Deep Dive: Can Klarna, the BNPL category creator, rise to its market challenge?

A digital lender with a struggling credit model, or a payments company with an ecosystem of revenue-generating products

Gm Fintech Architects —

Today we introduce a new format — a deep dive on a target company.

Summary: The Buy Now, Pay Later (BNPL) business model has fundamentally changed the e-commerce shopping experience across the world. Led by the Swedish company Klarna, the BNPL model has been rapidly growing in popularity, particularly among millennials and Gen Z, who are looking for more flexible payment options. Klarna has expanded its services globally and now operates in over 20 countries, with partnerships with major retailers such as H&M, ASOS, and Adidas. Does that mean that Klarna and its BNPL business model is here to stay? We explore its most recent financials, competition, and emerging threats and opportunities.

Topics: Buy Now Pay Later, digital lending, payments, valuation

Tags: Klarna, Affirm, Apple, Afterpay, PayPal

Author: Enormous thank you to Michiel Milanovic for putting together this report in both analytics and narrative. Lex has edited the work within the broader context of the Fintech Blueprint view on market strategy and innovation.

If you got value from this article, let us know your thoughts — should we cover more companies in this way?

Klarna Company Deep Dive

Introduction

In 2005 at the Stockholm School of Economics, three entrepreneurs pitched a payments platform that promised to increase an online retailer’s conversions at checkout by up to 30%.

The concept was straightforward: (1) offer customers the ability to make payments in installments at checkout, but (2) pay retailers the order value immediately. The platform would take a fee from both sides — a merchant fee from the retailer for conversion of the customer, and interest fees from customers who make late payments on their instalments.

Today, this business model is known as “buy now, pay later” (BNPL). At the time of company founding, it was both new and brilliant to combine two previously separate fintech pillars — payments and lending.

BNPL companies target inefficiencies in the traditional financial value chain. Applications for credit generally lived outside of the commerce experience, within a banking environment. Further only 40% of applicants get approved for credit cards, and 6% of loans ultimately don’t get paid back.

By embedding underwriting in the digital payments journey, BNPL companies can merge traditional and non-traditional data to build new data-driven underwriting models. Combining the traditional “soft” credit check with data on customer purchasing behavior has enabled BNPL providers to accept an average of 70% applicants while keeping their losses at a lower 4%.

Over the years, this became a popular value proposition for online shoppers — especially young people with lower credit scores, who face high costs to access traditional credit products. Given the rapid growth of e-commerce over the past decade, BNPL captured 8% of online payments in Europe and 4% in the US in 2021 — about $100B in volume.

By 2025, these numbers are projected to triple. Assuming a 3% customer conversion fee, the industry has a $10B revenue opportunity across Europe and the US. If you add customer late payment fees, fixed transaction fees, and any interest on top, the math works out to an attractive target market size.

Klarna was the first mover in this space. Riding the wave of e-commerce growth, low competition, and ultra-low interest rates enabled it to gain an edge over emerging competitors. Ample funding from investors including Sequoia, General Atlantic, and Softbank also meant there was no need to go public. The company raised a whopping $4B in total.

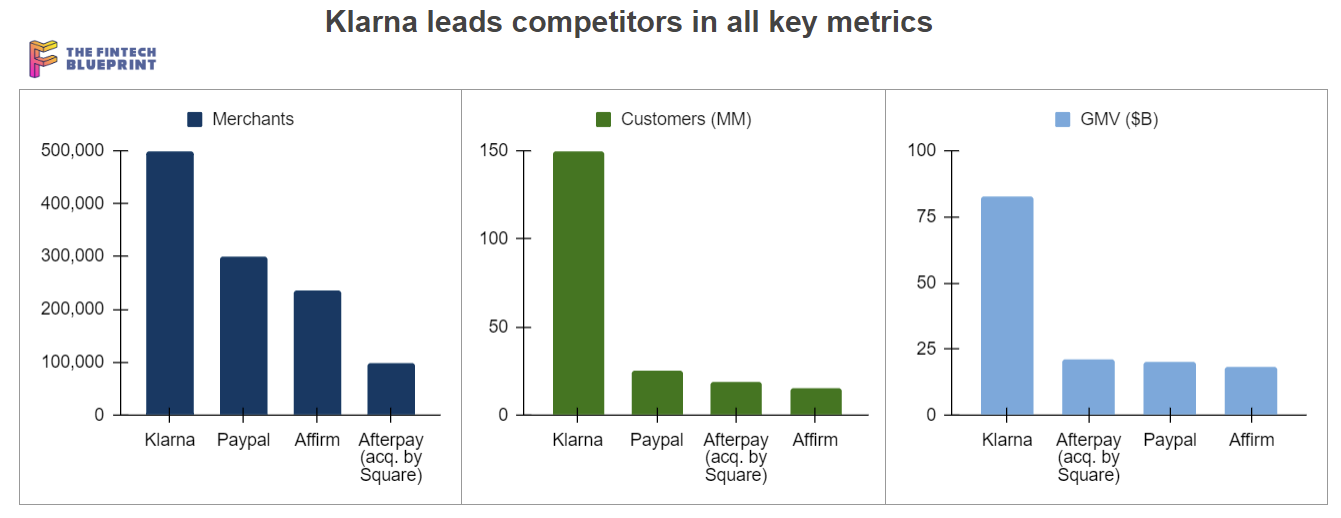

Klarna leads Paypal, Affirm, and Afterpay in market penetration with 500,000+ merchant partners, higher volumes, and more customers. Klarna processed $83B in GMV in 2022 (vs. ~$20B each for Paypal, Afterpay, and Affirm) and reached over 150M users (vs. 25M for Paypal, 19M for Afterpay, and 16M for Affirm). You can see this visualized below.

With the acquisition of a banking license in 2017, Klarna was able to expand its ecosystem to include more traditional products — a Klarna debit card, short-term loans, and savings accounts. These deeper financial bets should have been a meaningful revenue generator, deepening monetization. But a changing macro environment and increasing competition from incumbents are now starting to expose holes in the Swedish fintech’s business model. Let’s dive in.

Company Financials and Funding

Klarna’s high valuation came crashing down. Between 2019 and 2021, Klarna saw its valuation grow from $2.3B to a sky-high $46B, or 38x FY20 revenues of $1.2B. This was high compared to publicly listed comparables, but so were the times.

According to F-Prime Capital (here), companies with year-over-year (YoY) revenue growth in line with Klarna were trading at an average of 28x revenues at the time. When central banks began signalling higher rates in 2022, tech valuations plummeted. Among other factors, valuations are based on the current value of future earnings, and many high-growth tech companies take a longer time to make profits. Investors have to wait for network effects, data advantages, and economies of scale to kick in. Higher interest rates typically make investors less willing to sit tight as the opportunity cost of allocating capital elsewhere increases. Needless to say, when Klarna raised additional funds from investors in June-22, it saw its valuation slashed by ~85% to $6.7B. This followed a wider BNPL correction with publicly listed competitors down 80% on average.

But more importantly, it shifted the narrative for both public and private investors — once focused on top-line growth, but now increasingly looking for profitability. Lending risk has also materialized in the shape of losses, something that isn’t fully appreciated when valuing underwriting revenues 40x. Generalist venture investors have received an education in the different quality of financial services revenues.

Klarna Financials

In 2022, Klarna reported decent revenue growth, but a widening loss.