Artificial Intelligence: Mistral $2B valuation and Open Source strategy

Founded by former DeepMind and Meta employees, Mistral AI secured $487M from Andreessen Horowitz, Nvidia, and Salesforce

Gm Fintech Futurists —

Welcome to AI in Finance, focused on the application of artificial intelligence — LLMs, generative AI, machine learning, deep learning, and neural networks — to financial services.

Today we highlight the following:

Fintech’s Future is AI: Mistral AI and the Hype Around Generative Models (link here)

CURATED UPDATES: LLMs and other Machine Models; AI Applications in Finance; Infrastructure & Middleware

For weekly deep dives on the frontier of fintech, check out our premium offering.

Fintech’s Future is AI: Mistral AI and the Hype Around Generative Models (link here)

With a recent $2B valuation, generative AI startup Mistral AI highlights the insatiable investor appetite for AI in Fintech. Despite being less than a year old, the French startup, founded by former DeepMind and Meta employees, has just secured $487M in a funding round from investment firms like Andreessen Horowitz, Nvidia, and Salesforce. This shows both Mistral AI potential, and the broader market belief in the potential economic opportunities from this new sector.

Arthur Mensch, Co-founder and CEO of Mistral AI, says they plan to use this funding to develop AI models that surpass GPT-4 capabilities, and that within 4 years from now, Mistral’s vision is to offer the best technology in the industry.

The startup has a unique approach to developing large language models (LLMs). Instead of the industry standard of secretive “black-box” models, Mistral takes inspiration from the open-source movement that developed web browsers and operating systems, and applies the same community-driven approach to their LLMs.

For instance, the company’s Mistral 7B model, which has 7 billion parameters, is freely available to developers. It can process and generate text faster than larger models and does this far cheaper (Mistral AI). Furthermore, as shown below, Mistral claims their 7B model outperforms other language models on various metrics.

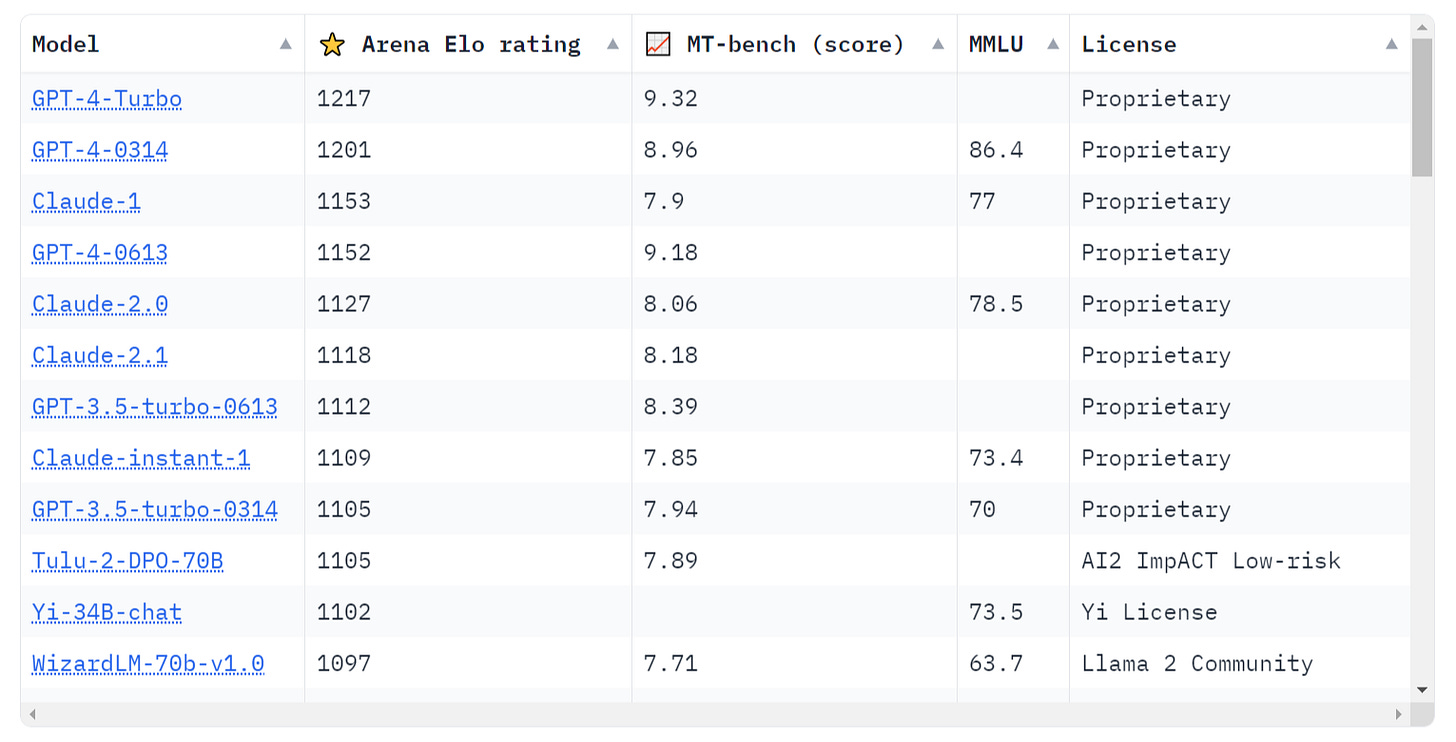

But there is disagreement. Contrary to these claims from Mistral AI, Andrej Karpathy, former Sr. Director of AI at Tesla and current OpenAI employee demonstrates how closed models, such as GPT and Claude, score higher in the MT-bench, a set of multi-turn questions used to assess model responses, than Mistral’s 7B model, and other open-source models, including Meta’s WizardLM.

The expensive battle over training LLMs, whether open- or close-source, is creating the infrastructure for a variety of powerful applications, including those in financial services. Fintech companies can leverage these lower-level services to create applications that provide bespoke investing guidance, personal finance management, customer service, and trading automation based on individual risk.

One recent example is the fintech Airwallex, which successfully reduced Know Your Customer (KYC) false positives by 50% and “boosted the number of customers that pass through the onboarding process without human intervention by 20%” by using generative AI. This potential for AI to augment financial services is estimated at $13B in value in 2023, and is projected to grow at a CAGR of nearly 20% from 2024 to 2032.

While there are also many other generative AI companies securing significant investment – think Perplexity AI, AssemblyAI, and Inworld AI – there are not many other startups saying they are capable of challenging OpenAI. Reminder that it costs $40-100MM now to train a large enough LLM. To that end, it is likely that the industry structure will support a few very large LLM providers, then a long tail of open source alternative, and a broad marketplace of applications, including those tuned on financial services.

Whether the financial companies, fintechs, or Web3 are up to the challenge is a question yet unresolved.

👑 Related Coverage 👑

In Partnership

For forward-thinking leaders eyeing sustainable growth, investment in an integrated platform for managing fraud, credit, and compliance risks is no longer optional — it's imperative.

In this guide, we discuss:

AI Risk Decisioning: The Foundation of Risk 3.0

How to Evaluate Risk Decisioning Platforms

Future Proofing your Fraud & Risk Strategy

Curated Updates

Here are the rest of the updates hitting our radar.

Machine Models

⭐ Apple joins AI fray with release of model framework - The Verge

AI Applications in Finance

⭐ Airwallex Cuts KYC False Positives in Half With Generative AI and Boosts Customer Onboarding - Fintech Times

New Ways Technology is Revolutionizing the Stock Market - Clayton County Register

Infrastructure & Middleware

⭐ Nvidia’s stellar 2023 performance: A decade’s best in stock market - Readwrite

The World Depends on 60-Year-Old Code No One Knows Anymore - PC Mag

⭐ Shape your Future

Go deeper with the Fintech Blueprint. Our premium subscription grants access to:

Wednesday’s Long Takes with a deep, comprehensive analysis.

Office Hours, monthly digital roundtable discussions with industry insiders.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts.

Archive Access to an array of in-depth write-ups on the most important topics and companies in fintech.