GM Fintech Futurists,

Today we highlight the following:

DIGITAL ASSETS: Dissecting Michael Saylor’s Corporate Crypto Gamble

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below (if you haven’t yet). For $3 per week, you get institutional-level research delivered to your Inbox.

Call for Companies

If you are building at the intersection of AI, Fintech, and Web3 and looking for investment, share your materials with us at 👉👉👉 Generative Ventures here.

DIGITAL ASSETS: Dissecting Michael Saylor’s Corporate Crypto Gamble

Maybe you are thinking about what black swans hide in the waters.

Let’s look at MSTR, the levered Bitcoin company.

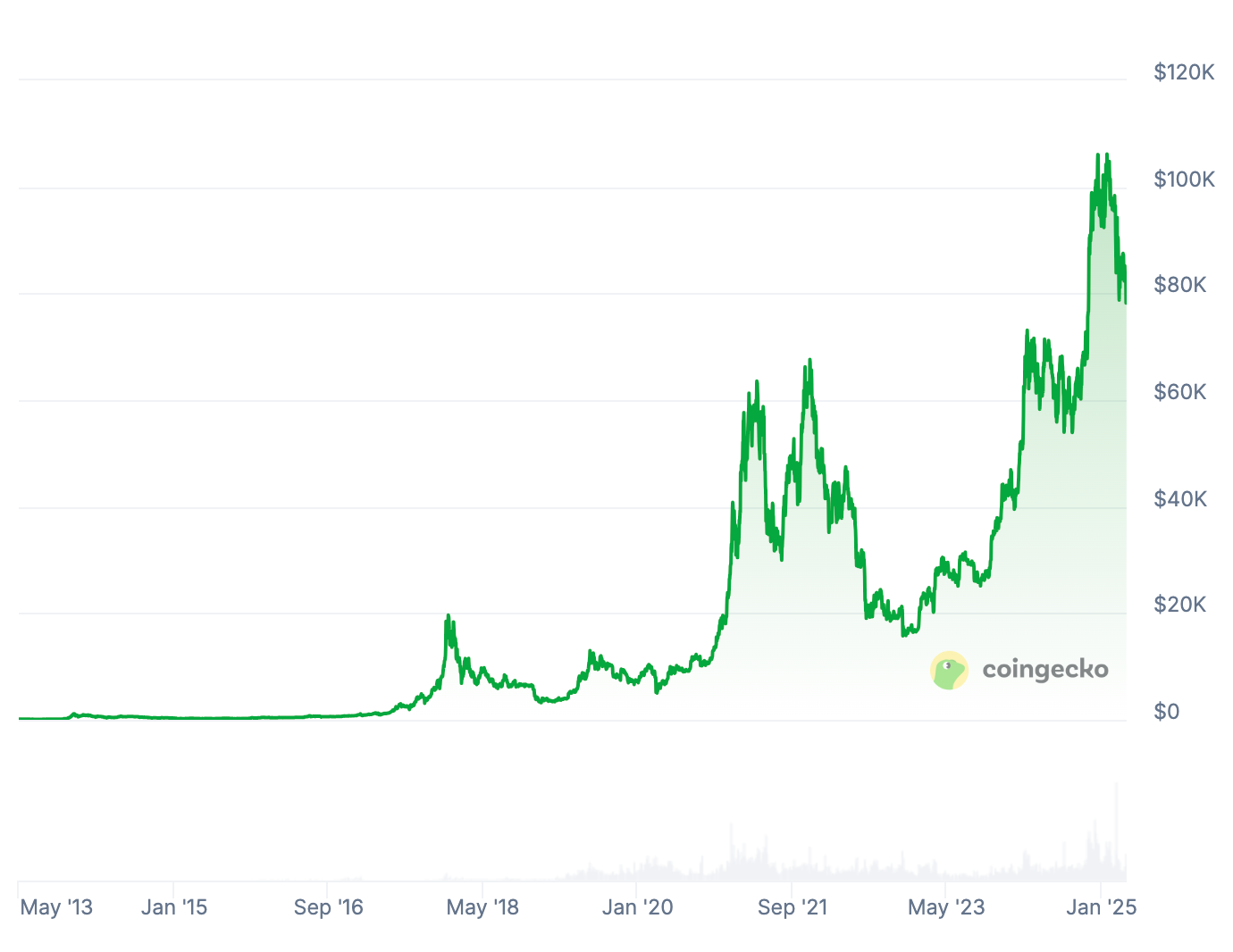

Since August 2020, MicroStrategy, recently rebranded as Strategy under Michael Saylor's leadership, has undertaken an extensive financial engineering experiment on Bitcoin. By early April 2025, the company had acquired approximately 506,137 BTC, around 2.5% of Bitcoin's total circulating supply, at a cumulative cost of approximately $35.6B, averaging $67,500 per Bitcoin. Based on today’s price of $80,000 per BTC, that marks a 20% return on its entire investment.

Of course, we are also witnessing a significant downturn in crypto at the time of writing, which begs the question of whether this thing can blow it all up.

Strategy's initial Bitcoin purchase in August 2020 — 21,454 BTC at about $11,650 per Bitcoin — was a tactical decision to hedge against inflationary pressures stemming from expansive global monetary policies. It was funded through the deployment of excess corporate treasury cash. Subsequent purchases started leveraging both debt and equity instruments to crank up exposure. In December 2020 and February 2021, Strategy issued over $1.7 billion in convertible notes explicitly earmarked for acquiring Bitcoin.

These purchases can be segmented into distinct phases through multiple bear and bull markets.

In March 2025, Strategy added 22,178 BTC through equity-financed purchases. This included 130 BTC on March 17, acquired for $10.7 million at $82,981 per Bitcoin, and a significant purchase of 22,048 BTC from March 24 to 30, at an average price of approximately $86,969 per Bitcoin, totalling $1.9 billion.

Things are getting expensive.

These acquisitions were primarily financed through common stock sales, highlighting Strategy’s willingness to leverage equity markets to sustain its aggressive accumulation. Or, more precisely, highlighting the appetite of traditional markets to fund things. Despite BTC being down 10% since these purchases, MSTR is down even more, from $340 to $260 today. The volatility is embedded because the stock is acting like a levered Bitcoin holding company with little to no meaningful operating business.

Why invest in BTC?

Michael Saylor is a religious believer in Bitcoin — he consistently highlights Bitcoin’s decentralised nature, limited supply, and potential for being an inflation hedge. He is also playing the markets by raising cash and reinvesting it into a speculative asset to then issue more equity.

Strategy treats Bitcoin as its treasury reserve and claims it will hold it indefinitely as long-term value storage (this is what you have to say). Prior to the launch of BTC ETF, Strategy was often considered an indirect form of BTC exposure, effectively making it the original BTC ETF, with the added baggage of a legacy tech company.

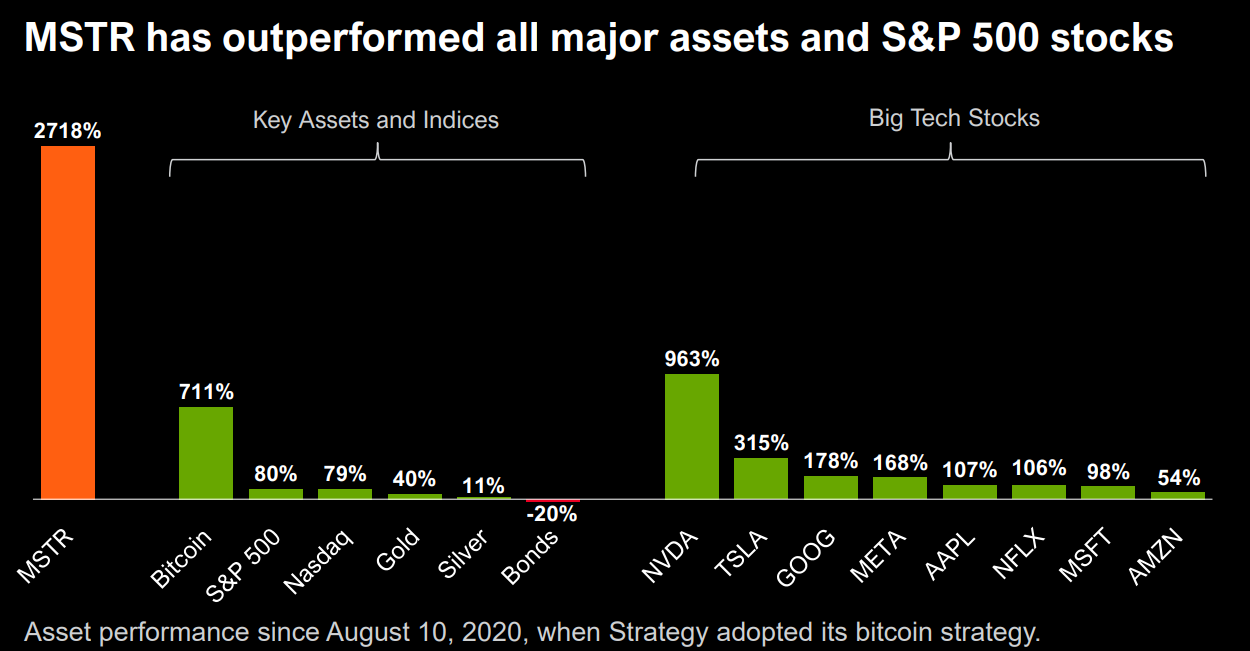

The ancillary benefits of the corporate treasury Bitcoin strategy are enhanced brand visibility and shareholder value. The company has received significant press attention and raised Strategy and Saylor’s profiles to somewhat mythical figures within the BTC community.

Is it better to hold Bitcoin directly? Yes. Is it easier to invest in a $70B holding company that has extremely high correlation? Yes, for some large liquid investors.

Because of the structure of the various investment instruments, which often have options tied to the bonds, the volatility of Bitcoin exposure is a positive for performance. Investors in the company have made money. And because they have made money, that attracts more large investors.

Other public companies also have meaningful crypto treasury exposure, but they have approached it more organically. Tesla has a singular substantial Bitcoin investment of $1.5 billion in early 2021, followed by subsequent partial divestments. Block allocated about 5% of its treasury to Bitcoin and has maintained that position without aggressive expansion. Galaxy Digital’s Bitcoin holdings emerged organically from its crypto-focused operations.

Could it all come crashing down?

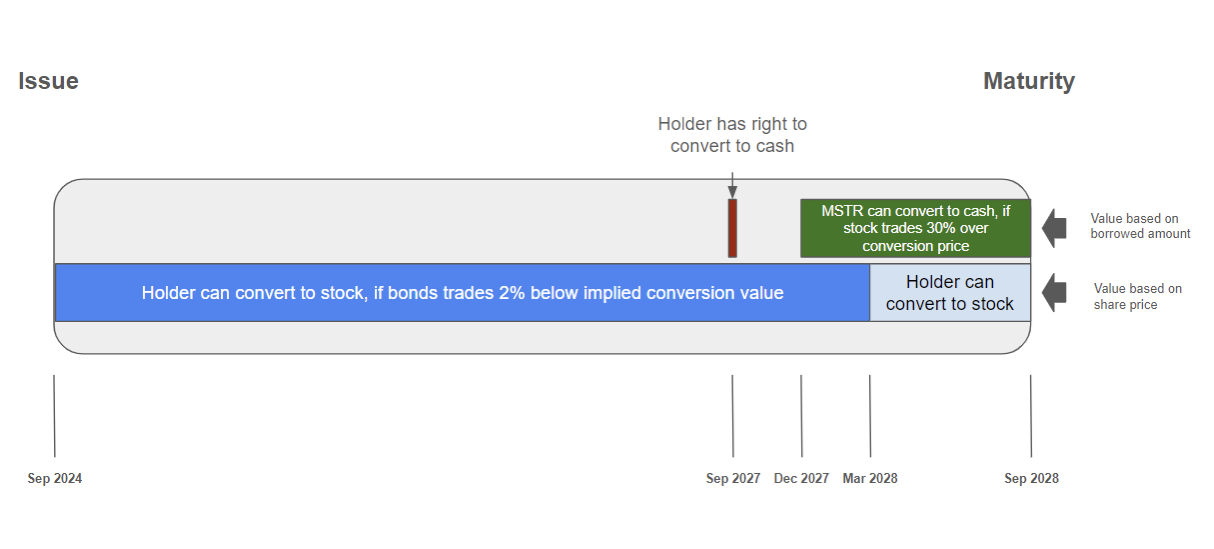

As mentioned, Strategy has issued multiple convertible bonds to finance its BTC purchases. These bonds have varying terms and maturities. They also grant holders the option to convert their debt into equity under specific conditions, typically when the company's stock price exceeds a predetermined threshold. This mechanism allows Strategy to raise capital at lower interest rates, leveraging its stock volatility and the market's bullish sentiment towards Bitcoin.

However, if Strategy's stock price declines significantly, particularly below the conversion prices of these bonds, bondholders might opt not to convert their holdings into equity. In such cases, Strategy would be obligated to repay the bond principal in cash upon maturity. So, if longer term BTC crashes out to zero, investing in this Strategy wrapper isn’t going to save you.

Given that Strategy's core software business is not currently cash-flow positive, the company might face challenges in meeting these obligations without liquidating its Bitcoin holdings.

The specific terms of each bond, including maturity dates and conversion prices, play a crucial role in determining when and how these scenarios might unfold. For instance, some bonds grant holders the right to demand cash redemption at specific dates before maturity, while others allow the company to redeem the bonds under certain conditions. The specific financial mechanics of convertible bonds effectively embed leverage into Strategy’s crypto holdings.

By holding such a significant portion of Bitcoin’s supply, Strategy inadvertently exerts considerable influence on market dynamics. Any large-scale unwinding could materially impact Bitcoin’s market price, effectively making Strategy a critical player not just financially, but structurally within Bitcoin’s ecosystem.

Leverage loops create price increases on the way up, and liquidation cascades on the way down.

We’re also starting to see copycats for other crypto assets with the launch of Defidevcorp, a public crypto company mimicking Saylor’s strategy, except with Solana instead of Bitcoin. It has received $40MM in seed capital from Pantera, Arrington Capital, and Protagonist.

Here is their financial mechanism:

This is a cyclical process of a convertible-debt funded investment driving the appreciation of an underlying token without creating real demand for the underlying technology. We can see now how people must have felt about private equity LBO firms in the late 1980s.

Is the crypto market simply a series of financial games propping up token values, or is there real technical utility being developed that will fundamentally change how our financial systems operate?

Today we are too tired to answer the question.

👑 Related Coverage 👑

Advertise with the Fintech Blueprint

To reach 200,000 decision makers in financial services, Fintech, and Web3, reach out to discuss sponsorship opportunities today.

🔥🔥🔥 Contact us to discuss options 🔥🔥🔥

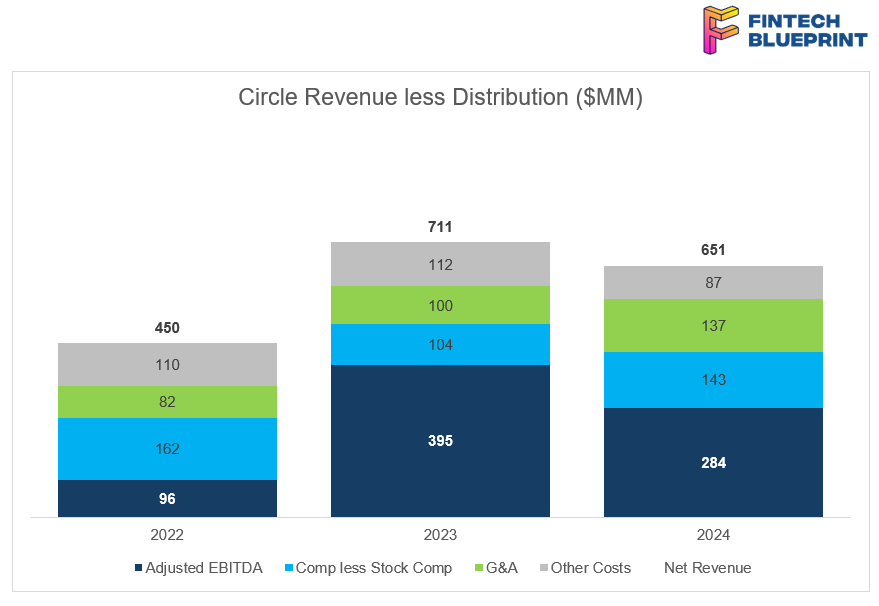

Analysis: Our Circle IPO Primer, $1.6B revenue reaching for $10B valuation

We examine Circle’s IPO financials amid a broader resurgence in fintech public listings. Circle generated $1.6B in revenue and $157M in net income in 2024, primarily from interest earned on USDC reserves, with performance closely tracking interest rate movements. Circle operates with a risk-averse, compliant model, but faces growing revenue compression from rising distribution costs and competitive pressure to pass on yield to users.

Tether, by contrast, is generating significantly more revenue ($14B in 2024) by taking on more portfolio risk. While Circle may pursue a $10B valuation, falling margins, rising costs, and unclear derivative-related losses highlight the challenges of sustaining profitability in a maturing, highly competitive stablecoin market.

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ Fidelity Lets Investors Directly Invest in Crypto Through New IRA Plan - CoinDesk

Custodia Launches Bank-Issued Stablecoin on Ethereum - Decrypt

Tokenisation to hit $19tn by 2033, say Ripple and BCG - DLNews

Solana, Chainlink Support Coming to Both PayPal and Venmo - Decrypt

Tether May Launch New Stablecoin If US Regulators Push Out USDT, Says CEO - Decrypt

USDC Sets All-Time High Market Cap Above $60 Billion as Adoption Surges - Decrypt

Aave targets institutions and $19bn real-world asset market with new ‘Horizon’ initiative - DLNews

Circle Deepens Japan Commitment as SBI Group Prepares USDC Launch - Decrypt

DeFi and Digital Assets

⭐ Watr Moves to Avalanche to Bring $20 Trillion Commodities Market Onchain - The Block

Tron's Justin Sun Bailed Out TUSD as Stablecoin's $456M Reserves Were Stuck in Limbo, Filings Show - CoinDesk

Blockchain Protocols

⭐Ripple Integrates RLUSD Stablecoin Into Cross-Border Payments System - CoinDesk

AI-Infused Blockchain Ambient to 'Replace Bitcoin,' Says Co-Founder - CoinDesk

NFTs, DAOs and the Metaverse

⭐ Ethereum Role-Playing Game ‘RavenQuest’ Set to Launch QUEST Token on Immutable - Decrypt

Why Arbitrum DAO’s $200m gaming play came under fire by frustrated members - DLNews

ZKasino’s year-long silence on investor refunds ends in a $27m liquidation - DLNews

This Week in Crypto Games: Jurassic World in 'The Sandbox', Telegram Gets 'Not Games' - Decrypt

Napster Snapped Up for $207 Million to Build Music Metaverse - Decrypt

🚀 Level Up

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

Long Takes with a deep, comprehensive analysis.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Special Reports

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.