Digital Wealth: AI wealthtech Range gets $12MM to replace human advisors with neural nets

Range's master plan involves temporarily using human financial advisors to leverage their knowledge to train AI models that will eventually replace those same human advisors

Hi Fintech Futurists —

Happy Thursday! Today we highlight the following —

NORTH AMERICA: Range Raises $12MM Series A Led By Gradient, Google's AI Fund, To Revolutionize Wealth Management

APAC: GBST Acquires WealthConnect

GEOGRAPHIC NEWS CURATION

Based on your feedback, we know that many of you are interested in reviews of companies or projects highlighted by our community. Leave a comment below with a company of your interest and we’ll do a deeper take on it later!

Let’s Meet!

As a member of the Fintech Blueprint community, you are invited to our first-ever, in-person gathering with free drinks and live entertainment!

Join me (Lex) and other Fintech Blueprint team members at the Edison Ballroom in NYC on May 11 at 5:30pm to celebrate our partnership with Fintech Nexus.

⭐🇺🇸 Range Raises $12MM Series A Led By Gradient, Google's AI Fund, To Revolutionize Wealth Management - PR Newswire, May 3, Virginia

Range has raised $12MM in a Series A funding round led by Google's AI-focused venture fund Gradient, with participation from Expa, Red Sea Ventures, and 8-bit Capital. The fintech is an evolution of the roboadvisor genre, planning to use AI to make human financial planners obsolete. While earlier startups focused on deterministic rules in investment management or financial planning software, new wealthtechs can play the same game while targeting the human touch of the financial advisor using LLMs.

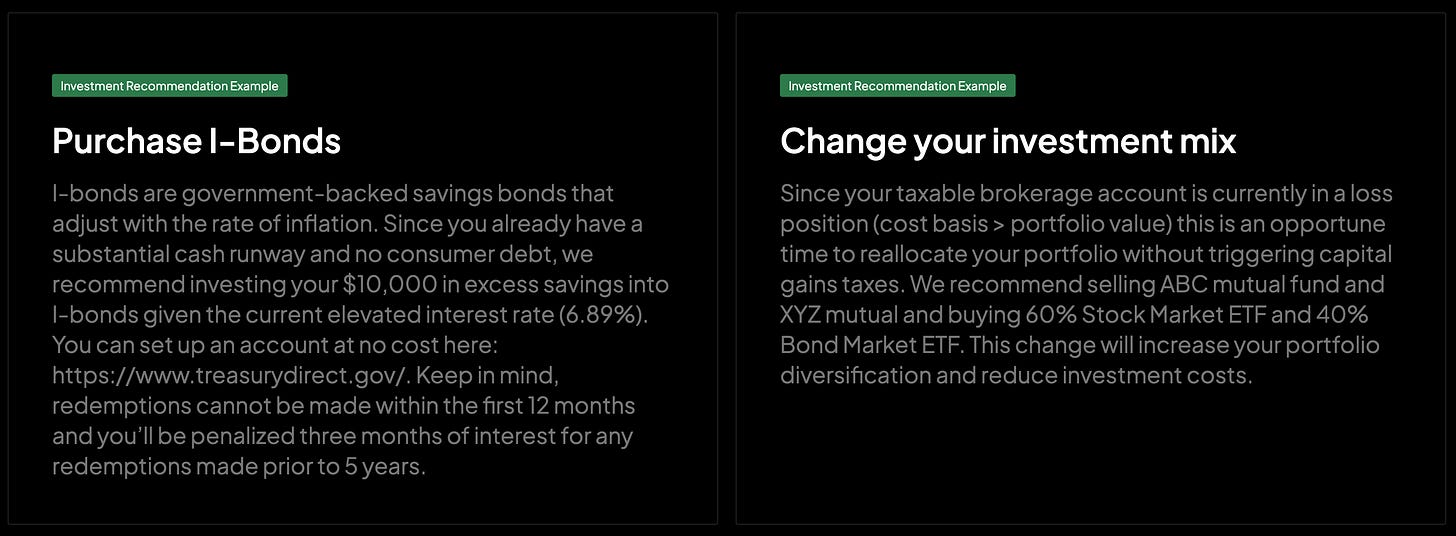

The company’s investment planning service comes with a team of expert financial planners who provide portfolio analysis and investment recommendations. While each customer is currently assigned a human advisor, the company is leveraging its advisor knowledge and customer data to train AI/ML models that will eventually augment and replace those human advisors.

The standard investment management service generates portfolios for the usual 0.25% annual fee. The company's other offerings extend to tax, retirement, estate, insurance optimization, and education planning — an expensive set of feature for a single start-up to deliver. For context, the roboadvisor Wealthfront had secured $200MM+ in funding solely dedicated to investment management. Although complete AI model integration holds promise, achieving this will require far more scale and cost. We wonder what the MVP looks like.

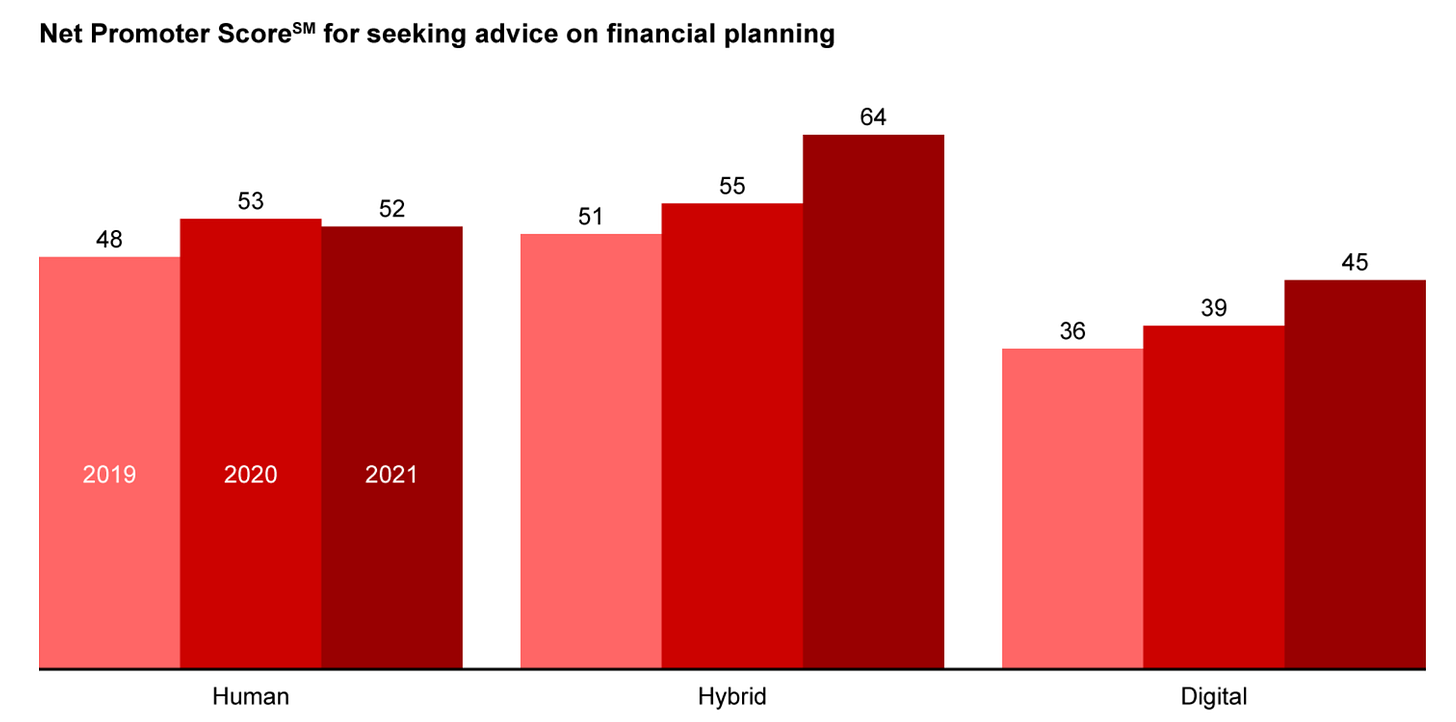

Range is also competing against a wave of legacy and startup wealth management companies incorporating AI. One noteworthy example is Morgan Stanley, which made headlines in March when it announced that it would leverage GPT4 and feed its research data to provide AI-powered financial advice via its 16,000 advisors. Further, while favoring digital channels, younger customers still value human interactions for complex decisions. This preference has led to hybrid engagement models that blend AI-powered guidance with a human touch.

The question remains: will this preference persist if AI-powered advice becomes 2x or 3x, or even 5x cheaper? We think LLMs have the potential to match human empathy and experience, if not surpass it.

⭐🇦🇺 GBST Acquires WealthConnect - Finextra, May 2, Sydney

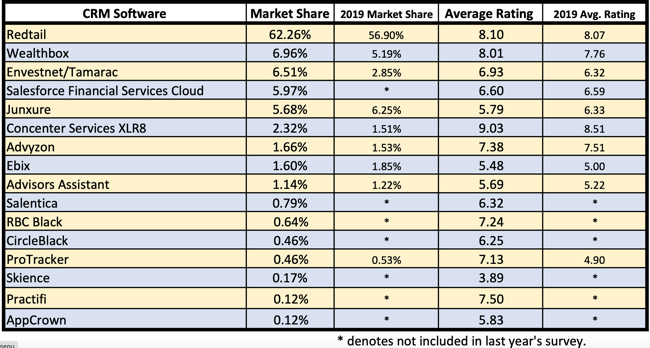

Sydney-based wealthtech GBST is acquiring wealth CRM platform WealthConnect, based on Salesforce, for an undisclosed amount. Previously, WealthConnect served as the flagship product of the now-defunct fintech CreativeMass, so we wonder if this is a distressed tech acquisition. It's been a tough year for tech companies, and the troubled state of the financial markets has been unforgiving. Compressed valuations have reduced risk appetite, and this is further amplified among young fintechs.

The acquisition comes shortly after GBST's March announcement of a complete rebrand that included updates to its existing cloud-native SaaS wealth administration platform, Composer. For context, as of Feb 2022, the Composer platform had £180B in AUM with 3MM+ active accounts.

GBST's current tech stack provides clients with a suite of services designed to streamline the administration of wealth products from the distribution channel through to the back office with its tools Composer and Catalyst. Other digital tools like Equate allow advisors to leverage GBST's built-in models/calculators that can be white-labeled on their own sites to create "what-if" scenarios for a more personalized customer experience and enable better lead generation. WealthConnect's CRM platform is built on Salesforce, which is particularly suited to large enterprise clients.

Though we've begun to see a consolidation of providers, the battle to differentiate between platform tech providers and advice tech (like CRMs) has not changed much. It's a competitive and fragmented market, leading to a frustrating experience for both the advisors and the customer. Additionally, the pool of quality advice tech platforms ready to be acquired is still relatively shallow, which we think is a function of wealth management market structure.

Curated News

North America News

🇺🇸 Deal Box Announces Integration With Fireblocks To Increase Security And Reliability For Digital Asset Management - PR Newswire, May 3, California

🇺🇸 Bunker Taps InvestCloud To Launch Digital Investment Platform In LatAm - Fintech Futures, April 28, California

🇺🇸 Envestnet Introduces Product Updates, New Partnerships At Annual Conference - Investment News, April 28, Pennsylvania

🇺🇸 Technology Problems at Envestnet Frustrate Advisors - WealthManagement, May 1, New York

EMEA News

🇬🇧 Wealth Intelligence Platform 1fs Wealth Secures Backing - Fintech Global, May 2, London

🇳🇴 Huddlestock Signs First Family Office To Use The Portfolio Management Platform - Huddlestock Fintech AS, May 3, Stavanger

🇦🇪 Property Tech Platform Stake Offers Golden Visas To Investors - Zawya, May 2, Dubai

🇦🇪 MEA-Focused Pyypl Rolls Out Micro-Investment Platform - Zawya, May 3, Abu Dhabi

🇦🇪 xCube Launches Retail Trading Platform In The UAE - Finextra, May 2, Dubai

Asia Pacific News

🇯🇵 Webull Expands To Japan - PR Newswire, April 27, Tokyo

🇮🇳 CoinSwitch To Diversify Into Wealthtech Platform In FY24 - Financial Express, April 28, Bengaluru

Blogs, Webinars, Podcasts

🇬🇧 Oxford Risk Predicts M&A Rise In UK Wealth Industry -

Wealth Briefing, May 3, London

🇭🇰 Syfe’s Founder & CEO On Elevating & Scaling The Digital Investment Platform And Offering - Hubbis, May 4, Hong Kong

🇨🇭 The Rise Of The Retail Investor Continues – Here’s How The Financial System Can Accommodate Them - World Economic Forum, May 2, Cologny

Events & Reports

🇺🇸 Fintech Nexus USA - Fintech Nexus, May 10 - 11, New York

🇺🇸 Wealth Management Edge - Informa Connect, May 21 - 24, Florida

🇺🇸 Finovate Spring - Informa Connect, May 23 - 25, California

🇬🇧 Innovation In Wealth Management - Professional Wealth Management, June 8, London

🇬🇧Private Banking & Wealth Management London Conference & Awards 2023 - Arena International, June 14, London

Shape your Future

Wondering what’s shaping the future of wealthtech, Fintech, and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry. Subscribe now to level up your knowledge and get access to our weekly Long Takes!

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime. Leave a comment below on what you think and what we should cover next.