Blueprint: Fireblocks $8B valuation on $45B AUC; Wealthfront is UBS' third roboadvisor; Wonderland CFO doxxed as ex-convict

Gm Fintech Futurists — our agenda for today is below.

CRYPTO: Crypto infrastructure company Fireblocks nearly quadruples valuation to $8B in six months (link here)

ROBOADVISOR: UBS to acquire robo advisor Wealthfront for $1.4 billion (link here)

CRYPTO: CFO of DeFi Project Wonderland Outed as Co-Founder of QuadrigaCX: Report (link here)

LONG TAKE: Markets wiping out value is a gift for curious learners; on Olympus DAO, SPACs, Diem, Botto (link here)

PODCAST: Modernizing $25B of assets with retirement wealthtech, with Vestwell CEO Aaron Schumm (link here)

We also want to give a special shout out to Nik Milanović, publisher of the “This Week in Fintech” newsletter, who has just launched an early stage ecosystem investment vehicle called The Fintech Fund. One of the most collaborative and kind people in our industry, we are excited to see Nik excel in this new adventure.

As always, if you want to go deeper, check out our premium features below.

Visit our carefully curated Sponsors:

Fintech Meetup Is Almost Here — Only 30 Days Left To Get Your Ticket! The first 1,000+ companies have already signed up so they can meet new partners, fill their pipelines, meet investors and get business done. Meet and create opportunities with the leading Fintechs, Payments Cos, Networks, Banks, Investors, Neobanks, Credit Unions (and many more!). Virtual, March 22-24. Discounted startup rate available for qualifying companies.

👉 Get your ticket now!

Short Takes

CRYPTO: Crypto infrastructure company Fireblocks nearly quadruples valuation to $8B in six months (link here)

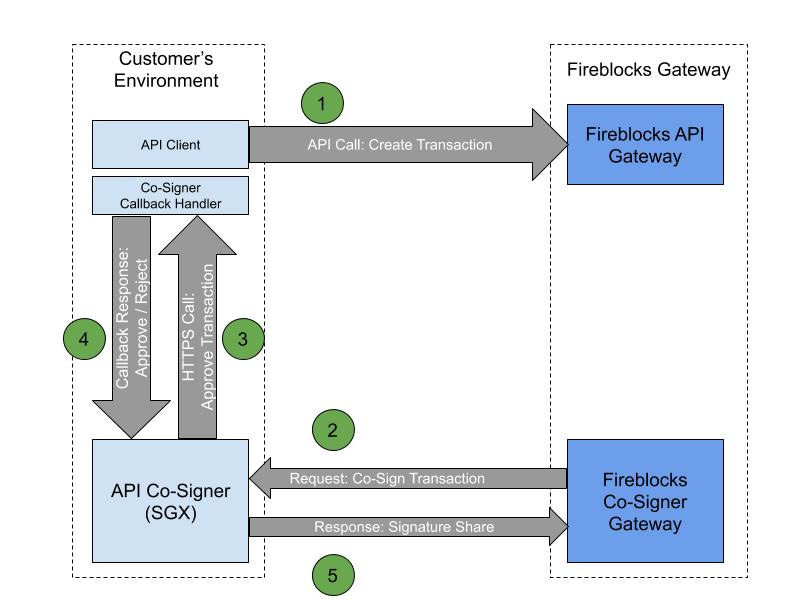

Fireblocks, a crypto custody platform differentiated by its multi-party computation approach to key management, has raised $550 million in Series E funding at an $8 billion valuation. The deal quadruples its Series D valuation of $2.2 billion from six months ago, which was triple the Series C valuation. Total funds raised since 2018 now amount to over $1 billion. This fits into a rapid blitz-scaling trend to establish dominant market positions for crypto-players that are generating real revenues, yielding a whole bunch of private near deca-corns.

Fireblocks helps financial institutions, like BNY, BlockFi, and eToro, by providing “custody” of their digital assets across 25 different blockchains. 2021 saw demand soar with the client base growing from 100 to 800 companies, and $45 billion in assets generating $2 trillion of volume since inception. That’s an interesting figure — about 40x trading turnover. As a result, revenue also grew 600% last year bringing the total to between $50-100 million (according to a loose Techcrunch estimate that would imply an 80x multiple). Further, onchain DeFi is now accounting for about 10% of Fireblocks' transaction volume, spurred largely through their DeFi custody offering with the Aave Arc protocol.

Crypto custody is a rapidly growing market and getting hyper-competitive, despite being in about the second inning of the game. Competitor Copper raised $85 million to date, and has over 400 clients with about $50 billion in monthly notional flows. As more financial institutions engage with digital assets, there's more than enough room for several players to snap up this market — though network effects for stuff like this are very intense and powerful.

ROBOADVISOR: UBS to acquire robo advisor Wealthfront for $1.4 billion (link here)

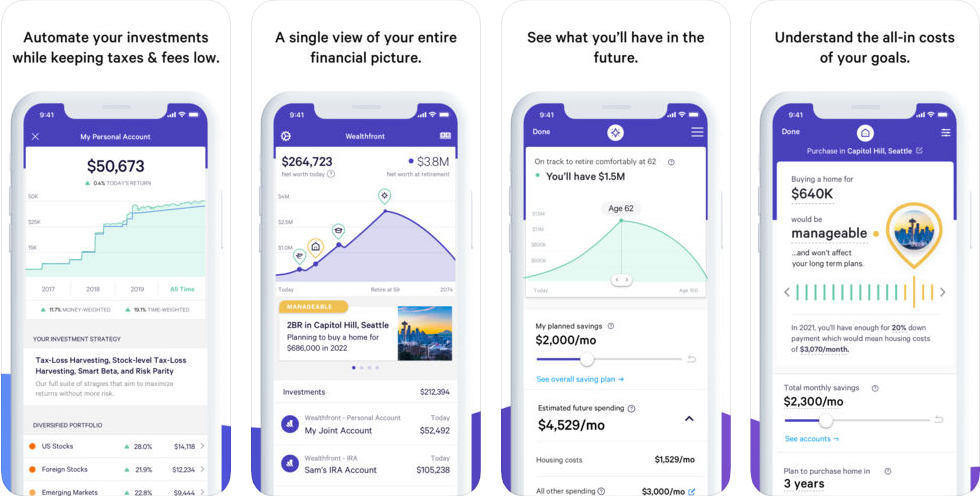

UBS is doubling down on roboadvice with a $1.4 billion acquisition of Wealthfront. The deal brings with it Wealthfront's 470,000 client accounts in the US and more than $27 billion in assets. Reminder that UBS previously had an internally-built Smart Wealth roboadvisor in Europe, and was using SigFig in the US through a fairly deep partnership — selling Smart Wealth into SigFig when the former didn’t work out. So we have seen them dance with digital wealth before.

Wealthfront offers custom plans based off client responses to questions on risk tolerance, time horizon, and desired return. Other features include automatic portfolio rebalancing, proprietary ETFs, tax-loss harvesting, and a cash management account, priced at an annual fee of 25 bps on assets under management. There’s lots to say about how disrupting digital wealth ended up being “making wealth management better” rather than disrupting it. Roboadvice, or rather automated asset allocation and trading and rebalancing, is a useful packaging of a feaure of the financial advisor’s service, but not a reinvention of it.

That the company yelling at RIAs about self-driving money ended up getting sold to UBS, the incumbent’s incumbent, is a useful reminder about the difference between marketing and truth. And that end of the day, venture investors are there to cash out their fund after about 7-10 years, not wait around for 10% annual growth. In the case of Wealthfront, their $30 billion of assets represent 5% of consideration, which is 2x-3x more than the industry RIA average. Not a bad outcome, but similar to Personal Capital, not a crazy good one either. It was never about your pie chart — Coinbase, Robinhood, and Cash App were the smarter plays.

CRYPTO: CFO of DeFi Project Wonderland Outed as Co-Founder of QuadrigaCX: Report (link here)

In a world of anons (anonymous accounts), crypto comes with some special risks. The latest case study comes in the parable of oxSifu, a co-founder and CFO of OlympusDAO fork Wonderland. Reminder — in the current market environment, sentiment-based game theory meme projects are melting into nothingness. Following some diligent research by the community, oxSifu has been outed (i.e., doxxed) as a co-founder of QuadrigaCX, the Canadian crypto exchange labelled a Ponzi scheme by the Ontorio Securities Commission in 2020. oxSifu’s real name is Michael Patryn.

QuadrigaCX was a crypto exchange, until the co-founder Gerald Cotten's “death” or “mysterious disappearance” or “very clever escape” (we don’t know) highlighted that $215 million was missing from the company’s funds. The exchange also misreported trading volume to attract customers — i.e., defrauded them to take their money. So associations with QuadrigaCX generate a pretty high probability of a project being a fraud or scam. Wonderland's co-founder Daniele Sestagalli reportedly knew of Patryn’s history and continued to work with him, based on the premise that people shouldn’t be judged by past history, but by contributions in the present moment.

For context the Wonderland project currency collapsed in value from $10,000 to about $300 since November of last year. At its height, marketcap was around $2.5 billion, being a major player on Ethereum competitor Avalanche. It also connects to a bunch of other things like stablecoin MIM (Magic Internet Money, $3.5B supply), decentralized exchange SushiSwap (via human resources), Popsicle Finance, and a tribe of followers dubbed the “frog nation”. Explosive, correlated, systemic stuff at the edges of the DeFi ecosystem.

We highlight two key observations in the crypto world: (1) there is a cultural preference for anon founders, because that’s counter-establishment, but we still need reputational systems of some sort for the long game; and (2) the doxxing of crypto-influencer accounts has been increasing as the market has been falling, including NFT personality Beanie. Ethics and reputation seem to not matter to people when everything is going up, but when the tide reverses, all of a sudden fairness and compassion are a priority.

Rest of the Best

Here are the rest of the updates hitting our radar. Note that DeFi and digital investing now have their own dedicated weekly emails, on Tuesday and Thursday respectively.

CONSUMER: Vesta closes on $30M in an a16z-led Series A to build a new kind of mortgage infrastructure

INVESTING: Moneyfarm raises £44 million

INVESTING: Robinhood shares tank on Q4 results

PAYMENTS: Premium financing startup Ascend raises $30 million

Markets wiping out value is a gift for curious learners; on Olympus DAO, SPACs, Diem, Botto (link here)

The market is breaking things apart, and we can peer inside to understand them.

The functioning of mechanisms and the results of mistakes are revealed under pressure — let’s not squander such treasure by being afraid. We look in some detail at what’s happened with Olympus DAO and a bit into the public/private fintech markets via SPACs, and touch on Facebook’s Diem’s exit and art robot Botto’s troubles.

Podcast: Modernizing $25B of assets with retirement wealthtech, with Vestwell CEO Aaron Schumm (link here)

In this conversation, we chat with Aaron Schumm, the Founder and CEO of Vestwell, an entirely new kind of digital retirement platform transforming the way plans are offered and administered — for the benefit of advisors, employers, and employees alike.

Prior to founding Vestwell, Aaron was a co-founder of FolioDynamix, a wealth management and advisory services company that powered $800 billion in assets for over 100,000 advisors. At FolioDynamix, which was sold to Envestnet in 2017, Aaron oversaw the strategy, revenue, marketing, customers and product. Aaron holds a B.S. degree in finance from the University of Illinois and an M.B.A. degree from Duke University, The Fuqua School of Business. He was named as one of 40-under-40 by InvestmentNews and WealthManagement.com’s “10 to Watch”

More specifically, we touch on all things 401ks, IRAs, Portfolio Balancing, Roboadvice in portfolio management, and all things FinTech and financial services and so so much more!

More? More!

If you want to go deeper in Fintech & DeFi, upgrade to a premium Blueprint subscription below. Our value prop is simple: experienced judgment, accurate vision. If you knew the shape of the tomorrow, what would you do today?