Blueprint: Column, a chartered bank for developers, launched by Plaid co-founder; MakerDAO deploys on StarkNet; Global HR Payments platform Oyster becomes 🦄

Gm Fintech Futurists — our agenda for today is below.

BANKING: Plaid co-founder launches new banking venture (link here)

DEFI: Ethereum’s MakerDAO to Launch on StarkNet, Promises 10x Lower Gas Costs (link here)

PAYMENTS: HR Payments Platform Oyster Raises $150MM Reaching Unicorn Status (link here)

LONG TAKE: Twitter, Elon, Jack, and the promise of decentralized social media (link here)

PODCAST: Launching protocols, DAOs, and NFTs in media and finance, with CEO of Palm NFT studio Dan Heyman (link here)

To go deeper and support our analysis, check out the premium features below.

In Partnership with:

1440’s got you covered. Check out 1440, the fastest way to an impartial point of view on the news. Their team scours 100+ news sources, ranging from culture and science to sports and politics, to get you caught up on the day’s events in a single 5 minute email.

Short Takes

BANKING: Plaid co-founder launches new banking venture (link here)

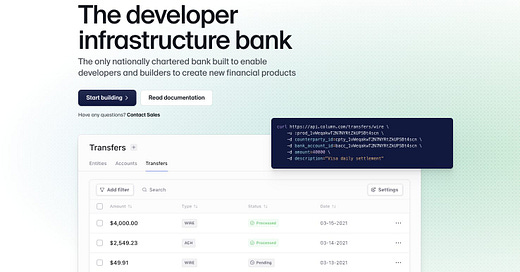

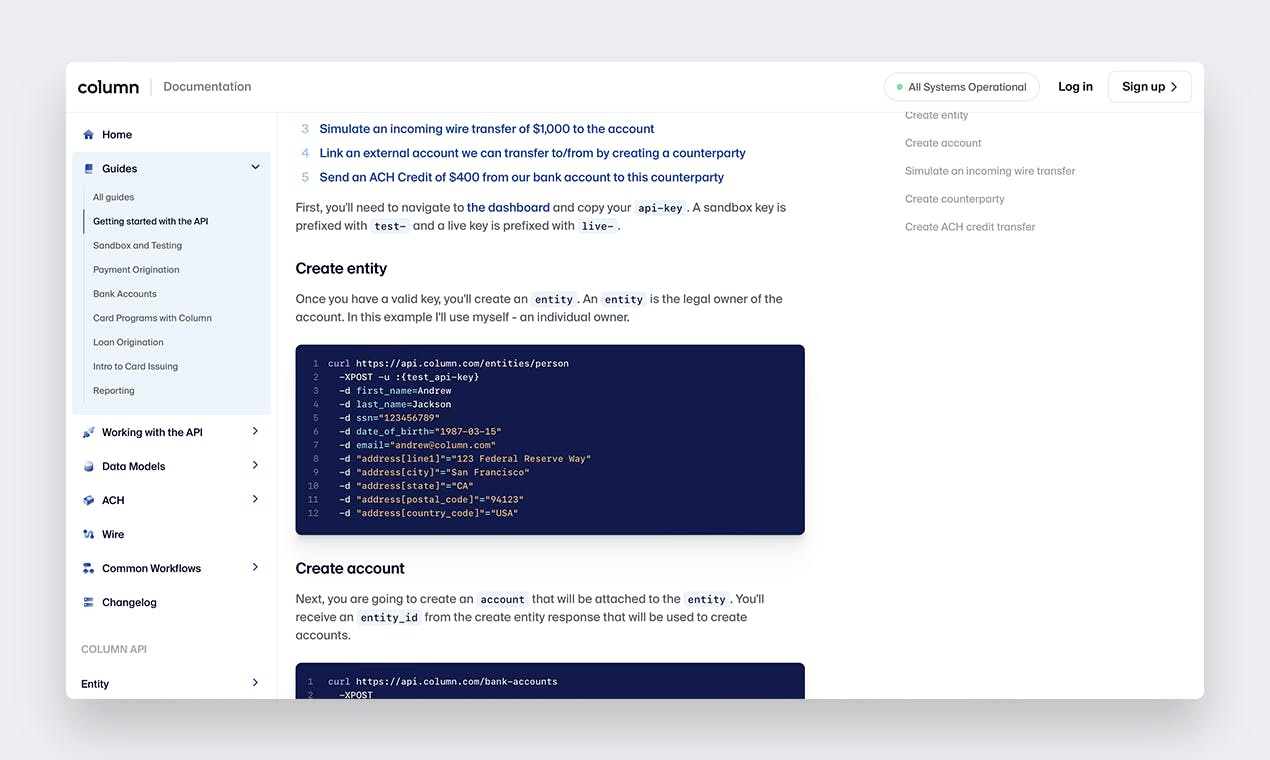

Since 2019, Plaid co-founder William Hockey has been working on Column, a nationally chartered financial infrastructure bank that emerged from stealth last week. Column built its technology stack from the ground up, including “our own ledger, core, and direct integration into the Federal Reserve.” This is in stark contrast with various other fintech products, which must rely on partnerships with banks, middleware companies, and core processors — which leads to worse economics, slower technology, and unclear accountability.

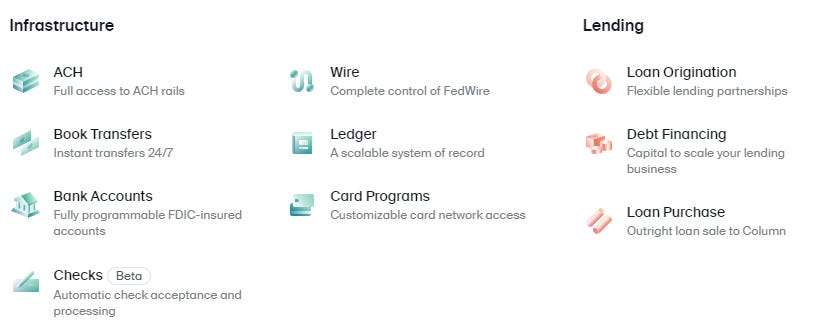

Using Column, developers can build FDIC-insured checking and savings accounts, create apps that pull and push funds between any bank account, and launch debit or credit programs with any issuer processor. Its customers already include Brex, Plaid, and mobile banks Oxygen and Nearside. Some of that functionality is shown below.

In order to gain its national charter, Hockey bought NorCal bank, a small single branch bank from California, for $50MM and rebranded into Column. Hockey and his wife, who serves as co-CEO, have bootstrapped the entire project, giving them control over the direction of the bank.

This reminds us of the founding story for CBW Bank, as well as recent execution from players like Cross River Bank and The Bancorp. Those companies choose a different level of abstraction, and have older technology than what Column is bringing to market today. As you know, small differences in user and developer experience can result in billions of enterprise value.

DEFI: Ethereum’s MakerDAO to Launch on StarkNet, Promises 10x Lower Gas Costs (link here)

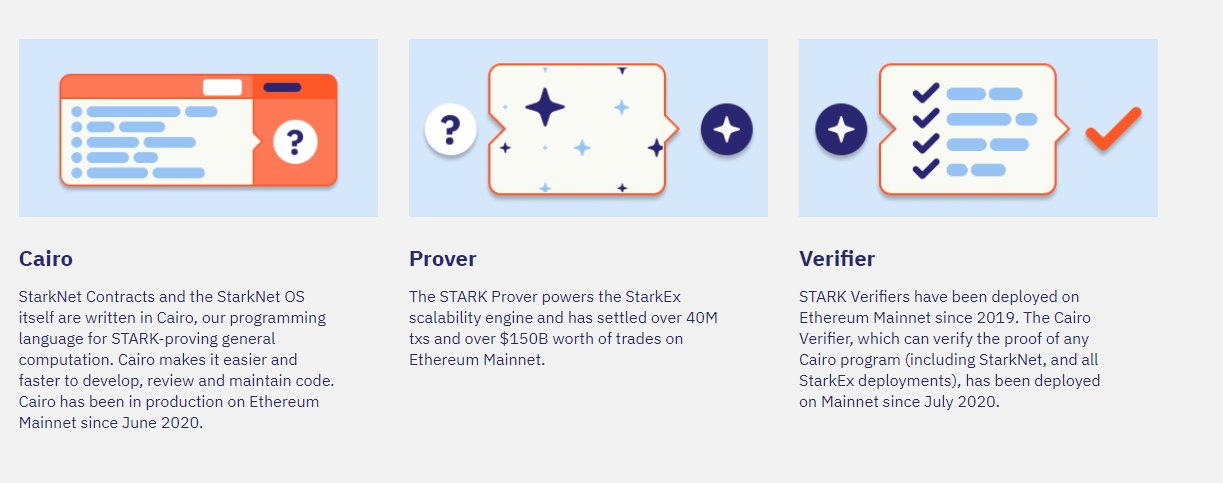

DeFi protocol MakerDAO is looking to lower the cost of accessing its products through an upcoming deployment on Ethereum layer-2 scaling solution StarkNet, on the 28th April. StarkNet, created by Israeli company StarkWare, uses a technology called Zero-Knowledge (ZK) rollups to process large batches of transactions quickly and cheaply. ZK roll-ups preserve user privacy, making it a preferred choice of roll-ups for many DeFi users.

Currently, Maker’s gas costs are predominantly incurred from minting their native stablecoin, DAI, and with transactions related to oracle costs. However, once Multi-Collateral DAI (MCD) is deployed on StarkNet, MakerDAO expect minting costs to reduce by 10x compared to costs on the Ethereum mainnet. Users will be able to make faster withdrawals and reduce DAI minting times as well.

Last year, Maker also integrated with Arbitrum and Optimism, who provide optimistic rollups instead of ZK rollups — a different way of relaying transaction data to mainnet. These layer-2 scaling solutions are meant to make MakerDAO more accessible for widespread adoption, with lower fees and quicker transactions.

The broader story here is about how individual applications are intersecting with an increasingly multi-chain world. Such integrations are expensive to implement with scarce talent, and open up vectors of attack. But they also create operational efficiency within particular functions. A lot more hardening of the technology stack to come.

PAYMENTS: HR Payments Platform Oyster Raises $150MM Reaching Unicorn Status (link here)

Oyster has raised $150MM in a Series C funding round, led by Georgian, giving the company a $1B+ valuation. The global employment platform empowers companies to hire and pay international teams through compliant payroll services and invoice aggregation across 180+ countries.

Businesses pay a flat fee per employee/month starting at $399 for full time employees, depending on the country. In 2021, the number of applicants placed increased by 17x and revenue 20x. The company hired 20,000 applicants in Q1 2022 with an average fee of $699 per employee. We think the capability to route multi-currency payroll payments is particularly interesting, and connects to our prior coverage of tooling that automates the office of the CFO. You can see that money movement here is hidden behind the need to hire labor.

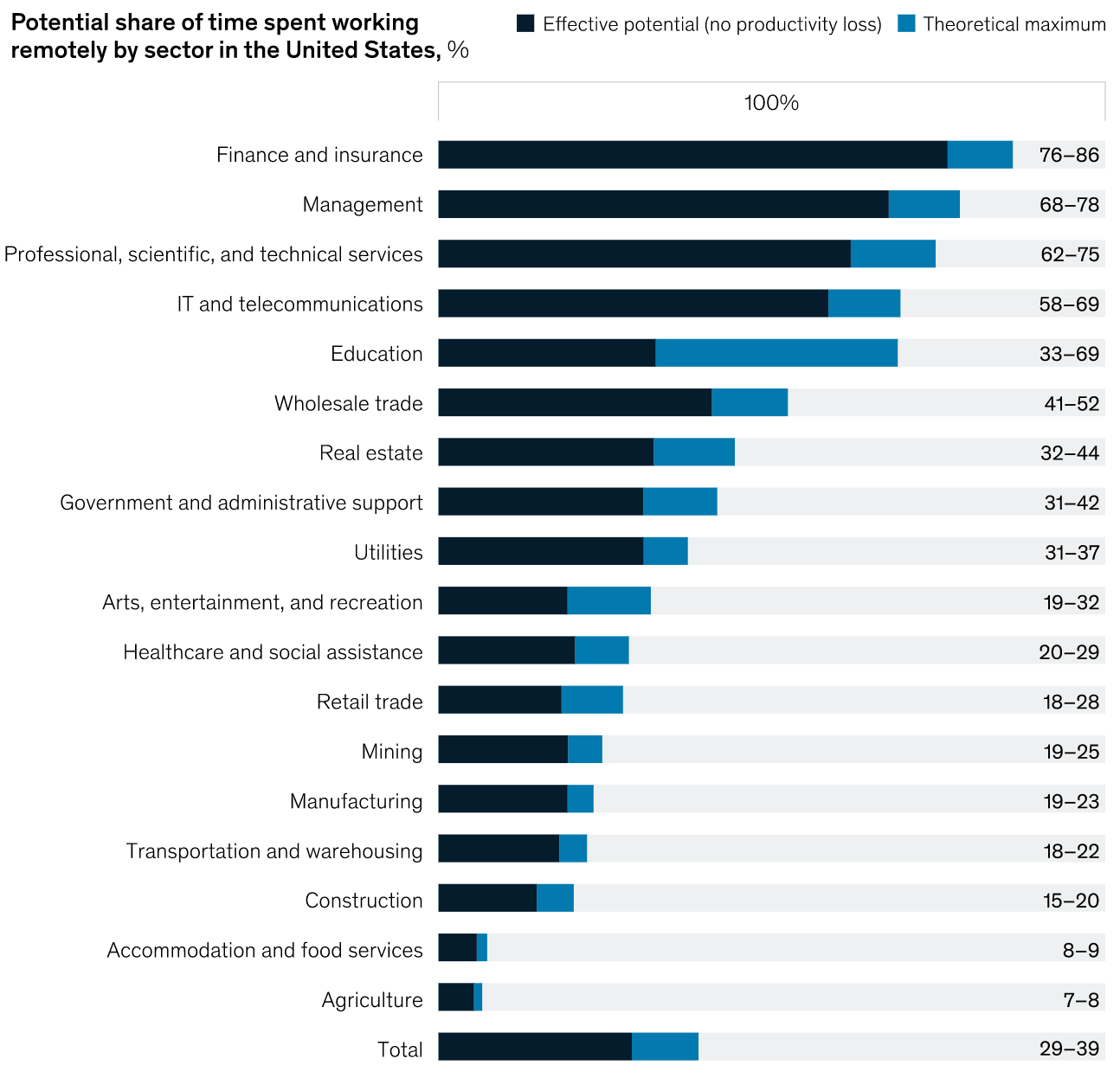

Another interesting angle is thinking through remote work more generally. In employment like intellectual labor — finance, fintech, crypto, tech — physical presence is increasingly less important to value creation. Having a global, distributed workforce is a potential normal to plug into talent pools, so we are not surprised that the platform says that 25% of total pay goes to recipients in emerging countries. Building out this future-of-work infrastructure layer is compelling, especially if at some point it intersects with DAO tooling.

Rest of the Best

Here are the rest of the updates hitting our radar. Note that DeFi and digital investing now have their own dedicated weekly emails, on Tuesday and Thursday respectively.

INSURTECH: Responsive raises $2.8 million

INSURTECH: SIAA acquires Rogue Risk

INSURTECH: Japanese insurance company Tokio Marine launches CVC fund to back early-stage startups

PAYTECH: Here’s why Brex just paid $90M for 10-person software startup Pry Financials

METAVERSE: CaixaBank and Imagine Show Us What Fintech in the Metaverse Should Look Like

Twitter, Elon, Jack, and the promise of decentralized social media (link here)

Elon Musk wants to buy Twitter for $43 billion at the lulz price of $54.20. Twitter has offered him a board seat, on which Elon rage quit, and now the company is pursuing a poison pill to stop the unwanted acquirer. Why is it important to own a social media network?

What principles motivate this behavior? And how can our industry build more trustworthy, decentralized solutions that preserve dignity and the freedoms of expression? We explore several decentralized social approaches in the analysis and point to areas of future promise.

Podcast Conversation: Launching protocols, DAOs, and NFTs in media and finance, with CEO of Palm NFT studio Dan Heyman (link here)

In this conversation, we chat with Dan Heyman, Co-founder and CEO of Palm NFT Studio and Network. Dan is a blockchain industry leader with experience building and leading organisations through the design, development and implementation of enterprise-grade blockchain protocols.

More specifically, we touch on Dan’s fascinating journey from working with the poverty action lab to founding Palm, as well as, Dan’s experience at MIT, ConsenSys enterprise solutions, the philosophy behind Crypto Art, NFTs and their value to large media enterprises, setting up a creator-focused DAO, some exciting upcoming collaborations with DC Comics, and so much more!

More? More!

If you want to go deeper in Fintech & DeFi, upgrade to a premium Blueprint subscription below. Our value prop is simple: experienced judgment, accurate vision. If you knew the shape of the tomorrow, what would you do today?