Digital Wealth: How Vise spent $60MM and landed at a "refounding"

Fintechs EV/LTM revenues dropping from 20-30x in 2021 to 3-5x. At a time of valuation re-rating, the shifting macro environment places a premium on a company's capital efficiency

Hi Fintech Futurists —

Happy Thursday! Today we highlight the following —

NORTH AMERICA: Refounding Vise

GEOGRAPHIC NEWS CURATION

Based on your feedback, we know that many of you are interested in reviews of companies or projects highlighted by our community. Leave a comment below with a company of your interest and we’ll do a deeper take on it later!

⭐ 🇺🇸 Refounding Vise - Vise, March 3, New York and The unraveling of fintech darling Vise - Business Insider.

Generally speaking, we want to cheerlead for young companies doing hard things.

Sometimes, however, the mismatch between what companies promise and what we know the market can sustain is too great. And the knowledge gap between generalist venture capitalists and specialist niche markets, such as RIAs and financial advice, is too great. Having founded on of the 2012 vintage wealth tech platforms, we are particularly skeptical of the claims of emerging wealth tech platforms that haven’t yet cracked distribution.

So when media reached out to us for comment on Vise — an AI-powered Envestnet type — in 2020, and the excitement about the company reached venture fever pitch, this was our grumpy answer (with some parts redacted for being too critical).

The Silicon Valley spin on this really wild. I don't see anything different in the positioning from what has been built by multiple teams over the last decade, including AdvisorEngine. … Maybe the recent exits of Folio and United Capital to GS, AdvisorEngine to Franklin Templeton, Motif to Scwhab, etc., are driving renewed interest in the RIA market in the Valley. Stash and Robinhood continue to raise too.

But the RIA theme is a 20 year theme and nothing is radically changing. Having VCs act as if they discovered it now, and therefore it is different and more important, is odd to me. It would be a shame to see a blitzscaled player come in and obliterate the current wealth tech ecosystem by pricing in an unsustainable way.

Last, I am having trouble understand where machine learning is implemented and what precise benefit it is providing in the portfolio management process. Maybe there is some absolutely insane AI-driven investment track record that is getting people excited, but the website does not communicate anything about AI that jumped out at me.

The fintech venture capital market is on fire right now. Take a look at GoHenry with $40M, Tink with €85M, Cleo with $44M, Step with $50MM; Monzo with £60MM, and Moov with $27MM. There is also the recent Addepar raise as a comp. Enabling technology and embedded finance in particular is in the cross-hairs and people are living more digital lives. So the market and the commercialization that's possible is far higher now than even 5 years ago. As an example, take Plaid being worth more than Envestnet.

The hires around the management team, and the size of the check, show that Sequoia wants to make a serious bet on the wealthtech market. There are not that many fresh ideas or choices available since that first SigFig / AdvisorEngine wave, though I am a fan of Altruist, Responsive.Ai, and Onramp. Vise's concepts around consumer customization, which will allow advisors to reflect the values of the investor through the investment product, are potentially compelling. But I think I have too much scar tissue to understand the pace of investment.

Today, we know that BlackRock is selling off the FutureAdvisor portfolio and many of these tech stacks are in disarray. Vise remains the last big bet standing, or does it?

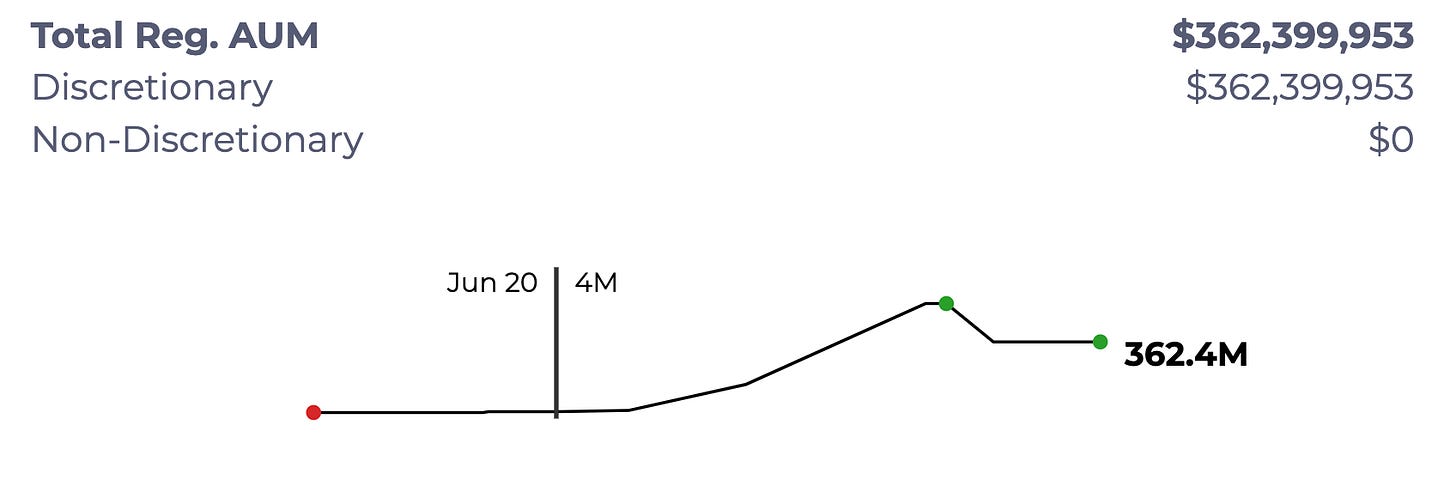

In the blog post linked above, the management of Vise describes a “re-founding”, over the last year, including operational, team, and cultural restructuring. The company raised a whopping $130MM in funding from high quality fintech VCs, like Sequoia and Ribbit Capital, and expanded its workforce from six to 100+ within 18 months. Look, on $400MM of AUM, or even $1B, you can make 25 bps at best in digital wealth — so $2.5MM of revenue. The low end of that would be closer to $1MM instead. You just can’t hire 100 people at this scale.

We have to give credit to the company's founding — Vasavada and Mehrotra launched the firm when they were just 16 years old in 2016. The objective was to help RIAs offer tailored services to clients, using AI to customize each client's portfolio. The portfolio management platform also helped advisors create risk profiles for each portfolio and performs tax-efficient rebalancing. But you know, so did Riskalyze.

In early 2020, Vise appeared to be growing — expecting $800MM in pending AUM and $10B more in the pipeline. However, regulatory filings from mid-2020 underlined that Vise was managing only $4MM. Salespeople reported the total AUM of prospects as if they would bring it all to Vise's platform, inflating real values. Moreover, quotas for senior salespeople were as high as attracting $1B per annum. We point to the Business Insider here for more details of the drama.

Vise eventually reset its headcount, transitioned its leadership team, increased employee equity packages, scaled back sales efforts, and focused on product development and iteration. These changes reduced burn rate from $3MM to less than $1MM a month and provided 60+ months of runway. Of that $130MM, about $60MM (according to the company) — which could have powered an entire wealthtech focused early stage venture fund — was the learning capital for the young entrepreneurs.

Advisors needs tools, and they manage nearly $4 trillion of assets in the United States alone. However, the market is fragmented, complex, and hyper local. It is driven by custodial oligopoly and technology coopetition with a web of integrations. Coming in and assuming no market structure or switching costs exist, and ignoring the reactions of the industry they were trying to serve isn’t a good look.

Fintechs in general are struggling for now in public and private markets, with EV/LTM revenues dropping from 20-30x in 2021 to 3-5x. Capital efficiency is at a premium and we are glad to see Vise restructure and continue to move forward. The new humility and focus on clients — and their real ability to pay — is step one. Step two is to really understand the path of those that have gone before and differentiate. Wealthtech does need real innovation.

Curated News

North America News

🇺🇸 Bestex Research Raises $10MM To Expand Algo Execution Solution Into New Asset Classes And Regions - Finance Feeds, March 3, Connecticut

🇺🇸 InvestCloud Launches White FMB+ - The new product offering includes integrated front, middle and back-office InvestCloud solutions, Fintech Finance News, March 2, California

🇺🇸 Pretium Announces New Partnership With iCapital- PR Newswire, March 8, New York

🇺🇸 Altruist Announces Self-Clearing, Becoming The Industry’s First Vertically Integrated Custodian - Businesswire, March 2, California

🇺🇸 BetaNXT Buys Mediant With Backing Of PE Affiliates - Businesswire, March 2, New York

🇺🇸 Empower Launches Personal Wealth Division With Digital-First Planning Experience To Help Americans Achieve Financial Freedom - Businesswire, March 8, Colorado

EMEA News

⭐🇬🇧 $1T Fintech To Unleash Hybrid Financial Advice On Australia - Financial Review, London, March 8

Asia Pacific News

⭐🇮🇳 Meet Daulat: A Digital Wealth Management Platform Tailored For India - Hacker Noon, March 8, West Bengal

🇦🇺 Low Barrier Ethical Investing Option For Islamic Australians Launched - Professional Planner, March 1, Sydney

🇮🇳 ORCA, India’s First One-Stop Platform For Learning, Analyzing, And Investing In Capital Markets, Launched By Enrich Money - The Hindu, March 6, Bengaluru

Blogs, Webinars, Podcasts

🇮🇱 The Next Generation Of Wealthtech: How Fintech Is Transforming Finance - Finance Magnates, March 3, Tel Aviv

🇺🇸 Just 10% Of Wealth Managers Say They Have All The Tech They Need - Financial Adviser, March 3, New Jersey

🇨🇦 What's Happened To All The Robos? - Wealth Professional, March 7, Ontario

🇬🇧 German FinTech Deal Activity Saw A Correction In 2022, Dropping 24% From Previous Year - Fintech Global, March 2, London

Events & Reports

🇺🇸 Envestnet Summit 2023 Elevate - Envestnet, April 26 - 27, Colorado

🇺🇸 Wealth Management Edge - Informa Connect, May 21 - 24, Florida

🇺🇸 Finovate Spring - Informa Connect, May 23 - 25, California

🇬🇧 Innovation In Wealth Management - Professional Wealth Management, June 8, London

🇬🇧Private Banking & Wealth Management London Conference & Awards 2023 - Arena International, June 14, London

Shape your Future

Wondering what’s shaping the future of wealthtech, Fintech, and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry. Subscribe now to level up your knowledge and get access to our weekly Long Takes!

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime. Leave a comment below on what you think and what we should cover next.