Blueprint: Bored Apes "acquires" CryptoPunks; Acorns Raises $300M @$2B; Digital real estate unicorn Roofstock

Gm Fintech Futurists — our agenda for today is below.

METAVERSE and NFTs: Yuga Labs acquires CryptoPunks and Meebits and gives commercial rights to the community (link here)

DIGITAL INVESTING: Acorns squirrels away $300M Series F after scrapping SPAC, now worth nearly $2B (link here)

REAL ESTATE: Roofstock valued at $1.9 billion with new funding round led by SoftBank Vision Fund 2 (link here)

LONG TAKE: Rugging, early token liquidity, and the expected cost of holding (link here)

PODCAST: Investing in Web3 and fintech for CFOs, with Redpoint's Urvashi Barooah (link here)

As always, if you want to go deeper, check out our premium features below.

Visit our carefully curated Sponsors:

Don’t miss out on 30,000+ meetings with thousands of participants from leading Fintechs like Alloy, BlockFi, Cash App, Checkout.com, Feedzai, NIUM, Pipe, Socure, Stripe & Upstart, Banks like Bank of America, Barclays, Citibank, J.P. Morgan & USBank, Investors like Bain Capital Ventures, Commerce Ventures, General Atlantic, 175+ Credit Unions, Networks and many others! Virtual, March 22-24.

👉 Get your ticket now!

Short Takes

NFTs: Yuga Labs acquires CryptoPunks and Meebits and gives commercial rights to the community (link here)

Creators of the Bored Ape Yacht Club (BAYC) NFT collection, Yuga Labs, has acquired the intellectual property rights for the CryptoPunks and Meebits NFT collections from their creator, Larva Labs. Yuga Labs now owns 400+ CryptoPunks and 1,700+ Meebits, as well as the brands, copyright of the art, and IP rights. The combined market cap of the top two PFP projects (BAYC and CryptoPunks) is worth about $3.6B in the current market.

The first move is to provide CryptoPunk and Meebits holders commercial rights of their NFTs, similar to the model used for current BAYC holders. The lack of such rights was controversial, and hindered the holders of these collections from engaging with digital or brand collaborations for their NFTs, effectively cutting off meaningful monetisation and associated distribution. This move opens up possibilities for Punks or Meebits based spin-offs, allowing community creators and developers to begin using these NFTs in their Web3 projects. That in turn will drive further attention to these projects, and NFTs generally, as users discover ways to monetize their super popular digital objects.

Punks won’t necessarily go the social club route, like BAYC, but will be guided by community feedback. This is a very interesting acquisition to us, and perhaps the first of its kind in pointing to how quickly a fashion can rise, or fade. We also find it notable that Larva Labs is pointing to their lack of a skill-set needed to maintain and grow the Punks, a skill-set that largely requires community building, fashion surfing, and new media collaboration. It’s also a better outcome than ownership by a traditional media enterprise like Disney, which would struggle with the Web3 ethos of giving most value back to owners.

Interested in sponsoring?

We work with select companies to deliver brand awareness to our 100,000+ digital finance audience. See our prior partners here, and reach out here with interest.

DIGITAL INVESTING: Acorns squirrels away $300M Series F after scrapping SPAC, now worth nearly $2B (link here)

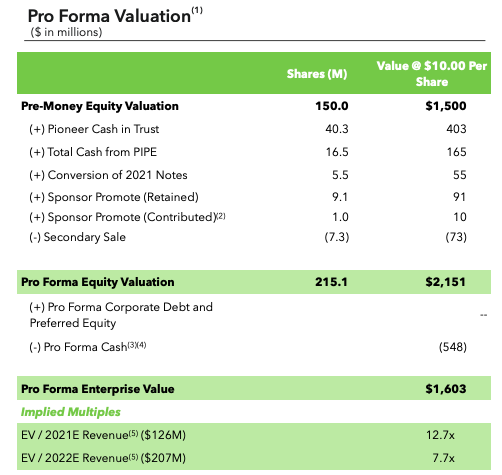

Acorns, the micro savings and investing app, has raised $300MM in Series F funding at a valuation of nearly $2B, led by TPG. The announced fundraise comes just 6 weeks after a cancelled $2.2B SPAC with Pioneer Merger Corp, which was vetoed in favour of a traditional IPO in the future. The most previous fundraise was $105MM in 2019, at a $860MM valuation. For context, we previously covered the SPAC here.

Over the past year Acorns has acquired two businesses: (1) Pillar, an AI-powered startup that helps manage student loan debt, and (2) Harvest, a startup helping consumers reduce debt. Acorns now has 4.6 million paid subscribers and its projected revenue last year (which it claims to have beaten) was $126 million. The company expected to burn $85MM between 2020-2021, and given the way that digital economics collapsed at year end, we expect the underlying financials to be more challenged rather than less. But that’s a guess.

The SPAC and fintech public markets are ugly for lots of reasons. Despite this TPG round, Acorns will continue to ready itself for an IPO as the market evolves, and the playbook is to add new features like crypto investments, family-specific offerings, and customised portfolios. That said, the challenge of squeezing a large subscription fee (e.g., $100/yr) from small accounts (e.g., $1,000) means you are charging a lot on a little as a percentage. We like the offering from a functionality perspective, and hope they can work out a fair model at scale.

DIGITAL INVESTING: Roofstock valued at $1.9 billion with new funding round led by SoftBank Vision Fund 2 (link here)

Roofstock raised $240MM in a Series E funding round led by Softbank, bringing the valuation of the company to $2B. The digital real-estate marketplace specialises in Single-Family Rental (SRF) investing, offering both first-time home investors and global institutions a more accessible and cost-effective way of owning property.

Properties are listed online through Roofstock Marketplace. Once purchased, users can track income, expenses, leases and other information relating to the rental process. Besides their online marketplace, Roofstock One allows real-estate to be securitised, enabling investors to buy whole or fractionalised shares of managed property.

The institutional activity around real estate portfolios is quite interesting too. Redfin’s analysis of US home purchases found that a record 74% of investor purchases were Single-Family homes and 18% of these homes were acquired by institutions and businesses. Such trends helped the company acquire $1.2B worth of assets for institutional clients in 2021. In total, Roofstock has processed $5B in transactional volume, half of which it generated in 2021. In a world where people are looking for interest rates, this aspect of real estate can become quite attractive. We can add to that the pressure from unbounded inflation and the value of hard assets increasing from capital gains.

Rest of the Best

Here are the rest of the updates hitting our radar. Note that DeFi and digital investing now have their own dedicated weekly emails, on Tuesday and Thursday respectively.

NEOBANKS: Neobank Lunar raises $77 million as it rolls out crypto tools

DIGITAL LENDING: Stilt secures $114M in debt & equity to help fintechs and neobanks launch credit offerings with its API

DIGITAL LENDING: Pension fund leads $276 million investment in loan platform Lendable

OPEN FINANCE: Bank Rakyat Indonesia Leverages Open Banking To Boost the Country’s Rate of Financial Inclusion

PAYTECH: Branch Closes $75 Million Series C to Expand Accelerated Workforce Payments

INSURTECH: Talage raises $9 million

CAPITAL MARKETS: Hong Kong chamber puts a Nasdaq-style board on wish list to compete with mainland China bourses for tech listings

Rugging, early token liquidity, and the expected cost of holding (link here)

We look at “rugging” in the crypto space, and the different forms it can take.

In particular, we explore the impact on DeFi from Andre, the impact on LTC from Charlie, and the academic literature about insider selling in the equity markets. The simple answer is that insiders selling is bad. The complicated answer is, it depends on the time horizon and the reasons. Further, the crypto space and its early liquidity and costs of failure are uniquely set up to incentivize opportunistic selling.

Podcast Conversation: Investing in Web3 and fintech for CFOs, with Redpoint's Urvashi Barooah (link here)

In this conversation, we chat with Urvashi Barooah, a Principal at Redpoint Ventures. Urvashi holds a B.A. from Middlebury College, has 3 years experience in Mergers & Acquisitions consulting at Ernst & Young’s New York office. Since then she has worked at BCG, Primary Venture Partners, and Redpoint Ventures - where she has been an integral part to investing in high growth startups across Web3 and Fintech.

More specifically, we touch on the journey to becoming a venture capitalist, the essential tools and mental models used to become an effective VC such as the CFO tech stack, the modernisation of financial platforms, the transition to investing in crypto companies, and so so much more!

More? More!

If you want to go deeper in Fintech & DeFi, upgrade to a premium Blueprint subscription below. Our value prop is simple: experienced judgment, accurate vision. If you knew the shape of the tomorrow, what would you do today?