Blueprint: Gemini 10% staff cut; Kroo neobank raises $26MM; Utopia Labs gets $23MM for DAO payroll and finance

Hi Fintech Architects —

Friendly reminder that we released our new Greatest Hits Report series last week.

Every month, we plan to build out a well rounded perspective on a particular issue by combining our best short takes, long takes, and podcasts on a specific topic.

We just published the first “Greatest Hits” issue on Stablecoins.

We started with stablecoins, because, well, we don’t want to lose 95% of our portfolio! Premium subscribers of the Fintech Blueprint get full access to the “Stablecoin Greatest Hits”.

Today’s Agenda

You are the best. Also —

CRYPTO: Gemini lays off 10% of workforce as the ‘crypto revolution’ enters its ‘contraction phase’ (link here)

NEOBANK: UK neobank Kroo raises £26 million in Series B funding (link here)

DAOs: Utopia Labs Raises $23m in Series A Led by Paradigm Capital (link here)

LONG TAKE: MasterCard's biometric payments, Web3 soulbound NFTs, and the construction of digital identity (link here)

PODCAST: Building the income and employment data layer for financial services, with Pinwheel CEO Kurtis Lin (link here)

Short Takes

CRYPTO: Gemini lays off 10% of workforce as the ‘crypto revolution’ enters its ‘contraction phase’ (link here)

The Winklevoss owned crypto exchange, Gemini, laid off 10% of the workforce following the downturn in the crypto markets, which the firm expects will last for a meaningful amount of time. Employees that were laid off will receive healthcare benefits and a severance package. Physical offices have also been closed — perhaps to preserve privacy of those laid off, perhaps as part of remote work, or perhaps to save cash in the bear market.

This symptom is part of a wider trend in risky assets markets, although it is having an outsized impact on crypto exchanges. Coinbase has been rescinding job offers and Bitso cut 80 employees last week as well. Why exchanges? The short answer is that brokerage is cyclical twice — in users and in market value.

Retail investments in crypto have been steadily on the rise for some time, with 16% of US households now invested (that’s more than property). Yet US household debt is now at $15.8T, up $1.7T since 2019, and retail investors are likely too cash-strapped to keep the party going. In turn, retail users numbers are down — in the case of Coinbase from 11.4MM MTUs to 9.2MM between Q42021 and Q12022.

It’s not all doom and gloom. Fidelity’s digital asset branch is doubling headcount to cater to institutional investor demands, and FTX is branching into equities trading, through SBF’s stake in Robinhood, to keep growth in adjacent markets. Many crypto firms are also better prepared than in the last cycle, with large fundraises in 2021. Gemini’s last round was a $400MM equity round valuing the company at $7.1B.

A last side note is that Gemini is currently under the scope for a US CFTC filed lawsuit regarding a Bitcoin Futures Contract the exchange created in 2017, so perhaps there’s more here than meets the eye.

NEOBANK: UK neobank Kroo raises £26 million in Series B funding (link here)

Kroo, a London-based challenger bank, has raised £26MM in Series B funding despite fintech funding multiples being down 90%, as we covered last week. Competitor Starling also raised £130.5MM a month ago, highlighting that reaching a stable business model nets you investment regardless of the macro environment.

Kroo differentiates itself in the neobank market by providing “socially conscious” initiatives for its users, ranging from a portion of profits going to social causes, to a customer tree-planting referral scheme. Aside from environmental initiatives, Kroo also incorporates a ‘groups’ product, where you can track and split funds between friends on the app, and, like many challenger banks, offers zero fees at home or abroad. So far Kroo has amassed 23,000 users on its prepaid card — an indication of interest but not real scale.

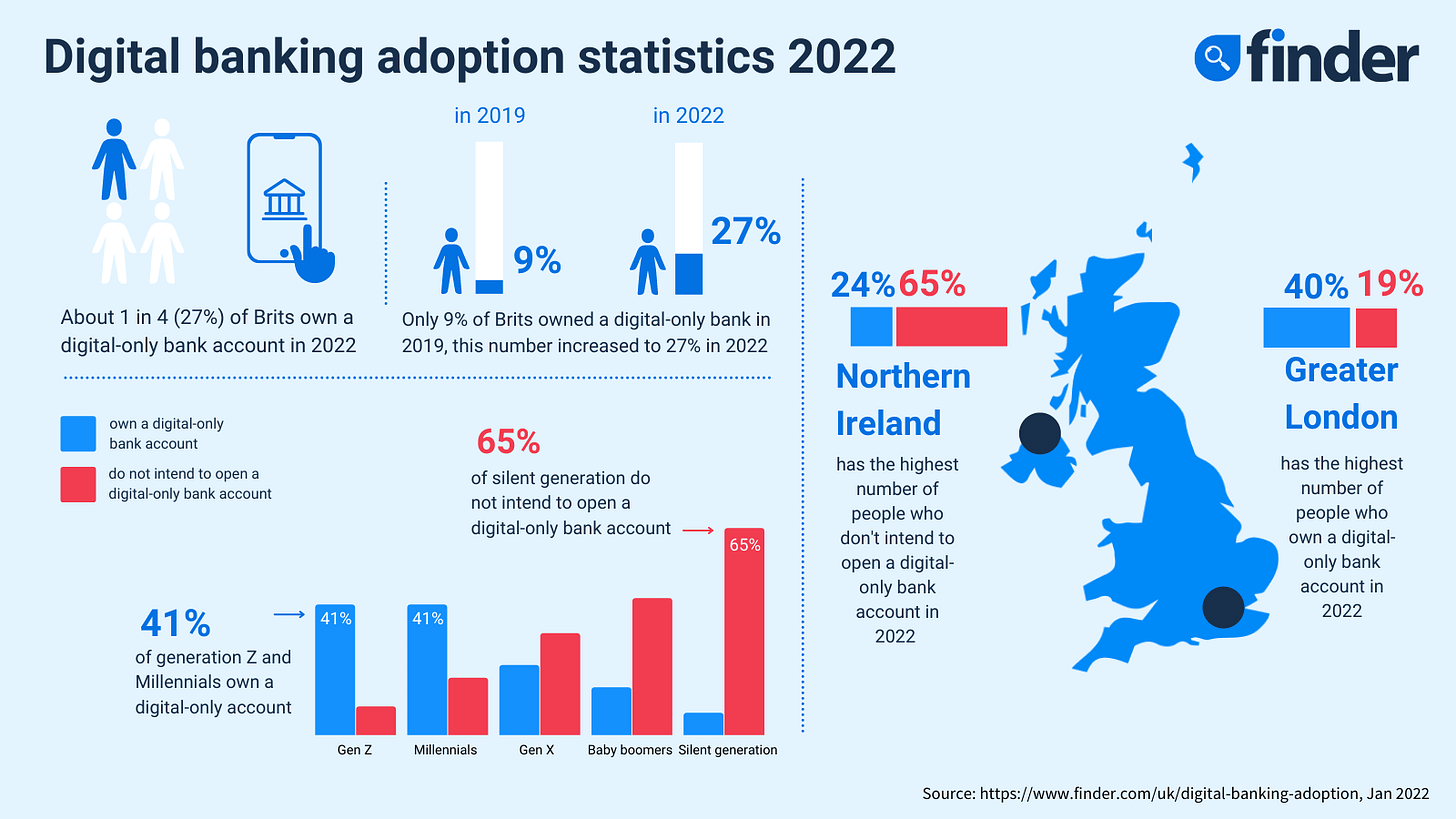

The UK is full of challenger banks — 1 in 4 Brits now own a digital-only bank account. Yet despite over 1 billion neobank accounts worldwide, less than 5% are expected to be profitable. Neobanks striving for profitability will need to identify pain points that customers would be willing to pay for to solve. Starling, for example, have been able to crack profitability by targeting up market customers with larger accounts, lending products, and through a banking as a service model.

Whether Kroo’s sustainability angle will be enough to reach profitability is yet to be seen. In the US, Aspiration is the closest comp, and has been leading in building out a compelling API-led ESG offering, with B2C fintech as the initial distribution motion.

DAOs: Utopia Labs Raises $23m in Series A Led by Paradigm Capital (link here)

Utopia Labs, a DAO building tools for other DAOs to set up their operations, has raised $23MM in their Series A round led by Paradigm Capital and joined by Kindred investors, amongst others. The main tools include automating payroll, expense management, and the ability to effectively co-ordinate contributors. It has been used to help stand up over 100 platforms in the space, including Lido, Friends with Benefits, Illuvium DAO, and Sushiswap. These are marquee names in the space.

The new fundraise is for new products -- financial analytics, token and treasury management, and bookkeeping and accounting. In turn, consolidating many common DAO tooling products in one package will make it easier for future DAOs to spin up and start adding value without the operational complexities inherent with open decentralized online communities.

There are many DAO tools out there right now, catering for the new organisation type as it gains traction. We expect many of these products to consolidate over the coming years, both through integration and acquisition, as managing an array of solutions can be difficult, and the highly segmented nature of the space makes it hard to find the right products.

Thus the dialectic of unbundling, rebuilding, unbundling.

Long Take: Longer term strategy for crypto wallets, with launches from Zerion and GameStop (link here)

Today we look into the Zerion and GameStop launch of their crypto wallets, and articulate a number of core threads.

First, we define the differentiation and value added from crypto wallets, separating them from paytech, neobanks, and digital investing apps. Second, we touch on fintech integration of the crypto asset class, and then look at the path of data aggregators and performance reporting apps into vertically integrated solutions. Finally, we take a quick look at NFT avatars and their connection into Metaverse identity.

Podcast conversation: Building the income and employment data layer for financial services, with Pinwheel CEO Kurtis Lin (link here)

In this conversation, we chat with Kurtis Lin, the co-founder & CEO of Pinwheel, a leading payroll connectivity API.

More specifically, we touch on the journey to building a fintech API infrastructure play, integrating inset payroll systems via APIs, the demise of payday lenders, and so so much more!

Rest of the Best

Here are the rest of the updates hitting our radar.

BNPL: Affirm and Klarna ramp up competing efforts to attract US consumers

INSURTECH: Foxen raises $44 million

INSURTECH: ALM. Brand acquires Codan DK

PAYMENTS: Trustly acquires Ecospend

PAYMENTS: HourWork raises additional $2.5 million

PAYMENTS: South Africa’s Talk360 raises $4M to build single payment platform for Africa

NEOBANK: Finclusion Group raises $20 million

NEOBANK: Ant Group Soft Launches Its SME-Focused Digital Wholesale Bank ANEXT