Can the $4 Trillion municipal bond market be a digital asset in your pocket? +20 key Fintech developments

Hi Fintech futurists --

In the long take this week, I reflect on ConsenSys acquiring a broker/dealer focused on municipal bonds, and why we believe that blockchain-native platforms are a fantastic fit for this $4 trillion asset class. Can direct holding of franctional munis enable deeper community participation and usage of common resources? Are there new sources of liquidity to unlock? At the same time, there are real dangers. I compare the evolution of digital lenders and their funding sources against the current possibilities in municipal bond markets. We also look into the reasons that some innovative Fintechs have failed to achieve their stated missions, and what can be learned and done better.

These opinions are personal (or maybe made by a robot) and do not reflect any views of ConsenSys or other parties.

Long Take

I looked closely at digital lenders a year or so ago, and there was a lot to learn about what happened from 2008 to 2018. When Lending Club launched, the core thesis was to generate small loans from the community for the community. These loans between people, i.e., personal loans, would replace the high rates on credit card debt that can range easily up to 25% APRs. Technology would make the person-to-person (P2P) loans much cheaper to issue and operate, and therefore the entire personal lending market would be disrupted.

Over time, two core things happened. First, there was a steady proliferation across risk types. We started with personal loans, but grew into student lending (SoFi), small business (OnDeck), home equity loans (Figure), and all sorts of other categories. Many analysts in the early days believed that this digital-native approach would not work for adjacent, larger categories like automobile financing, home equity loans, or mortgages. It has been fantastic to see that objection proven entirely, fully wrong. Fintech lenders are an increasingly meaningful (though small) share of the consumer fixed income markets across most exposures and geographies. And companies like Goldman Sachs have become fintech lenders by launching neobanks like Marcus, paying hundreds of millions in cost to catch up to the start-up industry.

But, second, P2P didn't work. You couldn't crowdfund enough money and liquidity to match supply and demand across the loan book. Building out unknown website destinations with no underwriting experience required a lot of venture capital to be burned on Google and Facebook advertising. So whatever you saved in onboarding and servicing efficiency, you burned on customer acquisition. The answer to this second problem was the same as always -- institutional money willing to take underwriting risk. Hedge funds and private equity firms moved in to provide capital to these Fintech lenders, who rebranded from P2P to merely "digital". As a result, digital lenders today are growing in terms of the things they cover, but consolidating their capital sources and streamlining their book management. Consumer access remains, but it is hard to bootstrap sufficiently.

And now we come to municipal bonds. I start with a story of a failure -- a startup called Neighborly that raised $33 million to create a local crowdfunding platform for municipal bond projects in people's backyards. Would you like a new school bus, or road improvement? Help your municipality by financing these micro-projects with mini-bonds, feel connected to your neighorhood, and get paid interest for the pleasure.

Unfortunately it didn't work, and Neighborly is dead. I do not have full visibility into the Why, but I suspect largely that it was too difficult to aggregate consumer interest without sufficient integration into the value chains of municipal finance -- in the same way it has been too difficult for digital lenders to avoid using institutional backing, and in the same way that equity crowd-funding has done little to change investment banking. But that doesn't mean the core thesis is wrong! People for sure are holding more assets directly! For equity crowd-funding, for example, the desired outcome of consumers holding private equity assets may be solved not just at the original issuance, but at the going public stage through direct listing. That has all sorts of bad implications around missing alpha capture by being late, but life is hard.

Anyway, I am thinking about Munis because last week, ConsenSys acquired Heritage Financial Systems, a broker/dealer focused on municipal issuance. Our ConsenSys Codefi software will sit underneath the human side of the business and power primary tokenization and the ongoing lifecycle of digital assets. We have a strong conviction that this particular financial instrument is a great fit for programmable blockchains, and I'll talk about what that means first. As I've described before, blockchain-based finance is ingesting the manufacturing of all financial instruments, the functioning of their maintenance, and the guts of related markets. This is why tokenization is not enough, and we have designed modules for Assets, Payments, Networks, and Data to create a coherent whole articulated below.

The most value comes from specialty markets with difficult, paper-led infrastructure, a lack of automation and standardization, and bumpy exchanges. The counterfactual to focusing on such specialty markets is Digital Asset Holdings, which tried to re-build an entire public equities exchange for Australia. It has since pivoted away and into legal markup language to compete with similarly positioned Nivaura. So in this case, it is precisely the type of instrument that Munis represent and the type of market in which they are exchanged that makes them a compelling technology opportunity.

But equally important is understanding how to stand up a market. Neighborly and the Digital Lenders did not hit a technology wall, they hit a market structure wall. To understand Munis, you need to understand the instrument, and how it is aggregated to consumers. One of the most attractive features of muni bonds is that they are tax exempt, which gives them an "unfair" advantage in the returns they provide to holders. Those returns tend to be low, given this is usually a tax- or revenue-backed financial obligation. But when structured appropriately, interest income taxes are not paid to the federal government (watch out for the AMT tax). You can see a tangible example of this for high-yield and investment grade bonds below, showing these instruments outperforming the corporate-issued alternatives.

But somebody has to buy the things! These sales are usually faciliated by an advisor, which is either part of a global investment bank, a specialist fixed income firm, or one of the Big Four. That advisor will hit up pools of institutional capital -- high net worth individuals, family offices, hedge funds, private equity, or mutual fund managers. And it's pretty easy to outsource capital aggregation into these third parties, because they do all the placement work. The cost, however, is there as well -- you pay an investment banking fee for investment banking.

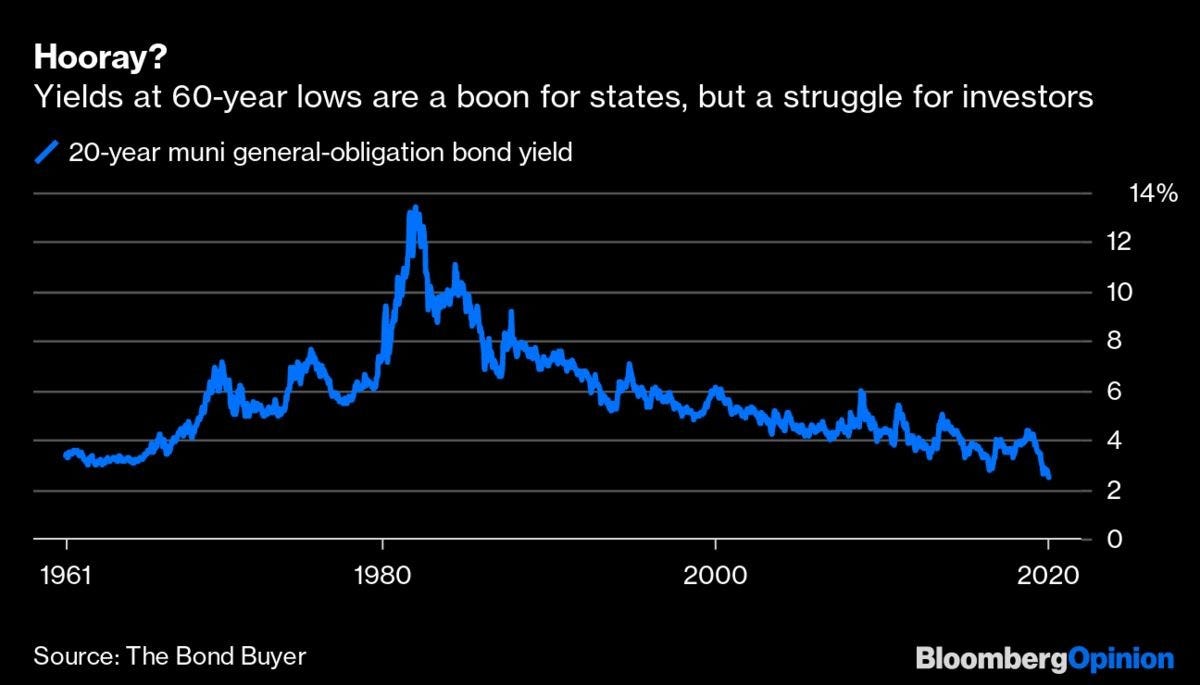

For large chunks of debt, the bonds will go into the portfolios of large fixed income fund managers. Those managers will be buying up obligations, fueled by investor demand and inflows on the other side (if performance of the fund holds up). And right now, muni fund flows are holding up pretty well as yield continues to be historically low across most exposure types. This could be, in large part, the outcome of a supply/demand imbalance, rather than a fundamental goodness of municipal credit (though being able to tax Amazon helps). There are just not that many places to get risk-free interest. Yet nothing is ever risk-free.

Look, I bring all this up to say that things aren't as simple as putting up a website and hoping that investors will come. You have to look deeply at the thing you are working on replacing, and identify where your mouse-trap is better than the previous one. The current mouse-trap works to raise a lot of debt -- $3.8 trillion of debt to be exact. Fees come out to large banks, who help pool debt it into even larger funds. Those are distributed through asset allocation systems into portfolios for retirees, endowments, institutions, and the occasional regular people. If you squint closely enough, you may hold some blended average of all Munis ever, around 3% of your portfolio. But there's a key thing missing.

The thing that's missing is that nobody cares. No community engagement. No local ownership. No feeling the wind on your face or the water in your palms. No helping your neighbor's kid get on the school bus. Just numbers ticking red and green on the Bloomberg screen. This works for your money, but not your heart.

Financial instruments don't have to only be a mathematical destination. There is a path where they can anchor you to story and to community, while achieving a substantially similar result as a Modern Portfolio Theory based asset allocation. For most people, this doesn't work if you need to buy Munis in denominations of $5,000. It doesn't work if you need to write $25,000 checks to invest in early stage speculative start-ups. It doesn't work if the skyscraper is raising $100 million in debt from a single wealthy family. But it does work if you are able to offer fractional ownership to the community, and create the diversification effect in smaller denominations held directly, versus only at the fund level.

An individual could participate in building a contextual, meaningful portfolio by transacting for tokenized assets in denominations as small as a single dollar. We know that companies like Schwab understand the power of fractionalization, having created a shadow accounting system for fractional stock prices just last year. Extending this into assets and securities that do not ride on traditional rails, but can be enabled on blockchain-based ones without relying on a chain of third party service providers, is opening up a blue ocean of opportunity. You can also use fractional asset ownership as a claim to a usage right -- for example getting free passes to a community health center you financed, or reduced fare on public transport you helped overhaul.

The key questions for me remain (1) how to blend together the energy of P2P and the stability of institutional funding sources to maximize the success of issuers, and (2) what interface will allow consumers to aggregate their specialty finance holding into a diversified, sensible portfolio. Decentralized finance has started on this journey, but there is significantly more work to be done in marrying permissionless web tools with regulated industries. Here's to the first step!

Key Fintech Developments

I tried something new with the Key Fintech developments section this week on the LinkedIn version, but it didn’t fit into this already long email.

Readers have long told me to split up the Long Take from the link aggregation, and I might just do it depending on what you think. The below links on their own are not sufficient content for a separate mailing, so I am thinking about pulling out a relevant graphic for each article below as well. Would that work? Should I then add text under each one? Let me know please here!

Barclaycard has announced a deal to become a preferred payments partner for the 60,000 online retailers hosted on BigCommerce's SaaS e-commerce platform and Payments infra startup Finix closes $35M Series B led by Sequoia

The Electronic Transactions Association (ETA) has published its annual report on Fintech and how it helps the population that is underbanked or not banked at all and For the first time, in the fourth quarter of last year Russians made more payments digitally than with cash, according to analysis from Sberbank

Goldman in talks with Amazon to offer small business loans and Goldman bolsters Marcus staff as Britain spearheads consumer bank push

Chief Fintech Advisor to Premier of Bermuda says island nation is planning to launch complete crypto and DLT ecosystem and Cambodia’s central bank set to launch ‘quasi’ form of digital currency this quarter and The deputy governor of the Bank of Japan has said the institution must be ready to issue a central bank digital currency (CBDC) should public demand surge in response to technical developments and Bankers in China believe that blockchain will change the core standards of the financial system

Looking for more?

Get this writing directly in your Inbox by subscribing here.

Find me on Twitter here for Fintech and here for Digital Art.

Check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments.

Want to send me a note? Reach out here anytime.