Blueprint: Mega Mutant Serum for $6MM; Monzo Raises £444m; and Truebill acquired for $1.3B

Gm Fintech Futurists — welcome to 2022! Our agenda for today is below.

NEOBANKS: Tech giant Tencent invests small stake in Monzo as part of a £444m fundraising round

NFTs: Mutant Ape Yacht Club sales surge 500% with the release of Mega Mutant Serum

PERSONAL FINANCE: Rocket Companies to acquire personal finance app Truebill for $1.275bn

LONG TAKE: The Roaring Twenties of Populism, Institutionalism, and Technology's Meaning (link here)

PODCAST: Pioneering Crypto ETPs to $3B in assets in 3 years, with 21Shares CEO Hany Rashwan (link here)

If you want to go deeper in Fintech & DeFi, check out premium features below.

Visit our carefully curated Sponsors:

Whoever you need to meet in 2022, you’ll find them at Fintech Meetup! With 30,000+ double opt-in online meetings, it’s the easiest way to meet Fintechs, Banks, Credit Unions, Investors, Networks and many others. Create the leads, deals, partnerships and funding your business needs in 2022! Online, March 22-24.

👉 Get your ticket now!

Perpetual Protocol is a decentralized perpetual futures contracts exchange on the cutting edge of finance and technology. Traders use it to permissionlessly trade the most popular products in Web3. Builders create new protocols and projects on top of it. Liquidity providers use it to earn yield on their capital.

👉 Learn more at Perp.com

Short Takes

NEOBANKS: Tech giant Tencent invests small stake in Monzo as part of a £444m fundraising round (link here)

UK-based neobank Monzo has secured a £3.3 billion valuation after raising £444 million. Chinese tech giant Tencent is one of the biggest backers in the round, investing £74 million of the total. The round follows on from fair business performance in 2021, with an increase in user growth of 20% and revenue growth of 18% — worse than its peers, but still buffered by the shift to digital from the pandemic. The condensed financial statements (link here) provide a further breakdown of the company’s performance in recent years.

Yet, Monzo’s topline growth has still led to net losses increasing by £16 million in 2021, burning £130 million all in. As discussed in our podcast conversation (here), Monzo has a higher proportion of retail investors when compared to their main competitors, Starling and Revolut, which have both followed business line and customer diversification strategies. Monzo’s current valuation of £3.3 billion values each of their 5 million users at ~£660 ($900), while the average user is generating only £16 in annual revenue, indicating a multiple of about 40x — in line with historic exuberance in the sector.

A few years ago, we would have pointed to Tencent’s aggressive investment strategy in both fintech and media as indication of Chinese fintech rise to global power. This round, essentially supporting Monzo’s unicorn valuation growth after its previous down-round, feels more like evidence of a hot venture capital market, rather than some deeper underlying truth about the world. The Chinese tech companies have had a tough 2020 and 2021, with various regulatory problems and global cooling on the sector. Just see Tencent’s stock price above. That said, we think that large fintech champion brands will continue to attract capital, and it’s no small feat — Theranos not included — to create new companies in the world.

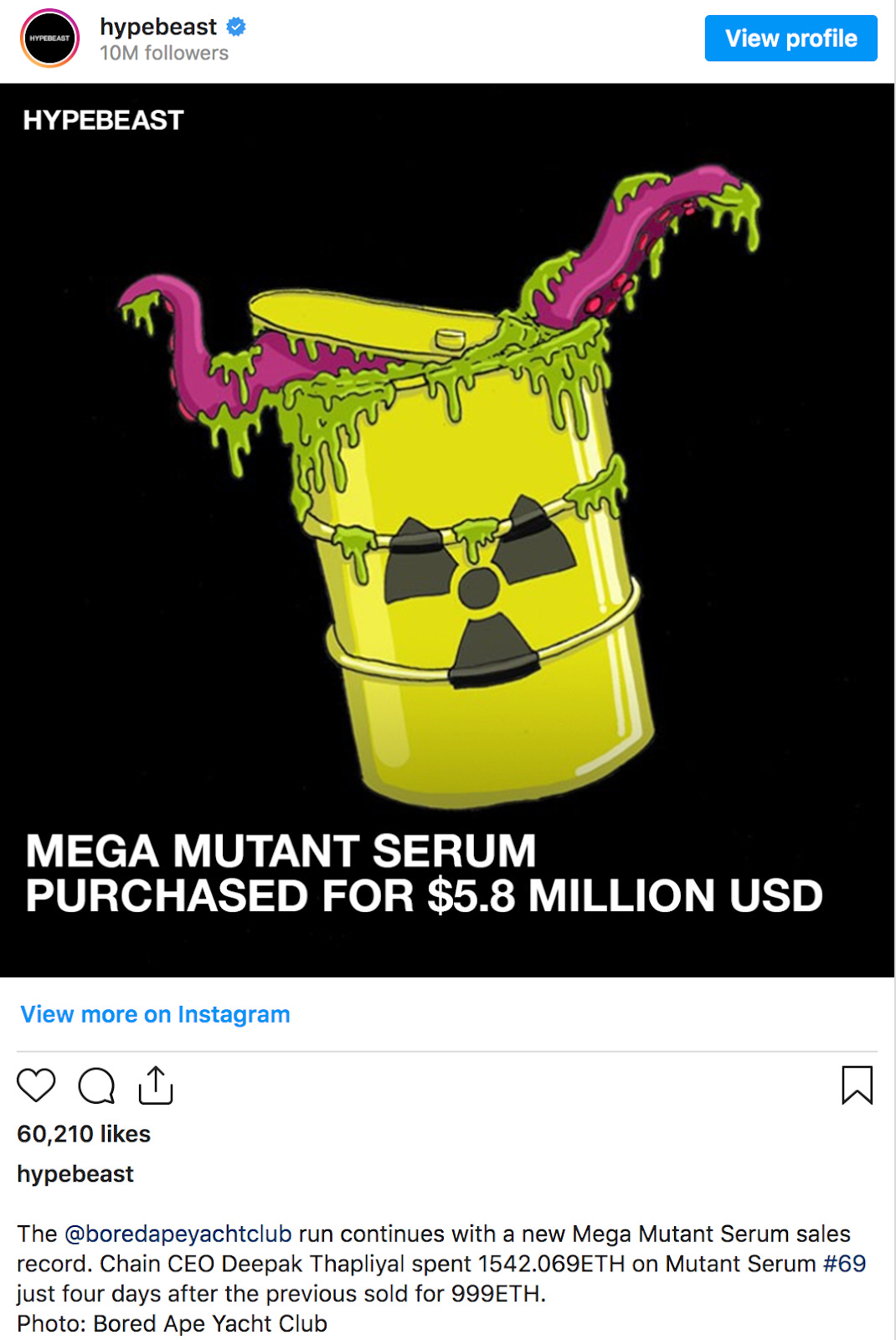

NFTs: Mutant Ape Yacht Club sales surge 500% with the release of Mega Mutant Serum (link here)

Let’s start with the premise that the most expensive NFTs are atomic brands — ongoing, engaging, digital fashion stories that function as owned objects within a social media context. Then the next question is “how do these brands engage and retain value” in the swirl of our financial and attention tsunamis. How do digital objects leverage social networks to create relevance and worth?

The Bored Ape Yacht Club (BAYC) is the leader (sorry Punks) at inventing and implementing the rulebook on what it means to be cool in Web3. The most recent enhancement to their popular spin off, Mutant Ape Yacht Club, is the Mega Mutant Serum. Prior versions of serums were released to all holders and could be used to alter a bored ape, based on their original traits, into a mutant ape. Whereas, Mega Mutant Serum transforms apes into a completely unique version of a mutant ape.

There are only 8 Mega Mutant Serums in existence, and 10,000 BAYC owners. You can do the supply/demand math. Mega Mutant Serum #69 sold for 1542 ETH (about $6 million at the time of sale) to the CEO of crypto company Chain. The new release also led to sales growth in the overall NFT family — 500% from the previous seven-day period for bored apes, as well as a floor price increase of almost 40%, currently sitting at about 70 ETH or $250,000.

There are a few key factors that propelled BAYC into being one of the most valuable NFT collections and emerging brands. First, the core team understands the importance of engagement through new drops that enhance or transform their NFT collections. Things need to feel new and different, while also having capital markets implications and increasing the potential perceived value of the assets. This is the physics of luxury goods. Second, the community is the perfect social club for the our age, with members like Eminem joining and promoting on social media. A far cry from mom’s spaghetti.

PERSONAL FINANCE: Rocket Companies to acquire personal finance app Truebill for $1.275bn (link here)

Consumer lender Rocket Companies has purchased personal money management application provider Truebill for $1.3 billion. With the acquisition, Rocket Companies claim to be looking to improve their customer experience, as well as bring in an additional $100m a year in recurring annual revenue.

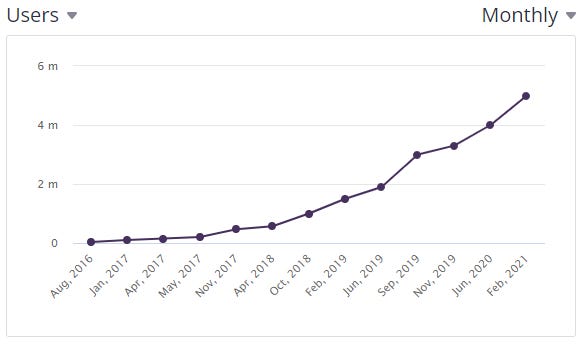

Truebill acts as a financial hub that helps customers better manage their funds — visualizing money flows, cancelling subscriptions, pushing around micro-savings, and establishing credit scores. It is the data aggregation personal finance Mint.com playbook, just fifteen years later. Truebill now has 2.5 million users and analyses $50 billion in monthly transaction volume. The company claims to have saved customers over $100 million since inception.

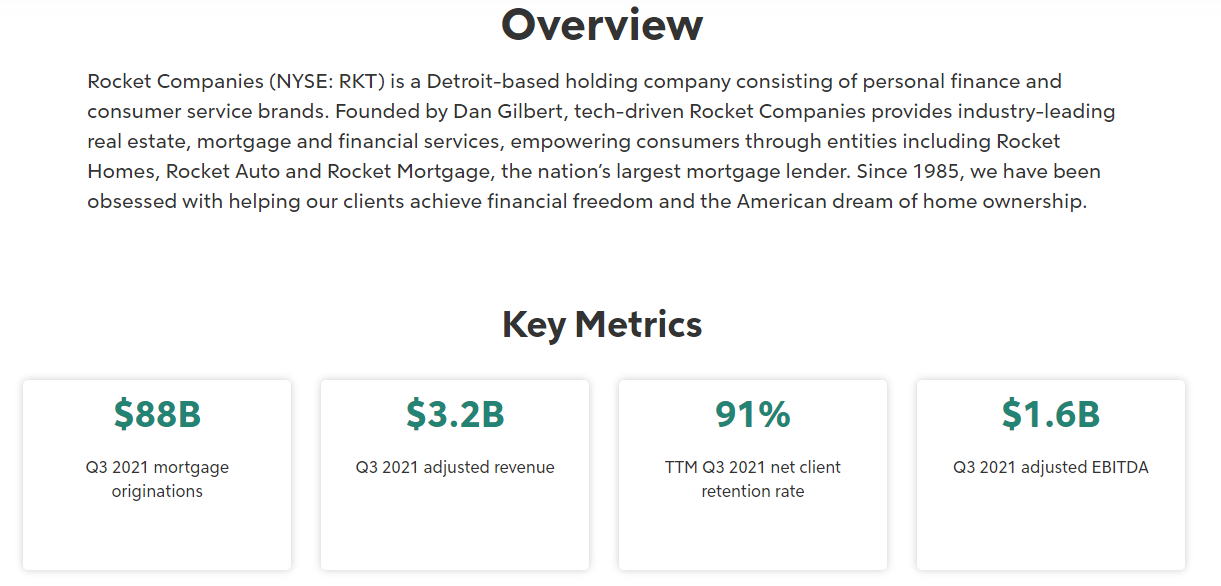

This is a top of funnel acquisition, and at a $1.3B valuation, each user costs Rocket about $500. That’s not unreasonable for a company best known for their mortgage provisioning product printing $90 billion of originations and $3 billion of revenue per quarter. The key to success will be whether Rocket is able to cross-sell their products to this new pool of users, or whether the budgeting fintech stuff will remain separate and unintegrated. Challenges include the torrent of personal finance and lending comparison sites, as well as our fickle customer loyalties. On the other hand, Rocket has an unusually broad portfolio of financial products for consumer real estate, insurance, and lending that can be plugged into a PFM tool.

Another take is that Rocket’s share price is under pressure since IPO, and using the capital markets to underwrite a transaction is still cheap in management’s view.

Rest of the Best

Here are the rest of the updates hitting our radar:

MARKETS: A New European Real Estate Securitization Platform Steps into the U.S.

CRYPTO: Ethereum 2.0 Testnet Kintsugi Goes Live in Preparation for Merge

CRYPTO: Gas Fees on Ethereum Got You Down? There's a New Airdrop for That

DATA: Noname Security becomes first API security unicorn with $135m Series C raise

NFTs: China’s state-run news agency to launch NFT collection

AI: Chinese tech company Baidu says artificial intelligence is entering a ‘golden age’ on the mainland

Analysis: The Roaring Twenties of Populism, Institutionalism, and Technology's Meaning (link here)

Are you on the side of the People or the State?

We dive into the two predominant factions in the world that have been propelled into the limelight by crypto — Populism and Institutionalism. This piece draws parallels from the past and explores how crypto is driving a digital reformation unseen before, but in rhyme with history’s political revolutions.

Podcast: Pioneering Crypto ETPs to $3B in assets in 3 years, with 21Shares CEO Hany Rashwan (link here)

In this conversation, we chat with Hany Rashwan – the founder of Amun and 21Shares. Hany built the company that put out the first physically backed crypto Exchange Traded Product (ETP). In simpler terms, he created a vehicle for people to buy crypto assets, such as Bitcoin or Ethereum, on the stock market. Alongside Cathie Wood of ARK, 21Shares recently submitted a Bitcoin ETF to the SEC. While he waits for the US to get on board, Hany's products are already offered all over Europe, with more than $3 billion under management.

More specifically, we touch on his early entrepreneurial mindset which lead him to building successful businesses, how currency devaluation in Egypt pushed him to create 21Shares, what an Exchange Traded Product (ETP) is and how it related to Exchange Traded Funds (ETFs), the regulatory landscape for crypto-backed ETPs, and so so much more!

More? More!

If you want to go deeper in Fintech & DeFi, upgrade to a premium Blueprint subscription below. Our value prop is simple: experienced judgment, accurate vision. If you knew the shape of the tomorrow, what would you do today?

Want to discuss? Stop by our Discord and reach out here anytime.