Blueprint: Apple using own cash for BNPL; Engagement banktech Backbase valued @$2.6B; Optimism market maker $20MM hack

Hi Fintech Architects —

You are the best. The markets are awful, hold on to your hats, we’ll cover Celsius soon. Today’s agenda below.

BNPL: Apple Announces Plans to Launch a Buy Now, Pay Later Service Within Apple Pay (link here)

BANK TECH: Backbase raises its first funding, $128M at a $2.6B valuation, for tools that help banks with engagement (link here)

DAOs: A Message to the Community from the Optimism Foundation (link here)

QUARTER IN REVIEW: Top 3 key Fintech developments in Q2 2022 (link here)

PODCAST: Were we wrong about neobanks and B2C fintech? With 2x digital bank founder Will Beeson (link here)

To go deeper and support our analysis, check out the premium features below.

Short Takes

BNPL: Apple to fund pay-later loans off its own balance sheet (link here) and Apple Announces Plans to Launch a Buy Now, Pay Later Service Within Apple Pay (link here)

BNPL, called “Apple Pay Later”, will launch as part of the iOS 16 update in September 2022. It will let users make purchases and pay for them in four installments over a six week period, with the initial payment on purchase and the remaining three payments every two weeks thereafter. This works for online and in-app purchases, but not point-of-sale transactions.

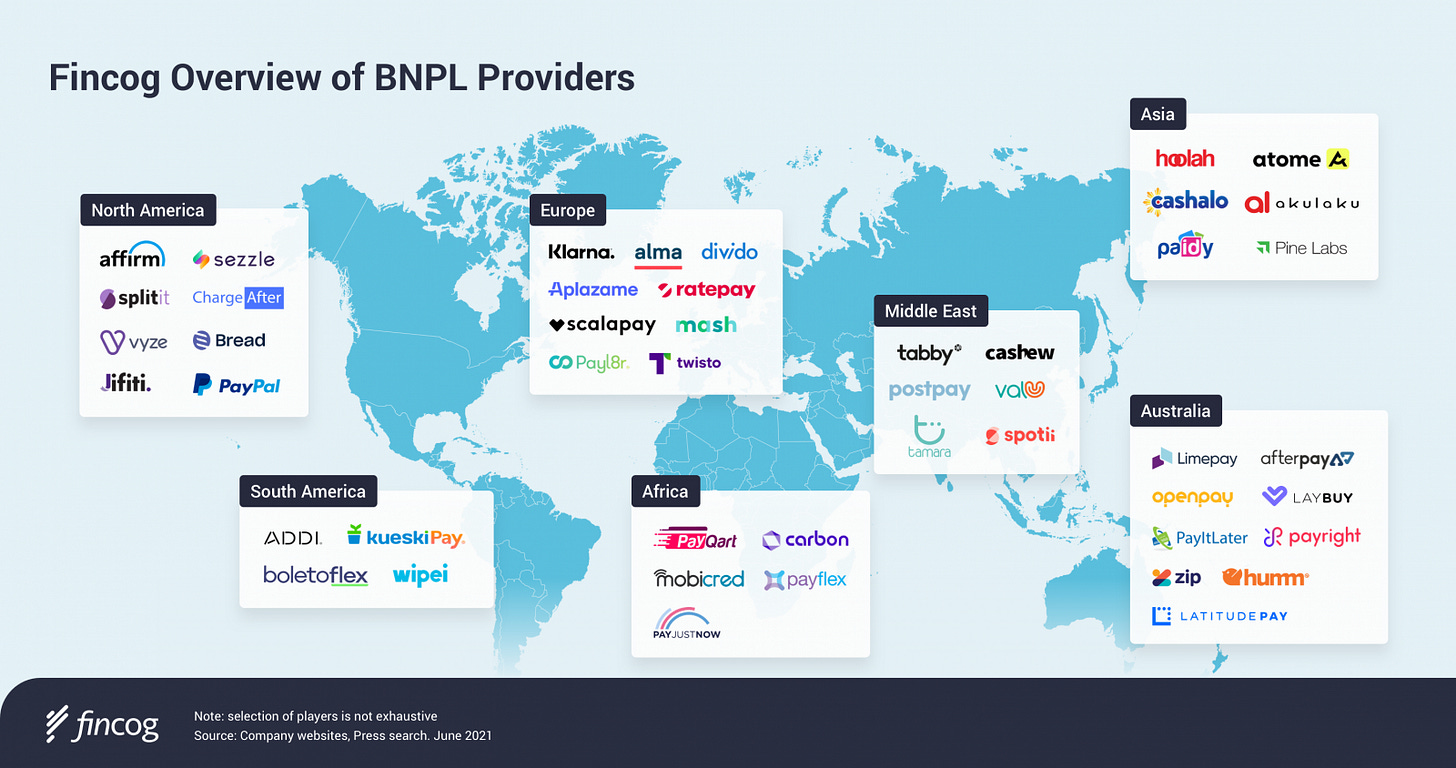

Several unicorns emerged around the BNPL feature in recent years, and in 2021 BNPL users grew 100%+ year over year, but momentum is starting to slow. The fast rate of growth correlated with the pandemic, which led to a 43% increase in e-commerce in 2020. Despite popularity, BNPL sparked regulatory concerns around the financial burden on some users and that insufficient checks are made to ensure that loans are made to individuals who can afford it. We still think this a good user experience for Apple customers; adding financing adjacent to Apple Pay infrastructure makes it easy users to use BNPL within the commerice flow, without requiring third-party underwrirting. We expect Apple to be growing out the market as a result, while pure play firms spin fast to stay in place (i.e., see Klarna’s layoff of 10% of their workforce).

The last bit of news is about Apple using its own balance sheet to underwrite the BNPL loans — that’s easy enough to do with $50B+ of cash. That means that Goldman Sachs, Wells, Green Dot, or any other embedded fintech provider isn’t embedded. Given the tight economics within Apply Pay costs for financial partners, it’s probably not a big monetary loss, just a market share, psychological one. We also like this take from Simon Taylor, pointing to Pay Later as a way to penetrate deeper into merchant adoption and compete with Square and PayPal, as well as strengthening its stranglehold over user identity.

BANK TECH: Backbase raises its first funding, $128M at a $2.6B valuation, for tools that help banks with engagement (link here)

Amsterdam-based Backbase was founded 10 years ago, and just raised its first funding round — a €120MM ($128MM) investment at a €2.5B ($2.6B) valuation. Motive Partners was the sole investor in this round, and they usually take a private equity view rather than a YOLO fintech VC view. The firm provides a middleware platform across retail banking, business banking, and wealth management that connects both to the core and B2C apps.

Backbase has 150 large banking clients, revenue of €200MM, and has become profitable, all while bootstrapping. The company wants to accelerate its go-to-market strategy, moving into Middle East, Africa, and Latin America, and explicitly not acquisitions. Platforms like this deliver meaningful value add to banks and midsize financial institutions, using their data to develop engagement and personalization for customers. We also wonder how much of that value is in the UI/UX vs. the underlying data engine as well.

It takes perseverence to land this type of play over a decade, especially where willingness to pay for many financial institutions is low until value is proven. We see onboarding and SMS / texting nudges here as ways to increase bank conversions — and Backbase claims 10x customer retention and 90% lower channel maintenance costs for their clients. This is a good example of a company thoughtfully built.

DAOs: A Message to the Community from the Optimism Foundation (link here)

Last month Optimism launched their DAO and started to airdrop tokens to its users. Just last week, 20 million OP tokens, intended for the market-maker Wintermute, were lost in a crypto hack / user mistake.

Wintermute provides liquidity provisioning services for crypto projects looking to launch a token. For their services, Optimism was paying 20MM OP tokens (prior to the hack this was worth $20MM+) from the Foundations Partner Fund. The Optimism team initially sent two test transactions, and once Wintermute confirmed they were received, Optimism sent the remainder. Wintermute realised they could not access the tokens as they provided an address for an Ethereum multisig, which was not yet deployed to Optimism. Consequently, Wintermute was not able to access the funds until they deployed the L1 multisig on Ethereum to the same address on Optimism’s L2. TLDR, a fat finger infrastructure mistake that could have been remedied, but…

… before Wintermute was able to do this, a hacker was able to deploy the multisig to L2 with different initialisation parameters, giving the attacker access to the 20MM OP tokens. So far, around 1MM OP tokens have been sold on, and 1MM sent to Vitalik Buterin. Optimism provided a new grant of 20MM OP tokens to Wintermute to continue their liquidity provisioning operations, a pricy mistake in an already bad market.

Two takeaways. First, even seasoned players like Wintermute and Optimism can fall victim to usability mistakes, with errors nearly impossible to reverse and lots of adversarial actors around. Second, despite the hack, it is incredibly difficult to use the stolen funds — they are tracked on-chain with the world watching.

Quarter in Review: Top 3 key Fintech developments in Q2 2022 (link here)

We look into three overarching thematics over the last several months: (1) Digital banks, lenders, wealth, and brokerages stop defying gravity, (2) Big Tech continues awkward flirtation with Finance, with strength in payments and infrastructure and (3) crypto splinters into Web3 DAOs culture and scalability architecture, destroying most app valuations.

Podcast conversation: Were we wrong about neobanks and B2C fintech? With 2x digital bank founder Will Beeson (link here)

In this conversation, we chat with Will Beeson, co-founder & Chief Product Officer at digital bank BELLA, and co-founder of Allica Bank.

More specifically, we touch on frameworks for navigating down markets, valuations, multiples, why some fintechs have to disclose themselves as tech companies than banks, covid-19 implications, buy now pay later developments, and so so much more!

Rest of the Best

Here are the rest of the updates hitting radar.

INSURTECH: Zywave acquires Strategic Insurance Software

INVESTING: Fruitful raises $33 million

INSURTECH: Overalls raises $4.6 million

PAYMENTS: Nava Benefits raises $40 million

PAYMENTS: Finch raises $15 million

INSTITUTIONAL: Sage announces the acquisition of Futrli

AR: Amazon is using augmented reality to let you try on shoes virtually before you buy them

INSTITUTIONAL: Middesk raises $57M to automate business verification and underwriting

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts