Digital Wealth: Rathbones acquires Investec UK for £840MM, AUM at £100B+

Also who wants a crypto mortgage?

Hi Fintech Futurists —

Happy Thursday! Today we highlight the following —

NORTH AMERICA: Moon Mortgage Launches Mortgage and Borrowing Products To Materialize Digital Wealth

EMEA: Rathbones Agrees Wealth Deal With Investec To Create £100B Business

APAC: LGT Wealth India And Asset Vantage Announce Collaboration

GEOGRAPHIC NEWS CURATION

Based on your feedback, we know that many of you are interested in reviews of companies or projects highlighted by our community. Leave a comment below with a company of your interest and we’ll do a deeper take on it later!

Digital Wealth Short Takes

⭐🇺🇸 Moon Mortgage Launches Mortgage and Borrowing Products To Materialize Digital Wealth - The Daily HODL, April 4, Florida

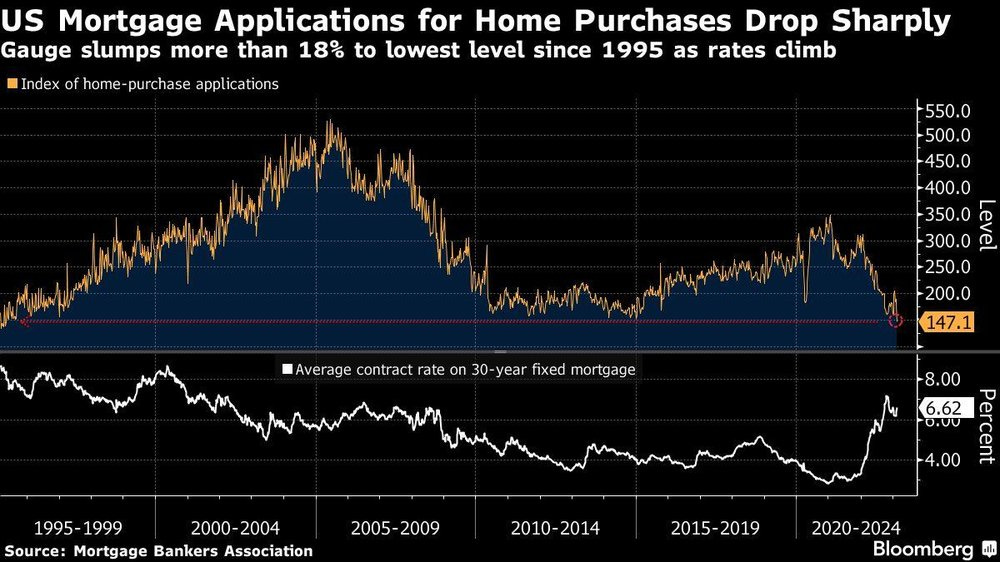

Moon Mortgage, a crypto lending platform that raised $3.5MM last October, has launched a mortgage product for crypto investors. One of the recurring challenges for people who generate capital in the Web3 space is how to actually deploy it in order to improve their life in the real world. Providing a mortgage collateralized by digital assets is one of the more mainstream use cases that we have seen, especially as price of real estate remain unaffordable in the current rate environment

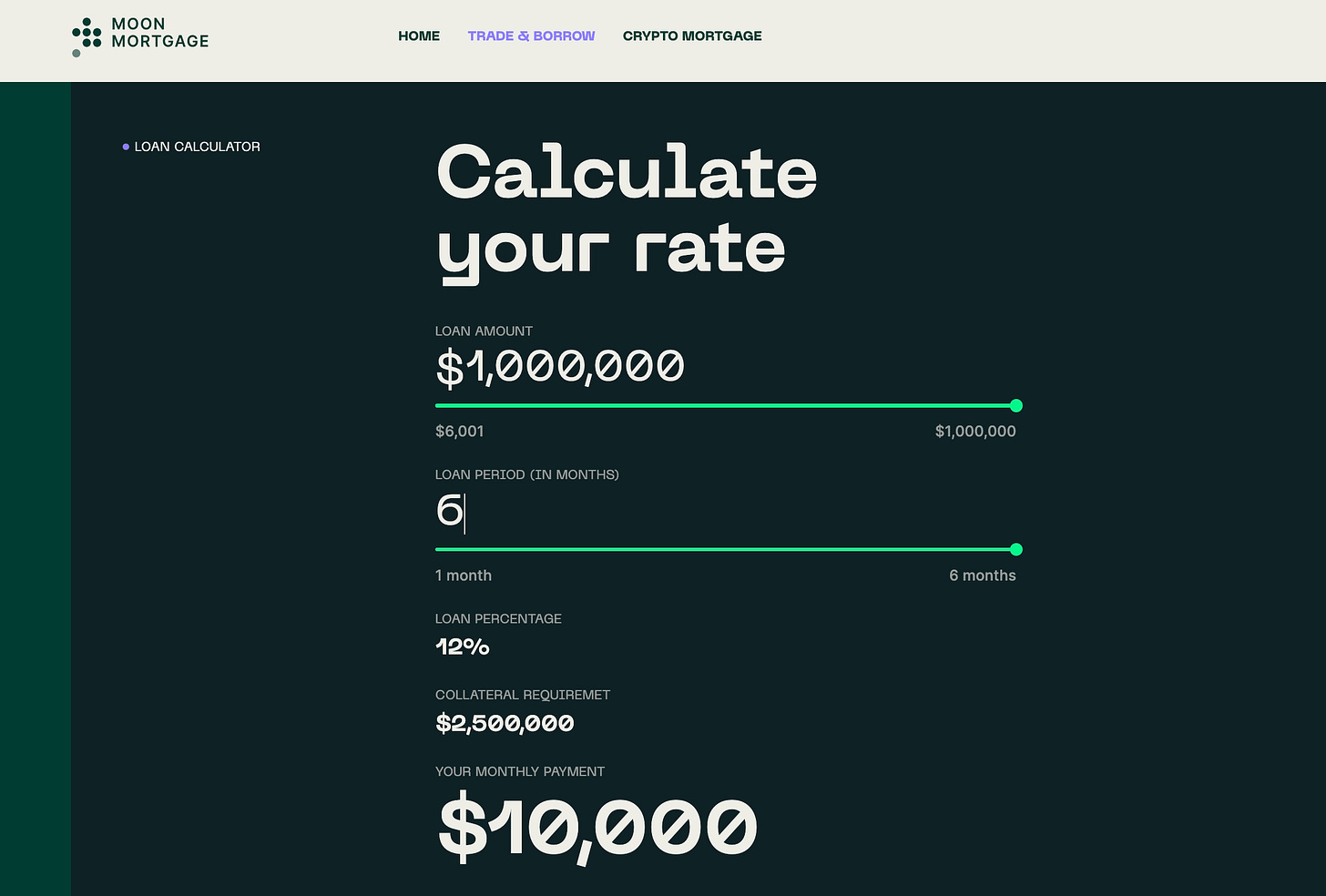

The core product, called “Trade and Borrow”, allows investors to borrow against the total value of their portfolio, offering loans with a minimum amount of $6,000 at a 12% loan percentage and an LTV of 40%. Supported assets include BTC, ETH, and USDC, with no origination fees or prepayment penalties, but positions will be liquidated if there is a 50% drop in a borrower's portfolio value.

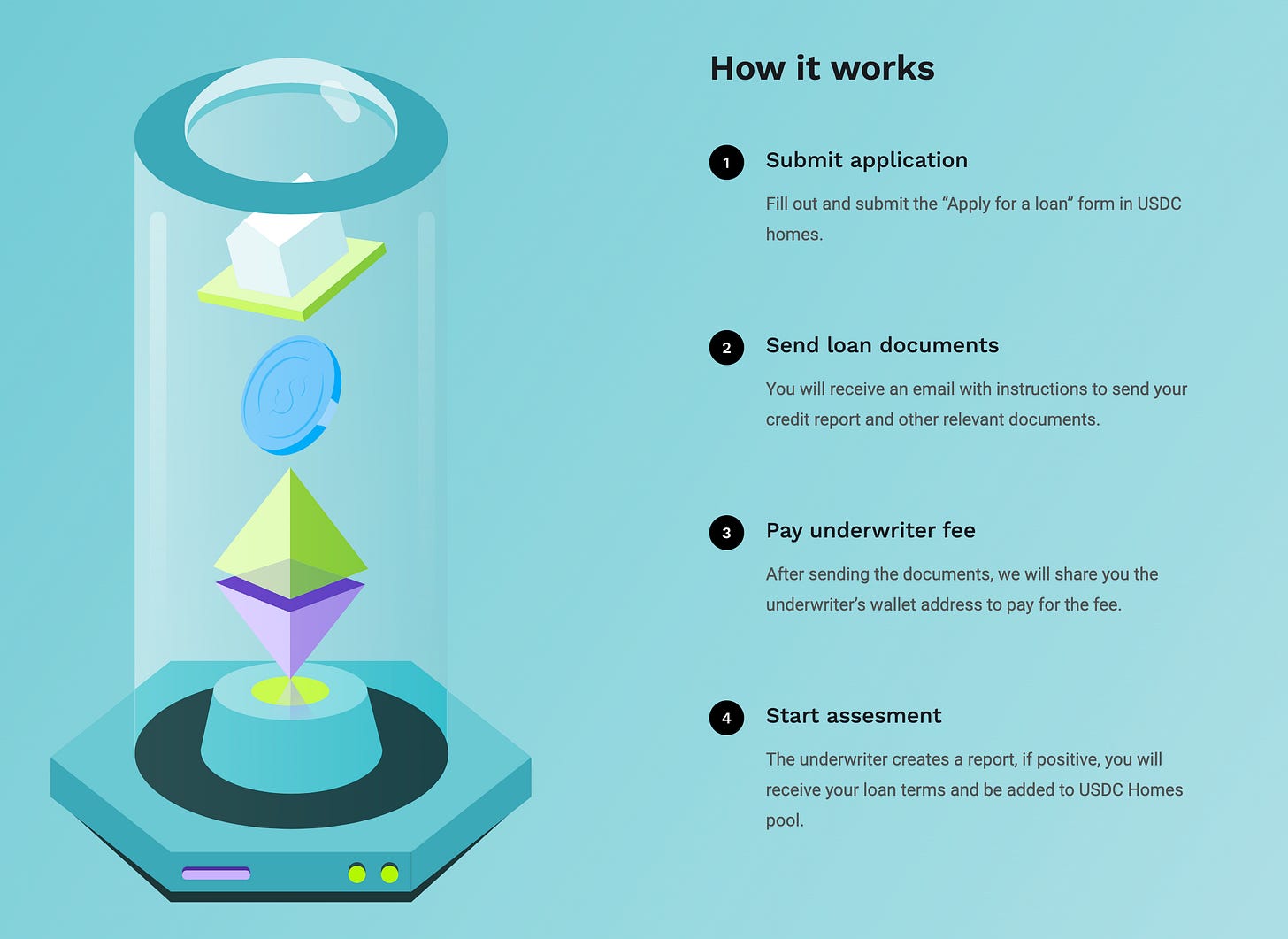

In addition, the company has launched its mortgage product, allowing investors to use their assets as collateral to secure funding to purchase real estate. The minimum loan amount is $1MM. The application process takes six steps, and the expected close time is 14 days.

Moon Mortgage is not the only company in the crypto mortgage game. Milo, for example, offers 30-year loans of up to $5MM with rates starting at 9.95%. DeFi marketplace USDC.Homes offers crypto mortgages for an NFT-tokenized real-world property where the down payment of the crypto mortgage is staked, and borrowers accrue interest on the collateral, offsetting a part of the monthly mortgage payment.

The real risk in using digital assets as collateral is the possibility of a margin call if the price of the assets drops significantly. And, as we have seen with other lenders, there may be risk in dealing with a centralized counterparty. However, given high interest rates charged by banks, perhaps some of these collateralized solutions can be more capital efficient for a subset of customers.

⭐🇬🇧 Rathbones Agrees Wealth Deal With Investec To Create £100B Business - Financial Times, April 4, London

Rathbones, the UK-based asset manager with £60B+ in funds, is acquiring the UK wealth management arm of Investec for an all-share deal valued at ~£850MM. Rathbones is expected to onboard an additional £40B+ from Investec to create a conglomerate with $100B+ in funds under management. That’s about 2% of assets as a metric for valuation, consistent with industry practices.

Rathbones has grown by acquiring smaller wealth-management firms — see the £105MM buyout of Speirs and Jefferey in 2018, followed by the £150M acquisition of Saunderson House in 2021. The industry in the UK remains highly competitive and fragmented, with the UK wealth sector estimated to hit 2.1T by 2024. Horizontal consolidation strategies continue to be attractive for building scale and modern products — see Abrdn's £1.5B acquisition of Interactive Investor in 2021 and JP Morgan's $1B acquisition of Nutmeg.

As traditional asset managers expand into digital distribution channels, they compete with modern players that offer clients a digitally native experience at a lower cost. A review of Rathbones' management fee structure compared to roboadvisor Moneyfarm shows that clients at Rathbone are paying significantly more. For an investment of £400K, fees at Rathbones run you £4,500 vs. £2,800 at Moneyfarm.

The other issue is that KPIs published by Rathbone in their 2022 annual report show that customer satisfaction is declining, and customers are 21% less likely to recommend the platform to someone than two years prior. The client experience is critical to the wealth management business proposition, so Rathbones must figure out how to reduce costs, stay competitive and retain customers. Some large asset managers struggle to compete — this week, Vanguard announced that it was shutting down its UK financial planning arm after a stint of fewer than 24 months. You can’t scale away from customer experience.

⭐🇮🇳 LGT Wealth India And Asset Vantage Announce Collaboration - IBS Intelligence, April 5, Mumbai

Private wealth management company LGT Wealth India has partnered with Asset Vantage (AV), a performance reporting company, to create a Full Stack Digital Family Office and Portfolio Analytics Solution. LGT Wealth India's offerings range from portfolio management and family offices to private markets and alternatives, while AV's platform provides financial data aggregation, portfolio performance, and integrated general ledger capabilities.

For financial data aggregation, AV's platform offers a smart upload feature that handles custodian account and bank data feeds. Additionally, the platform supports multi-asset class data aggregation, allowing for tracking art, jewellery, and cars, as well as life and property insurance policies. AV's portfolio performance feature handles investment accounting and reporting requirements, and performance measurement reports across sectors, geography, liquidity, and entity. They can also track illiquid assets (e.g. private equity) and performance return metrics like IRR. As for the integrated general ledger feature, it provides book-keeping built on global IFRS and GAAP standards.

Family offices have historically focused on liquid bond and equity markets, passive alternative investments (i.e., hedge funds and PE), and real estate, but India's family office industry has nearly doubled their allocation to private markets in the last six years. It is expected that family offices will account for 30% of the total $100B of Indian startup funding by the year 2025. Offerings like AV's portfolio reporting engine are required to reflect the rising importance of the asset class.

Curated News

North America News

⭐ 🇺🇸 United Capital Co-founders Launch Modern Wealth Management With $200MM Equity Financing From Crestview Partners - Businesswire, April 5, California

🇺🇸 Flourish Launches Integration With Redtail Technology Platform - Globe Newswire, April 4, New York

🇺🇸 New Premium Income Barrier ETFs™ Seek To Offer High Income With Built-in Barriers Against Loss, Over A 12-month Period - Globe Newswire, March 30, Illinois

🇨🇦 Digital Mortgage Brokerage Perch Opens Mortgage Investment Fund To Retail Investors - CNW, April 5, Toronto

EMEA News

⭐ 🇬🇧 Newcastle Wealth Innovator True Potential Hails Record Results As Assets Top £24B - BusinessLive, April 4, Newcastle

🇱🇮 Digital Asset Tech Provider Metaco Secures Partnership With Liechtenstein Private Bank - CoinDesk, April 4, Vaduz

🇦🇪 Sarwa Soars: 2.5x Growth In 3 Months With High-Yield Cash Account Offering - Zawya, April 5, Abu Dhabi

Asia Pacific News

🇨🇳 Hywin Launches WealthTech Platform To Enhance Its Services For High-Net-Worth Clients Through Data Analytics By Leveraging IBM Technology - Globe Newswire, April 4, Shanghai

🇭🇰 illio Launches Direct-To-Consumer App, Helping Everyone Make Sense Of Their Wealth - Digital Journal, April 4, Hong Kong

🇹🇭 KTB Targets Virtual Banking, Wealthtech - PR Newswire, April 5, Bangkok

🇸🇬 SG’s Endowus Cuts Less Than 10% Of Staff, Citing Market Downturn - Tech in Asia, March 31, Singapore

Blogs, Webinars, Podcasts

🇺🇸 Investor Satisfaction With Full-Service Financial Advisors Crumbles As Markets Fall, J.D. Power Finds - J.D. Power, April 4, Michigan

🇺🇸 Asset Management Industry Transforms to Align with Changing Financial Advisor Needs - Advisorhub, April 3, Massachusetts

🇺🇸 Stock ETFs See Lowest Quarterly Inflow Since Start Of Pandemic - Bloomberg, March 30, New York

🇮🇱 Wealthtech And The Democratization Of Investing: Opportunities For Retail Investors - Finance Magnates, March 31, Tel Aviv

Events & Reports

⭐ 🇺🇸 Envestnet Summit 2023 Elevate - Envestnet, April 26 - 27, Colorado

⭐ 🇺🇸 Fintech Nexus USA - Fintech Nexus, May 10 - 11, New York

🇺🇸 Wealth Management Edge - Informa Connect, May 21 - 24, Florida

🇺🇸 Finovate Spring - Informa Connect, May 23 - 25, California

🇬🇧 Innovation In Wealth Management - Professional Wealth Management, June 8, London

🇬🇧Private Banking & Wealth Management London Conference & Awards 2023 - Arena International, June 14, London

Shape your Future

Wondering what’s shaping the future of wealthtech, Fintech, and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry. Subscribe now to level up your knowledge and get access to our weekly Long Takes!

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime. Leave a comment below on what you think and what we should cover next.