Big Fintech: LSE's $27B for Refinitiv, Softbank's second $108B vision, Ping An's $160B Revenue; plus 12 short takes on top developments

Hi Fintech futurists --

In the long take this week, I start with the $27 billion contemplated acquisition of Refinitiv by the London Stock Exchange, track the $20 billion of projected Fintech venture capital investment in 2019, highlight the second $108 billion SoftBank fund, and land on the Fintech story in China. Did you know that Ping An was running at over $150 billion in revenue?

The latest short takes on the Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below. Thanks for reading and let me know your thoughts by email or in the comments!

Long Take

Fintech is expensive. Fintech is everywhere. If you are a thinking about starting a financial services company, and it does not have technology at its core -- don't. You will lose to someone similarly positioned building a more augmented business. Fintech is the global competition for regulation, talent, and macroeconomic supremacy. Fintech is the trade war between the US and China. Fintech is Facebook and Amazon. Fintech is the next bubble to burst. Fintech has burst already.

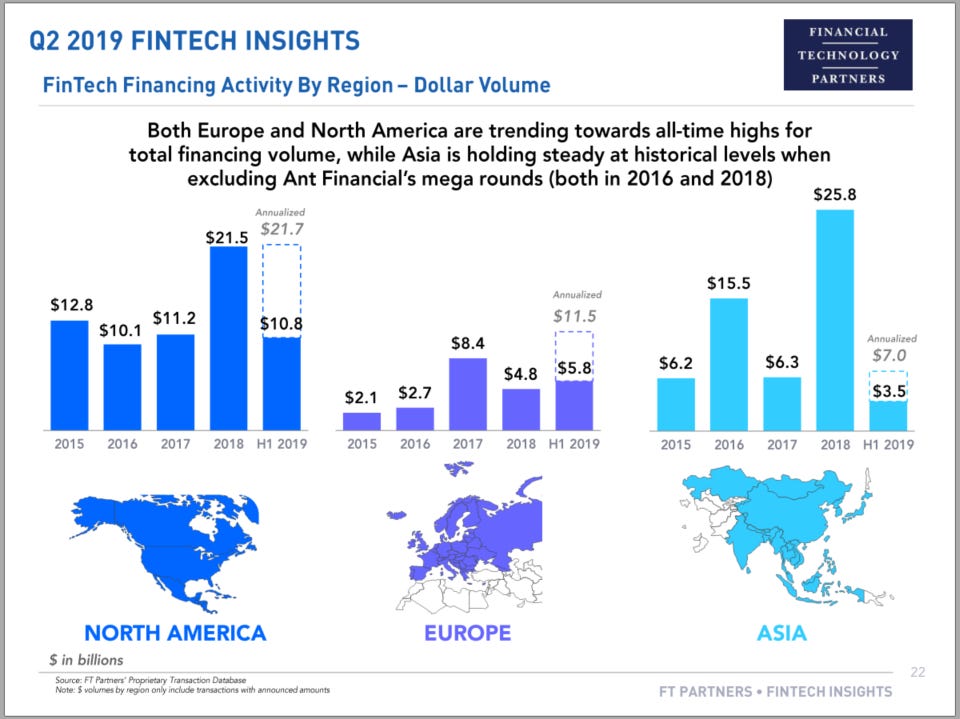

Rhetorical flourish aside, I think we can paint a good picture of the macro environment in the industry, and see where both investments and returns are flowing. The stellar FT Partners quarterly research report is out, and you can see continued health in the sector. In terms of North America, we can expect over $20 billion in venture financing this year again -- much of it flowing to data aggregators, banking-as-a-service entrants, and insurtech (e.g., Plaid, Lemonade). In Europe, over $10 billion could be invested this year, doubling that of 2018 and driven by the sector's leadership in integrated digital banking (e.g., Revolut, N26). In Asia, however, the numbers are slowing down. That's partly due to the Ant Financial outlier last year, partly due to the collapse of the P2P digital lending industry, and partly (I think) due to the rise of crypto assets (e.g., excluding $1 billion for Tether).

Let's cut more specifically on the difference in how value is accrued and realized. Perhaps I am relying too much on anecdotal evidence, so let me know if you see data that suggests otherwise. But, we can still plod along with this thought experiment. One of the big news items last week was that the London Stock Exchange, valued at $20 billion, is in talks to acquire Refinitiv, valued at $27 billion. You may remember the massive payments and core banking consolidations earlier in the year, and this is a version of that type of consolidation in the capital markets. For a while now, the story has been that the most valuable thing about exchanges isn't the trading venue, but the data generated from the trading venue. Such an acquisition is a massive directional bet towards data and market infrastructure.

For fun, some history. Refinitiv was partially spun out of Thomson Reuters (which now owns a minority stake) at a $20 billion valuation into the hands of Blackstone in 2018. In a bit over a year, it has added $7 billion of value. The entity is essentially 130 fintech companies assembled together into a 40,000 client powerhouse, generating $6 billion of revenue. That extra $7 billion of value that LSE is willing to pay won't be fully covered by $350 million of cost-savings over 5 years, but you know, Fintech is hot. I wouldn't mind being a private-equity backed CEO in a case like this. That said, it's not a fresh tech stack. If anything, it is the opposite of a fresh tech stack -- rather, it is the financial optimization of a massive financial industry data infrastructure founded in 1850.

And that managerial optimization of legacy finance is something that the United States is really good at doing. Gigantic, global, US-headquartered businesses are consolidating into immobile utilities that define what is possible for entrepreneurs. How can you not be excited about Crypto, when your only alternative is to buy a Bloomberg (or Refinitiv) terminal? Why would you want to buy $7 billion of accounting goodwill on solidifying this infrastructure, when $7 billion of venture activity can get you a super highway to the future? Most of the banks are getting it now -- whether you are Deutsche Bank or JP Morgan or BBVA, the story is how you will spend $10 billion on digital transformation and fire all your employees.

Venture investors invest in ventures, and traditional investors invest in tradition. This gets me to other side of the barbell -- SoftBank and China. SoftBank is launching a $108 billionfollow up to its first Vision Fund, which unwitting public investors could get to own any day now. While it is easy to snipe at SoftBank for sky-high price-insensitive valuations, it is wrong to dismiss the strategy without appreciating the results. SoftBank famously played the key role behind Alibaba (cashing out $11 billion), which launched Ant Financial, arguably the most important fintech company in the world. Without Ant, we wouldn't have Facebook building Libra, or the Chinese payments revolution. Without SoftBank, we also wouldn't have many of today's American and European fintech unicorns, from SoFi, to Robinhood, to Revolut. When you are price insensitive, a $100 million option bet on a owning an entire market of future consumers is a fair gamble.

What is SoftBank? It is, at its core, an Internet company. It wants to spends its winnings to do to Finance -- companies like Refinitiv -- what it did to Media. Who is investing in their second Vision fund? Microsoft, Apple, and Foxconn. Facebook, Google, and Amazon are building Fintech solutions directly, so no need for side-car bets with idle cash. How much of that cash is there? Between the top US tech companies, there is at least $500 billion of a balance sheet. You still think Deutsche's Bank $10 billion digital transformation makes any long term difference to anything but the CEO's golden parachute?

The last puzzle piece in our journey this week is China, with Alibaba's success largely subsidizing SoftBank's swashbuckling. I want to point you to a couple of high quality pieces. Fortune's China’s Biggest Private Sector Company Is Betting Its Future on Datawalks through how Ping An generates about $160 billion of revenue (haha, $6 billion Refinitiv) and uses AI to settle 7 million auto accident claims per year. The company collects data on hundreds of millions of customers, and re-uses that data across healthcare, insurance, and wealth management. Its products are distributed by over 1 million indepedent sales agents.

Or check out this a great write-up on Tencent's WeBank (by Norbert Gehrke), which is another top Chinese fintech that delivers products across lending, investing, banking, and wealth management. While we in the West are just starting to think about our Fintech bundles, these apps started with attention and spun out one finance feature after the other. What really stuck with me, however, is that WeBank has a valuation of about $30 billion after receiving its license in 2014. Deutsche Bank, that giant of suits and accountants, boasts a market capitalization of less than $15 billion. The screenshot below is twice as valuable.

The best macro mental model I found for why Fintech activity in the East is both more innovative and more valuable is from Gapminder. The vertical axis in the chart below is life expectancy, and the horisontal one is a logarithmic plot of income. Each bubble is a country, color coded for its continent and sized for its population. That big green one on the right is the United States, surrounded by smaller ones like Singapore and Sweden. The two big Red bubbles are China and India, with China having higher GDP per capita.

I am showing you two time periods about 70 years apart, but seeing the animation in real time is quite persuasive. The simple answer is that all countries are floating up and to the right, improving both their life expectancy and GDP per capita. The two are deeply interlinked. While the US has a bit more room to squeeze out, it is pretty much on top of the world. Nobody is standing still. What is more impressive: going from $16k to $60k per capita (3.5x US), or from $1k to $16k (16x China) in the same time period? And if you look forward 70 years, what possible outcomes do you see? Covering the ground of bringing a billion people towards AI-enabled financial services is a much bigger opportunity than optimizing how institutional traders download their PDFs.

That said, there is a high amount of irrational exuberance around this thesis, and it is easy to lose your shirt. I recently had an invaluable lunch with a reader of this newsletter, who is a venture investor in China, and she suggested that many private Fintechs are hitting the wall. It is difficult in the mainland to go public or achieve a free-market exit, other than flipping the company to Baidu, Alibaba or Tencent. This limits the upside structurally. Separately, opportunism and scams have been rampant in both P2P lending and crypto businesses, resulting in increasing central government control and legal action. Thousands of companies have been shuttered, users have lost access to their invested capital, and unscrupulous entrepreneurs are being tracked on public offender maps.

Chinese tech company valuations are more expensive than ever. User attentions are over-saturated with commerce, lending, and other financial products across dozens of competing apps. As a result, venture investment into the sector is slowing, with bike companies dying left and right. If you go back to the very first Fintech venture chart in this write-up, you'll see that the Asian numbers are the only ones down year-over-year.

In this context, it is interesting to think about the opening up of Chinese financial markets just initiated by the central bank. One of the main barriers -- a restriction on foreign investors owning more than 25% of a company's shares -- has been removed. Similarly, foreign rating agencies can now rate bond instruments in the inter-bank markets, as well as make their own investments, and set up money management enterprises (from wealth to pension funds). Will Facebook and Google now be able to acquire a Chinese high-growth lending Fintech? Will Ant Financial stake and distribute Libra through its mobile app? Fintech is the next big bubble! Fintech has already burst!

Short Takes

TAMP on the rise: AssetMark goes public. This company is a wealth management enabler, and sold $275 million in equity at a $1.6 billion valuation. The revenues sit around $370 million -- a bit higher I would say than the 2x more "valuable" Plaid.

Atom Bank raises £50 million. Largely owned by BBVA, Atom is a UK neobank that is spending more money on expansion and to upgrade its core banking system to one built by cloud startup Thought Machine. Similar news in the US: New York City-headquartered MoneyLion, which provides customers both financial advice and access to loans and other services, said today it has raised $100 million. The team started with payday loans using heavy data science, and has now converged on the same model everyone is using.

Betterment Moves Beyond Robo Investment Advice and Into Banking. Joining Wealthfront, the other top roboadvisor is offering its own banking product through third party banks. This is big news in the digital advice world -- and of course a super clear strategy for several years now.

Home Insurance fintech Hippo Raises $100 Million. Mark my words -- insurance providers like Hippo will soon get married to home equity lending providers like Figure.

German Regulators Approve $280 Million Ethereum Token Sale. The German financial regulatory has appoved an STO which packages up a chunky real estate-backed bond. The firm performing the offering is called Fundament, and it spent 7 months getting regulatory permission. It seems that the Europeans, including France and the UK, generally get it a bit more than their American cousins.

Metamask Launches Mobile App Beta to Broaden Appeal of Ethereum DApps. One of the better crypto wallets out there is coming to mobile. None of these things will remain wallets, however -- they will be multi-featured dashboards across decentralized finance offerings, from trading to lending to banking.

I wanted to point out a couple of interesting essays on DeFi. Superfluid Collateral in Open Finance considers a world where collateral in one lending protocol can be packaged and used as a derivative in another lending protocol. Cool, but actually not cool. Digital Asset Lending via Decentralized Lending Protocols Q2 2019 summarizes where the $150 million of Q2 loans were originated -- first place to MakerDAO, second place to dYdX. Ethereum: The Digital Finance Stack walks through the infrastructure, manufacturing, and distribution layers of what is possible today.

Apple contractors 'regularly hear confidential details' on Siri recordings. Whistle blowers at the tech company are saying that Siri records private conversations routinely -- from doctor visits, to crimes in progress, to sexual encounters. It then sends those recordings to human staffers to "improve speech recognition".

The FTC’s Remarkable $5 Billion Fine for Facebook. Facebook makes about $60 billion in revenue annualized, with a $20 billion profit, so this is a 10%-ish haircut for a single year. The cost of undermining democracy and blowing up privacy on the Internet is like paying a nasty parking ticket. Alternately, you could tell a story about how allowing Cambridge Analytica access to user data wasn't intentional, and the fine is an oversized and arbitrary regulatory response. But you know, actions louder than words.

NASA Partners With US Navy To Develop AR Displays For Spacesuits. The article shows pictures of deep sea divers, and talks about how astronauts and military are going to be using data rich helmet displays. In similar-ish news, This $399 Gadget Brings Augmented Reality to Your Motorcycle Helmet. One dystopian outcome is that these helmets are distributed by Uber or Deliveroo to food delivery motorcyclists. Certainly financial incentives will be instantiated somehow.

Unity, now valued at $6 Billion, raising over $500 million. Who gets to make the rendered world real? Video game companies, of course.

The internet is piped across all the attention platforms, including the ones nobody uses yet. See -- Firefox Reality Brings Secure VR Web Browsing To Oculus Quest, and also I Spent a Full Day Working in the Magic Leap One & Discovered the AR Office of the Future. Will we all be waving around like lunatics, wearing our augmented reality glasses in 2030?

Looking for more?

Find me on Twitter here for Fintech and here for Digital Art.

Want to send me a note? Reach out here anytime.