Digital Wealth: Massive $725MM funding round for broker Acrisure, valuing it at $23B

Insurance broker Acrisure announced a $725 million round in Series B-2 Preferred Equity, funding an aggregator model with $3.5B+ of revenue

Dear readers — thanks always for your time and attention! Your essential news in digital wealth is here. For actionable insights on growing your digital strategy or investing in fintech companies, explore our subscription options.

North America News

⭐ 🇺🇸 Acrisure Closes $725MM Equity Funding, Valuing Business At $23B - Businesswire, May 31, Michigan

Insurance broker Acrisure has announced a $725 million round in Series B-2 Preferred Equity. The firm is now valued at $23 billion, a 31% increase from its last $3.5 billion private equity raise in March 2021. Acrisure couples human intelligence with AI to provide clients intelligence-driven financial services solutions for insurance, reinsurance, real estate services, cyber security and wealth management. The company has grown total revenue by 46% to $3.5B, and the new raise reduces net debt leverage by 0.6x.

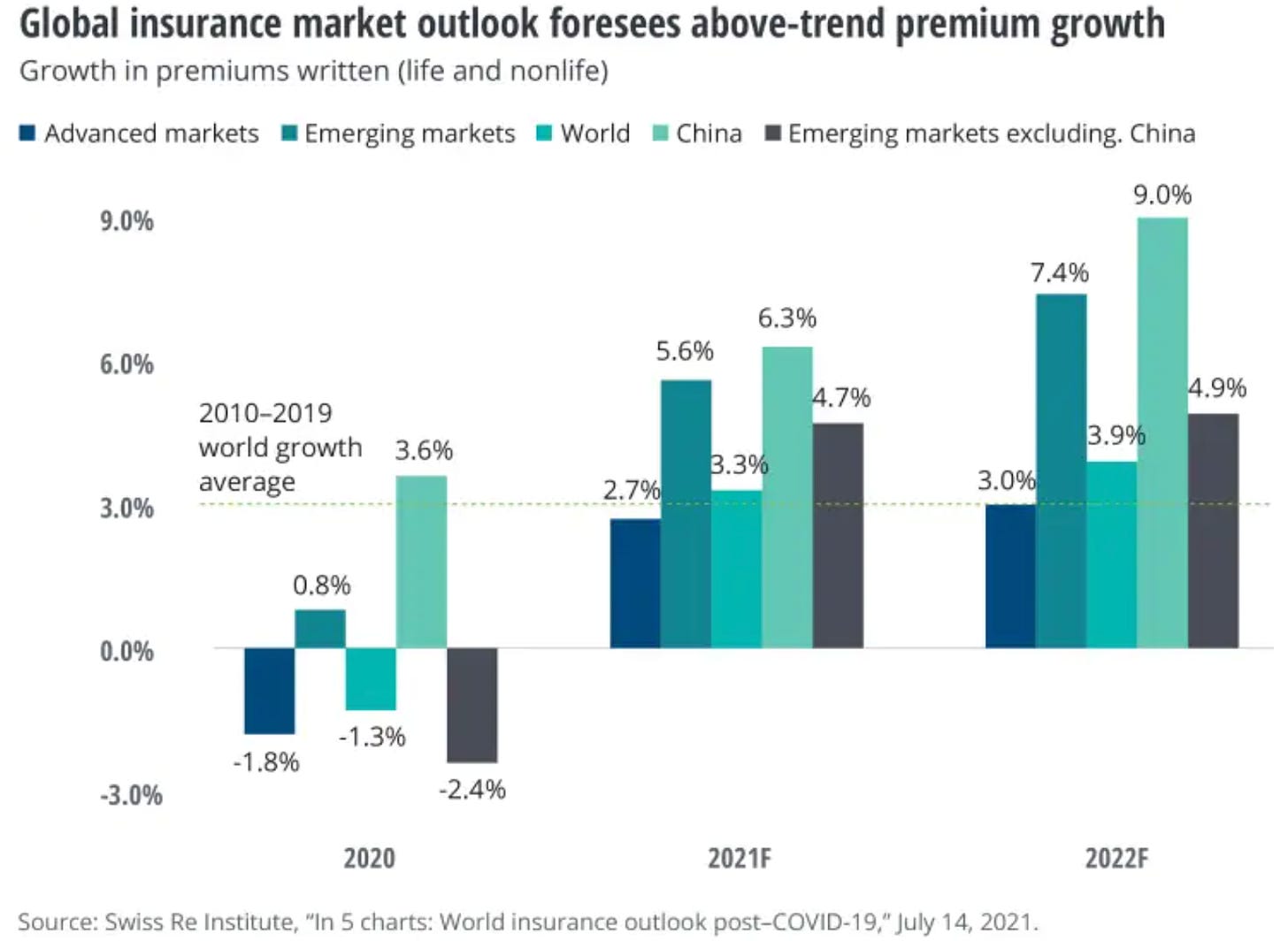

A note that investments in insurance brokers is not slowing down — one of Acrisure’s biggest competitors, Newfront Insurance Services, raised $200 million in April at a $2.2 billion valuation. This is difficult to square with the valuation drop in public insurtech and digital investing companies.

⭐🇨🇦 IG Wealth Management Works With Carbon Streaming Corporation To Deliver Funds That Align With Global Effort To Reach Net Zero - Businesswire, May 31, Toronto

IG Wealth Management, a Canadian wealth management firm, and Carbon Streaming Corporation, an ESG-focused firm offering investors exposure to carbon credits, announced the launch of IG Climate Action Portfolios; four sustainable investment solutions that provide clients with ways to support the world's transition to net-zero emissions.

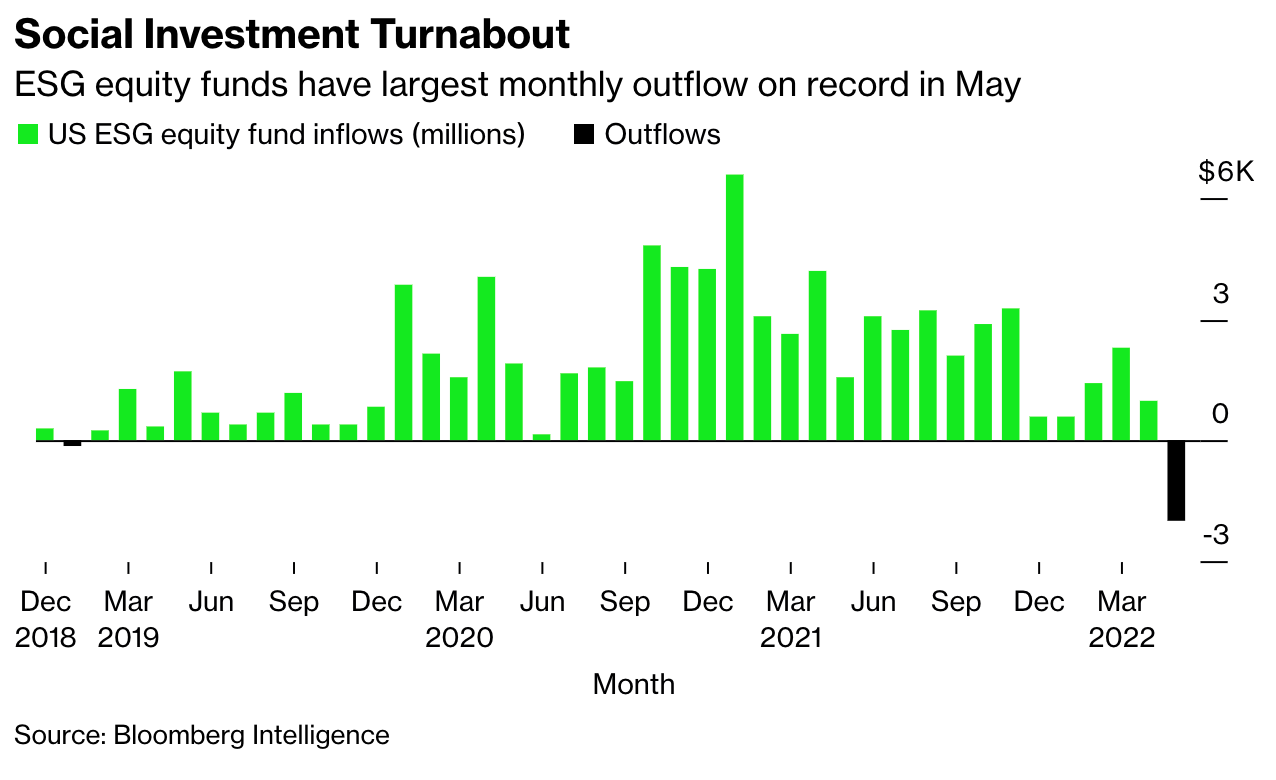

ESG investing boomed during the pandemic, with more than $68 billion flowing into ESG equity funds in the past two years. However, the sharp rise in oil prices since Russia invaded Ukraine has lifted fossil-fuel shares, driving the S&P 500 Energy Index to gain 59% this year even as the benchmark overall has dropped 14%. For some firms, ESG is being sacrificed in the short term; Royal Bank of Canada Wealth Management recently surveyed over 900 of its US-based clients, and 49% said that performance and returns were a higher priority than ESG impact, up from 42% in 2021.

🇺🇸 Envestnet Acquires A 401(K) Marketplace, Pushing Deeper Into Retirement Space - ThinkAdvisor, June 1, Pennsylvania

🇺🇸 Zoe Announces Partnership With National RIA, GreenUp Wealth Management LLC - GlobeNewswire, June 1, New York

🇺🇸 BridgeFT Partners With Eaglebrook Advisors To Provide Integrated Crypto Solution For Financial Advisors - PR Newswire, June 1, Illinois

🇺🇸 Enhanced Digital Group Announces $12.5MM Seed Round To Fund Expanded Access For Crypto Structured Trading Products - Businesswire, May 26, New York

🇺🇸 RFG Advisory Announces Affiliation With RVA Wealth Management - Businesswire, June 1, Alabama

🇺🇸 Indyfin And Wealthbox Announce New Technology Integration To Streamline The Gathering Of Client Feedback - PRWeb, May 26, Texas

🇨🇦 D1g1t Achieves SOC 2 Type II Certification For Its Wealth Management Platform - PR Newswire, May 25, Toronto

🇨🇦 Worldsource Wealth Management Launches Conquest Planning’s Intuitive Financial Planning Solution - GlobeNewswire, May 31, Markham

EMEA News

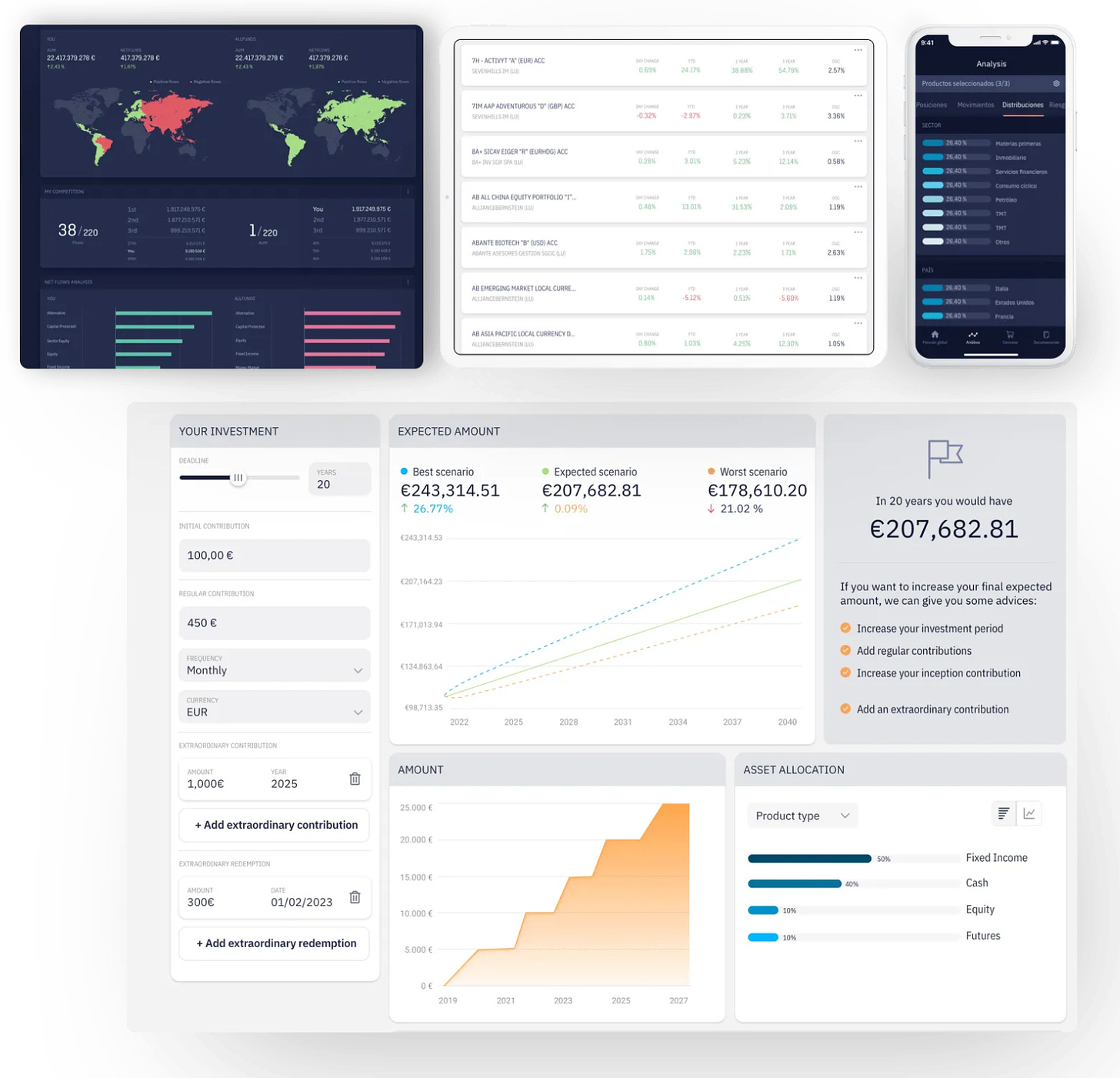

⭐🇪🇸 Allfunds Closes The Acquisition Of Web Financial Group - Hubbis, June 2, Madrid

B2B WealthTech platform, Allfunds, has announced the €145 million acquisition of Web Financial Group (WebFG), a provider of wealth management software. Allfunds is the world’s largest fund distribution network with nearly $1.4 trillion in Assets under Administration. The firm provides fund houses and distributors dealing services and digital tools for data & analytics, portfolio & reporting, research, and regulatory services. The acquisition helps Allfunds grow its presence across France, Germany, Spain, Sweden, Switzerland and the UK, and will add 91 employees.

The global wealth management software market size was valued at $3.76 billion in 2021, and is expected to grow at a compound annual growth rate (CAGR) of 13.9% from 2022 to 2030. The growth can be attributed to the growing adoption of the latest technologies (including the need for automation) in the wealth management industry.

🇩🇪 Bordier & Cie First Private Bank In Asia To Sign Agreement With Private Equity Fintech Moonfare - Hubbis, June 2, Berlin

🇨🇭 Green Digital Finance Alliance Announces First Green Fintech Taxonomy - Finance Feeds, May 30, Geneva

🇦🇪 UAE’s Gulf Islamic Investments Acquires Digital Bank From Mubadala - Zawya, June 1, United Arab Emirates

Curated sponsorships

We work with select companies to deliver brand awareness to our 100,000+ digital finance audience. See our prior partners here, and reach out here with interest.

Asia Pacific News

🇸🇬 Matrixport Launches World's First Non-Liquidation Loan Product For Digital Assets - Yahoo Finance, June 1, Singapore

Crypto exchange Matrixport has launched a 'Non-Liquidation Loan' product for altcoins. The product offers investors the ability to use altcoins as collateral for long or short-term USDC or USDT loans, without the risk of margin calls. In turn, users are able to more effectively manage their liquidity and have more flexibility to capture market opportunities. Avalanche (AVAX), Chainlink (LINK), Polygon (MATIC) and STEPN (GMT) are the only altcoins currently supported, with more to come, and you can get loans starting from $1000.

An interesting alternative product allowing investors to enjoy the potential rewards of altcoins, whilst reducing some of the risks. We’ll be keeping an eye on what other altcoins become supported.

🇲🇾 Malaysia’s CIMB Takes WM Hit - Finews Asia, June 1, Kuala Lumpur

🇦🇺 Cosmos Asset Management Launches Ethereum ETF - InvestorDaily, June 1, Sydney

🇲🇾 Versa Launches Affordable Investment Product From RM100 - Fintech News Malaysia, June 2, Kuala Lumpur

🇮🇳 Religare Enterprises Shoots Up 10% As Lenders To Subsidiary To Mull Loan Settlement Proposal - The Economic Times, June 2, New Delhi

Blogs, Webinars, Podcasts

🇮🇪 Accenture’s APAC Lead For Wealth Management On Driving Digitisation And Strategy To Deliver Enhanced Client Engagement - Hubbis, June 1, Dublin

🇦🇺 ‘We Can’t Wind The Clock Back’: Why Advisers And Technology Must Come Together - IFA, May 27, Sydney

🇭🇰 Martin Wong And Ray Ang On Evolving Grandtag Financial Consultancy’s Digital Wealth Proposition - Hubbis, May 30, Hong Kong

🇺🇸 Technology Can Make Advice Simpler, Easier And More Efficient - Tenet CEO - ProfessionalAdviser, May 25, Texas

Events & Reports

🇸🇬 WealthTech, Neo Banks - FemTech Partners, June 14, Virtual

🇬🇧 Cloud In FinTech & Banking Summit - TechForge Media, June 30, Virtual

🇰🇪 The Africa Fintech Summit - Dx5group, June 22, Virtual

🇺🇸 Vanguard Vs. Fidelity: Here’s The Best Robo-Advisor - Nasdaq, May 25, Pennsylvania

🇩🇪 Fintech Pitch - The Startup Club, June 2, Virtual

🇩🇪 Germany Summit 2022: Fintech Europe - Plug And Play Fintech Europe, June 29, Virtual

🇺🇸 How Fintech Is Changing The Game For Unbanked Minorities - Gerardo Kerik, June 8, Virtual

Shape your Future

Wondering what’s shaping the future of Fintech and Digital Wealth? At the Fintech Blueprint, we go down the rabbit hole to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts