Blueprint: Bitcoin network overwhelmed by Ordinals; 1300 investors crowdfund ESG neobank Green-Got; $80MM for Singaporean mega-fintech Advance Intelligence

The impressive scale of Kredit Pintar, and the rise in meme coins

Hi Fintech Futurists —

You’re the best, today’s agenda below.

NEOBANK: Green-Got is a neobank for climate-conscious customers (link here)

CRYPTO: 'Attack on Bitcoin’ Claims Circulate as Transaction Fees Climb Higher (link here)

LENDING: Warburg-Backed Advance Intelligence Raises $80 Million Funding (link here)

LONG TAKE: FDIC consent order vs. $3B banking-as-a-service champion Cross River Bank (link here)

PODCAST CONVERSATION: Value of digital identity in fintech and crypto, with Plaid Head of Identity Alain Meier (link here)

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

In Partnership

The event brings together top minds in fintech to cover topics like digital banking, fraud, blockchain, embedded finance, fintech investing, and more. 5,000 attendees will engage in 20,000+ double opt-in meetings this May 10-11 in NYC. It’s the can’t-miss event of the year!

👉Use promo code “FinBlue” and get 15% off today

As a member of the Fintech Blueprint community, you are invited to our first-ever, in-person gathering with free drinks and live entertainment!

Join me (Lex) and other Fintech Blueprint team members at the Edison Ballroom in NYC on May 11 at 5:30pm to celebrate our partnership with Fintech Nexus.

Short Takes

NEOBANK: Green-Got is a neobank for climate-conscious customers (link here)

Green-Got, an aspiring French neobank focused on climate change, raised $5.5MM (€5MM) in funding led by ESG venture investor Pale Blue Dot (like the Earth!). Notably, €2MM came using equity crowdfunding via Crowdcube from 1,300 investors, showing consumer demand for initiatives at the intersection of sustainability and banking. While not yet a licensed bank, Green-Got partners with the bank Crédit Mutuel Arkéa, and acts as the retail payment distributor on top.

On neobanking features, Green-Got matches the standard model — digital account setup, debit card in the post, Apple / Google Pay compatibility, no foreign transaction fees, and a modern mobile app. However, Green-Got differentiates itself through an explicit focus on climate change, showing the carbon dioxide equivalent of all of your card purchases to give users insight into their environmental impact (e.g buying flights vs. renting a bike). Another niche feature interchange fees going to select non-profits as donations, rather than towards economics of the business. And since Green-Got is yet a licensed bank that can lend, revenues must come from users paying a €6 monthly account subscription.

It is important to highlight that digital financial institutions can go beyond distributing traditional financial product, rather helping align the value generation of their business model to the ethical values of their customer base — doing well by doing good.

Green-Got is certainly more expensive than some of its free competitors, but does have over 13,000 paid customers — about $1MM in revenue if an average user stays subscribed for the whole year. People pay more for products and services whose mission they believe in. Being cheaper and faster isn’t the only proposition, providing a vision that appeals to your customer base can be differentiator enough. For comparison, check out our podcast conversation with Aspiration, one of the first green-focused neobanks below.

👑Related Coverage👑

CRYPTO: 'Attack on Bitcoin’ Claims Circulate as Transaction Fees Climb Higher (link here)

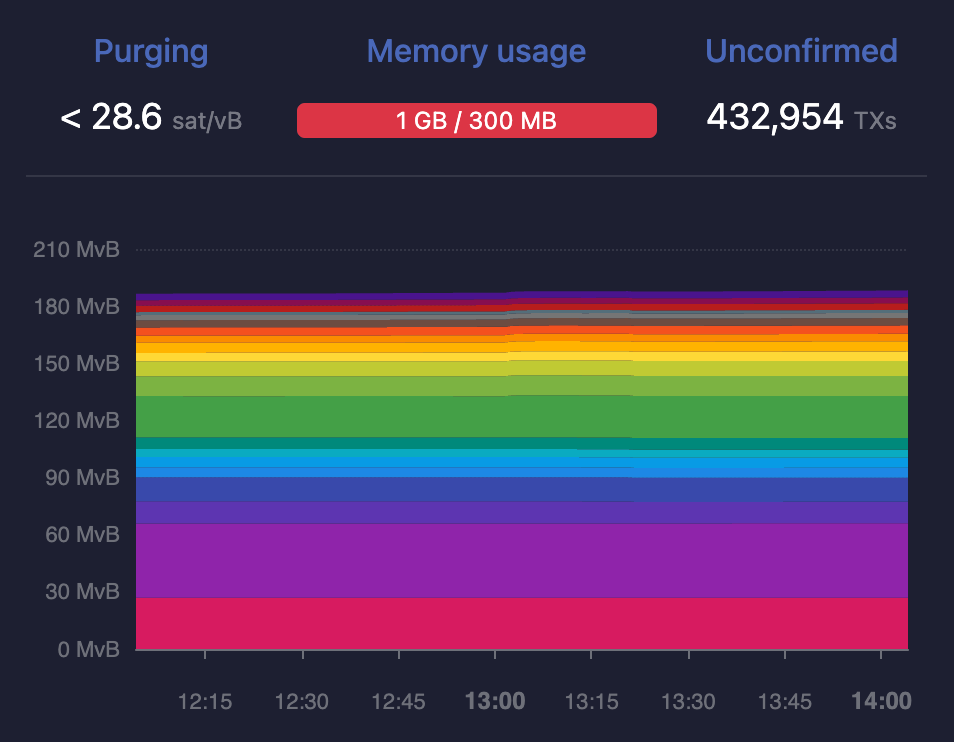

The promise of a next generation value network is that it can process transactions. But Bitcoin is seeing over 430,000 transactions still waiting to be confirmed in Bitcoin's mempool. As a reminder, the mempool receives transactions before they are picked up by miners and incorporated into the blockchain. Transaction fees are also relatively high, sitting at around $26.

Some commentators claim this is a “denial of service” attack on Bitcoin, hampering its speed and cost. But the cost of submitting sufficient transactions to slow the network is very high, so we think this is unlikely.

More likely, the impact is due to the popularity of Ordinals, the digital assets encoded into the Bitcoin blockchain, most resembling NFTs with an ERC-20-like structure. The number of inscriptions — a method of saving an image — via Ordinals reached 4.3MM on Sunday, up from 2.5MM the week before. UniSat Wallet, an exchange, processed $9.3MM in inscription trading volume on Sunday alone.

The rapid rise of these inscriptions, dubbed BRC-20 tokens, points at a world where Bitcoin could have the same level of programmability as more advanced computational blockchains like Ethereum. We too are excited to see any sign of adoption and increased utility, since Bitcoin is still the predominant cryptocurrency and any innovations that boost its utility are likely to gain some level of traction. However, it is also possible that these inscriptions are driven by a meme coin trend, which has recently accelerated.

From a strategic perspective, the question is whether Bitcoin can add computation, or Web3 smart contract protocols can gain BTC-equivalent levels of decentralized security.

👑Related Coverage👑

Interested in Sponsorship?

To support the Fintech Blueprint and reach our 170,000+ Substack and LinkedIn audience of builders and investors, learn more below or contact us here.

LENDING: Warburg-Backed Advance Intelligence Raises $80 Million Funding (link here)

Singaporian fintech Advance Intelligence Group raised $80MM in Series E funding led by Warburg Pincus and Northstar Group. The round brings total funds raised to $700MM. The last round was the company’s $400MM Series D in 2021, at the time led by SoftBank Vision Fund II and valuing the firm at over $2B.

Since its founding in 2016, Advance Intelligence has developed a suite of AI-powered and credit fintech products and services. These include Atome (a BNPL provider), Kredit Pintar (a digital lending platform), ADVANCE.AI (an end-to-end risk management platform), and Ginee (a platform for e-commerce merchant services). Several of these are unicorns in their own right.

Together, these products have coverage of over 40 million customers, 235,000 merchants, and 500 enterprise clients. Additionally, over $4B in loans have been disbursed by the group. The new investment will focus on the application of AI in customer transactions, which is of particular importance given the company’s geography.

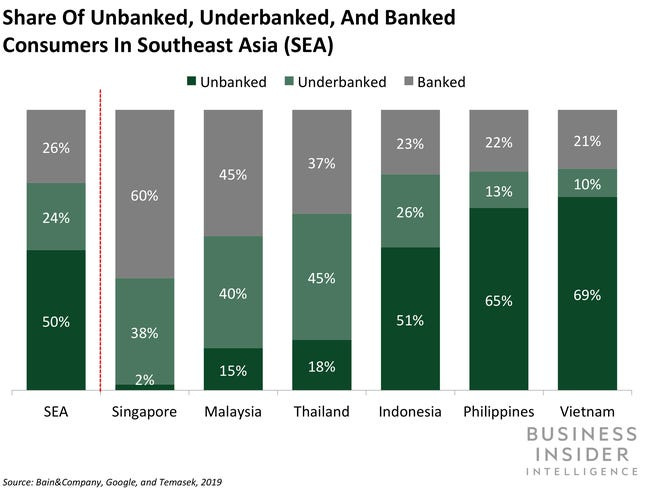

We are highlighting Advance Intelligence to show the art of the possible — growing into a fintech unicorn group with over 40 million users in 7 years. Further we see the opportunity around credit and digital finance in the Southeast Asia markets, where around 70% of all adults in the region are still unbanked or underbanked.

Long Take: FDIC consent order vs. $3B banking-as-a-service champion Cross River Bank (link here)

We continue to develop our view on the unfolding situation in American banking, including the collapse of First Republic.

We explore the incentives of regulators like the FDIC and OCC during “war time”, and highlight the types of companies that seem to be in the regulatory cross hairs to preserve systemic stability — whether for the right or wrong reasons. Further, we focus on Cross River bank, its API-first banking-as-a-service strategy, and its competitors. Then we look at the FDIC consent order targeted at the company, and the types of remedies it has to make in order to remain compliant. Will the USDC-backing bank be able to survive?

Podcast Conversation: Value of digital identity in fintech and crypto, with Plaid Head of Identity Alan Meier (link here)

In this conversation, we chat with Alain Meier, the Head of Identity at Plaid.

Plaid builds a data transfer network that powers fintech and digital finance products. Plaid's product, a technology platform, enables applications to connect with users’ bank accounts. Alain has spent the past decade problem-solving in all things digital identity. He was a founding member of the Stanford Bitcoin Group and went on to start identity verification company Cognito, which was acquired by Plaid.

Rest of the Best

Here are the rest of the updates hitting radar.

PAYTECH - Cross-border processor Rev acquires online payments company Netspend to reach underbanked customers

PAYTECH - African payment service provider Nomba raises $30M, backed by Base10 Partners and Shopify

NEOBANK - Neobank creator Fintech Farm raises $22m

OPEN BANKING - Tarabut Gateway raises $32 million for Saudi push

LENDING - EMBEDDED LENDING STARTUP NIRO RAISES $11M IN SERIES A FUNDING ROUND

CAPITAL MARKETS- Deutsche Bank to acquire Numis

CAPITAL MARKETS - Billionaire Thiel-Backed SPAC Is Said to Near Merger With Hyphen

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions.

Later this week, we will share our Short Takes on the latest Web3 and Digital Investing news, reviewing several companies. If you’d like us to look at any specific item, feel free to share your thoughts in the comments below. We will provide our best analysis in response to your requests.