Blueprint: Apple spends $150MM on open banking with Credit Kudos; Corp Card fintech Ramp raises @$8.1B; Haun Ventures launches $1.5B crypto fund

Gm Fintech Futurists — our agenda for today is below.

OPEN BANKING: Apple acquires UK open banking startup Credit Kudos (link here)

PAYTECH: Fintech firm Ramp more than doubles valuation to $8.1B after latest fundraise (link here)

WEB3: Katie Haun’s Crypto Venture Capital Funds Break Records (link here)

LONG TAKE: The Yuga Labs triple threat -- $3B NFT floor, $4B valuation, and $12B of $APE (link here)

PODCAST: Perpetual futures in DeFi and seeing frontier technology, with Perpetual Protocol Co-Founder Yenwen Feng (link here)

To go deeper and support our analysis, check out the premium features below.

Visit our carefully curated Sponsors:

One America Works' FinTech remote recruiting event can connect you to fantastic companies in the crypto space like Blockdaemon as well as fast-growing wealth management startups like Harness Wealth. Best of all, all of the roles are 100% remote. The virtual recruitment event runs until Sunday, May 15.

👉 Register Here

Short Takes

OPEN BANKING: Apple acquires UK open banking startup Credit Kudos (link here)

Apple deepens its fintech capabilities with a $150MM acquisition of UK open banking start-up Credit Kudos. The fintech provides insights and scores on loan applications using transaction and loan outcome data sourced from the UK open banking framework. The premise with such data sets is better payments and underwriting — lenders can reduce risk, increase higher quality acceptance rates, and underwrite faster.

There’s a lot of consolidation within the Open Banking space, unsurprisingly spearheaded by the card networks — Mastercard and Visa defending their network-of-networks turf. The latest acquisitions include Visa’s $2.15B acquisition of Tink and Mastercard’s acquisition of Alia in the second half of 2021. As for Apple, such an acquisition grants them integrations and access to bank data in Europe, accelerating product development and human resourcing timelines.

A couple of opportunities would come naturally: (1) Apple launched Apple Card credit card a few years in the US with Goldman Sachs, and maybe this leads to Apple Card launching in the UK, (2) Apple may integrate Credit Kudo’s account-to-account payments into Apple Pay, bypassing the card rails and their fees, and (3) Apple could build out a BNPL offering, using Credit Kudo’s credit scoring alternative to assess credit worthiness. Putting credit on top of commerce is a good way to juice revenues in the short term.

Reminder: finance is a feature.

Interested in sponsoring?

We work with select companies to deliver brand awareness to our 100,000+ digital finance audience. See our prior partners here, and reach out here with interest.

PAYTECH: Fintech firm Ramp more than doubles valuation to $8.1 bln after latest fundraise (link here)

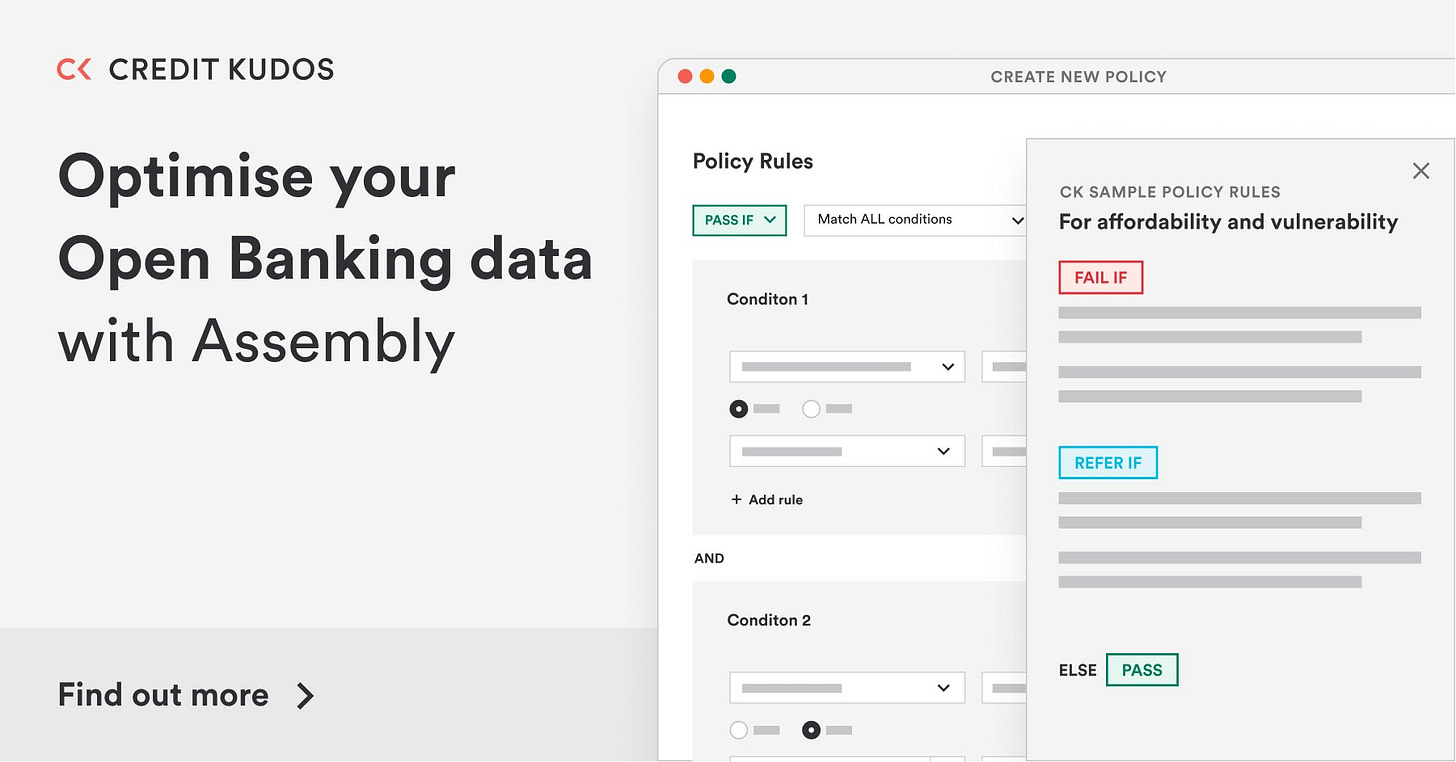

Ramp, a corporate card and finance automation platform, has raised $750MM, bringing its valuation from $3.9B to $8.1B. The deal is composed of $200MM in fresh equity and $550MM in debt — we interpret the debt slug of the round as capital for lending downstream. Total funds raised since founding in March 2019 are now at over $1 billion, which, you know, is a lot. The round was led by Founders Fund (Thiel) and joined by Stripe, Iconiq Capital, and Thrive Capital (Kushner), among others.

In 2021, Ramp quadrupled headcount, grew revenue by 10x, supported 5,000 businesses on the platform, and powered $5B+ in annualised payment volume. It also launched two new products: (1) BillPay, a B2B payments tool, and (2) Ramp for Travel, which provides an AI-assisted travel experience from bookings to expense reporting. For context, here’s a framing of its revenue growth — more on this shortly.

The software product is an offering for employee spend management — automating non-payroll spend, streamlining employee expenses, travel management, procurement, and bill payments. This is part of the broader trend of Silicon Valley taking a swing at the office of the CFO and the “financial function” within companies. Our podcast on the topic is here. We are bullish on the trend given that retail comes first (already done!), and then SMBs and institutions follow.

A few things for the careful reader. The software is marketing for the company’s monetization strategy, which is digital lending. Of course lending is profitable upfront — we know this from OnDeck Capital and how things can play out if venture SaaS multiples are applied to underwriting. Second, Ramp is a fast follower of Brex, which has proven the marginal economics around this business model. But, it is backed by Stripe, which means an open door to the most modern API-based point of sale in the world. And like we said about Apple, “Putting credit on top of commerce is a good way to juice revenues in the short term”. A lot of tactical things are set up to go right for the company.

WEB3: Katie Haun’s Crypto Venture Capital Funds Break Records (link here)

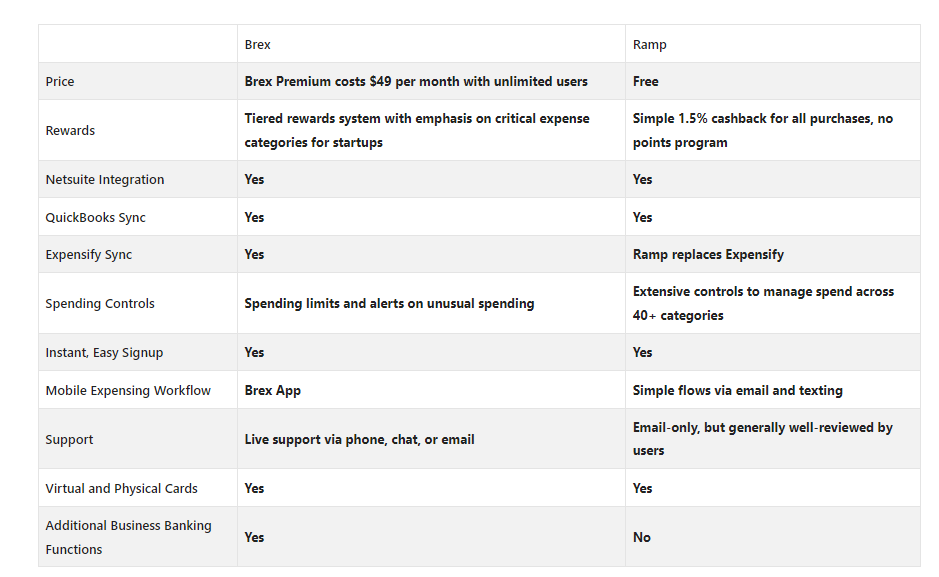

Ex-a16z and federal prosecutor Katie Haun has raised $1.5B for her new venture capital firm, Haun Ventures. The fund will be split $500MM towards early-stage start-ups and another $1B towards more mature startups within the Web3 space. Haun and her team are coming out of Andreessen, one of the leading venture conglomerates backing crypto today.

Despite the current risk-off macro environment, Haun believes the timing is right given strong founders build foundational projects throughout cycles. We agree, and continued private investing activity in the space confirms others think this too - Electric Capital recently raised $1B for crypto investments and Bain Capital Ventures have just launched a $560M fund. As further evidence of this hypothesis, about $32B was invested by venture firms into crypto startups last year.

Haun’s vehicle will be deployed over 2+ years in digital tokens and equity across DAOs, DeFi, and NFTs. Current positions include OpenSea, NFT company Autograph (hi Tom Brady!), crypto lender Moonwell, and blockchain builder Aptos (bye Zuck!). We expect to see large checks go into expensive companies as a result of this type of raise. SoftBank, Tiger, a16z now have more competition.

One notable strategy is the team of political insiders to influence Washington. That means Capital is worried about Regulation, but thinks it *can* change it through lobbying and pressure. It also means this is no longer a game of money, but a game of power. But you knew that.

Rest of the Best

Here are the rest of the updates hitting our radar. Note that DeFi and digital investing now have their own dedicated weekly emails, on Tuesday and Thursday respectively.

INSURTECH: Buckle raises a $15 million loan

INSURTECH: Acrisure acquires international MGA platform Volante Global

LENDING: SME lending platform Validus acquires Citi Singapore’s CitiBusiness loan portfolio

LENDING: Ola to acquire fintech Avail Finance

VR: Surgery Training Platform ‘Osso VR’ Secures $66M Series C Financing

WEALTHTECH: InvestCloud works with Oppenheimer on digital wealth platform

WEALTHTECH: Wealth raises $16 million

The Yuga Labs triple threat -- $3B NFT floor, $4B valuation, and $12B of $APE (link here)

We look at the $450MM raise by Yuga Labs, creators of Bored Apes and acquirer of CryptoPunks.

In particular, we focus on the interplay of primary issuance and its dynamics relative to the markets — a $3B NFT collection, a $12B fungible token, and a $4B venture valuation. These are recursive dynamics. We double check the logic of issuing fungible tokens on top of luxury goods communities by looking at ConstitutionDAO and Loot.

Podcast Conversation: Perpetual futures in DeFi and seeing frontier technology, with Perpetual Protocol Co-Founder Yenwen Feng (link here)

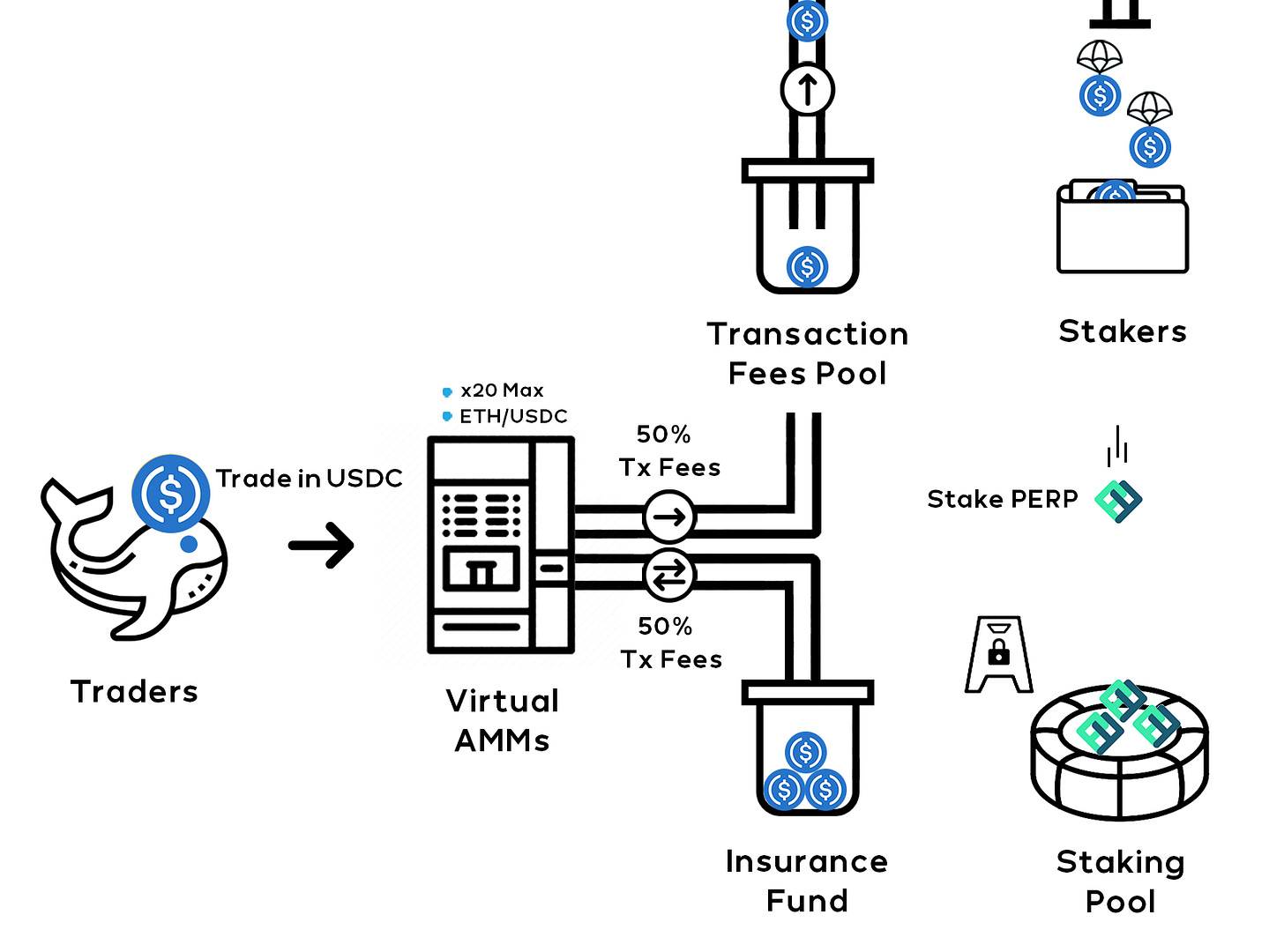

In this conversation, we chat with Yenwen Feng, co-founder of Perpetual Protocol, a decentralized perpetual contract protocol for every asset, made possible by a Virtual Automated Market Maker, with an aim to create an accessible and secure decentralized derivatives trading platform. Yenwen has over 17 years of various expertise and experience in the financial and tech industry, co-founding businesses like Cubie Inc. and Cinch Network. Yenwen also holds an MS degree in computer science from National Chiao Tung University.

More specifically, we touch on the idea of "perpetual trading" on top of AMMs. He explains how the idea is similar to traditional spot trading of the self custody assets on AMMs and how it's really capital efficient. He also talks about how he and his co-founder fell in the crypto rabbit hole in 2017 and how they joined Binance, and so so much more!

More? More!

If you want o deeper in Fintech & DeFi, upgrade to a premium Blueprint subscription below. Our value prop is simple: experienced judgment, accurate vision. If you knew the shape of the tomorrow, what would you do today?