Blueprint: SEC rewriting exchange rules to target DEXes; Musk's super app plans for Twitter and X.AI; Clear Street gets $435MM

Don't let the winds blow you astray

Hi Fintech Futurists —

You’re the best, today’s agenda below.

AI: Musk Incorporates X.AI, Suggesting Plans for OpenAI Rival (link here)

INFRASTRUCTURE: Fintech startup Clear Street raises $270M at a $2B valuation (link here)

CRYPTO: U.S. SEC sees decentralized crypto platforms as exchanges, seeks public input (link here)

LONG TAKE: Building Company Playbook #5: Creating your Fintech financial model and raising venture capital (link here)

PODCAST CONVERSATION: Modern Wealthtech for complex balance sheets, with Masttro CEO Padman Perumal (link here)

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

In Partnership

Join us at Fintech Nexus USA — we will be there. The event brings together top minds in fintech to cover topics like digital banking, fraud, blockchain, embedded finance, fintech investing, and more. 5,000 attendees will engage in 20,000+ double opt-in meetings this May 10-11 in NYC. It’s the can’t-miss event of the year!

👉Use promo code “FinBlue” and get 15% off today

Short Takes

AI: Musk Incorporates X.AI, Suggesting Plans for OpenAI Rival (link here) and eToro Announces Crypto, Stock Trading Integration With Twitter (link here)

Shortly after releasing an open letter looking to pause AI experiments more powerful than ChatGPT-4, Elon Musk has incorporated a rival company called X.AI. The incorporation, based in Nevada, has not currently released further details and Musk has declined to comment. What we do know is that in February it was reported that Musk was forming an AI research to compete with OpenAI, alongside ex-DeepMind alum Igor Babuschkin. We also know that Musk was formerly co-chair of OpenAI, and has since lambasted the firm claiming it is controlled by Microsoft and is training AI to be “woke”.

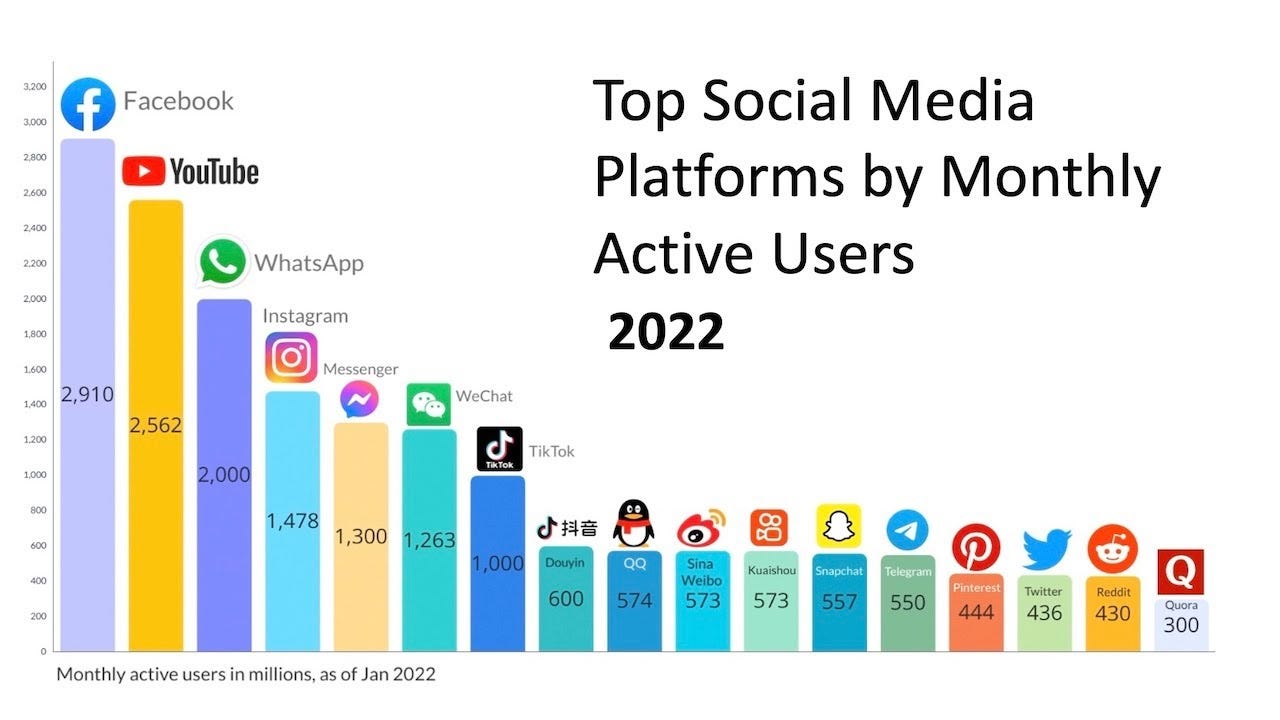

Zooming out, there is speculation that this is part of Musk’s broader ambition of creating a all-in-one super app, akin to WeChat in China. First, Twitter was merged into X Corp, its new parent corporation. This is indicative that Twitter will fit into a broader suite of products within X Corp.

Next was the integration between crypto trading platform eToro and Twitter. Through the partnership users can view financial investment market charts by using the “$” sign before a ticker on twitter. It does not support crypto transfers yet, but we have seen Musk’s interest in combining payments with the social media app through the tipping functionality, and a natural next step would be to enable users to hold, send and receive funds directly within Twitter’s UI. Already, Twitter’s logo had been changed into a Dogecoin symbol, because Why-Not.

Of course Musk is eyeing up the potential of Twitter’s 400 million users for a “super app”, especially if that means expanding revenue per user from a few dollars to several hundred dollars. WeChat has more than a billion daily active users and the application dominates daily life. But it isn’t necessarily the technical success of the app itself that has led to its popularity, but rather the commercial network effects and integrations with payment rails. To go deeper on the topic, check out our Long Take below:

Interested in Sponsorship?

To support the Fintech Blueprint and reach our 150,000+ Substack and LinkedIn audience of builders and investors, learn more below or contact us here.

INFRASTRUCTURE: Fintech startup Clear Street raises $270M at a $2B valuation (link here)

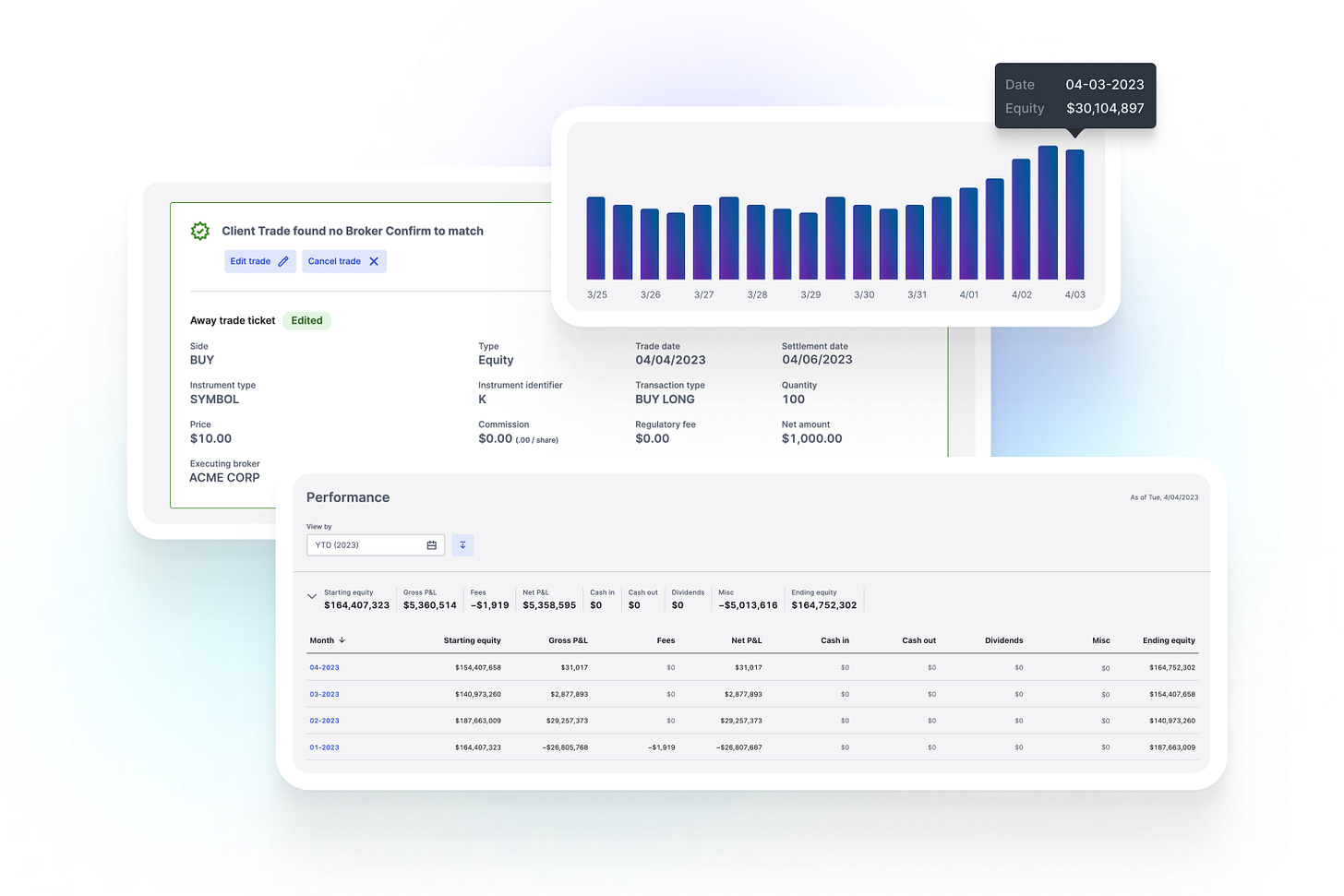

Clear Street raised a large round, particularly given the fintech investment environment, with a $270MM second tranche in Series B funding at a $2B valuation. This tranche brings the total round to $435MM, with the first tranche being raised at a $1.7B valuation in May 2022. That’s a lot of potential value creation in the worst of times.

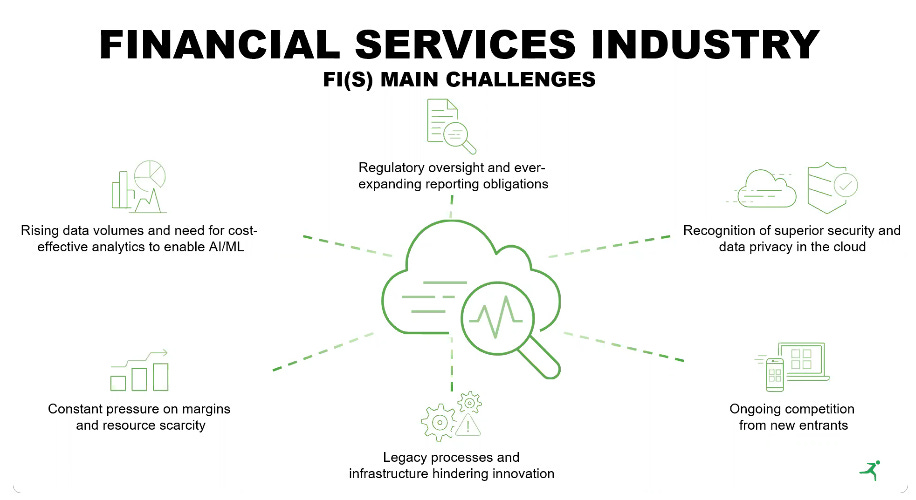

Founded in 2018, Clear Street targets legacy infrastructure across capital markets, with an initial focus on prime brokerage platforms for institutional investors. It draws on the challenges in the public US securities industry, which relies on substantial layers of legacy systems. Clear Street has developed a cloud-native prime brokerage and clearing system from the ground up. It has its own integrations with clearing houses and provides customers with all of the resources to clear, custody, and finance US equities and options.

The company has 200 institutional investors and hundreds of active trading entities as clients. The number of institutional clients rose 500% in 2022, daily transactional volume increased 300%, and financing balances grew by 150%. It is also reported to process 2.5% of gross notional US equities volume or about $10B in daily notional trading value, through its prime clearing platform. While revenue is not disclosed, Clear Street takes a fee on transactions, as well as making funds through the financing of public market securities.

There is enormous work to be done in replacing the capital markets technology stack with cloud-native, modern infrastructure. Clear Street’s growth shows the success of investing into improving operations within existing financial services, rather than into new, experimental solutions.

We also recognize the expertise of the founding team, which was likely pivotal to getting early go-to-market traction with complex institutional counterparties. For a company like this to succeed, an entire network has to shift its economic behavior into a new location.

CRYPTO: U.S. SEC sees decentralized crypto platforms as exchanges, seeks public input (link here)

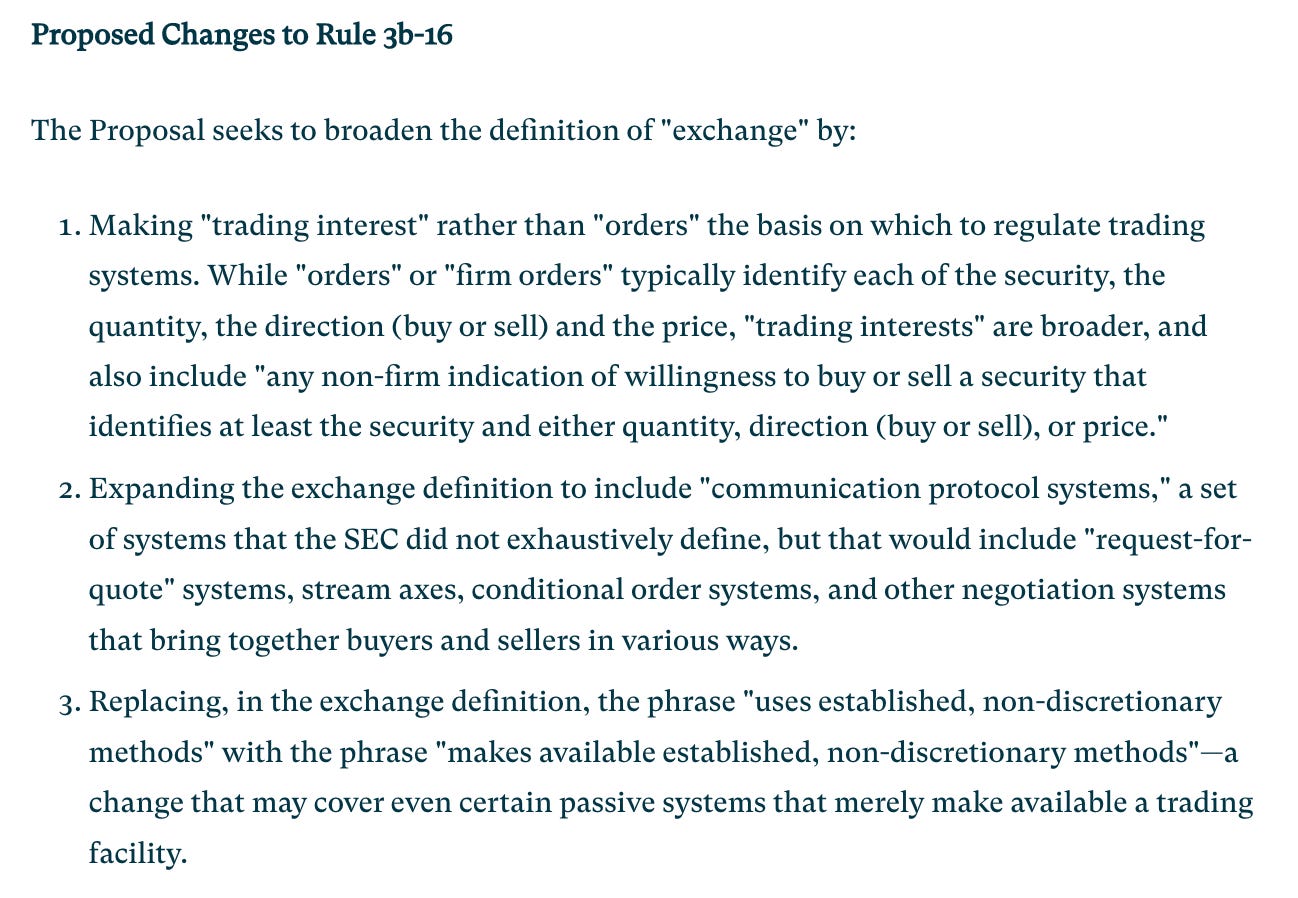

The SEC has reclassified its definition of an exchange, in an attempt to expand it to apply to decentralised exchanges (DEXs) built on blockchain technology. Previously, DEXes operated in a gray zone due to the fact that they are simply self-executing code deployed into the Web3 wild, without reliance on a third party to manage its particular business operations or activities.

The key change here from the SECs stance is amending the definition of an exchange to include platforms using “communication protocols”. These communication protocols include request-for-quote systems, which broadens the scope of the definition to include at least 12 DeFi platforms, none of which have yet been named publicly. The proposal focuses on marketplaces for other government securities and Treasury markets, which are where inter-dealer crypto brokers effectively function as unregistered exchanges.

Many in the space are pushing back against existing security regulations being applied to crypto without practical amendments to reflect the change in technology and market behavior. Regulations should be designed in concert the innovation we are seeing in the crypto space, protecting investors, but also encouraging growth, better solutions, and global cooperation.

The SEC have agreed, in a 3-2 vote, to take on public comments for a period of 30 days, highlighting the divide amongst commissioners. Hester Pierce’s dissent in particular is inspirational, and should really be quoted in full.

Long Take: Building Company Playbook #5: Creating your Fintech financial model and raising venture capital (link here)

We are continuing our Building Company Playbook series, targeted at addressing some of the key questions in getting Fintech and DeFi projects off the ground.

This entry will focus on the issues around generating financial projections, raising capital, and making it through market cycles.

Podcast Conversation: Modern Wealthtech for complex balance sheets, with Masttro CEO Padman Perumal (link here)

In this conversation, we chat with Padman Perumal is the Chief Executive Officer of for Masttro.

Masttro is a privately-held FinTech company that delivers a truly global wealth technology ecosystem to wealth owners and their trusted advisors. Before Masttro, Padman was Managing Director and Transformation Executive for the Commercial Bank division of JP Morgan Chase where he was member of the Commercial Bank’s Operating Committee responsible for building the division’s transformation function.

Rest of the Best

Here are the rest of the updates hitting radar.

PAYTECH - General Atlantic invests another $100 million in PhonePe

CREDIT - Credit Card Processor Network International Attracts Private Equity Interest

CREDIT - Lending startup Kala is helping Latin American banks more easily offer credit

INVESTING - Altruist raises Series D

INVESTING - Tradier Raises $24.6M in Series B Fundi

AI - MARTINI.AI CLOSES $6 MILLION SEED ROUND TO LEVERAGE AI TO TRANSFORM PRIVATE AND PUBLIC CORPORATE CREDIT

AI - Alphabet leads $100 million investment in AI startup AlphaSense

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions.

Later this week, we will share our Short Takes on the latest Web3 and Digital Investing news, reviewing several companies. If you’d like us to look at any specific item, feel free to share your thoughts in the comments below. We will provide our best analysis in response to your requests.