DeFi: Tokenization is cool again, from Franklin Templeton, to Fasanara's Untangled Finance, & SC Ventures Libeara

The tokenized funds market witnessed its issuance on public blockchains grow from $100 million to over $800 million in 2023.

Gm Fintech Futurists —

We are conducting a survey to understand your perspectives on Fintech, DeFi, and AI. Your input will directly shape our future content. As a token of our appreciation, when you complete the survey, you’ll be entered to win a $100 Amazon Gift Card.

The survey closes this Sunday, January 21at 11:59pm.

Today we highlight the following:

DIGITAL ASSETS: The Growth of Tokenization in 2023 and Beyond

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

Fintech Meetup (March 3-6) is the best place to find new business, partnerships and opportunities. Attendees & sponsors say Fintech Meetup is “the highest ROI event” with reasonably priced sponsorships, tickets, and rooms. Meet everyone for any reason across every use case over 45,000+ double opt-in meetings, and Network with 5,000+ attendees.

PS. Lex will be speaking at Fintech Meetup.

DIGITAL ASSETS: The Growth of Tokenization in 2023 and Beyond

The BTC ETF approval has planted the tokenization seed deep into the minds of the biggest names in traditional finance. Credit rating agency Moody's is heralding the "untapped market potential" of blockchain-based tokenized funds. Larry Fink, the CEO of BlackRock, claimed this week that tokenization could put an end to money laundering and corruption.

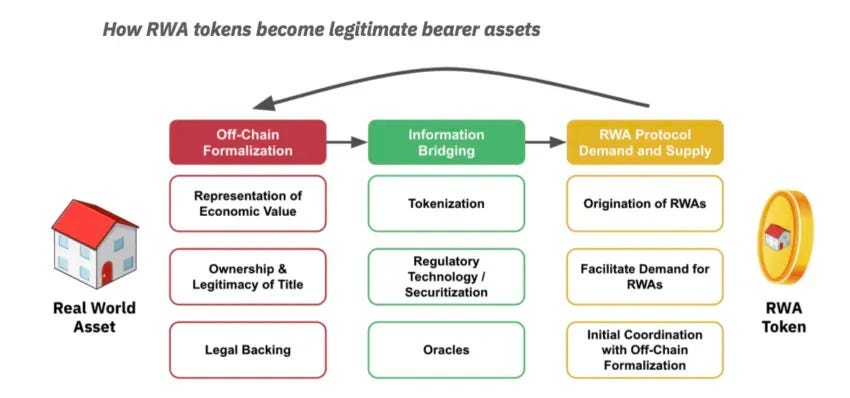

Tokenized funds invest in familiar financial instruments, but differ from traditional funds in representing their shares as digital tokens on a distributed ledger, rather than as entries on a centralized, closed-off database. This transformation can enhance market liquidity and accessibility, improves transparency, reduces costs, and enables fractionalization. The tokenized funds market — primarily driven by investments in government securities during the crypto bear market — saw issuance on public blockchains grow from $100MM to over $800MM in 2023.

Now, financial incumbents and Fintechs alike are launching products to meet demand. Let’s dive into a few examples we are watching.

First the investment banks. Franklin Templeton registered its U.S. Government Money Fund on the Stellar blockchain in 2021 and extended it to the Polygon blockchain in 2023. UBS issued a tokenized money market fund on the Ethereum blockchain using the UBS Tokenize platform. JP Morgan has been using tokenized cash to move interbank positions around using Onyx.

More recently, Untangled Finance launched on Celo with a $13.5MM investment, focusing on tokenizing real-world assets. The investment is led by Fasanara Capital, who opened two credit pools on the platform for managing off-chain operations and underwriting loans. Untangled's platform targets the traditional private credit market, worth over $1 trillion, through tokenization of fintech lending, such as invoice financing and consumer loans, as well as green infrastructure projects.

The infrastructure hosts blockchain-based credit pools, where certified investors, firms, and DAOs can deposit funds to lend and earn yields, receiving ERC-20 tokens representing their positions. Their approach includes a built-in liquidation engine, a forward-looking credit assessment model, and an auction-based withdrawal mechanism for early exits.

Standard Chartered’s venture arm SC Ventures has also launched a tokenization platform called Libeara, which issued tokenized fund units on the Ethereum and Stellar blockchains in November. Last week, Singapore’s FundBridge Capital became the first fund to use Libeara, creating a tokenized Singapore-dollar government bond fund, with an AA rating from Moody's. Notably, the credit quality of the underlying assets were AAA, so there was some discount for FundBridge Capital being a smaller sized issuer and being a novel vehicle on a public blockchain.

Moody's approach to rating tokenized issuances has generally paralleled conventional issuances. However, the issuance of tokenized funds on public blockchains is still under review. For comparison, Moody's rated three out of four European Investment Bank (EIB) tokenized digital bonds as AAA, issued on various new permissioned blockchain platforms.

In an increasingly global and open market, tokenization allows us to create a customizable, shared financial system open to all. By mutualizing the cost of running financial systems, we can all benefit from improved efficiency, transparency, fractionalization, and the transformation of legal enforcement into software code.

Of course, there are complexities and new risks, like technological vulnerabilities and governance issues that will require fund managers to upskill their capabilities. And there is not yet a clear answer for where all of this will live — Ethereum, L2s, Solana or a new finance chain entirely, architected by the BlackRocks of the world.

But what we do know is that traditional distribution mechanisms are being adopted by crypto (i.e BTC ETF), while traditional assets go the other way to adopt crypto distribution mechanisms (i.e tokenized RWA). It is a sign that the new and the old are finally beginning to break bread in pursuit of the noble goals of accessibility, efficiency, and, as Blockworks and Larry Fink put it, ending the biblical sin of corruption.

👑 Related Coverage👑

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ Crypto’s HashKey Raises $100 Million, Claims Unicorn Status - Bloomberg

Grayscale, BlackRock and Fidelity dominate spot ETF market with nearly 90% of volume on third day of trading - The Block

DeFi and Digital Assets

⭐ Bitcoin ETFs Win SEC Approval, Bringing Easier Access To Biggest Cryptocurrency - CoinDesk

Chainlink integrates with Circle’s CCTP protocol for cross-chain USDC transfers - The Block

Ethereum restaking protocol Renzo raises seed round at $25 million valuation - The Block

Blockchain Protocols

⭐ Solana Mobile to Sell Second Crypto Smartphone - CoinDesk

Xai Gaming Token Surges 35% as Airdrop Value Hits $140 Million - Decrypt

NFTs, DAOs and the Metaverse

⭐ Visa pilots Web3 customer loyalty platform - Blockworks

Animoca Brands’ subsidiary Anichess completes oversubscribed US$1.5 million seed round to develop innovative chess game - Animoca Brands

Pontem raises $6 million to enable Ethereum and Move-compatible apps - CoinMarketCap