Blueprint: Railsbank, embedded finance Unicorn; Dune Analytics memes $69.420MM; Solana's Phantom Wallet raises $109MM

Gm Fintech Futurists — our agenda for today is below.

EMBEDDED FINANCE: UK fintech Railsbank to hit unicorn valuation with new funding round (link here)

CRYPTO: Dune Analytics raises $69.42 million in Series B, now valued at $1 billion (link here)

CRYPTO: Solana Pay Connects Merchants and Consumers via Stablecoin Payments (link here) and Phantom’s $109M Series B and launch of iOS App (link here)

LONG TAKE: Are DAOs and Nations conscious? A look at Diem/Silvergate, Google Plex, and Solidly AMM (link here)

PODCAST: Distributing €1.4 trillion of investment funds on blockchain, with Allfunds' Ruben Nieto (link here)

As always, if you want to go deeper, check out our premium features below.

Visit our carefully curated Sponsors:

More than 1,000+ companies have signed up to Fintech Meetup! From Fintechs like Alloy, Checkout.com, Dave, NIUM, Pipe, Revolut, Socure & Upstart to Major Banks like Bank of America, Citi & J.P. Morgan and VCs like Bain Capital Ventures, Commerce Ventures & General Atlantic, all of fintech and banking’s leading companies are joining Fintech Meetup! There’s less than 30 days left to get your ticket and prices go up on Friday.

👉 Get your ticket now!

Short Takes

EMBEDDED FINANCE: UK fintech Railsbank to hit unicorn valuation with new funding round (link here)

Railsbank is raising an additional $100M, which will bring bestow upon them a unicorn valuation. Railsbank offers a Banking-as-a-Service (BaaS) platform that builds APIs for entities who wish to offer financial products to their consumers and acts as a complete back-end solution for its clients. The handy diagram below disambiguates *open banking*, BaaS, and *embedded finance* as terms. We just think of it as a regulatory crowbar opening up bank data and functionality to third parties (3PPs).

The London-based fintech has two clear customer segments: (1) neobanks and (2) traditional brands. Neobanks are digital storefronts that need digital financial products, like banking and credit. Reminder that the acquisition of Wirecard UK in 2020 gave Railsbank card issuance technology — without all that accounting fraud — helping it launch a Credit Card-as-as-Service to US-based clients. But there’s also a lot of this stuff in the US, including well established public market players like Green Dot and The Bancorp.

For traditional brands, we are familiar with the demand for integration of financial services into the user’s digital experience. A recent survey suggests that retaining front-end customer experience is the main demand driver for embedded finance (85% of respondents), and that the market could grow to $7.2 trillion in enterprise value by 2030. Whatever the actual future of financial distribution, we do suspect it’s not more ATMs and bank branches.

CRYPTO: Dune Analytics raises $69.42 million in Series B, now valued at $1 billion (link here)

Onchain data platform Dune Analytics is following in FTX’s footsteps with a meme-worthy fundraise of $69.420 million in their Series B. The round was led by Coatue, joined by Multicoin Capital and Dragonfly Capital. We love Dune and FTX, and a good troll of course, but must this really be our culture? It probably alienates not just the bankers. But we digress.

Founded in 2018, Dune has became one of the main leaders in crypto analytics. It allows users to create data charts and dashboards across onchain metrics such as DEX and NFT trading volumes, exposing the raw data flow of blockchain activity. The product is targeted at data analysts and developers to pipe together the analytics in a crowd-sourced way. The platform has 10,000 analysts and 100,000 pieces of analysis, with many freely accessible to the public. A paid version, which comes at $390 per user per month, provides deeper customisability.

Dune’s future plans include building out a community of 1 million analysts, increasing blockchain support, building an API, and growing out the team. Dune has an ocean of under-utilised blockchain data that anyone with SQL skills can begin deciphering. This provides an opportunity for people looking to move into the crypto space to develop data analysis skills that are valuable in the industry. There will be more data, more people, and more analysis.

A reminder that crypto firm valuations are carrying on from a big year in 2021, which saw at least 40 of them reaching unicorn status, according to The Block Research. Also reminder that at a fully monetized current user base, the company generates a $4MM ARR. Growing to 1 million users would yield a $400MM ARR, but also would require a 100x increase in the number of people slinging SQL queries into a blockchain data platform.

CRYPTO: Solana Pay Connects Merchants and Consumers via Stablecoin Payments (link here) and Phantom’s $109M Series B and launch of iOS App (link here)

Solana hit the headlines with two pieces of news. First — Solana Pay, a set of decentralized payment standards and protocols geared towards dollar-based stablecoin settlements (primarily Circle’s USDC) for consumers and users. And second, crypto wallet Phantom raised $109 million in Series B funding and launches an iOS app.

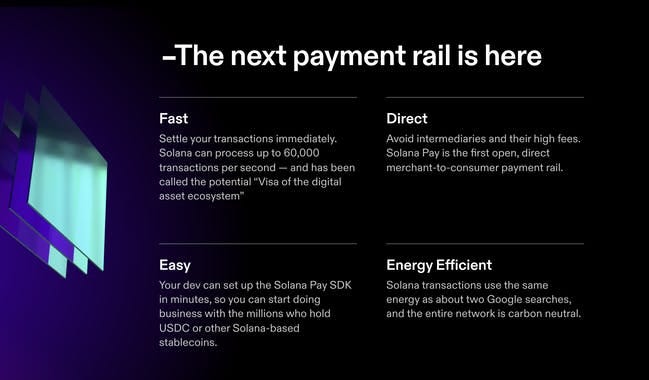

Solana Pay is trying to become a new payment rail, enabling dollar-based stablecoin payments like the movement of Centre-backed USDC. Solana Labs, Checkout.com, Circle, and Citcon worked on the development, with Phantom, FTX, and Slope working on digital wallet integrations. All of these companies are expected to integrate the product into their platforms, with Checkout.com being the standout name in our view.

Using Solana’s SDK, a merchant can integrate the product to offer Solana users the ability to pay in cryptodollars. On the positive side, Solana is scalable to up to 60,000 TPS, has settlement within 400 milliseconds, and fees around $0.00025 per transaction. On the negative side, it does seem to go down more frequently than larger chains. Also, maybe stablecoins are the cash equivalent in an investment portfolio and not a payment instrument, but who knows.

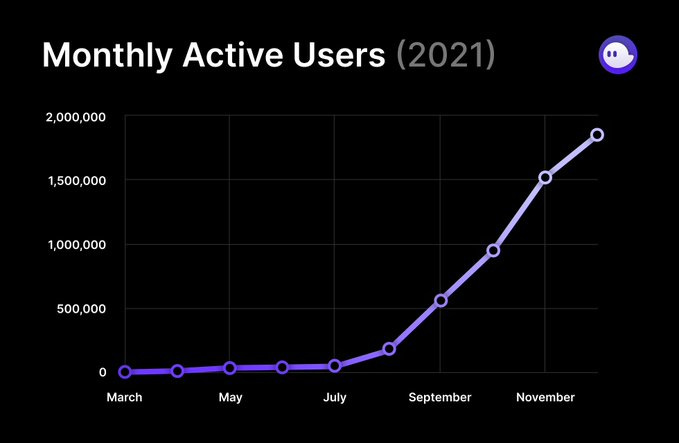

Second, Solana’s Phantom Wallet raised $109 million at a $1.2 billion valuation for its 2 million users. That’s powerful stuff to do in just 6 months, and reflects the very intense interest and speculation around Solana from Silicon Valley and the FTX-led suite of companies.

We have a soft spot for MetaMask, the 30 million MAU wallet from ConsenSys focused on EVM chains, and that was most recently part of a $3 billion raise along other parts of the firm. There is definitely a disconnect here for a smart venture capitalist to uncover. There is also much to say about concerted ecosystem-building by closely networked companies with large cash war chests.

Rest of the Best

Here are the rest of the updates hitting our radar. Note that DeFi and digital investing now have their own dedicated weekly emails, on Tuesday and Thursday respectively.

PAYMENTS: Apple to Deploy NFC Acceptance on iPhone

PAYMENTS: Colombia’s Bold raises $55M in Tiger Global-led round to enable digital payments in LatAm

BANKING: Walmart’s Fintech Arm Acquires Two Firms In Financial Services Super App Quest (h/t Simon Taylor)

BANKING: Numeral wants to turn bank accounts into microservices

INVESTING: Fidelity Updates Wealthscape Platform, Integration Xchange

ROBOADVISOR: UBS Outlines What It Will Do–And What It Won’t–With Wealthfront

INSURTECH: 180° Insurance raises $31.4 million

VR: Quest Store Surpasses $1 Billion in Content Revenue, Showing Major Growth and Meta Reports More Than $2 Billion Revenue From Reality Labs In 2021

Are DAOs and Nations conscious? A look at Diem/Silvergate, Google Plex, and Solidly AMM (link here)

We bring thinking from neuroscience, and in particular how emotions and thoughts are made by the brain, and apply it to society-level super organisms like countries, tribes, DAOs, and companies.

In pushing our understanding of how events happen and meaning gets made, we create a hypothesis about how and why different ecosystems perceive events differently. Of note is the separation between governance and incentive setting — think tokens, regulations, law. We apply this logic (or attempt at logic) to Meta selling Diem to Silvergate, Google failing at neobanking, and the Fantom-based Solid exchange model.

Podcast: Distributing €1.4 trillion of investment funds on blockchain, with Allfunds' Ruben Nieto (link here)

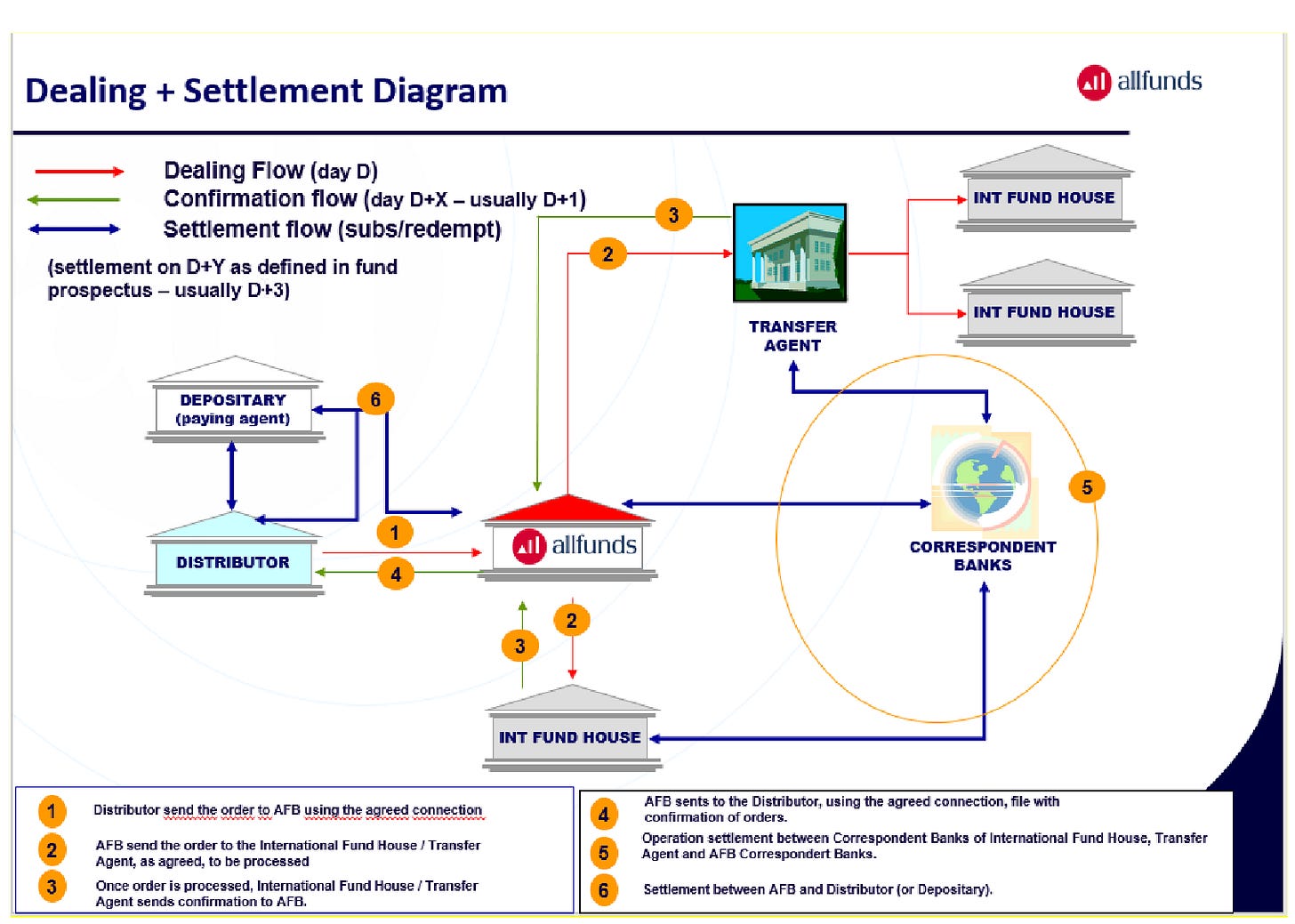

In this conversation, we chat with Ruben Nieto, the managing director at Allfunds Blockchain S.L.U., who has more than 15 years applying technology to the financial services industry. Ruben has been intrumental in building solutions for the institutional fund distribution leading platform in Europe, Allfunds Bank.

More specifically, we touch on all things digital asset management, wealth management, Ruben’s, blockchain journey around digital assets in the enterprise space, and so so much more!

More? More!

If you want to go deeper in Fintech & DeFi, upgrade to a premium Blueprint subscription below. Our value prop is simple: experienced judgment, accurate vision. If you knew the shape of the tomorrow, what would you do today?