DeFi: $BODEN and $TREMP, the Memecoins we deserve for financializing attention

Some people hope for a more rational crypto market, but they misunderstand its nature

Today we highlight the following:

DIGITAL ASSETS: Solana's soaring memecoins and the echoes of King Lear's fool

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

DIGITAL ASSETS: Solana's soaring memecoins and the echoes of King Lear's fool

In the world of finance (DeFi included), where fortunes rise and fall, there is a parallel to be drawn from the words of King Lear and his jester, the Fool.

Fool: If thou wert my fool, nuncle, I'ld have thee beaten for being old before thy time.

King Lear: How's that?

Fool: Thou shouldst not have been old till thou hadst been wise.

King Lear: O, let me not be mad, not mad, sweet heaven / Keep me in temper: I would not be mad!

The Fool may appear silly, weak, and powerless, but is in fact the truth-teller in a world of corruption and chaos. Stand-up comedians dare say that which would otherwise offend and divide. To joke and laugh is to explore the uncomfortable, and make our peace with it.

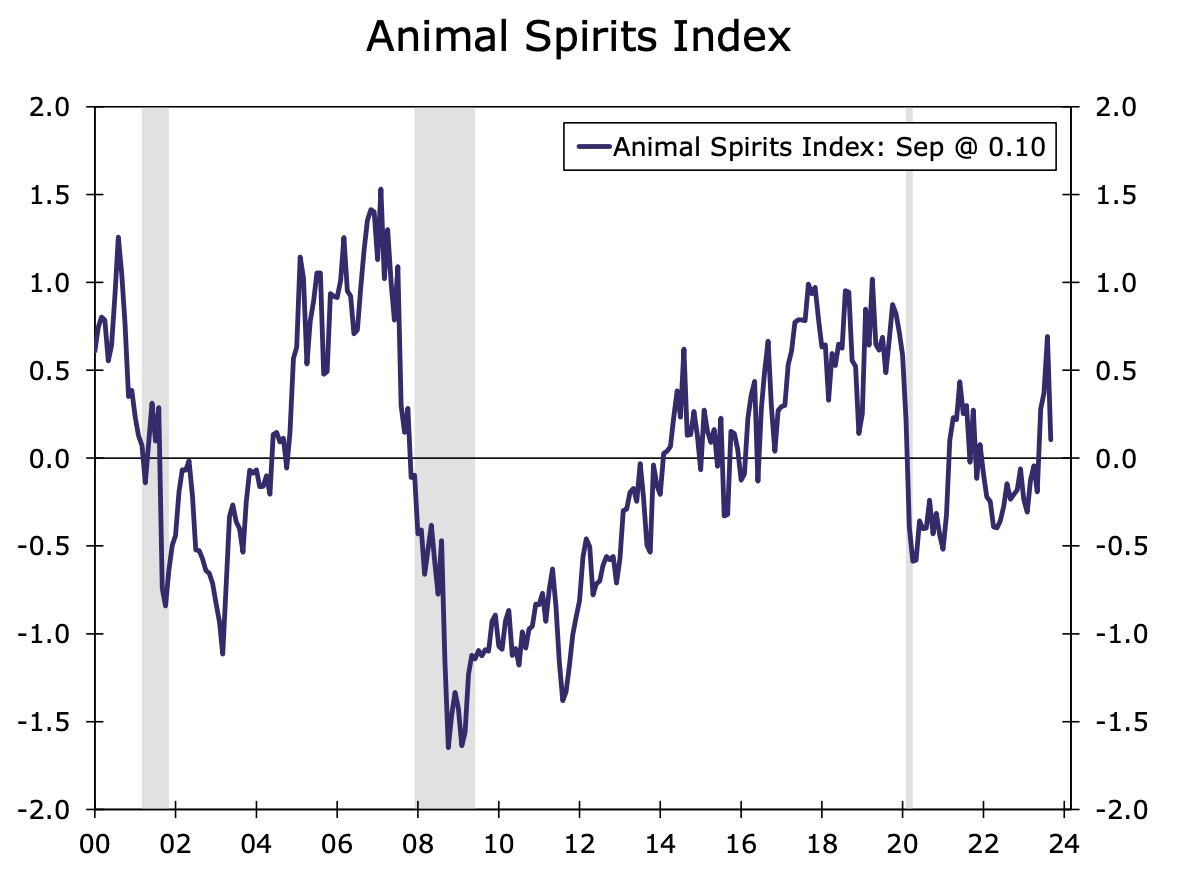

In a similar vein, Solana, has witnessed a surge of new memecoin launches boasting returns of up to 10,000%, and one wonders — what kind of animal spirits are in the air right now? Memecoins are the pure attention virus of the Internet, the distillation of ideas rendered in the minds of the online hive. They are the spear by which digital trolling penetrates mainstream culture.

A bit more context: Solana-based memecoins Bonk and dogwifhat experienced a stratospheric rise in value, with $BONK up 170% and $WIF (dogwifhat’s token) up 630% in the past month. The dogwifhat community even managed to rally and self-fund $690,000 in four days to showcase their token on the exterior of the new Las Vegas Sphere. Franklin Templeton is writing equity research on the topic.

Most recently, 4chan quality politically-inspired memecoins like jeo boden, doland tremp, elizabath whoren, have reached market caps in the tens of millions. $whoren is up 300% since yesterday. If you are a “serious finance person”, you still have to look at this and understand it. This is the natural conclusion of the Gamestop saga, memes taking over not how we trade, but the underlying financial asset as well.

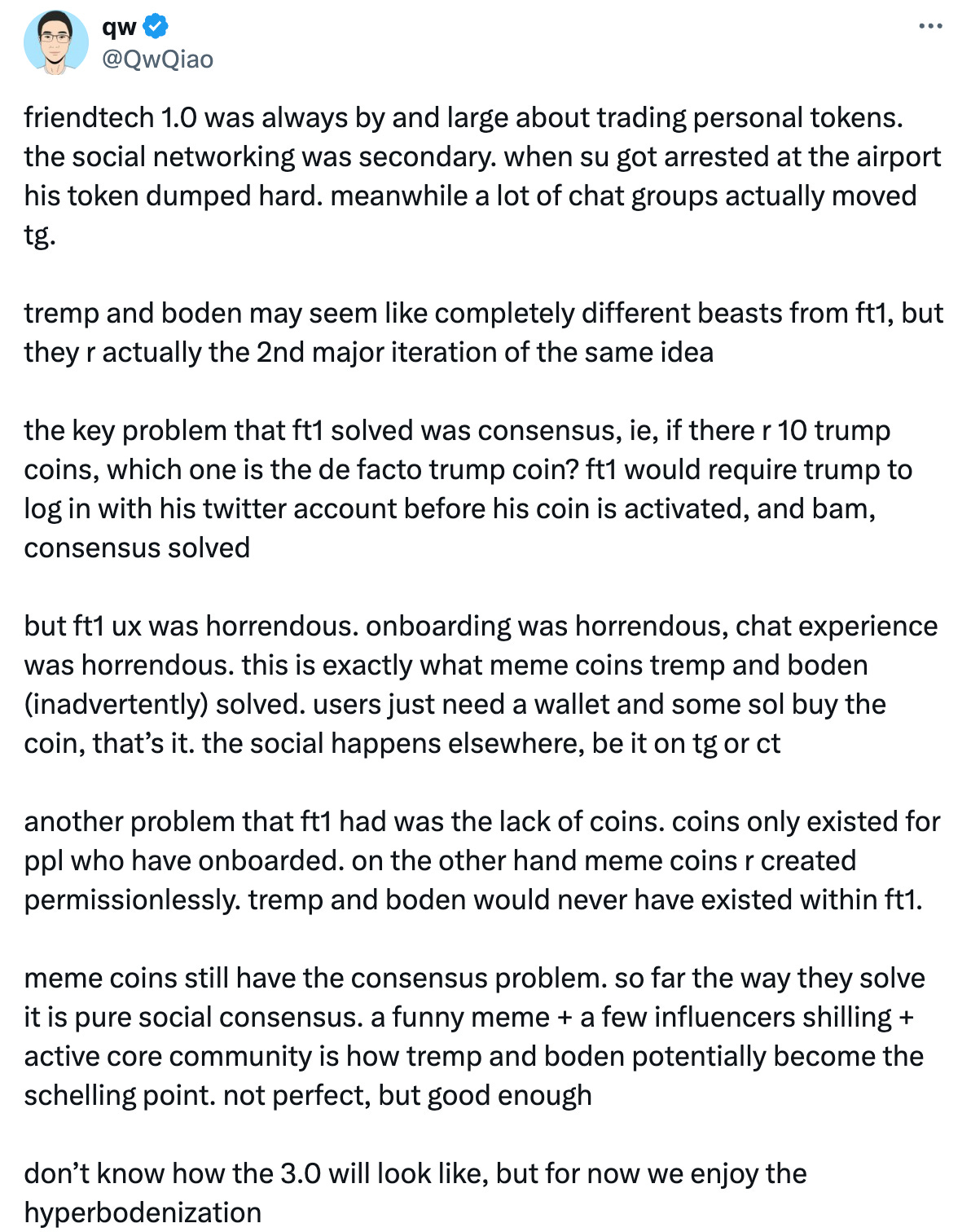

In the midst of all this, a wide range of opinions has emerged. One idea connects these political memecoins to Friend.tech, a platform that primarily focuses on trading personal tokens, with social networking as a secondary priority. The argument suggests that even though tokens like tremp and boden may seem quite different from Friend.tech, they actually represent a second iteration of a similar concept. But in our view, this is more of a trading of celebrity rather than self-tokenization.

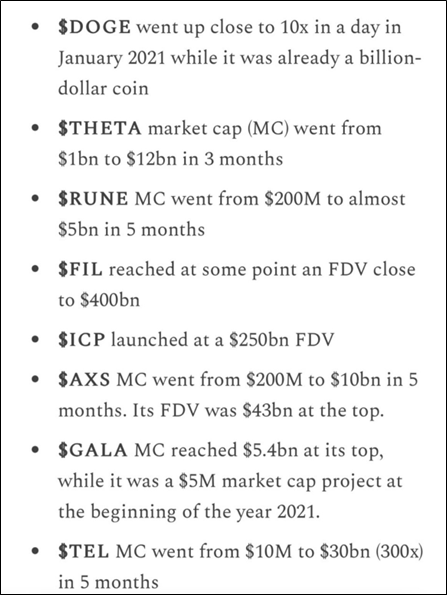

And note that friend.tech is not a new idea. Do you remember BitClout? Probably not, given the transience of the memecoin landscape. And when we take a closer look at the assets that drove trading volumes in prior cycles, memecoin rallies — like Dogecoin or Shiba — were part of the story. There are hundreds, if not thousands, of similar case studies.

Travis King, the Founder and CIO of Ikigai Asset Management, sheds light on this recurring theme by linking it to the rise of Financial Nihilism — an ideological standpoint that questions the value and legitimacy of financial systems, markets, and even the very concept of money. It is a useful perspective to consider when memecoins skyrocket by 10,000% and reach multi-billion dollar market caps in a matter of days. What’s the point of saving 5% in a bank account for years when an Internet troll can make that in a day.

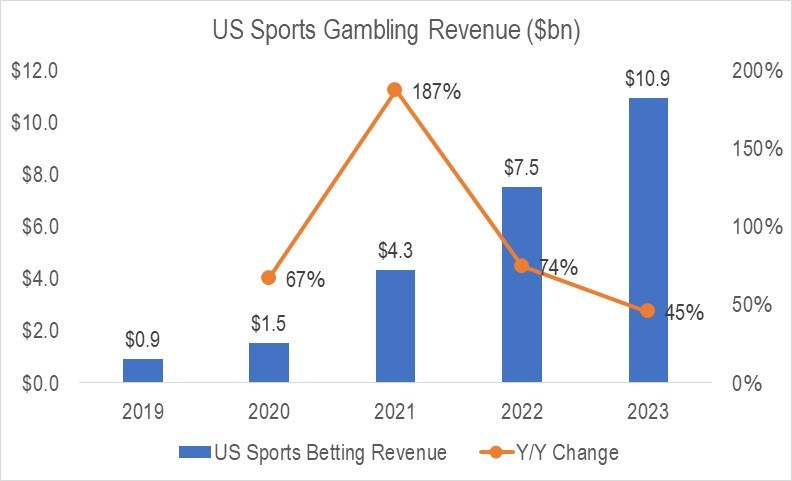

The rise of financial nihilism can be attributed to (1) the lack of upward mobility makes the American Dream feel like a thing of the past for many, and (2) the perceived irresponsibility of the US government and Federal Reserve. As a result, people have to take bigger risks to achieve financial stability — gambling on the future is the only way to get there.

“You take bigger risks. You feel driven to take bigger risks to try and leapfrog from your current financial position (mostly paycheck to paycheck; buying a home feels nearly impossible; saddled with student loans; salary increases not keeping up expense increases) to something more tenable. More comfortable. More baller.

So you gamble. You. F**king. Gamble. You look anywhere, for anything, that can give you a 5:1, 10:1, 50:1 type of payout. Naturally, you look to literal gambling, which is growing at a breakneck pace-” - Travis King

In a way, those who embrace financial nihilism are directly responding to, and mirroring, the monetary and fiscal policies of the Federal Reserve and the US government. According to Travis, this embrace has a significant impact on the price movements of crypto assets, and its influence seems to be growing even more pronounced. Just look at the national debt.

In our 2020 Long Take on the memetic infection of Finance, we touched upon this very topic. The analysis was largely inspired by Based Protocol, a DeFi game with a "vaporwave" aesthetic that made fun of the system. It's like the jester in King Lear, playfully mocking itself and its participants. Based Protocol’s Twitter account was a treasure trove of surreal memes sourced from Reddit, and it boldly labeled DeFi investors as degenerates. It poked fun at both traditional finance and DeFi, suggesting that money doesn't hold any real meaning and that it's all just a game where we compete against each other.

And while some people hope for a more rational crypto market, where valuation methodologies are based on reason, it is unlikely that these wishes will come true. The bubble will be bigger, followed by an even bigger collapse. As QwQiao puts it, “for now we enjoy the hyperbodenization.”

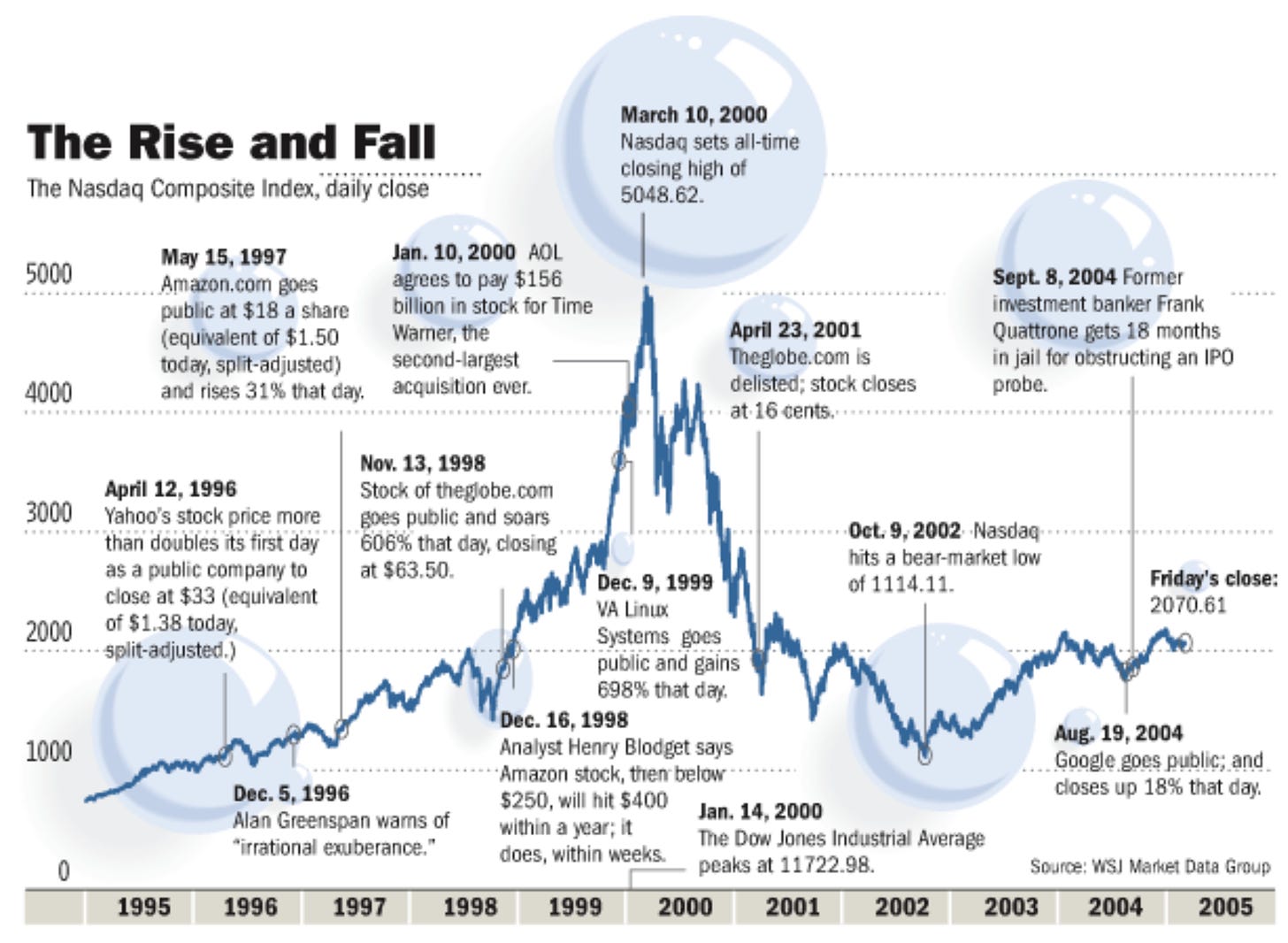

If you have been in traditional finance for a while, you are familiar with animal spirits taking hold of the market. Today's meme / momentum investors see the AI boom — they don’t have to be focused on assets with strong balance sheets or high profitability, nor are they drawn to companies based on their earnings growth potential. Instead, they get caught up in the excitement of sending non-cash flow paying assets to the moon, even as risk-free rates remain at 5.25%.

But this is not new. We saw similar exuberance in 1999 and 2007, and 1929. What might be different now is this idea of perpetual animal spirits, driven by an upwards-drifting stochastic component that keeps them increasingly volatile over time. Forget the memory of (literally) yester-year, and behold Financial Nihilism.

👑 Related Coverage 👑

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

Michael Saylor's MicroStrategy Raising Another $500MM To Buy More Bitcoin - CoinDesk

Goldman Sachs, BNY Mellon Test Blockchain Network With Other Firms - The Block

Fireblocks, Zodia Markets Partner To Improve Cross-Border Payments - CoinDesk

Bernstein Predicts Crypto Market Cap Could Grow To $7.5T By End Of 2025 - The Block

DeFi and Digital Assets

⭐ Aevo Airdrop Leaves Some Farmers Fuming As Token Debuts At $3B Valuation - the Defiant

EtherFi Expedites Roadmap, Will Launch Token In Coming Days - The Defiant

Vega Creates Derivatives Market For Crypto points, Starting With EigenLayer - The Block

Blast Stopped Producing Blocks Following Ethereum’s Dencun Upgrade - Blockworks

Blockchain Protocols

⭐ Ethereum Activates Dencun Upgrade, Ushering New Era For Layer 2 Scalability - The Defiant

⭐ zkBridge developer Polyhedra Network Reaches $1B Valuation In Token Round - The Block

BNB Chain Introduces Rollup-as-a-Service Solution To Expand Its Layer 2 Ecosystem - The Block

Swell launches Its Own Layer-2 For Restaking With Polygon CDK - Blockworks

Starknet To Roll Out Suite Of Fee-Saving Measures Alongside Dencun - The Defiant

Stack ‘Points Chain’ Layer-3 Aims To Bring Loyalty Points To Base - Blockworks

NFTs, DAOs and the Metaverse

⭐ Starknet Foundation Creates Gaming Committee With $120MM Budget - The Defiant

Delphi Digital Joins $5MM Round For Developer Of Crypto Video Game 'MetalCore' - The Block

🚀 Level Up

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

Wednesday’s Long Takes with a deep, comprehensive analysis.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts for deeper learning.

Special Reports

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.