Artificial Intelligence: The importance of temporal validity for financial AI

Understanding time series data, such as price feeds of the capital markets, would be a huge competitive advantage for market participants.

Gm Fintech Futurists —

Welcome to AI in Finance, focused on the application of artificial intelligence — LLMs, generative AI, machine learning, deep learning, and neural networks — to financial services.

Today we highlight the following:

Fintech’s Future is AI: Building Better AI Models with Temporal Validity

CURATED UPDATES: LLMs and other Machine Models; AI Applications in Finance; Infrastructure & Middleware

We're excited to kick off the New Year 🎉 with a special offer for those looking to level up their fintech knowledge. Take control of 2024 with 20% off a Premium membership to The Fintech Blueprint.

Fintech Meetup (March 3-6) is less than 60 days away! Don’t miss Fintech’s new BIG show with “the highest ROI” for attendees & sponsors. Ticket prices go up Friday 1/12 at midnight. Don’t miss out!

Fintech’s Future is AI: Building Better AI Models with Temporal Validity

While it may seem that generative AI is already capable of reasoning, the current generation of AI models lacks a degree of nuance to properly understand temporal validity, according to recent research by Wenzel and Jatowt from the University of Innsbruck – missing the timeliness of data and statements and their context. This shortfall is particularly relevant in the fintech sector, where the timing of information is critical for decision-making such as investment or money movement.

In human communication and data transmission, understanding the time involved in what someone says or writes is important, because it allows us to deduce whether or not the information is still true or relevant. Early information is valuable, whereas old or out-of-date information is not fit for purpose.

For example, if a person says, "I am driving home from work," and it has already been five hours, the recipient of that information will likely conclude that this person is likely no longer driving, if such trips usually take less than five hourse. The context of statements impacts their temporal validity duration. If “I am driving home from work” is followed by “There is a massive traffic jam,” the temporal validity duration of the target statement becomes longer.

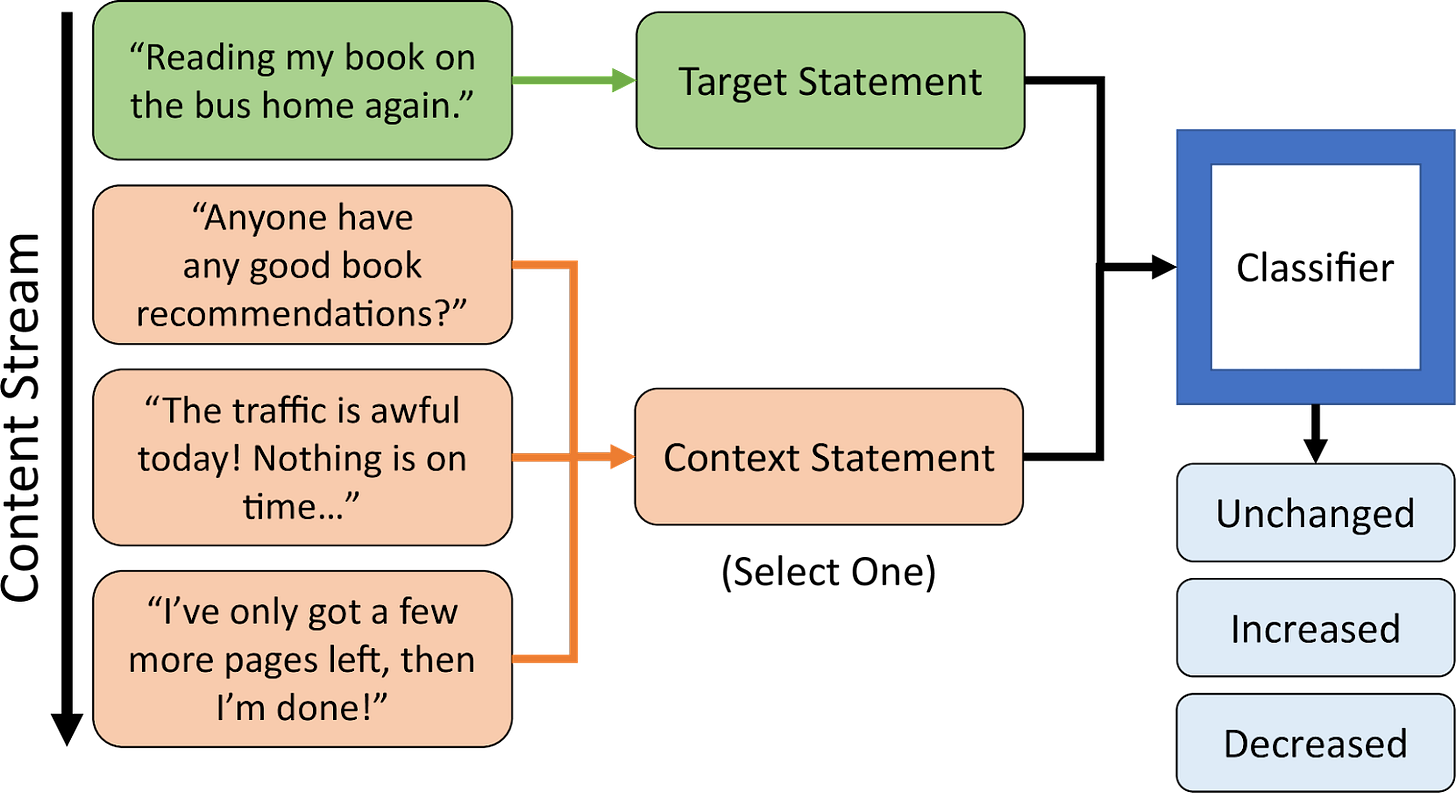

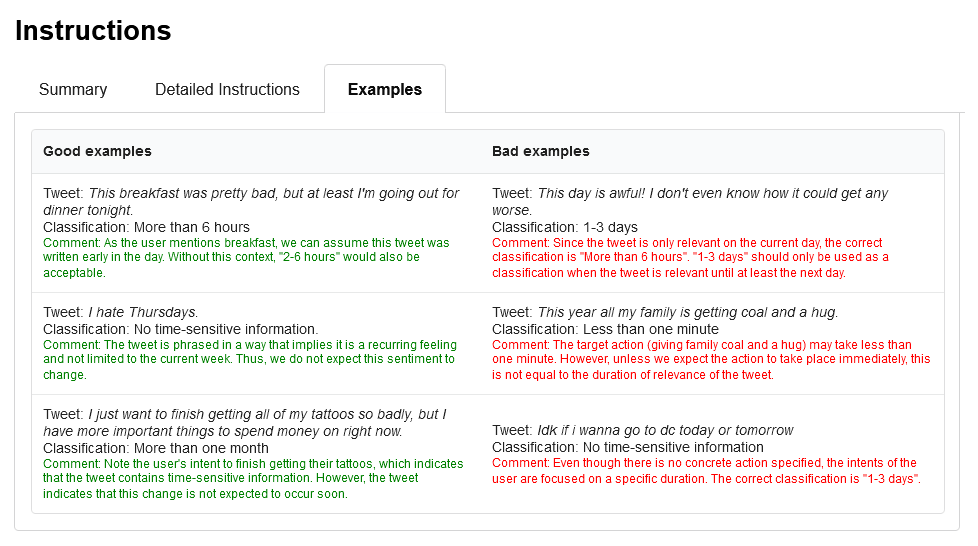

In their paper, the researchers created a data set from X in which they tested temporal validity duration prediction (TVDP) in several leading AI models using a novel natural language processing (NLP) task format called Temporal Validity Change Prediction (TVCP). This task required the AI model to reason over whether or not a context statement changes the temporal validity duration of a target statement. Their results showed that ChatGPT and other models perform poorly in this regard. However, they also demonstrated that performance could be improved by explicitly including the TVD during model training, to improve embeddings.

This research indicates a promising direction for developing AI systems capable of handling temporal data more effectively. Such systems would significantly improve performance in tasks requiring nuanced time understanding.

As AI continues to evolve, its ability to comprehend temporal validity will be a key factor in its effectiveness, particularly in sectors like finance, where the timing of information is a critical component of decision-making processes and their profitability. Wenzel and Jatowt's research provides a foundational step towards realizing AI models that are not just data processors, but contextually aware interpreters of time-sensitive information.

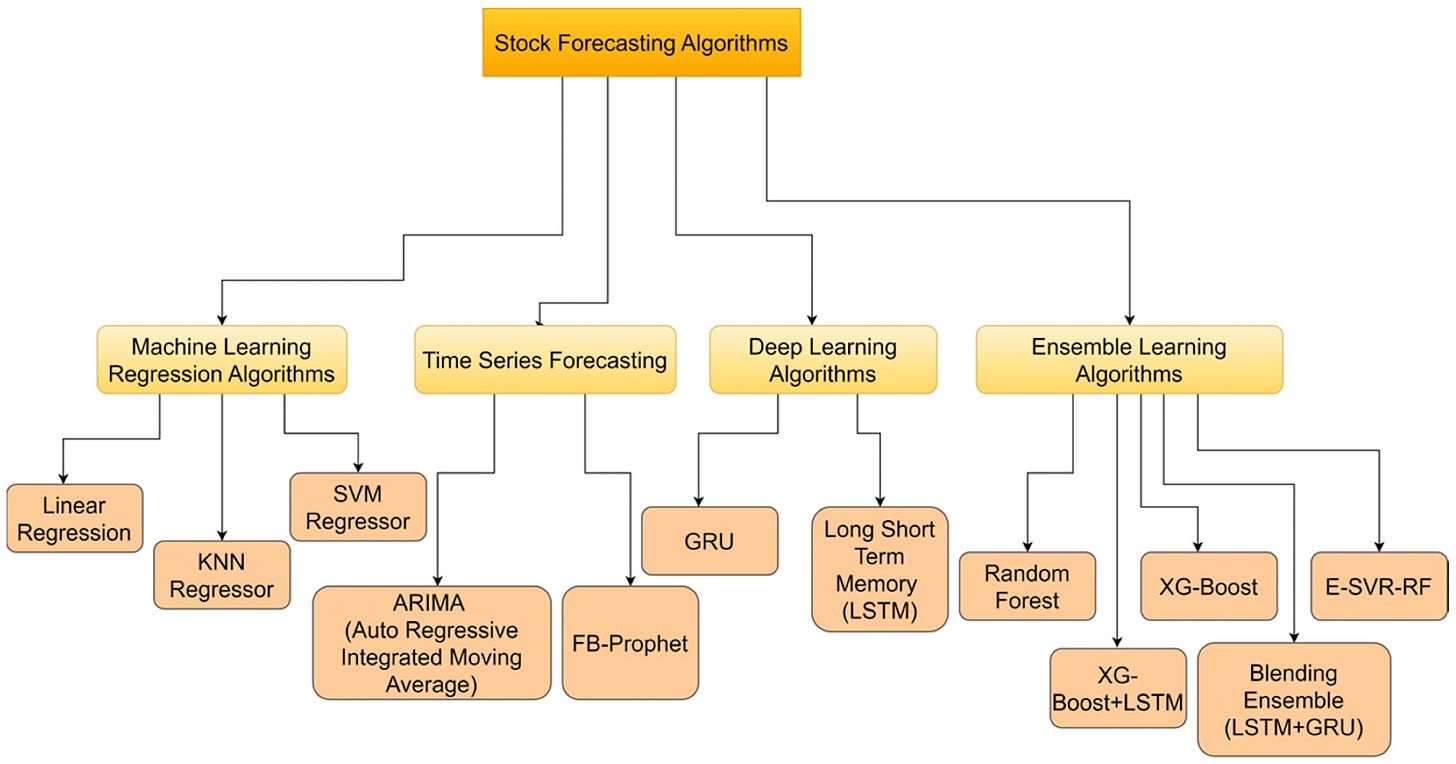

The time dimension has previously been a challenge for machine learning in financial services as well. Whereas machine learning can be successfully used to underwrite particular risks for a lending or insurance data set, it struggles with time series data, such as the price feeds of the capital markets.

Therefore, AI in capital markets is often focused on very short-duration future predictions for high-frequency trading, rather than longer-term projections of market activity. Figuring out a way around this limitation by extending the predictive power of models – even if just by a bit – is a huge competitive advantage for market participants.

Reach 200,000+ Fintech Professionals

With a 35% open rate and 1 million post views per month, we have an engaged audience of Fintech, DeFi, and AI enthusiasts receptive to your messaging.

Contact us to learn more about our custom opportunities.

Curated Updates

Here are the rest of the updates hitting our radar.

Machine Models

⭐ How AI and machine learning solutions drive value for financial institutions - IT World Canada

AI Applications in Finance

⭐ Scienaptic AI and DigiFi revolutionise credit lending with AI integration - Fintech Global

AI Will Transform the Credit Industry by Putting the Customer First - The Fintech Times

Are ChatGPT and GPT-4 General-Purpose Solvers for Financial Text Analytics? A Study on Several Typical Tasks - Queen’s University and J.P. Morgan AI Research

Infrastructure & Middleware

⭐ Amazon turns to AI to help customers find clothes that fit when shopping online - Yahoo Finance

AI-powered search engine Perplexity AI, now valued at $520M, raises $73.6M - TechCrunch

🚀 Level Up

Here are 5 ways a premium membership will elevate your fintech knowledge in 2024.

🗞️ Never Miss a Breakthrough:

Gain expert insight and stay on top of innovation with our four weekly newsletters covering fintech, AI in finance, DeFi and our popular Long Takes. They offer exclusive analysis on the most important happenings in fintech.📚 Get a Wider Perspective on hundreds of Fintech & DeFi topics:

Unlimited access to our archive offers a treasure trove of fintech knowledge. Use it to understand trends and developments over time, aiding in informed decision-making.🎙️ Learn from Insiders with Exclusive Podcasts:

Our premium podcast series — complete with annotated transcripts — is ideal for understanding complex fintech topics.📊 Improve Your Strategic Thinking:

Weekly Long Takes provide detailed reports on fintech and web3 topics, turning you into an informed insider. Regular reading will enhance your strategic thinking in Fintech and DeFi.💬 Engage & Expand Your Network in Interactive Office Hours:

Participate in our live digital roundtables with finance and tech leaders. These sessions are valuable for networking, gaining deeper industry insights, and opening new opportunities.

For a limited time, we’re offering 20% off on our premium membership. Take control of 2024 and go Premium with The Fintech Blueprint.