Digital Wealth: Cleo, the 4MM user personal finance AI chatbot, valued at $500MM

Cleo has raised $80MM in Series C funding at a $500MM valuation for their personal finance platform with over 4 million users.

Dear readers — thanks always for your time and attention! Your essential news in digital wealth is here. For actionable insights on growing your digital strategy or investing in fintech companies, explore our subscription options.

North America News

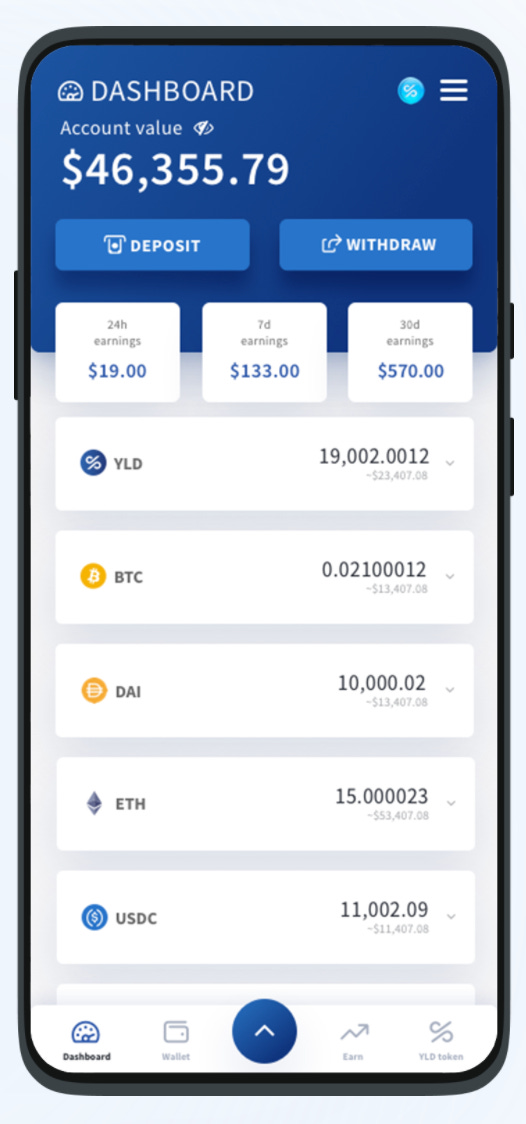

⭐🇺🇸 Yield App Unveils Mobile App To Simplify Digital Wealth Management - The Daily HODL, June 16, California. Check out our podcast with Yield App CEO Tim Frost about the company and how it is structured here.

Yield App, a digital wealth application with more than 80,000 customers and almost $370MM in AUM, has launched its iOS and Android app to simplify earning interest from digital assets. The platform lets you buy, deposit, convert and earn on digital assets with zero fees, and also offers a YLD Tier Rewards programme for those staking their YLD token. The more YLD tokens you stake, the higher the yields you’re entitled to (Diamond Tier members earn up to 12% annually).

We think this type of functionality will be integrated into and become common place across wealth management software, whether you are looking at private banks, RIAs, or family offices. It is akin to looking at roboadvisors in 2010, which are now integrated into every brokerage and asset manager as a feature.

🇺🇸 Edelman Financial Engines Launches Adviser/Robo Retirement Solution - InvestmentNews, June 17, California

🇺🇸 Focus Financial Partners Adds $2B Houston RIA To Platform - Wealth Management, June 17, New York

🇺🇸 Singer Wealth Announces Its Inflation-Proof Investment Strategy - Yahoo Finance, June 22, Florida

🇺🇸 VanEck Continues Aggressive Expansion Of Its Global Digital Assets-Focused ETF Lineup With Launch By Investo Of Fund “BLOK11” In Brazil - Businesswire, June 22, New York

🇨🇦 Mako Fintech SOC 2 Certification Increases Institutional-Grade Security To Canadian Wealth Managers - Yahoo Finance, June 22, Montreal

EMEA News

⭐🇬🇧 UK’s AI Enhanced Personal Finance Chatbot Cleo Raises $80MM - Crowdfund Insider, June 22, London

Cleo, an AI-based financial assistant platform, raised $80MM in venture funding at a $500MM valuation. Cleo integrates with client bank accounts and uses AI to analyse spending habits to help users with budgeting, saving, borrowing and improving credit rating.

The platform has 4 million users, largely in the Gen Z demographic, who’ve been enticed by novelty features like “roast mode” that roasts you for spending money. Other features include: (1) budgeting, which includes an AI assistant to help users stay on track, monthly targets based on spending, breakdowns by category, and bill management; (2) saving, which includes goal setting, round ups and cashback on everyday buys; (3) borrowing, which allows borrowing up to $100; and (4) building out a credit history. We think this stuff should be integrated into all wealthtech as well.

Users can get a card through the Cleo Builder subscription for $14.99 that unlocks the card, cash advances and cashback rewards. Important to do the math on those subscriptions however — last time we looked at Acorns, it ended up being very expensive on an AUM basis.

🇬🇧 Shard Credit Partners Raises £75MM Venture Debt Fund - Altfi, June 16, London

🇧🇪 Belgium-Based Wealthtech Expands Banking Reach - WealthBriefing, June 15, Brussels

🇨🇭 Swiss Private Bank Bergos AG Selects New Access SA To Support Its Digital Transformation - Fintech News, June 22, Zurich

🇳🇴 Huddlestock Fintech Partners With Solarisbank - The Paypers, June 16, Stavanger

Curated sponsorships

We work with select companies to deliver brand awareness to our 100,000+ digital finance audience. See our prior partners here, and reach out here with interest.

Asia Pacific News

⭐🇻🇳 Vietnam's Finhay Raises $25MM Series B - Finextra, June 22, Hanoi

Digital investment platform Finhay raised $25 million in Series B funding. There are currently 5 million retail stock investors in Vietnam (around 5% of the population), and the number of Vietnamese investors is growing at 238% year-on-year. Finhay is the only licensed digital investment platform in Vietnam after its acquisition of a securities brokerage, with more than 2.7 million registered users, making it Vietnam’s leading digital investment platform.

In 2021 Finhay released four new products: stock trading, cash-wrapped accounts with CIMB, gold trading, and a 12-month saving product, leading to a 150% increase in users. Finhay has captured more than half the market with its current offering, and we are interested to see if they can retain market share as the market matures, and whether international entrants will compete here as well.

🇻🇳 Vietnamese Fintech Anfin Bags $4.8MM Pre-Series A Co-Led By Y Combinator - Fintech News, June 22, Hanoi

🇸🇬 StashAway Launches Flexible Portfolios To Give Its Investors More Control - Fintech News, June 20, Singapore

🇹🇭 SCB Wealth Goes Digital In Youth Push - Bangkok Post, June 23, Bangkok

🇮🇳 Fintech Platform Raise Financial Services To Invest In Early-Stage Startups - Inc42, June 16, Thane

Blogs, Webinars, Podcasts

🇺🇸 Brian Barnes: Big Talk, And Big Results, At M1 Finance - Barron’s, June 17, Illinois

🇺🇸 Digital Wealth Managers Riding High On Wave Of Democratization - Wealth Professional, June 16, Massachusetts

🇩🇪 Calculating The Added Value Of Robo-Advisors - Finews, June 21, Berlin

🇺🇸 How TD Bank Deploys Robo-Advisors For End-To-End Wealth Automation - Bank Automation News, June 16, New Jersey

🇺🇸 Powered By Technology. Driven By People. - Wealth Management, June 17, California

🇺🇸 Former Onramp CEO Announces New Ventures - Wealth Management, June 15, Massachusetts

Events & Reports

⭐🇺🇸 Financial Planning Releases Its Annual Report On Wealth Management Technology -- The 2022 Tech Survey: The Wealthtech Labyrinth - Yahoo Finance, June 16, New York

The Tech Survey is an annual survey of financial advisors that explores the technology trends shaping the wealth management industry. The report dives into the top technologies being used in a financial advisor’s day-to-day to bring greater value across a range of areas from marketing to allocating assets.

One interesting insight is into how different sized firms are adopting different technologies. As an example, financial planning software, CRM, client portals and client communication tools are more common among organisations with smaller budgets (less than $500,000). Alternatively, firms with larger budgets (more than $1MM) are investing in marketing automation, roboadvisors, chatbots and cryptocurrency trading. The difference is essentially how close the firm is to the fintech frontier.

🇺🇸 Robo Advisory Market Predicted To Gather A Revenue Of $59,344.5MM By 2028, Growing At A Healthy CAGR Of 39.9% From 2021-2028 - PR Newswire, June 16, New York

🇩🇪 FinTech Pitch - The Startup Club, June 30, Virtual

🇬🇧 FinTech Europe: 2021 Vs 2022 - Storm2, July 6, Virtual

🇬🇧 Cloud In Fintech & Banking Summit - TechForge Media, June 30, Virtual

🇩🇪 Germany Summit 2022: Fintech Europe - Plug And Play Fintech Europe, June 29, Virtual

Shape your Future

Wondering what’s shaping the future of Fintech and Digital Wealth? At the Fintech Blueprint, we go down the rabbit hole to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts