Digital Wealth: Algo-advisor Delphia closes $60MM round led by Multicoin Capital

Delphia gets $60MM to collect your phone data and build a machine learning stock picking model for retail users

Dear readers — thanks always for your time and attention! Your essential news in digital wealth is here. For actionable insights on growing your digital strategy or investing in fintech companies, explore our subscription options.

North America News

⭐🇺🇸 Algo-Advisor Delphia Closes $60MM Series A Round Led By Multicoin Capital - Yahoo Finance, June 8, New York

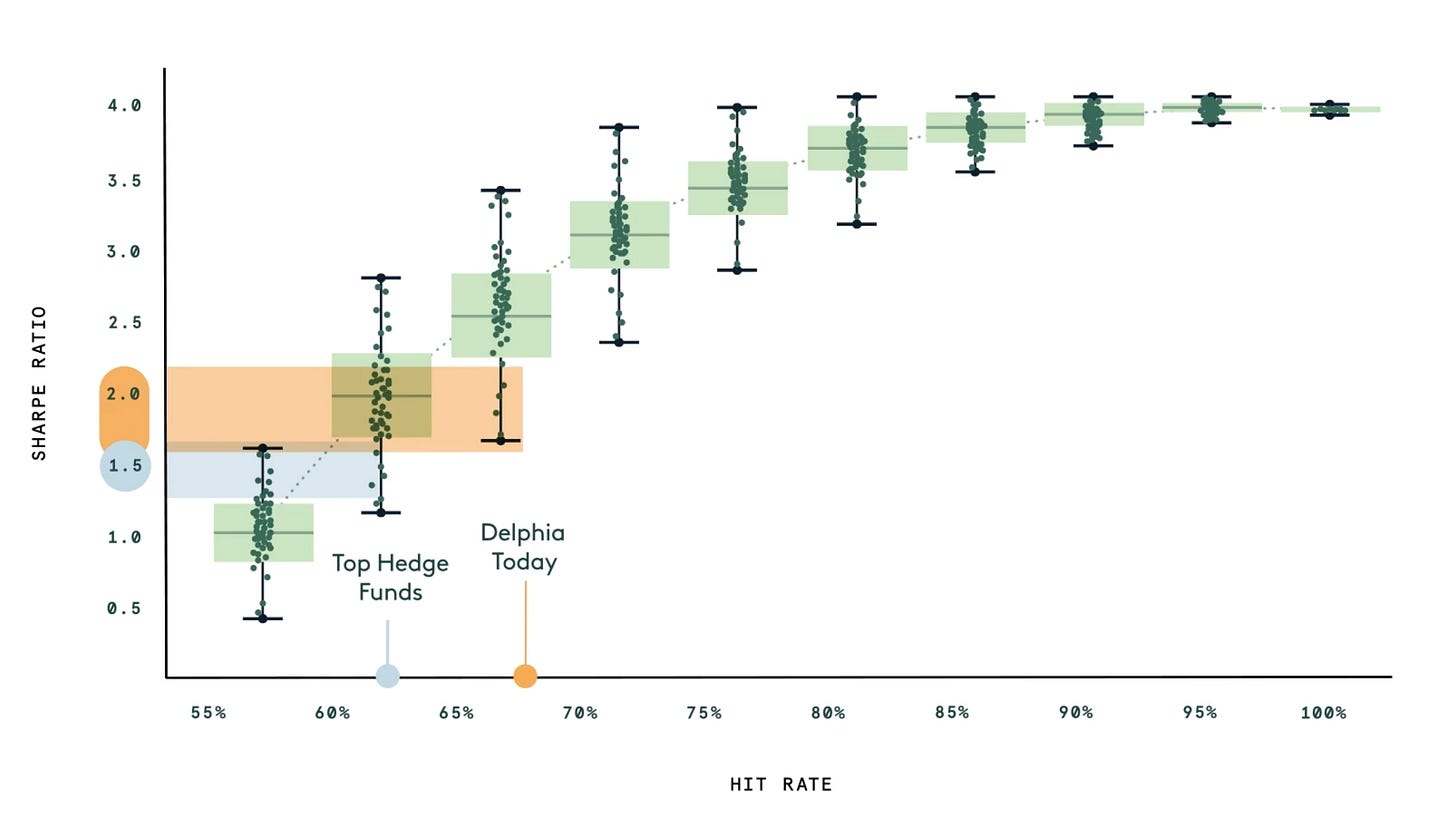

Delphia, an algorithmic stock-picking platform, announced a $60MM Series A round, bringing total funds raised to $80MM. There is an interesting play here implementing machine learning models for stock selection. However! You need large data sets to implement useful machine learning models, and Delphia solves this by having retail users share *data from their phone* with the Delphia app, and in exchange for rewards — such as their Amazon purchase history, LinkedIn, or Venmo accounts. Using consumer spending insights, employment patterns and public opinions, Delphia can try to create algorithmic models that were previously only for hedge funds.

"Currently, retail investors are forced to either invest in passive robo-advisors that are designed to achieve average returns, or they can pick stocks directly through platforms like Robinhood or E-Trade — where they're up against the best hedge funds in the world. Delphia gives investors a third choice in the form of a mobile-delivered algo-advisor that leverages machine learning ..." - Andrew Peek, CEO of Delphia

Marketing spiel aside, building out a new giant data set is the interesting bit. Also interesting is that the venture investor set here is largely from the crypto crowd, which shows the shift into trying to own fintech distribution. Also also, we like that there is a thing called an “algo-advisor”.

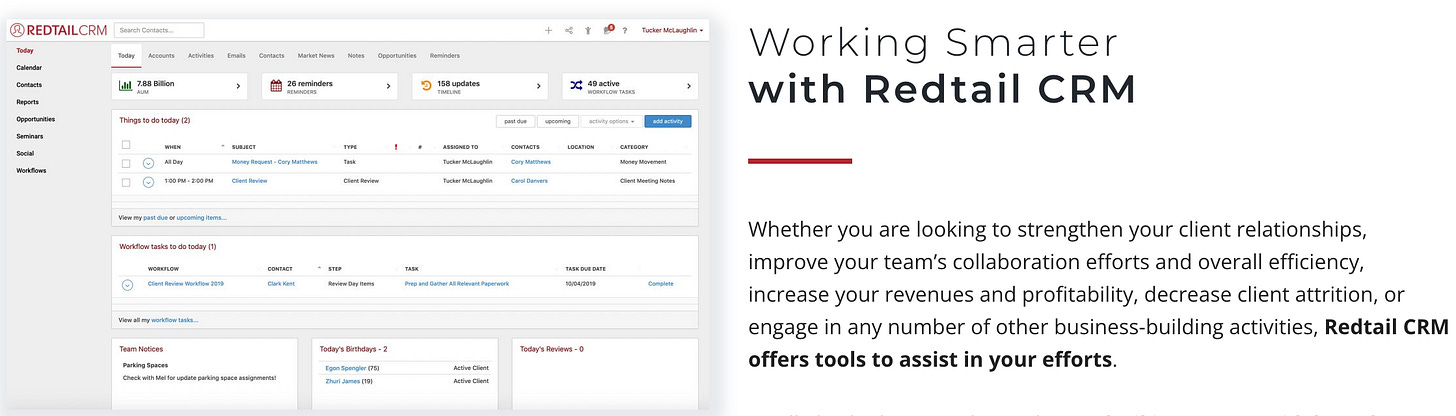

⭐ 🇺🇸 Orion Completes Acquisition Of Redtail Technology - Businesswire, June 6, Nebraska

Wealthtech platform Orion announced the completion of its acquisition of Redtail Technology, a web-based client relationship management (CRM) software firm serving the wealth management industry. Through integration of Redtail’s technology into Orion, it will provide an all-in-one solution for advisors to manage both clients and their funds.

Prior to the deal, Orion supported over 2,300 independent advisory firms with $1.9 trillion in assets under administration. The Redtail acquisition will push Orion into more than $3 trillion in assets under administration. The acquisition points to the natural trends of consolidation in the wealthtech industry, where growth can be capped by market size and requires vertical integration. This likely hurts Envestnet.

🇺🇸 Savant Wealth Management Invests $3MM In Advice Engagement Platform Lumiant - Fintech Futures, June 1, Illinois

🇺🇸 Bonsai Partners With Swiss Wealthtech, 3rd-Eyes Analytics - PR Newswire, June 7, Colorado

🇺🇸 Brooklyn Investment Group And Apex To Launch A.I. Powered Unified Managed Account Platform Across Digital And Traditional Assets - PEAK6, June 2, New York

🇺🇸 Libertas Capital Management Joins FamilyWealth - Yahoo Finance, June 2, Colorado

🇺🇸 Envestnet Announces Business Line Transformation To Streamline And Accelerate The Growth Of Its Financial Wellness Ecosystem - Yahoo Finance, June 7, Pennsylvania

🇺🇸 SoFi Invest Adds More Hours To The Trading Day To Empower Members To Trade On Their Own Terms - Businesswire, June 2, California

🇨🇦 Trading Central Introduces Technical Insight® “Active Trader Edition” - Businesswire, June 7, Ottawa

EMEA News

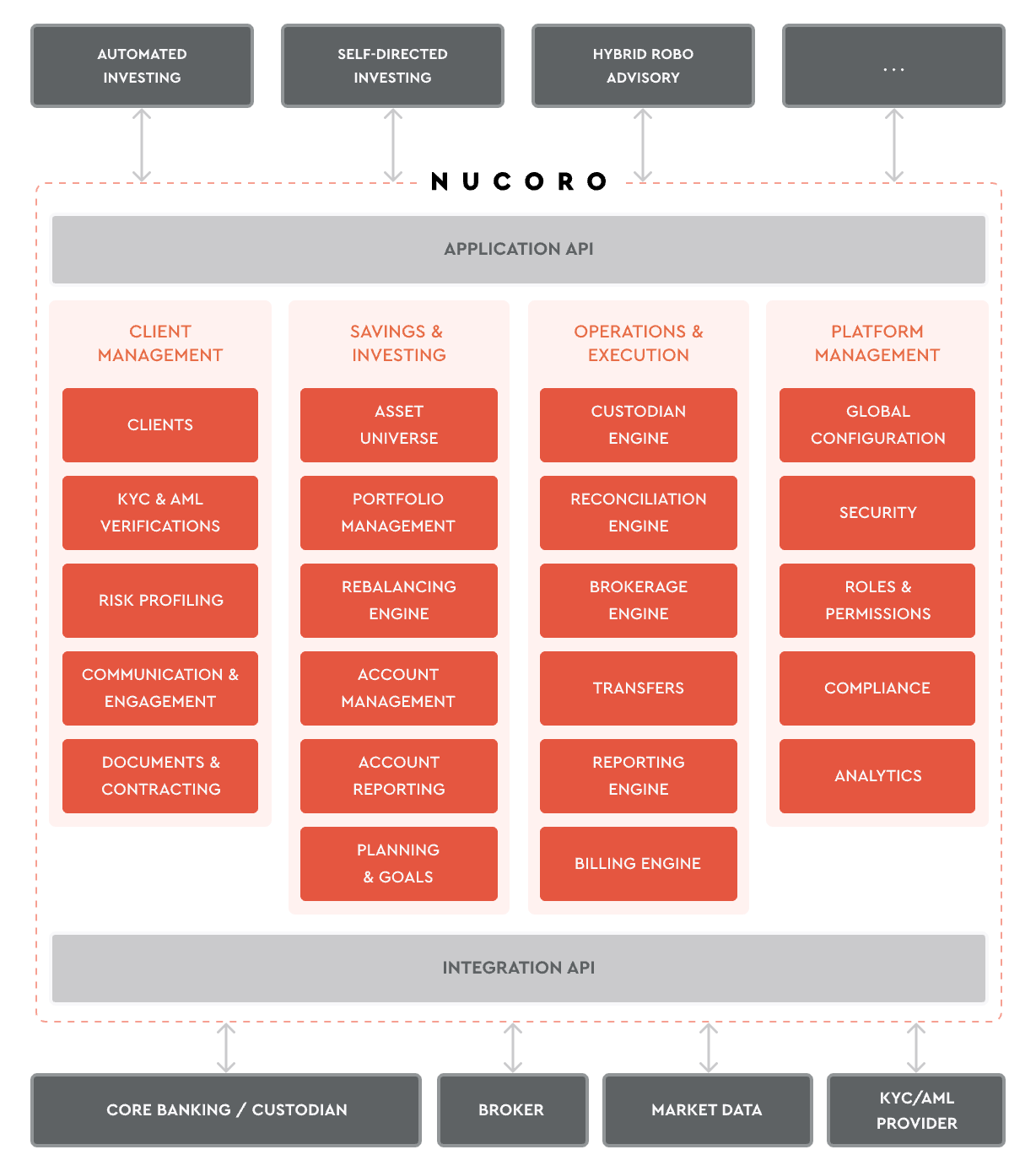

⭐🏴 Abrdn Scraps Deal To Acquire Exo Investing; Invests In Parent Company Nucoro - Finextra, June 7, Aberdeen

Abrdn, the investment company formerly known as Standard Life Aberdeen, invested in Nucoro, a savings and investment platform. Originally, Abrdn was buying Nucoro’s digital wealth division Exo Investing, but pivoted to invest in the parent company. Nucoro offers an API-driven service for developing personalised and automated investment products, and previously raised about $20MM. Their tools complement Abrdn's Personal vector, which offers wealth and financial planning capabilities, by providing helping developers build financial solutions. Think embedded finance for wealthtech.

Investments into digital wealth and wealthtech firms continue forward despite the market meltdown. Allfunds announced a €145MM acquisition of Web Financial Group, digital Investment App Bibit raised $80MM, and wealthtech firm TIFIN raised $109MM in their Series D funding round — all in the past month. We think this is because money-at-rest type revenues (i.e., fees on AUM or SaaS platform revenues) prove to be more valuable than brokerage in a down-cycle.

🇯🇴 Saudi Arabia Wealth Fund PIF To Invest $185MM In Jordan's Capital Bank Group - Gulf News, June 5, Amman

🇦🇪 Wealthtech FinaMaze Partners Investment Research Firm Ned Davis Research - Finextra, June 2, Abu Dhabi

🇬🇧 Hoping Club Will Launch A Digital Currency Intelligent Value-Added Service In The Asia Pacific Region - GlobeNewswire, June 6, London

🇭🇺 Dorsum Joins F10 - Finextra, June 8, Budapest

🇬🇧 ClearBank Opens The Door To Virtual GBP Accounts For Ziglu Customers - Altfi, June 7, London

Curated sponsorships

We work with select companies to deliver brand awareness to our 100,000+ digital finance audience. See our prior partners here, and reach out here with interest.

Asia Pacific News

⭐🇸🇬 SGX-Backed ADDX Allows Investors to Use Crypto to Gain Access - Bloomberg, June 8, Singapore

ADDX, a capital markets digital exchange platform, announced that it has become the first financial institution in Singapore to recognise cryptocurrencies like BTC, ETH, and USDC, for the purposes of onboarding accredited investors. Under Singapore law, accredited investors must meet one of the following three criteria: (1) income greater than S$300K in the previous 12 months, (2) net financial assets greater than S$1MM, or (3) net personal assets over S$2MM. Crypto assets are now recognised under (3) in Singapore, opening up the accredited investor space to the new wave of crypto whales.

Crypto is not currently recognised within Singapore as either income or financial assets, but this move signals a shift towards greater acceptance of digital assets in the APAC region. A recent survey highlighted that 52% of affluent Asian investors hold crypto in their portfolios.

🇦🇺 Lifespan Partners With OpenInvest To Launch Advice Solution - Financial Standard, June 3, Sydney

🇻🇳 Vietnam’s MSB Selects Temenos To Modernize Retail And Corporate Banking - Hubbis, June 3, Hanoi

🇮🇳 Kiya.ai Launches India's First-Ever Banking Metaverse - Kiyaverse - PR Newswire, June 3, Mumbai

Blogs, Webinars, Podcasts

🇸🇬 Among Affluent Asian Investors, 52% Hold Crypto, Survey Finds - Blockworks, June 7, Singapore

🇨🇭 Temenos Awarded Best Onboarding Product At WealthBriefing Asia Awards 2022 - Temenos, June 6, Geneva

🇬🇧 MENA Wealth Advisors Expect Robo-Advisors To March Ahead - WealthBriefing, June 7, London

🇸🇬 Syfe’s Head Of Investment Advisory On Aligning A Digital-First Platform With Personalised Advice And Human Delivery - Hubbis, June 6, Singapore

🇭🇰 IDEG’s Institutional Digital Assets Summit Just Wrapped. What Can We Glean About The Bright Future Of Mainstream Digital Assets? - CoinDesk, June 3, Hong Kong

Events & Reports

🇮🇪 Digital Assets: Unclaimed Territory In Asia - Accenture, June 1, Dublin

🇸🇬 WealthTech, Neo Banks - FemTech Partners, June 14, Virtual

🇬🇧 Cloud In FinTech & Banking Summit - TechForge Media, June 30, Virtual

🇰🇪 The Africa Fintech Summit - Dx5group, June 22, Virtual

🇩🇪 Germany Summit 2022: Fintech Europe - Plug And Play Fintech Europe, June 29, Virtual

Shape your Future

Wondering what’s shaping the future of Fintech and Digital Wealth? At the Fintech Blueprint, we go down the rabbit hole to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts