Blueprint: Galaxy walks from $1.2B BitGo deal; eToro buys Gatsby, a PFOF options broker, for $50MM; Remitly acquires Rewire

Hi Fintech Futurists —

You are the best, today’s agenda below.

CRYPTO: Galaxy Digital is abandoning its $1.2 billion BitGo deal (link here)

INVESTING: Social investment platform eToro to acquire fintech startup Gatsby for $50M (link here)

PAYTECH: Remitly to acquire Rewire (link here)

Long Take: Can governments kill software? The US is trying with Tornado Cash (link here)

Podcast conversation: Connecting 500,000+ small businesses to digital working capital, with Fundbox CEO Prashant Fuloria (link here)

Here’s that handy upgrade button to access the Long Takes — a rigorous view on the future of our industry. Level up your Fintech and DeFi knowledge. 👇👇👇

In Partnership:

Applications are open for leading global Web3 accelerator, Outlier Ventures' Polkadot and DeFi Base Camp programs. Base Camp is a 12-week accelerator program where they support early stage startups with the major challenges they face.

The Outlier vision is to empower innovators in web3, and Over 100 startups have leveraged their expertise to grow… Will you be next?

Outlier Ventures offers:

$100,000 cash stipend to cover running costs during the program

Access to Outlier Ventures and their global industry leading network of builders, investors and mentors

Tailored sessions with technical specialists to support design, building, scaling to enable you to succeed in Web3

Short Takes

CRYPTO: Galaxy Digital is abandoning its $1.2 billion BitGo deal (link here)

One of the biggest prospective deals in crypto —a $1.2B acquisition of BitGo by Galaxy Digital pencilled in May 2021 — has fallen through after BitGo reportedly failed to provide audited financial statements for 2021. BitGo now plans to sue Galaxy for improperly terminating the merger, claiming that they have provided audited financials and honored all legal obligations. BitGo is looking for over $100MM in damages, the size of the break fee on the merger agreement.

We think it is likely that market pressure has made the deal untenable as originally priced. Further, Galaxy took a $550MM loss in 2022Q2, largely due to exposure to Luna, and its stock has fallen from $30+ to about $6, just as most crypto / fintech companies. Still, performance has been good over the past 18 months, with partner capital growing 130% to $1.8B, employees increasing 3x to 375, and over $1B in earnings generated for shareholders. Mike Novogratz, Galaxy Digital’s founder, is also supposdely looking to list Galaxy Digital in the US.

There is still good industrial logic to do a merger — investment banks and asset managers should be able to own custodians and thereby provide the full asset lifecycle to large institutional clients. BitGo would also increase APAC and EMEA exposure for Galaxy, since about 50% of BitGo’s revenue come from non-US clients. Yet if the firm walked, it means the math of the price drifted too much, or target revenues fell too much, and that the probability-weighted cost of damages is less than the acquisition markup.

INVESTING: Social investment platform eToro to acquire fintech startup Gatsby for $50M (link here)

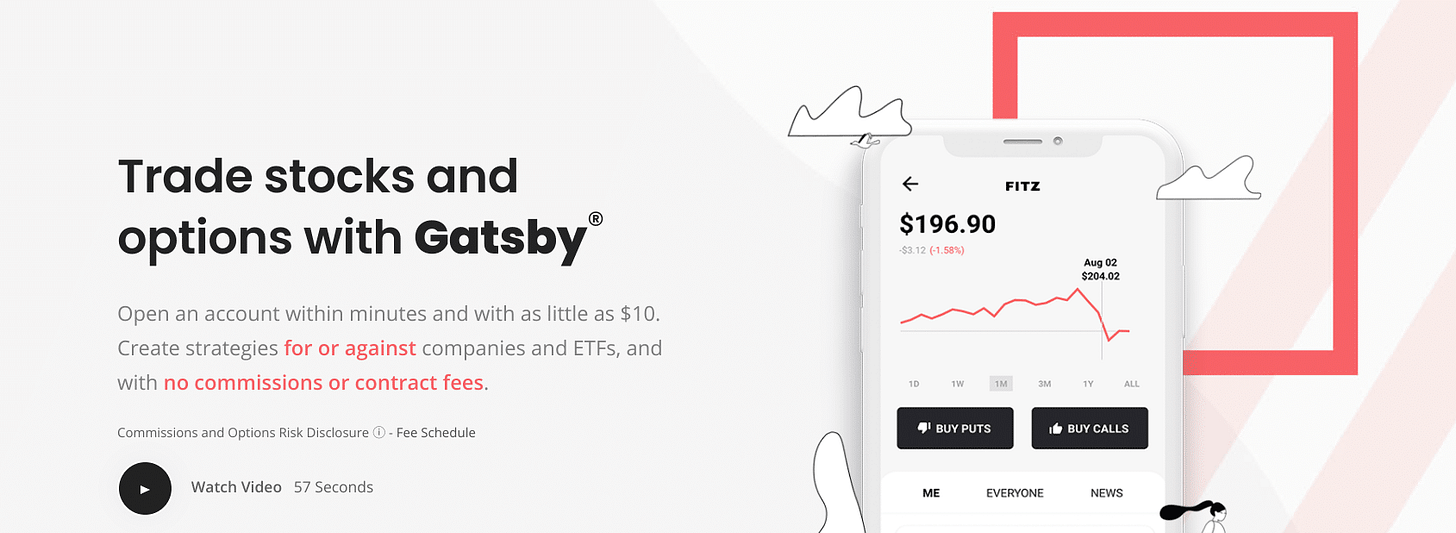

eToro, one of the leading global digital brokers (listen to our podcast with eToro CEO here) has agreed on a $50MM cash and stock deal with Gatsby, an investment platform geared towards the younger generation. eToro received approval the Financial Industry Regulatory Authority (FINRA) last week after applying for regulatory approval in December 2021.

Gatsby copied Robinhood, providing commission-free options and stock-trading in its app. Since 2020 it has seen growth in its options contract volumes — given the rise of retail day trading during covid, options found renewed demand as a financial instrument during the meme frenzy. eToro has also been growing fast, with more than 30MM users across over 100 countries, up from 10MM at the end of 2018. For scale, Total commissions hit $1.2B in 2021.

There’s inevitable consolidation inthe retail investing space, and the two big acquirerss in the West are Robinhood and eToro. A reminder that FTX has been steadily buying up Robinhood stocks this year. Given fintech valuations continue to be depressed, it seems like an good time to acquire customer footprints on the cheap. If we look at Gatsby, the $10MM prior round likely valued the company at around $50MM as well (20% rule of thumb), and so the exit is largely returning money to investors and recapitalizing the team.

PAYTECH: Remitly to acquire Rewire (link here)

Online remittance fintech Remitly is buyin Rewire in a $80MM cash and stock deal. Founded in Tel Aviv in 2015, Rewire provides migrants with a remittance platform for sending funds overseas, and has raised $57MM. The deal is expected to close in the second half of 2022 and is subject to regulatory approval from both Dutch and Israeli authorities. Back of the envelope — this is a down valuation exit for the target.

Rewire’s remittance platform cleanly fits into Remitly’s product offering. One stand-out feature is that Rewire allows its user to store funds, which can then be remitted at any time. Holding deposits building stronger user ties to financial actions, and allows for more paths to monetization. Rewire also extends Remitly’s presence to the the EMEA region, and in this business spanning multiple geographies is, of course, the key.

This is a large market — remittance flows to low and middle-income countries are a $630B market in 2022. We think that much of this should get eaten up by blockchain based networks eventually, especially as on an off-ramps improve, but for now the traditional payment infrastructure providers can still build a good business. Rewire seems to be doing this inorganically at a discount — they also acquired prepaid card provider Imagen in June 2022.

Long Take: Can governments kill software? The US is trying with Tornado Cash (link here)

We discuss the sanctioning of Tornado Cash, a mixer used for both criminal and legitimate use cases, by the US Treasury.

We parse concepts around speech, privacy, and due process as they relate to banning a particular implementation of open source software, and the intended and unintended implications of such precedent. This leads us to a broader discussion of the nature of rights, cultural taboos, and potential implementations of solutions for difficult questions.

Podcast conversation: Connecting 500,000+ small businesses to digital working capital, with Fundbox CEO Prashant Fuloria (link here)

In this conversation, we chat with Prashant Fuloria – CEO of Fundbox. With decades of experience in payments and monetization, he has served in a wide variety of leadership, operational, and product roles at prominent technology companies.

Prior to Fundbox, Prashant served as SVP of Advertising Products at Yahoo, having joined through the acquisition of Flurry, where he was the Chief Product Officer. He also served as Senior Director of Product Management at Facebook, where he led the company’s advertising and payment product efforts, and Product Director at Google, where he built their global payment platform and managed all of Google’s products for the APAC region.

Rest of the Best

Here are the rest of the updates hitting radar.

PAYTECH: Pomelo exits stealth mode with $20M seed to rethink international money transfer

PAYTECH: BlueTape raises $55 million

BANKING: Bank Behind Fintech’s Rise Reels in Billions in Pandemic’s Wake

NEOBANK: Covalto to become Mexico’s first US-listed fintech following SPAC merger

NEOBANK: Kaszek Ventures eyes more Latam digital assets after Bitso, Nubank

NEOBANK: Indian fintech Uni to suspend card services amid central bank’s guidelines

NEOBANK: YC-backed Arc, a digital bank for ‘high-growth’ SaaS startups, lands $20M Series A

INVESTING: Rocketplace raises $9M in seed funding to build the ‘Fidelity for crypto’

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes

Web3 Short Takes

Long Takes on Fintech and Web3

Digital Wealth

Access to the Podcasts with annotated transcripts

Full Access to the Fintech Blueprint Archive

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions