Blueprint: Mega banks, including Goldman, launch Canton blockchain network; Prism spins out of Petal card; Liquidity Group gets $40MM for AI business credit

Hi Fintech Futurists —

You’re the best, today’s agenda below.

LENDING: It’s a big day for the teams at Petal and Prism Data (link here)

LENDING: Liquidity Group reaches unicorn status with new $40 million investment from Japan’s MUFG (link here)

BLOCKCHAIN: Microsoft, Goldman Sachs, and Other Big Firms Back Launch of Financial Blockchain (link here)

LONG TAKE: Now is the time to learn Generative AI, not after the knowledge worker layoffs (link here)

PODCAST CONVERSATION: Building an $800MM blockchain infrastructure company with Quicknode COO, Jackie Kennedy (link here)

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

Short Takes

CREDIT: It’s a big day for the teams at Petal and Prism Data (link here)

Petal, the fintech credit card company, has raised $35MM in new funding and is spinning out subsidiary Prism Data into an independent company. The round is led by previous investor Valar Ventures and includes Samsung Next, Core Innovation Capital, and Synchrony. Petal uses open banking and machine learning to underwrite credit to consumers using their banking history. Bank data helps the company get a better sense of a prospect’s financial situation and ability to repay.

The company’s scoring system “CashScore” takes into consideration thousands of data points excluded from traditional credit scoring processes, such as how much you earn and what bills you pay. As a result, the average credit score on the platform within 12 months for a new user with no credit history is 681. Alongside CashScore, Petal provides Visa credit cards for building credit and managing finances.

During 2022, the number of Petal cardholders rose from 300k to 400k, and the firm has seen ARR increase from $20MM to $80MM. The business model relies on interchange fees, credit interest, and membership fees (e.g., $59). The last valuation for the company was $800 million, and we estimate that traded at a 40x in revenue multiple, now down probably into the 10x range.

Prism Data is the B2B infrastructure package for Petal, helping businesses make the most of cashflow underwriting by working with applications that require credit worthiness assessment — BNPL loans or mortgages. The service helps companies determine risk of default or first-party fraud, as well as providing insights into consumer credit behavior. The funding is meant to be split between the two entities.

We are fans of using more holistic alternative data for credit provision, and also believe that specialization helps companies achieve better outcomes.

👑 Related Coverage 👑

LENDING: Liquidity Group reaches unicorn status with new $40 million investment from Japan’s MUFG (link here)

Liquidity Group, an Israeli business lending fintech, raised $40MM at a $1.4B valuation from Japanese incumbent MUFG Bank. Total funding sits at $120MM, with MUFG owning 12.5% of fully diluted shares. Other investors are Meitav, with 33.3%, and Spark VC with 18% of the shares. The bank has an unusual guarantee — they can sell the shares back to Liquidity if they don’t go public within 2 years.

Liquidity provides unsecured, no-dilution, non-resource growth capital for companies. The platform syndicates and invests in growth and middle-market lending, with check sizes between $5MM to $100MM for mid- to late-stage tech companies. It underwrites the investment within 48 hours of application using AI to analyze metrics like benchmark scoring, risk rating, revenue forecasting, and through offer optimization, by predicting a way to structure the debt.

Last May, Liquidity announced a $2B investment fund in partnership with MUFG Bank and Spark Capital, bringing its total funds to six, of which five are debt funds and one is an equity fund. We like Liquidity because of its application of AI to mature debt-capital markets, and the use of business data to create multi-pronged cap table solutions.

Simulations and other modern statistical analyses are more powerful that Excel rules-based calculations, and to that end, seeing something like a merchant bank with an AI brain is compelling as it gives a preview how algorithmic bankers may look like in the future. We also think advancements in this asset class rhyme with the developments across the digital wealth space, deepening technology tooling in the alternatives asset class.

Interested in Sponsorship?

To support the Fintech Blueprint and reach our 170,000+ Substack and LinkedIn audience of builders and investors, learn more below or contact us here.

DEFI: Microsoft, Goldman Sachs, and Other Big Firms Back Launch of Financial Blockchain (link here)

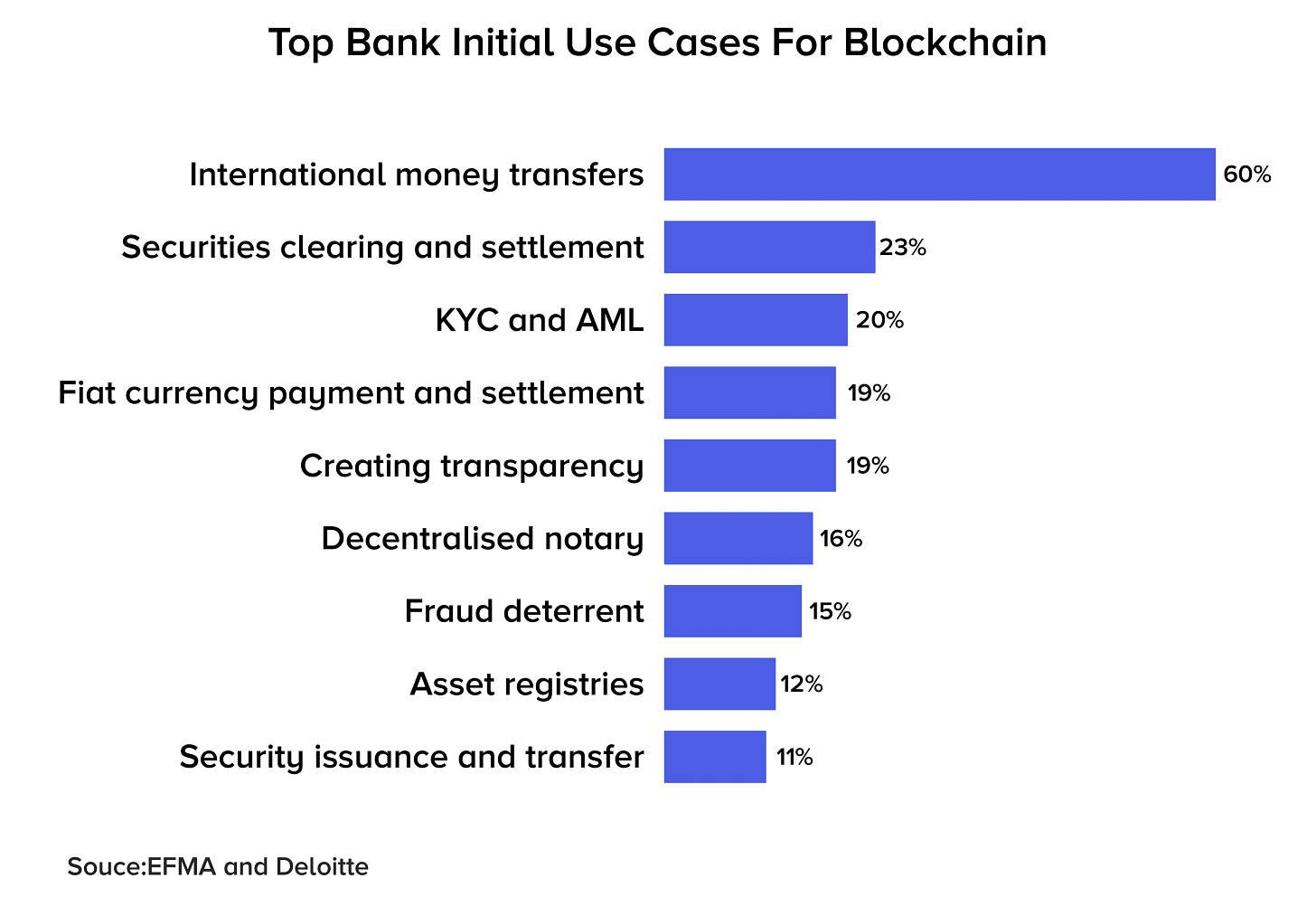

We are excited about this one — it has taken a long time. Canton Network is a new institutional blockchain focused on streamlining financial markets, with backing from some of the biggest names in finance, including Goldman, BNP Paribas, Broadridge, S&P Global, Moody’s and many more. The Canton Network provides a decentralisation infrastructure that bridges a range of independent applications, such as Deutsche Börse’s D7 post-trade platform and Goldman’s Digital Asset Platform, with Web3 native dapps.

While consumer Web3 has grown fastest in recent years, digital asset initiatives in the big banks were still under way. The firm Digital Asset, which at one point was to transform the Australian Stock Exchange, had built out the DAML programming language, used in this project. We are not surprised that industry decided to try and internalize the value of the network and create an environment according to its own standards, though we wonder about the Internet-Intranet distinction.

Bridging financial applications across their industries is valuable, providing a reconciliation-free environment where all assets, cash, and data can be synchronised. The regulatory environment of the moment pushes incumbents in this direction, rather than profound experimentation with crypto. Still, we like the promise of better efficiency and risk management within financial services based on a unified source of truth.

The network helps with some of the biggest challenges for financial institutions engaging with blockchain — privacy, control over data, scaling, and interoperability with legacy systems. Institutions are still figuring out how they can best leverage blockchains; with some like BlackRock CEO Larry Fink highlighting that the next generation for markets is tokenisation.

Long Take: Now is the time to learn Generative AI, not after the knowledge worker layoffs (link here)

In this analysis, we open up several frameworks for the Generative AI revolution, look into the reportedly-leaked Google memo on how open source will win the AI wars, and summarize the Stephen Wolfram coverage of ChatGPT math.

If IBM is planning to replace 7,800 jobs with AI, certainly now is the time to figure out why.

Podcast Conversation: Building an $800MM blockchain infrastructure company with Quicknode COO, Jackie Kennedy (link here)

In this conversation, we chat with Jacqueline Kennedy, Chief Operating Officer at Quicknode.

QuickNode is a Web3 infrastructure platform, that helps developers and businesses build, launch, and scale blockchain-powered applications (dApps). Tech maverick, investor, and visionary leader. From co-founding Oasys with Mark Cuban to driving growth at Amazon and Afore Capital, her strategic brilliance has left an indelible mark on the industry. With an unstoppable drive and a talent for spotting disruptive technologies, she's made QuickNode a global powerhouse. Jackie's passion for diversity and inclusion sets her apart, inspiring aspiring entrepreneurs to break barriers. A trailblazer in the tech world, she proves that with tenacity and vision, one can shape the future and make a lasting impact.

Rest of the Best

Here are the rest of the updates hitting radar.

FINANCIAL PLANNING - Firmbase raises $12 million for financial planning and analysis platform

INVESTING - The Mint, started by Better Tomorrow Ventures, wants to be the accelerator fintech needs

PAYTECH - Salsa dips into $10M to fire up payroll features for software companies

FINANCIAL CRIME - We've raised an $11M Series A to build more of what our customers want

NEOBANK - This new banking app wants to help with the financial woes of retirement

NEOBANK - Miami-Based Startup Kiddie Kredit Raises $1.4M With Support From Dwyane Wade And Baron Davis

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions.

Later this week, we will share our Short Takes on the latest Web3 and Digital Investing news, reviewing several companies. If you’d like us to look at any specific item, feel free to share your thoughts in the comments below. We will provide our best analysis in response to your requests.