency-centric AI utilization to investing into transparency, fairness and accountability. Increased human oversight, documentation, and explainability will mark a major shift as regulatory compliance becomes a central focus.

However, we are also concerned about over-regulating a nascent industry where the implications and industrial logic are not yet well established. Generating high cost and operational barriers to make start-ups chase things that technology cannot do — like explain an LLM hallucination — isn’t particularly useful. To that end, we hope to see regulators respond to the reality on the ground.

👑Related Coverage👑

Podcast conversation: Teaching financial AI to be ethical and fair, with Fairplay CEO Kareem Saleh

Curated Updates

Here are the rest of the updates hitting our radar.

Machine Models

AI Applications in Finance

Infrastructure & Middleware

🚀 Level Up

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete.

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

Wednesday’s Long Takes with a deep, comprehensive analysis.

Office Hours, digital roundtable discussions.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts for deeper learning.

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.

Read our Disclaimer here

Contributors: Lex, Laurence, Matt, Farhad, Daniel, Danny, Michiel, Bo