Blueprint: Nansen buys DeFi portfolio app Ape Board; Plaid launches identity, income verification; SpotOn raises $300MM for hospitality paytech

Gm Fintech Futurists — our agenda for today is below. You are the best.

PAYTECH: Block rival SpotOn raises $300M at $3.6B valuation (link here)

DEFI: Nansen acquires DeFi investment tracker Ape Board (link here)

OPEN BANKING: Plaid expands into identity and income verification, fraud prevention and account funding (link here)

LONG TAKE: The right lessons from Terra's $40B collapse (link here)

PODCAST: Scaling Ethereum and Web3 using Arbitrum optimistic rollups, with Offchain Labs CEO Steven Goldfeder (link here)

To go deeper and support our analysis, check out the premium features below.

Short Takes

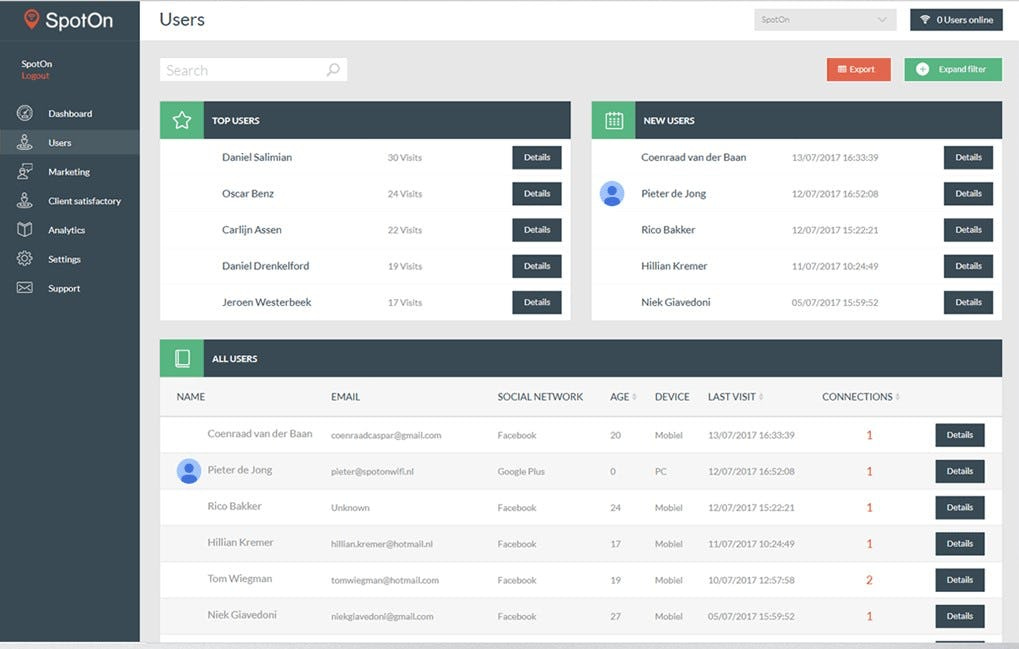

PAYTECH: SpotOn raises $300M at $3.6B valuation (link here)

SpotOn, a SaaS payments provider, raised $300MM at a $3.6B valuation in Series F funding. The round was led by Dragoneer Investment Group (invested 6x in SpotOn in past 3 years), and joined by a16z (led last two rounds), DST Global, Franklin Templeton, Mubadala Investment Company, and G Squared. The deal is a $500MM increase in valuation from their $3.15B Series E, where they raised $300MM.

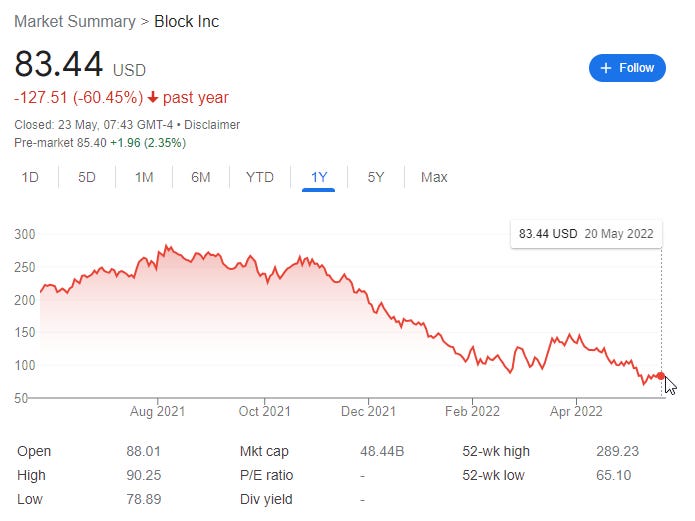

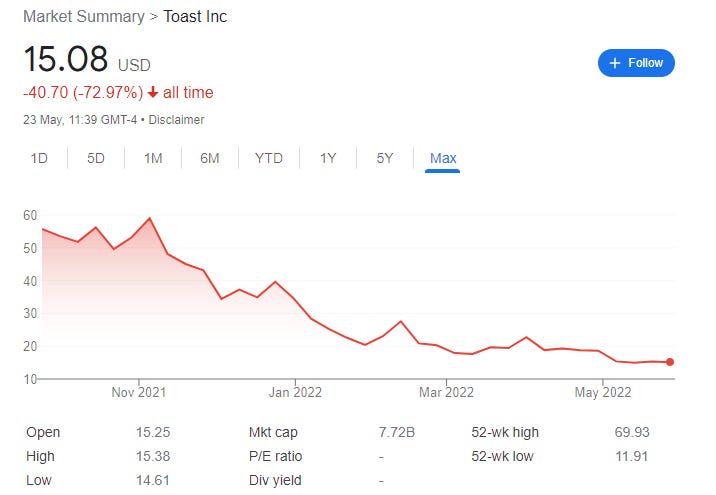

SpotOn provides payments software to the restaurant and retail space, such as online and in-store payment offerings. ARR grew 100% in 2022, built on acquisitions of enterpise POS solution Appetize (PGA Tour, Yankees Stadium), and Dolce, a provider of labor management software which aggregatees tip-pooling, scheduling, compliance, and payroll automation features. The company competes with Square/Block, worth around $50B having acquired BNPL provider Afterpay for $29B, and Toast in the restaurant payments space, which went public last year and melted since.

SpotOn still got a nice, fat unicorn valuation in the private markets — from repeat investors no less — up 15% on growing revenue. The public markets right now are not so generous, punishing Square/Block by a 70% collapse since peak last year. What we do like about the company is the hyper focus on the restaurant niche, and the workflow automation around its payments services. It is that embedding into workflow that will give the company an edge relative to stronger payments companies, but will also limit its growth horisontally. Another way to say it is that having an actual, specific value proposition is a growth hack.

Curated sponsorships

We work with select companies to deliver brand awareness to our 100,000+ digital finance audience. See our prior partners here, and reach out here with interest.

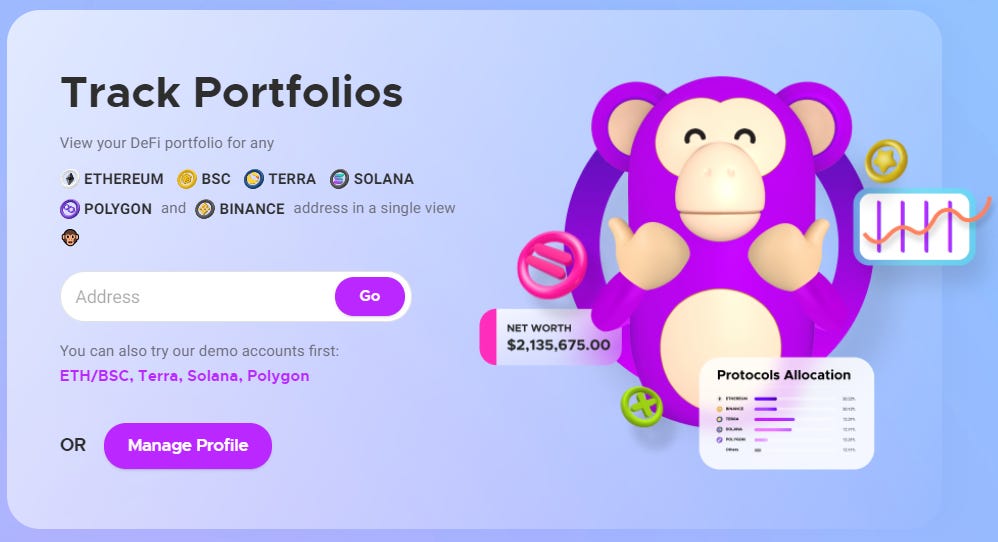

DEFI: Nansen acquires DeFi investment tracker Ape Board for undisclosed eight-figure sum (link here)

Nansen, the blockchain analytics platform, is acquiring Ape Board, a dashboard that enables users to track their NFT and DeFi investments. Nansen currently allows users to analyse blockchain data under wallet labels, helping track the activity of particular addresses on-chain. This portfolio tracker can build on top of Nansen’s data pipeline, and generate a high-fidelity data aggregation service for Web3.

Founded last year, Ape Board supports 36 blockchains and 390 protocols, pulling together DeFi data. The acquisition shifts Nansen from targeting primarily developers and analysts, to adding a B2C distribution channel. The deal is in the context of Nansen’s $75MM Series B round in December 2021, which we covered in a December short take. Nansen’s last valuation of $750MM was a 50-75x on revenue, assuming every one of its enterprise customers was paid.

We like the idea of offering higher quality analytics to retail investors in the space, differentiating strategy from competitor Dune’s focus on the enterprise market. That said, it’s an ongoing cost race to integrate protocols and long-tail assets and generate accurate reporting. Nobody has done accurate performance reporting to date. Monetization is likely to come in the form of integrated lead generation to DeFi protocols and NFT trading products for visitors to the dashboards.

OPEN BANKING: Plaid expands into identity and income verification, fraud prevention and account funding (link here)

Open banking provider Plaid has expanded its product offering to identity and income verification, tools for disbursements and managing accounting funding, and fraud prevention. As a reminder, Plaid has built out direct bank APIs — not just screen scraping — via Plaid Exchange, which is allowing the company to build more substantive functionality between traditional finance and fintech apps.

Identity verification features come from a recent $250MM acquisition of Cognito, a provider of ID verification. Further, the addition of account funding functionality looks to capture new customers in the first step of their engagement with Plaid-powered products. We see similarities to how Shopify has built out the B2C app on the back of its merchant distribution — they come for eCommerce and stay for the payments. This is vertical integration based on horisontal distribution. API competition with Stripe is also heating up — we covered Stripe’s foray into data aggregation in a Long Take, stepping directly on Plaid’s toes with a Financial Connections product.

Identity is the backbone for payments, and payments is one of the most commercial ways to monetize retail interest. Verification is still an open problem — see companies like Socure, a provider of AI identity verification software (raised $450M in November), or Persona, a provider of a no-code “personalised” identity verification platform (raised $150M in September). We don’t think this will be a break-out market, but rather a strategic piece of the value chain to own for a broader financial player.

Long Take: The right lessons from Terra's $40B collapse (link here)

We discuss the collapse of the Terra ecosystem and the destruction of the UST stablecoin.

Of particular interest to us are (1) understanding what happened, (2) comparisons to bank structures and bank runs, as well as their systemic solutions, (3) comparisons to international macroeconomics and countries attempting to defend currency pegs, and established solutions. If Soros could break the Bank of England, why do we believe that private pegged currencies would be immune, especially with weaker reserves? We take this moment not to gloat or stare into the fire, but to learn.

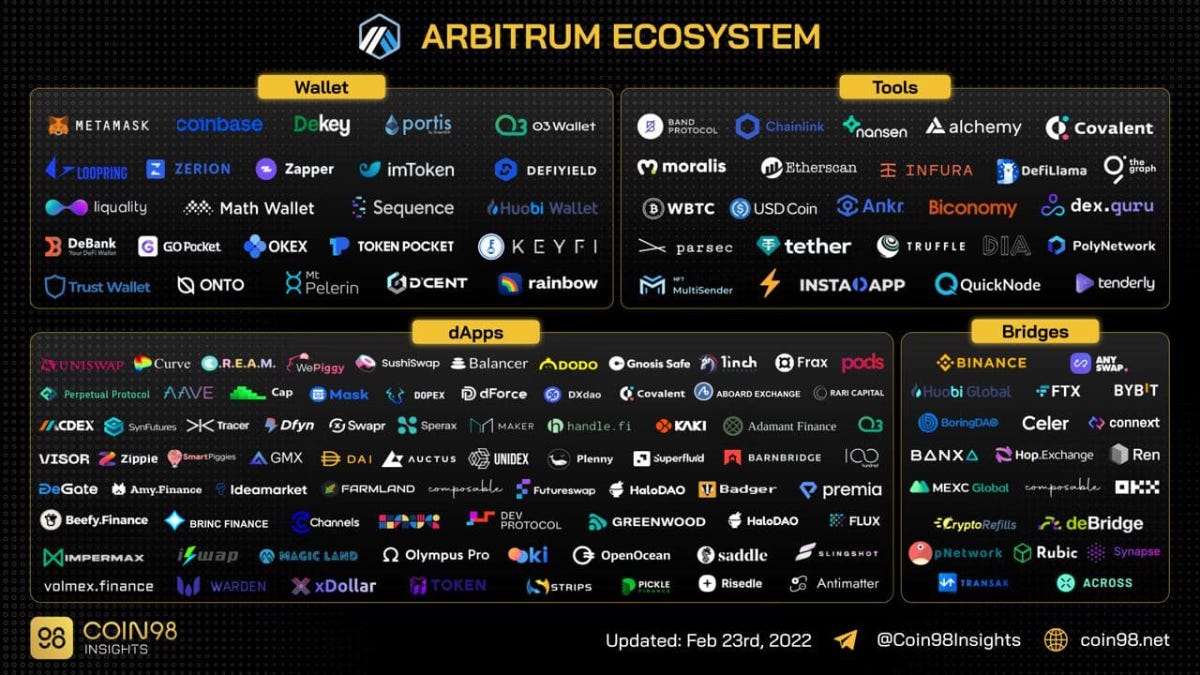

Podcast conversation: Scaling Ethereum and Web3 using Arbitrum optimistic rollups, with Offchain Labs CEO Steven Goldfeder (link here)

In this conversation, we chat with Steven Goldfeder, Co-founder and Chief Executive Officer at Offchain Labs – the team building Arbitrum.

More specifically, we geek out on the heydays of early cryptography and the connection to cryptocurrency, zero-knowledge proofs, the fundamental structure of Ethereum and how this birthed Arbitrum, the application of optimistic roll-ups, the existing data storage issues of Layer 1s and how Arbitrum seek to solve them, and so so much more!

Rest of the Best

Here are the rest of the updates hitting our radar.

BANKING AS A SERVICE: Unit raises $100 million

INVESTING: Robinhood Plans Ethereum Wallet With DeFi, NFT Trading—And No User Gas Fees

NEOBANK: Neon triples revenue in quest to become the biggest bank for Brazil’s working class

PAYTECH: Deel raises $50 million

PAYTECH: Southeast Asian payments infrastructure unicorn Xendit banks $300M

INSURTECH: Socotra Acquires Avolanta to Add Unified Agent and Customer Portal to Its Advanced Policy Core

INSURTECH: Liberty Mutual to acquire Fetch’s technology

INSURTECH: Noyo raises $45 million

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts