Digital Wealth: $1.1B acquisition of wealthtech platform BETA+ from LSEG by Clearlake Capital, Motive Partners

Clearlake and Motive Partners have also formed a long-term strategic partnership with LSEG: BetaNXT (formerly BETA+) will provide LSEG with content, data, and tools

Dear Fintech Futurists,

Welcome to another Digital Wealth issue, the weekly news aggregator regarding digital investing, asset management, and wealthtech. For deep, comprehensive, and insightful analysis on the Fintech and Web3 world, upgrade your subscription below.

North America News

⭐🇺🇸 Clearlake Capital And Motive Partners Complete Acquisition Of Wealth Management Software Platform BETA+ From LSEG And Launch BetaNXT℠ Brand With New Management Team - Yahoo Finance, July 1, New York

Private equity firms Clearlake Capital Group and Motive Partners have closed the $1.1B acquisition of BETA+ from the London Stock Exchange Group (LSEG). The company will rebrand as BetaNXT and be managed by a new leadership team.

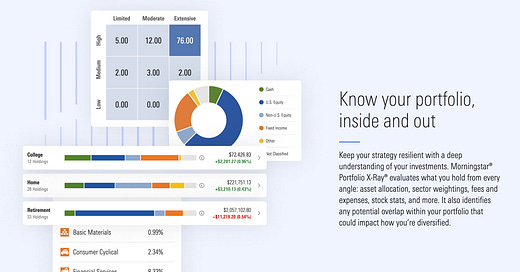

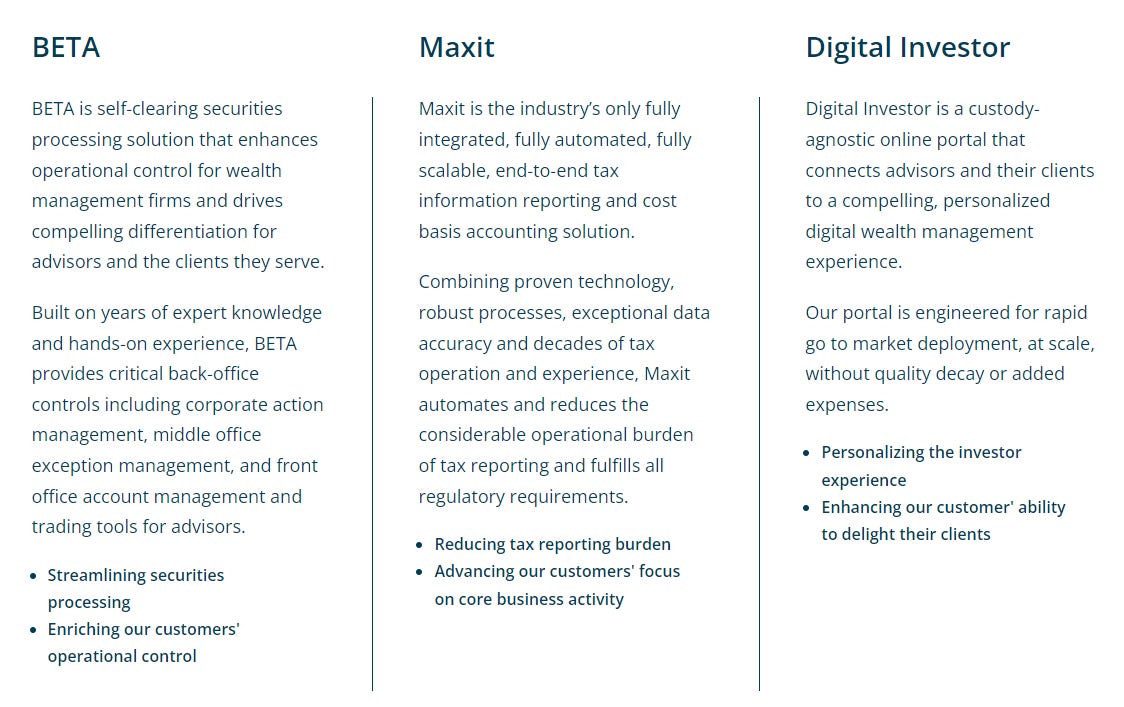

BetaNXT serves $6 trillion assets, has 50 million daily transactions, and has a tech stack that consists of BETA, Maxit and Digital Investor. BETA is a securities processing solution for back-office and front-office operations, which includes transaction processing, broker productivity tools and transmissions of customer and firm data. BETA also provides trading tools for advisors via its brokerage processing system, Maxit, a tax information reporting and accounting solution, and Digital Investor, an online portal that connects advisors — and their clients — to BetaNXT’s digital wealth management platform.

Clearlake and Motive Partners will be forming a long-term strategic partnership with LSEG, supplying the firm with content, data, and tools from BetaNXT. BetaNXT has annual revenues of around $300MM, which are mainly derived from U.S. markets, implying a multiple of about 4x on the valuation. We think that spinning out this software business to private equity simplifies LSE’s strategic focus, but we wonder how many customers BetaNXT will land once independent to grow beyond the current, very large infrastructure scale.

🇺🇸 Orion Completes Acquisition Of TownSquare Capital - Businesswire, July 1, Nebraska

🇺🇸 Envestnet Announces Acquisition Of Redi2 Technologies, Creating The Industry Leading Revenue & Billing Management Platform - PR Newswire, July 6, Pennsylvania

🇺🇸 Vanguard Rolls Out Robo Aimed At Retirement Plan Participants - Financial Advisor IQ, July 6, Pennsylvania

Footnote — the company’s other roboadvisors are Personal Advisor Services ($186.5 billion in assets under management) and Digital Advisor ($4 billion in discretionary assets under management)

🇺🇸 Goldman Eliminates Minimums On Robo, Slashes Management Fees - Financial Advisor IQ, July 5, New York

🇺🇸 TD Bank Doubles Down On ‘Complementary’ Digital Wealth Management - Bank Automation News, June 30, New Jersey

🇺🇸 FusionIQ Eliminates Barriers To Digital Asset Class Through Partnership With Equity Trust Company - PR Newswire, June 30, Massachusetts

🇺🇸 GeoWealth Integrates With Pontera, Enabling RIAs To Manage Clients’ Held Away Assets Inside Its Tamp And Enterprise Technology Platform - Yahoo Finance, June 30, Illinois

🇺🇸 Global Investment Firm Barings Selects FLX To Develop Differentiated Alternatives-Focused Distribution Solution - Yahoo Finance, July 6, New Jersey

🇺🇸 Fidelity To Open Direct Indexing To The Masses - Financial Times, July 5, Massachusetts

EMEA News

⭐🇬🇧 Morningstar Completes Acquisition Of Wealth Management Platform Provider Praemium's UK And International Business - PR Newswire, June 30, London

Investment research company Morningstar completed its acquisition of Praemium's operations in the UK, Jersey, Hong Kong, and Dubai for £35MM. As of June 30th, Praemium has been rebranded as the Morningstar Wealth Platform, and the platform services around 1,000 financial institutions and over 500,000 investors.

Morningstar Wealth Platform’s (formerly Praemium) offerings mainly include advice solutions via its cloud-integrated Wealthcraft platform, which provides services such as report building and plan generation, tracking and reconciling payments from clients, and client engagement services where you can, for example, create workflows dependent on client interactions. The firm also offers a managed accounts platform that claims to be portfolio-centric, rather than product-centric. The difference between the two is that the former builds the client's investments from the start (e.g., their self-invested personal pension) by asking what assets they want in their portfolio, whereas the latter starts with the clients’ chosen investments, and then coordinates how the client wants to hold those assets.

On the tech-side, Morningstar Wealth Platform’s automated managed accounts have features such as an auto-rebalancing engine that eliminates “drift” between investor and model. Overall, the acquisition of Praemium will add to the data, research and portfolio analytics offered to advisors by Morningstar.

We think this is a very inexpensive way to build a foothold in the UK market.

🇬🇧 ING Ventures Invests In OpenFin - Yahoo Finance, July 6, London

🇬🇧 FNZ Leads Series-A Investment In Fintech Start Up Bondsmith - Finextra, June 29, London

🇫🇷 BNP Paribas Wealth Management Further Expands Its Digital Services Offering And Launches A New Solution Dedicated To Investing In Private Assets – Private Equity, Real Estate, Infrastructure - BNP Paribas, June 29, Paris

🇬🇧 M&G Wealth Adds ESG Investment Range To Platform - ProfessionalAdviser, July 4, London

Curated sponsorships

We work with select companies to deliver brand awareness to our 100,000+ digital finance audience. See our prior partners here, and reach out here with interest.

Asia Pacific News

⭐🇮🇩 PINA Raises $3MM Seed Funding Led By AC Ventures - HEAPTALK, July 4, Jakarta

PINA, a personal finance and wealth management platform, raised $3MM in a Seed-funding round led by AC Ventures, Y Combinator, Vibe.VC and XA Network. Launched in 2021, the platform currently has 25,000 users with $4.1MM in AUM (AUM grew by 2x in February 2022 and 18x in March 2022).

High fees and minimums have made wealth management services inaccessible to most Indonesians. Another issue is the number of different players in the market across investment, checking accounts and budgeting apps. PINA simplifies this by offering free money management tools and advisors, where users can link their financial accounts in the app, and the platform will leverage user data to automate personalised investing goals. Users are charged a small fee when investing within the PINA platform.

PINA faces fierce competition from other Indonesian wealthtech firms: Bibit, a mutual fund robo-advisory investment app targeting mostly millennials, raised more than $80MM in May. Pluang, a wealthtech platform offering investment products, raised $55MM in January. Indonesian retail investment companies fundraises are not slowing down, likely driven by the 66% growth in the number of Indonesian retail investors over the past two years.

Taking a step back — there are still only 2.7 million retail stock investors in Indonesia (1 million of whom use Ajaib). That’s less than 1% of the country’s total population, meaning there is plenty of room for the market to grow if capital markets mature.

🇹🇭 Amundi, JP Morgan Eyes Takeover Of KBank’s Asset Management Arm - Private Banker International, July 6, Bangkok

🇭🇰 Endowus Launches In Hong Kong Making Its First Overseas Market Entry - Yahoo Finance, July 5, Hong Kong

🇦🇺 Digital Brokerage Platform Syfe To Make Australian Debut In Early August - The Business Times, July 6, Sydney

🇮🇳 AssetPlus Introduces Two New Financial Products, Several Others In The Pipeline - PR Newswire, July 5, Chennai

🇰🇷 Uprise Lost $20MM Of Client Funds On LUNA Short Bet - Crypto Briefing, July 6, Seoul

🇸🇬 MarketWolf Is A Trading-First Platform For New Investors - TechCrunch, July 5, Singapore

Blogs, Webinars, Podcasts

🇺🇸 Are Growth-Focused Wealth Firms Oblivious To Their Technological Debt? - Wealth Professional, July 4, California

🇨🇭 Stay Invested Through Market Turmoil – UBS - WealthBriefing, July 7, Zurich

🇬🇧 M&G Offers A Solid 10.1% Yield – But Future Growth Is Uncertain - MoneyWeek, July 4, London

🇬🇧 Nutmeg CEO Steps Down After JPMorgan Takeover: ‘I Am Now Taking Some Time Out’ - Financial News London, June 30, London

🇮🇳 How Are Robo Advisory Services Transforming India’s Wealth Management Industry? - Inc42, July 3, Mumbai

🇺🇸 WealthStack Roundup: GeoWealth And Pontera, American Century And Marstone, Advisor360° Updates Beneficiaries - Wealth Management, July 1, Illinois

Events & Reports

🇬🇧 Fintech Week London - Fintech Week London, July 11-15, London

🇺🇸 VenCent Fintech Summit - The Venture Center, August 15-18, Virtual

🇺🇸 Coffee & Conversation With A Fintech CEO - Intrinio, July 12, Virtual

🇫🇷 Women In Fintech & Digital Payments - Women In Tech - Global Movement, July 21, Virtual

Shape your Future

Wondering what’s shaping the future of Fintech and Digital Wealth? At the Fintech Blueprint, we go down the rabbit hole to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts