Deutsche Bank to fire 18,000 people while Amazon upskills 100,000; plus 14 short takes on top developments

Hi Fintech futurists --

I have been reading Paul Graham's Hackers and Painters, and noodling on the social role of exponential software monopolies. When a single person can be 1,000 times more productive than someone else, what is their responsibility to others? The long take this week pushes this question through the example Deutsche Bank planning to fire 18,000 people and invest €13 billion in Fintech, misunderstanding the massive value creation available from upskilling and frontier technologies. Amazon and Ant Financial get it.

The latest short takes on the Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below. Thanks for reading and let me know your thoughts by email or in the comments!

Long Take

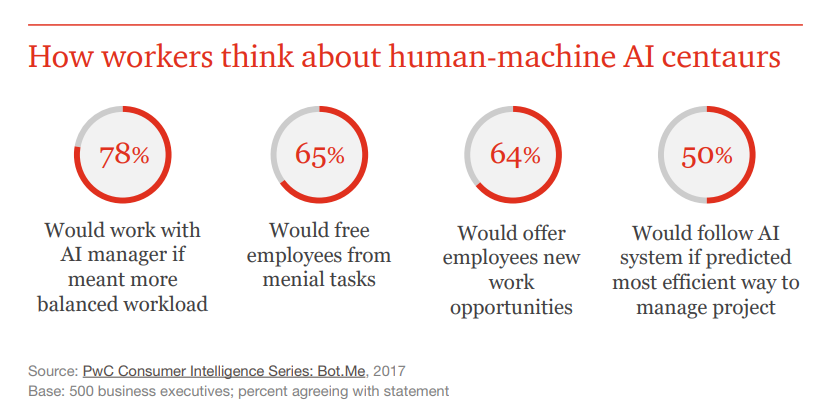

What's a human being these days? There's of course the human animal, with its various biological, family, and cultural roots. These roots must yield social fruit: each person thrust into our world is due their basic human rights, of which working dignity and mental health are becoming an increasing requirement. Then there is the technological self, with its software nodes splintering across thousands of websites, robot services, and automated agents. Your data and logins animate to life engineered systems and artificial environments. Each action, click, and command is wealth for the tech company. And then there's the Centaur -- a sci-fi way of saying human/machine hybrid -- the augmented person outpacing and outproducing the unplugged, unnconnected, and unbanked.

Today's corporations and governments are in the business of defining the balance of these aspects of our participation in society and the economy. Beliefs about the immutability of different attributes about what makes a person (or an employee) and how economies are built (cutting the pie, vs. growing the pie) determine the policy decisions you make, top down. As the core example this week, let's take Deutsche Bank. Facing pricing pressure and headwinds in several of its businesses, Deutsche is responding with a plan to fire 18,000 employees by 2022 and an announced investment of €13 Billion in technology and innovation by 2022. They even spun up a hipster-colored neobank as a proof point. Wall Street ain't buying it.

I am going to take a digression, so bear with me. Many people in Fintech derisively refer to big bank incumbent activity around the start-up space as "Innovation Theater" -- something that a Chief Innovation Officer is hired to do in order to make the company's story sound more promising for public investors, but that in reality has little connection to budget or operating executives managing a P&L. This is an exaggeration; in reality, accelerators (e.g., Barclays Techstars) and corporate venture funds (e.g., Goldman Sachs investing in Kensho, Circle) can make a big difference. And yet, caricatures also speak truth. What I believe we are seeing now is actually worse than innovation theater. It is a Cargo Cult.

During the Second World War, airplanes dropped supplies to troops stationed on the island of Melanesia. Local inhabitants saw this as a religious event, and tried to summon both the airplanes and the supplies by replicating superficial symptoms. They built wooden airplanes, imaginary landing strips, and bamboo control towers. Surely, by copying the steps to invoke airplanes, the supplies would come! Surely, by copying the symptoms of new finance -- neobanks, roboadvisors, Bitcoin, cool offices, the word "data" -- we can turn this thing around! The chant starts with "Innovation".

I live in a glass house, and am not poking fun at the Melanesians -- they are just like us. I am not laughing at legacy finance -- I worked there, and am partnered with many good firms in the space. But I am pointing out how all of us have a Bug in our brain, a Bug that makes us think that symptoms are causes. Or that a technology stack from the past is the same as a technology stack from the future. Or that there is no structural, competitive advantage in breaking your business model and starting from scratch on new ground. This is the existential lesson that Deutsche Bank needs to learn.

If you look structurally at the Capital Markets and Asset Management, a few trends from the last decade become clear quickly. The growth in electronic trading is tightening bid-ask spreads and increasing transparency. Associated regulation, like MiFIDII, is forbidding arcane pricing models that allowed investment research to be bundled with trading and thus be massively overpriced. Packaging technology that powers ETFs has catalyzed a massive shift from active stock pickers to passive index vehicles, and the associated pricing collapse as a result. As readers well know, roboadvisors have further pushed the business model such that wealth management costs 25 basis points, not 150 basis points. And European neobanks have done the same for retail banking, now coming for the Americas.

Trends like this are the reason for why Deutsche Bank is getting rid of its Equities division, focusing upstream on human-led advisory where it still has an advantage, and promising €13 billion of "Innovation" as an answer to the existential challenge. It is likely that JP Morgan is a positive aspirational example for them, which had similarly earmarked $10 billion for Fintech. And they have been executing fairly well! When attacked by Robinhood, JPM launched its own free trading app. Attacked by Wealthfront, it is now responding with a 35 basis point price-point roboadvisor, distributing its own asset management product. Threatened by Bitcoin, the bank launched its own crypto asset. And when targeted by Chime, JPM spun up a neobank. Oh wait -- it shut down that neobank, perhaps understanding that Digital is a transformation, not a Millennial channel.

Another progressive example is Schwab, which was a fast follower into the digital wealth market. Being a manufacturer of both the asset management product and the cash sweep, as well as a brokerage and custodian, it had multiple financial services paths to monetization. But in March, the firm implemented a business model innovation on top of the technology platform. Super simple -- it changed pricing to a subscription model. You get music and movies through subscriptions. You get shopping and deliveries done through subscriptions. You even buy Microsoft Office and Adobe Photoshop through subscriptions. There is nothing special about finance, especially as it increasingly is run by software agents and augmented Centaurs (see, I've brought us back home!). As reward, it has gotten $1 billion in new assets since the price change.

But let's be honest. This stuff is all peanuts, relative to the real value creation that can be unlocked by frontier technologies in short order. Take self-driving technology platform Argo AI was founded in 2016, barely 3 years ago. Last week, Ford and Volkswagon contributed $4.2 billion of value into Argo (investment and in-kind corporate assets), setting the valuation at over $7 billion. That's about $2 billion of enterprise value generated per year. This is how you compete with Google, Uber and Tesla -- on the core technology advantage. Give the house to someone who knows what they are doing.

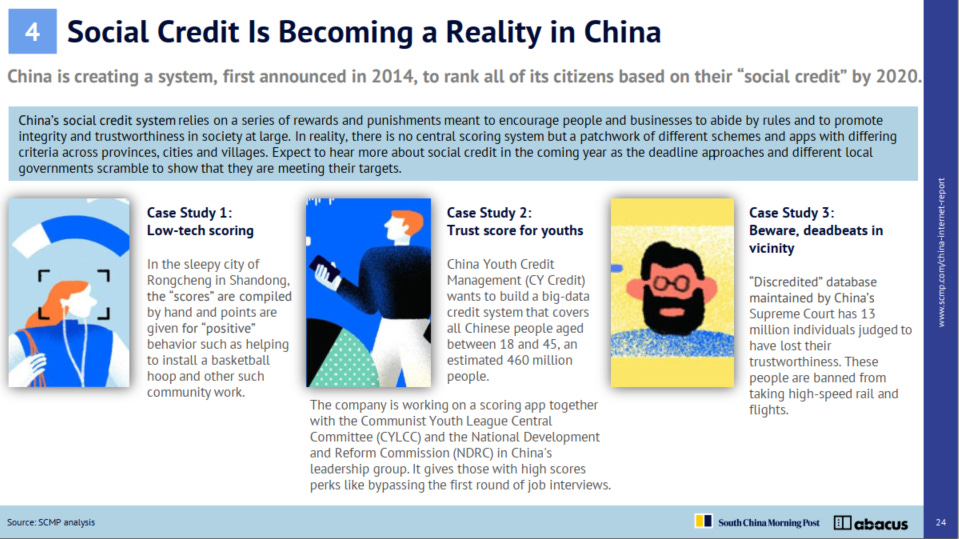

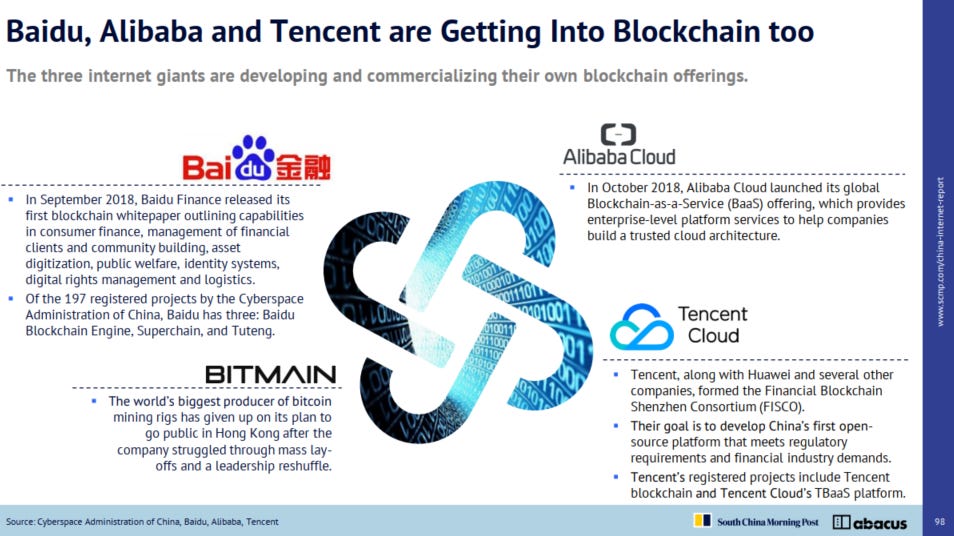

Maybe you think the automative example to be contrived. Or, maybe you think that financial institutions are doing this today with mutualized blockchain infrastructure (they are, but £50 million into Fnality is no $4 billion). So let's instead take the real competition for global financial services -- not Facebook or Amazon, but the Chinese super apps. If you haven't yet, check out this 110 page deep dive into the market. I quote pages below liberally so you can get the sense of scale and speed we are up witnessing.

Perhaps we have grown complacent about what it means to lift the productive power of a country's population into the technology age. Deutsche can optimize itself for financial returns and choose software over human bodies and bank branches. They can Cargo Cult themselves into appearing modern. But AI and automation have two potential outcomes. You can either (1) remove $1 billion of cost by slashing your team, or (2) make your team $1 billion more productive. If you do the former, you are not just shedding unnecessary gears of a clunky financial factory. You are losing nodes in your network; its advocates, ambassadors, and creators.

As technology raises the productive baseline for everbody regardless of their role -- through AI-enabled services and agents loosely alluded to in the beginning of this write-up -- leaders have a responsibility to their people. The question isn't what people can't do, but what is it that they can do in the Centaur world? Amazon is taking the right approach. As the robot / software side of the business becomes increasingly self-sufficient, 100,000 staff become less functionally useful to the eCommerce product factory. In response, the company is planning to spend $700 million to upskill these workers (on top of the $15/hr minimum wage vs. $7.25/hr for the US overall). While $7,000 per person on training is not breaking Amazon's bank account, it is an investment in the option value of human potential. And it may even save them from the Luddite revolution.

Short Takes

Brazilian Lending Platform Creditas Secures $250 Million Through Latest Investment Round Led By SoftBank. There's a reason SoftBank is trying to own the global layer of Fintech innovation -- it has already worked in multiple parts of Asia, and progress is tangible and growing. Global jurisdiction shopping and regulatory competition will increase once the geographic bundles are built and need more growth.

Robo-advisor for women targets literacy not assets and Islamic robo-advisor Wahed lists Shariah compliant ETF. People are still trying to paint the picture that specialized distribution channels for traditional product are sufficiently innovative. While I like the specialization, this doesn't work. See start-up graveyard.

Former SoFi CEO Mike Cagney's New Lending Startup Is Issuing $85 Million In Loans A Month. Home Equity Lines of Credit (HELOCs) of up to $150k to applicants in as little as five days. Looks like it's working. All lending products will come through digital storefronts or at point of sale.

Crypto Valley – PwC Report: $3.3 Billion Raised via Token Offerings in 2019. It's no 2018 at $20 billion, and the numbers fall once you strip $1 billion of Bitfinex "shoring up capital" via IEO. But still, a meaningful flow of funds.

U.S. proposes barring big tech companies from offering financial services, digital currencies. A draft bill floating around the House of Representatives would stop Facebook from doing Libra, and impede all the other AI companies from Finteching up. The writing is on the wall for how the United States is losing its edge -- China Could Launch Its Own Crypto To Counter Libra. Compete, don't Forbid.

Visa, Blockchain Capital back $40 million round for crypto custodian Anchorage. A total of $57 million has been invested into this company, which plans to add staking, governance, and tax/accounting angles for institutional custody. And don't forget the Facebook Libra node.

Samsung rolls out beta version of ethereum blockchain development kit. If you'd like to build decentralized apps on Samsung hardware, Ethereum is there for you. Hopefully they stick with a public chain, rather than going proprietary.

Embracing artificial intelligence for the buy-side. When the capital markets are run by trading bots, a human being has trouble understanding what is happening and why on a fast-enough time horizon. You have to be data-driven with trading rules in place, and quickly present decision makers with strategic options.

Need quick medical advice in Britain? Ask Alexa. Simple diagnostics and illness descriptions on the NHS website in the UK can now be spoken out loud by Amazon's smart speaker. While it's not really dealing with an AI doctor, we are starting to create consumer expectations. How much longer for Finance?

Amperity raises $50 million to unify disparate customer data. The startup is funded largely by financial customers, and parses raw files and data to find customer identities, and create data lakes with a holistic view for use in other system. I.e., data wrangling.

Most Windows VR Headsets Have Vanished from the Microsoft Store, Limited Stock Elsewhere. Early players are dying and integrated hardware/software seems to be the answer.

Walmart is Using VR to Assess & Promote Employees. Over 10,000 employees have been assessed for promotions by placing them into a simulated environment with an angry customer. Digitize your emotional intelligence, get paid for it.

Microsoft Launches Closed Beta Sign-Ups for Minecraft Earth Mobile Augmented Reality Game and Pokemon Go-like augmented reality game Snatch is a big hit in the UK, and it’s heading to the US. Millions of people are still playing AR games and getting trained in the user interface.

Matterport acquires AI special effects startup Arraiy. If you are a high-end real estate agent, Matterport is a helpful solution to digitize your inventory in VR, and sell it without having to bring the customer into a physical location. Next step is no more real estate agents.

Looking for more?

Find me on Twitter here for Fintech and here for Digital Art.

Want to send me a note? Reach out here anytime.