DeFi: Crypto media on sale as Coindesk sold to EOS exchange Bullish & The Block acquired for $70MM

Will owning a major media outlet allow Bullish to influence public perception or grow top-of-funnel?

Gm Fintech Futurists —

Today we highlight the following:

CAPITAL MARKETS: Crypto Exchange Bullish Completes Purchase Of CoinDesk (link here)

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

⭐ Black Friday Special: 50% Off Your Premium Subscription ⭐

This provides access to ALL our premium benefits, including weekly Deep Dives, monthly digital roundtables, our Builder’s Playbook (guide to building in Fintech), enhanced podcasts, archives access, and more.

This is our lowest rate to date: less than $10 per month!

CAPITAL MARKETS: Crypto Exchange Bullish Completes Purchase Of CoinDesk (link here)

Block One's subsidiary Bullish has completed an all-cash buyout of CoinDesk from Digital Currency Group (DCG). DCG had been actively seeking a buyer since January to plug a multi-billion dollar balance sheet hole as a result of the collapse of Genesis, the lender to bankrupt funds 3AC and others, as well as the structural market problems with its historically popular Grayscale Investment Trust. Binance expressed interest, and in July, a group of investors, led by Matthew Roszak of Tally Capital, made an attempt to acquire CoinDesk for $125MM. But neither of the deals materialized.

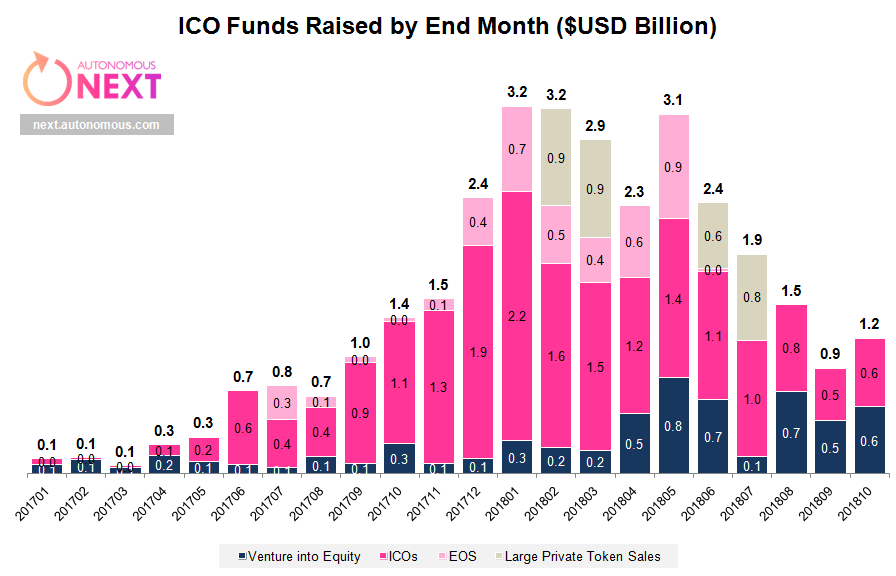

Bullish is owned by Block One, which created an early Ethereum challenger EOS that raised $4B in 2018. The ICO is perceived as a net drain on the industry — it ran for over a year, pulling in ETH liquidity while executing the fund raise on Ethereum to build a competitor. The tokens were deemed to be illegal securities offerings by the SEC, and EOS paid a $24MM fine for this pleasure.

Further, the EOS promises were never made real. The network peaked at $16B in value in 2018, trading now at around $800MM. To seed it with software, the team allocated funds to other ventures, including Bullish and social media platform Voice. Block One invested $150MM into Voice, which aimed to combine features of Twitter, Facebook, Steemit, and Brave. While on-chain social networking is an interesting direction, Voice did not catch on, then transformed into an NFT platform, and finally shut down in September.

Bullish, a crypto exchange based in Gibraltar, is another one of Block One’s projects, and leverages a private version of the EOS chain for trade execution. It was initially projected to be valued at $9B through a SPAC plan, to be raised largely on expected rather than live traction. Despite offering spot trading for only 23 cryptocurrencies, the crypto exchange has a reported daily trade volume of around $1.5B, which — if accurate — would surpass Kraken and approach Coinbase’s $2.2B. We assume nearly all this trading is institutional, and that some of the liquidity is the company’s own balance sheet.

The CoinDesk deal comes at an intriguing time, considering media company The Block just sold 80% of its stake to Foresight Ventures for $56MM. Foresight also owns crypto media companies BlockTempo (in Mandarin) and CoinNess (in Korean). The market is telling us that, while media controls attention and is enormously influential, shrinking sponsorship revenues create a lot of pressure in a bear market.

Owning a major media outlet provides Bullish with a platform to influence public perception and grow top-of-funnel that converts into trading. At 2.2MM visits per month or 25MM per year, TheBlock valuation is $3 per visit. This is also reminiscent of Binance acquiring CoinMarketCap for $400MM in 2020. That site generates 70MM in monthly traffic, so we can derive $0.50 per visit on public numbers. CoinDesk may have 100MM or so visits per year, as well as a profitable conference business, but was likely less expensive, even though it generates an annual revenue of $50MM.

When it comes to direct integration with Bullish, CoinDesk's index business could provide valuable benchmark data and analysis for integration into Bullish's offerings, such as its upcoming perpetual futures service. With these new developments and comparables, we expect to see other crypto media players raise funds or go through reorganizations in the coming months.

👑 Related Coverage 👑

How to Reach 200,000 Fintech Professionals

With a 35% open rate and 1 million post views per month, we have an engaged audience of Fintech, DeFi, and AI enthusiasts receptive to your messaging.

Contact us to learn more about our custom opportunities.

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ Binance To Pay $4.3B To Settle U.S. Criminal Case; Changpeng 'CZ' Zhao Resigns As CEO And Pleads Guilty In Seattle - The Defiant

SEC Sues Kraken Alleging Unlicensed Securities Trades And ‘Commingling’ Of Customer Funds - The Defiant

Aave Companies Rebrands As Avara To Reflect The DeFi Giant's Multiple Holdings - The Defiant

KPMG Canada Teams Up With Chainalysis To Fight Crypto Frauds And Exploits - CoinDesk

Genesis Sues Gemini to Recover 'Preferential Transfers' Worth $689MM - CoinDesk

DeFi and Digital Assets

⭐ Paradigm Leads $18MM Series A Raise For Web3 Infrastructure Startup Privy - The Block

⭐ Tron’s JustLend Surpasses Aave As Largest Web3 Lending Market - The Defiant

CoinGecko Acquires NFT Data Startup Zash - Blockworks

Celsius Network Shifts Focus To Bitcoin Mining Following Bankruptcy - Decrypt

Pyth Network Token Goes Live With $75MM Airdrop For DeFi Users - The Defiant

Expanso, A Distributed Data Processing Startup Led By Google And Microsoft Vets, Raises $7.5MM - GeekWire

Huobi’s ‘Heco’ Chain Bridge Drained Of $87MM In Crypto Assets - Blockworks

Blockchain Protocols

⭐ Vitalik Advocates For Renewed Exploration Into Plasma-Based Scaling Solutions - The Defiant

⭐ Blur Founder's Ethereum Layer 2 Blast Goes Live In Early Access After $20MM Raise - The Block

⭐ Taproot Wizards Raises $7.5MM For Its Ordinals Project To Bring The ‘Magic’ Back To Bitcoin - TechCrunch

Polkadot is About to "Fundamentally Change," Said Web3 Foundation's New CEO - The Defiant

Ethereum Validators Are Now Queuing To Exit The Network - The Defiant

Upstart Layer 2 Blast Draws In $100MM With Airdrop Scheme - The Defiant

NFTs, DAOs and the Metaverse

Uniswap DAO To Weigh Giving ‘Underrepresented’ Delegates More Voting Power - Blockworks

World’s First Blockchain Creators Celebrate History With NFT Mints On Kadena - nftnow

Delegate’s New Marketplace Lets You Sell Your NFT’s Utility - nftnow

🚀 Level Up

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete.

Sign up to the Premium Fintech Blueprint newsletter today to take advantage of our ⭐ Black Friday 50% off deal ⭐, and get access to:

Wednesday’s Long Takes with a deep, comprehensive analysis.

Office Hours, monthly digital roundtable discussions with industry insiders.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts.

Archive Access to an array of in-depth write-ups, spanning across 15+ topics and encompassing over 50 Fintech and DeFi brands.

Our 🔥 Black Friday 🔥 deal is here! And this is our best offer yet to elevate your experience and become a Premium Member — 50% off!