Blueprint: Circle's SPAC from $4B to $9B; African paytech Flutterwave worth $3B; Mastercard go-to-market in open banking, ESG, crypto

Gm Fintech Futurists — our agenda for today is below.

CRYPTO: Stablecoin Provider Circle Hits $9B Valuation After New SPAC Deal (link here)

PAYMENTS: African fintech Flutterwave triples valuation to over $3B after $250M Series D (link here)

PAYMENTS: Mastercard expands consulting with practices dedicated to crypto, open banking and ESG (link here)

LONG TAKE: What the Crypto Super Bowl says about Fintech brand building (link here)

PODCAST: Building an investment platform with a risk management heart, with Riskalyze CEO Aaron Klein (link here)

As always, if you want to go deeper, check out our premium features below.

Visit our carefully curated Sponsors:

Don’t miss out on 30,000+ meetings with thousands of participants from leading Fintechs like Alloy, BlockFi, Cash App, Checkout.com, Feedzai, NIUM, Pipe, Socure, Stripe & Upstart, Banks like Bank of America, Barclays, Citibank, J.P. Morgan & USBank, Investors like Bain Capital Ventures, Commerce Ventures, General Atlantic, 175+ Credit Unions, Networks and many others! Virtual, March 22-24.

👉 Get your ticket now!

Short Takes

CRYPTO: Stablecoin Provider Circle Hits $9B Valuation After New SPAC Deal (link here)

Circle will be going public at a $9B valuation, following its merger with the SPAC Concord Acquisition Group. The SPAC was priced at $4.5B in July, but the new numbers are at double the value. This increase is due to the rapid growth of Circle’s stablecoin USDC, which has exhibited 13X growth from 2021 and on-chain transfers surpassing $1.8 trillion. This is behind only Tether’s USDT.

The expansion of USDC can be partly attributed to their multi-chain integration on eight blockchains, including Solana and Avalanche. Integrating with products like Solana’s Phantom wallet aligns with the strategy we discussed in our prior Circle long take – aggregating platforms for institutions and individuals bridging between traditional and blockchain rails to generate income through USDC transaction fees.

Most income is earned through transaction and treasury services (TTS). Circle Accounts and API services – which now includes Circle Yield – allows users to earn higher interest rates on idle cash balances and aiding their working capital requirements.

Circle is going to continue to be one of the main drivers for retail and institutional adoption. Yet, the $9B valuation divided by the 10,000 expected number of accounts in 2022 gives a value of $900,000 an account. Alternately, the valuation dividied into $50B of reserves is a hefty 20% – a very premium price. Further, the SPAC and fintech equity markets have been getting hammered for structural reasons, so this change is indeed surprising.

Interested in sponsoring?

We work with select companies to deliver brand awareness to our 100,000+ digital finance audience. See our prior partners here, and reach out here with interest.

PAYTECH: African fintech Flutterwave triples valuation to over $3B after $250M Series D (link here)

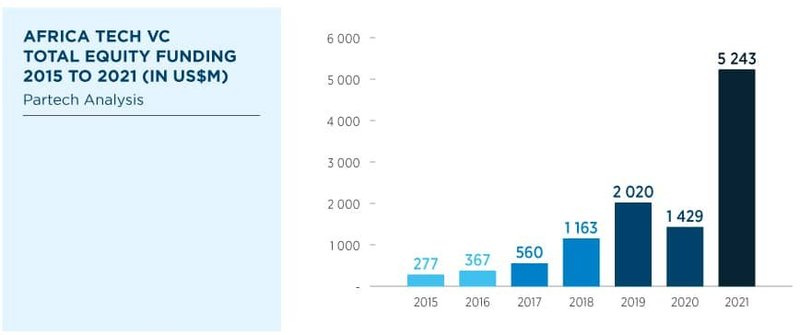

Flutterwave, a cross-border payments firm for small to large businesses, is now the most valuable start-up in Africa after raising $250 million in Series D funding at a $3 billion valuation. The fundraise brings total funds raised since inception in 2016 to $475 million, with the previous round raising $170 million in March 2021. For context, the two start-ups that were knocked off the African valuation top spot, OPay and Chipper Cash, are also both paytech firms.

In the year, Flutterwave has gone from processing 140 million transactions worth more than $9 billion to processing over 200 million transactions worth more than $16 billion. Customers have grown from 290,000 to 900,000, and its infrastructure now reaches 34 countries on the continent and can process payments in 150 currencies.

Consistent innovation has been key to Flutterwave’s recent success. Products like Flutterwave Market, which allows small African business to setup an e-commerce shop online with zero cost scale, and Send, a remittance service that has become Flutterwave’s fastest growing product, have boosted the client roster and created a more comprehensive package. As for the future, Flutterwave has its eyes set on growing its customer base through a series of paytech acquisitions.

Payments are a big business in Africa, as economies get plugged into modern financial rails without legacy baggage. The sequence of building is to start with money in motion to power economic activity, and then to mature money at rest with deposits and lending/borrowing. Capital markets develop simultaneously as liquidity seeks new opportunities and investments.

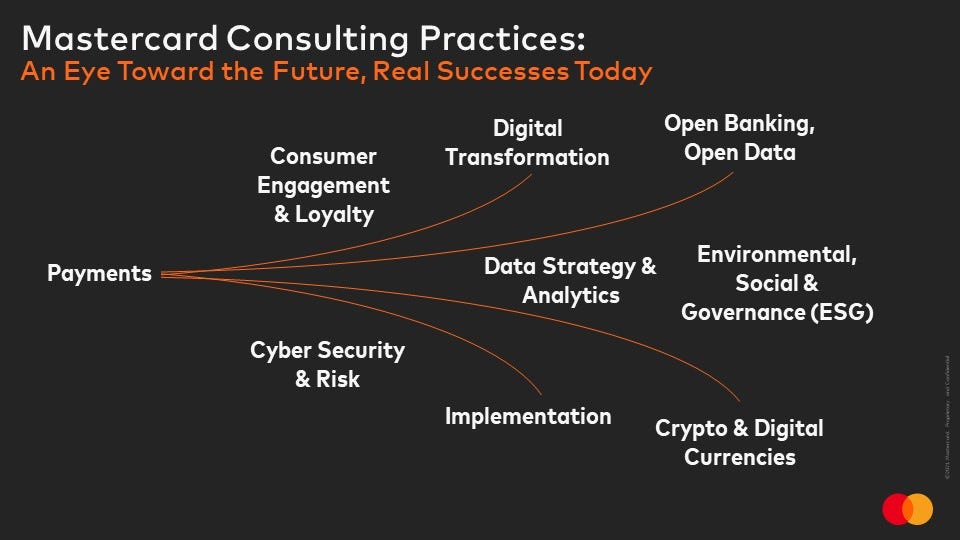

PAYMENTS: Mastercard expands consulting with practices dedicated to crypto, open banking and ESG (link here)

Mastercard is exploring new fintech frontiers, with its payments consulting service opening new practices across Open Banking, Open Data, ESG, and Crypto & Digital Currencies. The move will see Mastercard’s 2,000 strong data scientists, engineers, and consultants grow by 500 college graduates and young professionals.

The payment processor has been gradually moving into these ecosystems through various investments over recent years, such as the acquisition of blockchain analytics company CipherTrace. The new consulting services will cover early-stage education, risk assesments, as well as crypto and NFT strategy development (from crypto loyalty programs to crypto cards).

If you can’t beat them - join them. Mastercard has already been bringing crypto onto its network and teamed up with the likes of Wirex and BitPay to create crypto cards last year. We’re seeing a big push to make sure crypto still passes through their channels, opening up the crypto doors to thousands of merchants on their network.

Despite the news, Berkshire Hathaway still sold $1.3B in Mastercard stock and $1.8B in Visa stock this week, while buying $1B of Nubank. Professional services is a lower multiple business, as it is less repeatable and sticky than SaaS. But, it is also often the required go-to-market motion for infrastructure providers to install their rails and deploy their networks.

Rest of the Best

Here are the rest of the updates hitting our radar. Note that DeFi and digital investing now have their own dedicated weekly emails, on Tuesday and Thursday respectively.

INSTITUTIONAL: Genesis raises $200M in Tiger-led round to grow its finance-focused low-code application platform

CONSUMER: Mastercard expands consulting with practices dedicated to crypto, open banking and ESG

INSURTECH: ALKEME acquired Insurance Online

INVESTING: Stronghold launches $100M venture arm to invest in underrepresented founders and fintech

INVESTING: Nasdaq Europe to Launch New Equity Derivatives Platform

NEOBANK: UK neobank Atom raises more than $100 million as it eyes an IPO

PAYTECH: Check raises $75 million

PAYTECH: Philippines payment gateway PayMongo gets $31M Series B, will explore regional expansion

ROBOADVISOR: Kenanga takes on StashAway and Wahed with its own AI-driven investment products

What the Crypto Super Bowl says about Fintech brand building (link here)

Did you tune into the ‘Crypto Bowl’?

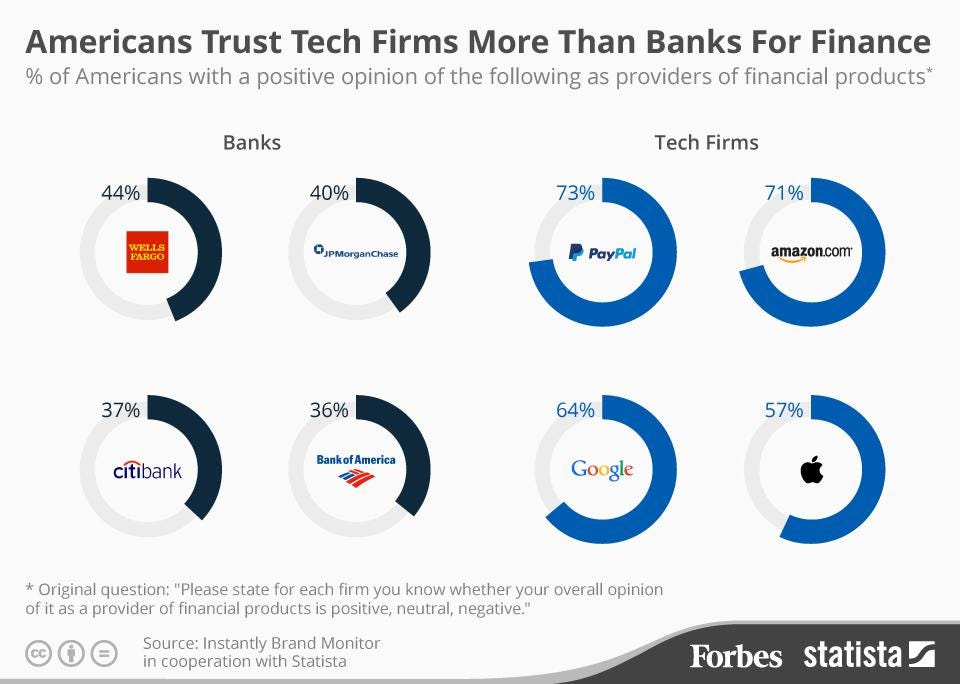

As fintech and crypto companies get large enough — after their blitzscaling unicorn rounds — they need to build brands on a national and global level. In this analysis, we review the brand promises and strategies of the companies that advertised during the 2022 Super Bowl. Their ads capture a moment in time, which we put in context of industry growth and the issues around trust in financial services.

Podcast: Building an investment platform with a risk management heart, with Riskalyze CEO Aaron Klein (link here)

In this conversation, we chat with Aaron Klein, the co-founder and CEO at Riskalyze. Aaron’s career has largely been at the intersection of finance and technology. As co-founder and CEO at Riskalyze, he led the company to twice being named one of the world’s top 10 most innovative companies in finance by Fast Company Magazine. Today, over 200 Riskalyzers serve thousands of advisors who have aligned the world's investments with millions of investors' Risk Numbers®. Aaron has served as a Sierra College Trustee, and in his spare time, he co-founded a school project for orphans and vulnerable kids in Ethiopia. Investment News has honored him as one of the industry’s top 40 Under 40 executives.

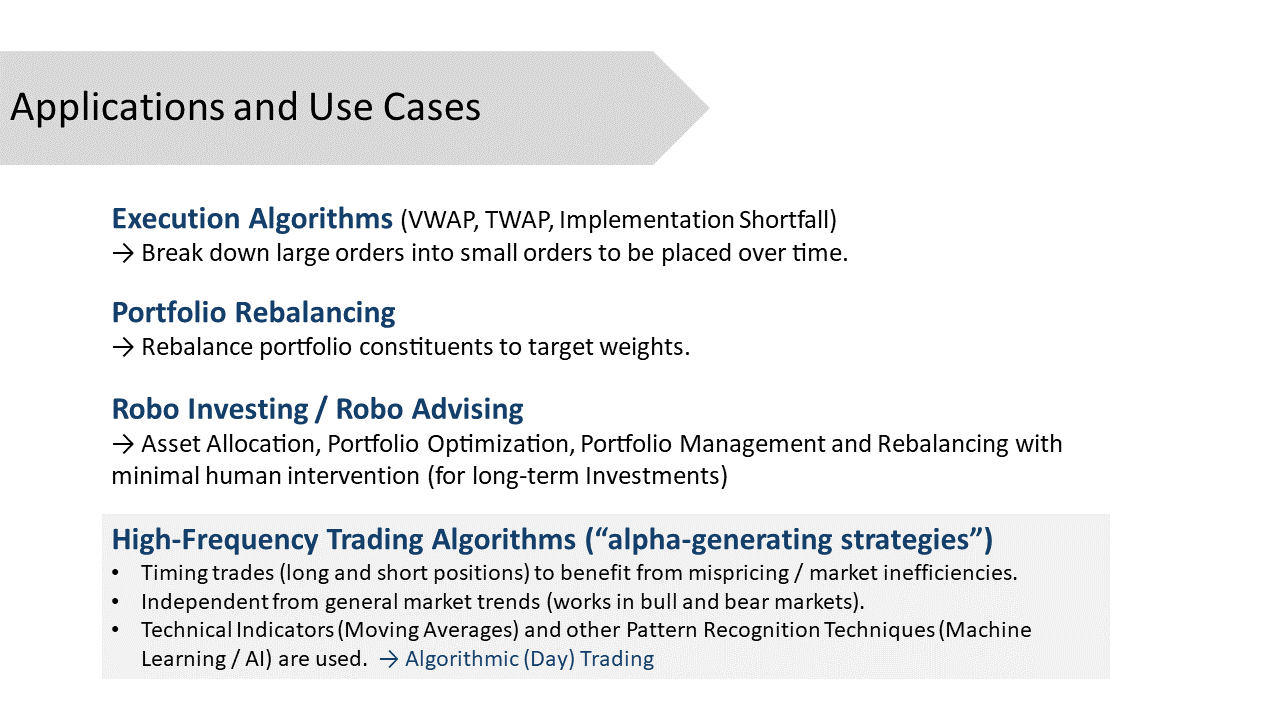

More specifically, we touch on the journey of entrepreneurship, Political campaign fintech and website development, roboadvisors vs. automated trading rebalancing, the future of wealth management and financial advice, and so so much more!!

More? More!

If you want to go deeper in Fintech & DeFi, upgrade to a premium Blueprint subscription below. Our value prop is simple: experienced judgment, accurate vision. If you knew the shape of the tomorrow, what would you do today?