Digital Wealth: UBS backs out of $1.4B Wealthfront acquisition, buys $70MM convert

Last month, UBS also sold its proprietary US alternative investment manager and the feeder fund platform known as “AlphaKeys Funds'' to iCapital

Dear Fintech Futurists,

Welcome to our Digital Wealth issue, the weekly news aggregator for digital investing, asset management, and wealthtech. For deeper dives, including Long Take analyses of wealthtech, subscribe below:

Fundraising?

Are you building in Fintech or Web3? We are actively investing in great teams at the pre-seed and seed stage. Click below to tell us about your company.

North America News

⭐🇺🇸 UBS Planned To Buy Robo-Advisor Wealthfront. Now The Deal’s Off - Barron’s, September 2, California

Swiss-bank UBS has terminated its $1.4B acquisition of roboadvisor Wealthfront after announcing the deal in January. Instead, the bank purchased a $69.7MM note convertible in Wealthfront shares, and the companies are supposedly exploring ways to still partner. Like that with SigFig.

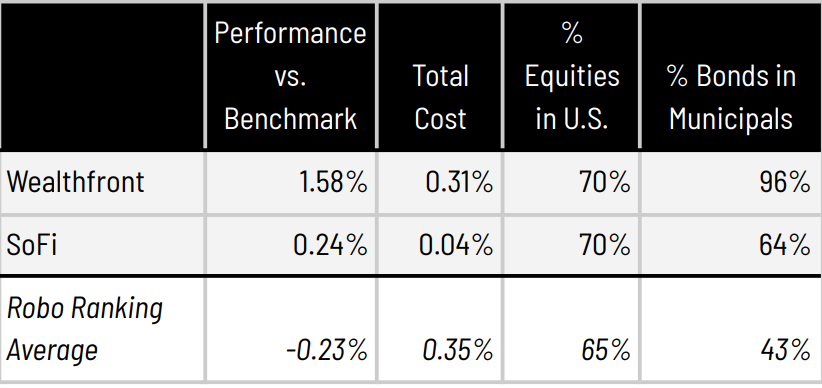

Wealthfront claims to be excited to remain an independent private company, but independent roboadvisors have experienced fairly slow growth as Schwab, Vanguard, Fidelity, Goldman, and Merrill all caught up with their own direct digital wealth and neobank offerings. Still, for what it’s worth, Wealthfront won ‘Best Overall Robo’ alongside SoFi this year.Last month, UBS sold its UBS Fund Advisor LLC, the UBS proprietary US alternative investment manager, and the feeder fund platform known as “AlphaKeys Funds'' to iCapital. We found this confusing considering UBS bought Wealthfront for digital distribution to retail and mass affluent investors but has sold its US alternative digital investment manager. Perhaps it’s not so confusing, and UBS is cutting riskier costs all around.

Who knows why the deal was terminated? We could guess that Colm Kelleher, who took over as chairman in April, has a different view from CEO Ralph Hamers about how UBS should grow its US business, who had said “If you expect [profits] to come from a business like that [Wealthfront] in the first five years, basically, you're setting it up for failure”. Or, perhaps Naureen Hassan, who led digital investing at Schwab and Morgan Stanley, now running UBS, would prefer to build rather than buy (h/t to Efi for the theory). Or, $1.4B is simply too much in the current environment, as fintech multiples dropped by 90%, and walking away is cheaper than buying in enterprise value terms.

The acquisition offered UBS 480,000 digital investors, $27B in AUM, and Wealthfront's proprietary tech. We guess they’ll have to spend that $1.4B on Google ads instead.

🇺🇸 iCapital® And Ares Wealth Management Solutions Expand Partnership - Businesswire, September 6, New York

🇺🇸 Orion Advisor Solutions Announces New Strategic Operating Model - Businesswire, September 6, Nebraska

🇺🇸 Wave Financial Acquires Geneva Based Criptonite Asset Management - PR Newswire, September 1, California

🇺🇸 InvestCloud Rolls Out 80 New Features For NaviPlan By InvestCloud, Further Positioning The Solution As North America’s Top Financial Planning Software For Wealth Clients - Businesswire, September 1, California

EMEA News

⭐🇦🇪 Digital Wealth Manager FinaMaze Launches US Rates Product - Finextra, September 6, Abu Dhabi

Digital wealth manager FinaMaze released an investment product meant to offset rising US Rates through hedging for retail clients. If US rates increase, the product will generate a positive performance, and a negative one if rates fall, providing a hedge against variable mortgage rates. FinaMaze portfolios are based around a number of themes, like Motif and Covestor before it — a US Rates Protect Smartfolio, the Black Swan Smartfolio, and Contrarian Bitcoin. The yearly management fee is 0.85%, and all Smartfolios are free to exit.

Pantera Capital claims the Fed will tighten considerably more than the markets currently forecast, and BlackRock sees “… inflation trending higher over the medium term than markets expect.” It is interesting to see more sophisticated hedging and derivative products becoming integrated into digital wealth footprints, alongside the usual Markowitz pie charts. It is also interesting to see how pervasive mobile distribution of financials has become across geographies.

🇫🇮 Selma Raises Additional CHF 7MM In Series A Extension Led By TX Ventures - Fintech News, September 2, Helsinki

🇬🇧 US Fintech Carta Snaps Up UK Counterpart Capdesk - Fintech Futures, September 5, London

Nom nom nom, goes private equity.

🇨🇭 SEBA Bank Enables Ether Staking As Merge Nears - Blockworks, September 7, Zug

Curated sponsorships

We work with select companies to deliver brand awareness to our 100,000+ digital finance audience. See our prior partners here, and reach out here with interest.

Asia Pacific News

⭐🇸🇬 Avaloq And Synpulse Sign License Reseller Agreement - EIN Newswires, September 7, Singapore

Avaloq, a wealth management SaaS firm that services 12MM HNWIs, and Synpulse, a management consulting firm, have finalized a 'license reseller' agreement to provide end-to-end digital solutions for private banks and wealth managers in Asia, starting with Indonesia.

Avaloq provides over 230 digital workflows via (1) Avaloq Engage, which helps relationship managers connect with clients using social messaging apps like WhatsApp or WeChat, and offers 100+ self-service features, such as chat bots to answer client requests; (2) Avaloq Wealth, an automated platform delivering investment strategies, risk analysis, and CRM, which in turn supports onboarding clients in hours vs. days; (3) Avaloq Core, a core banking solution, and (4) Avaloq Insight, which offers analytics and reporting. See here for more detail.

A 2022 Grand View Research report on wealth management highlights that financial institutions desire an integrated offering from their vendors. The success of FNZ, a wealth management platform-as-a-service firm that raised $1.4B this year, is a testament to this. Similarly to FNZ, Avaloq provides banks and wealth managers large software deployments to run their core operations.

🇸🇬 StashAway Partners BlackRock To Roll Out Multi-Asset Model Portfolios - Fintech News, September 1, Singapore

🇲🇾 Versa Asia Raises An Eight-Figure Funding Round - Fintech News, September 5, Kuala Lumpur

Digital storefronts are the only storefronts.

🇭🇰 Futu Securities (HK) To Launch 3 Risk-Based Model Portfolios With Franklin Templeton - Finance Feeds, September 7, Hong Kong

🇮🇳 ET Money's Retail Mutual Fund AUM Crosses $4B Mark - Economic Times, September 7, Haryana

Blogs, Webinars, Podcasts

🇨🇦 Why Integration Should Matter For Tech-Focused Wealth Firms - Wealth Professional, September 6, Toronto

🇮🇳 Tata Capital’s New Campaign Encourages Investors To Use The Digital Wealth Management App, Moneyfy - MediaBrief, September 7, Mumbai

🇭🇰 Wealth Managers Tap Mass-Affluent Market In Asia - The Asset, September 6, Hong Kong

🇮🇳 AI & ML Has Played A Huge Role In Revolutionizing The Wealth Management Industry - Express Computer, September 6, Mumbai

🇺🇸 Advisors Take On Alternatives - WealthManagement, September 6, New York

Events & Reports

🇺🇸 Wealthverse Summit - Eve Wealth, September 8, California

🇺🇸 Digital Asset Summit: 2022 - Blockworks, September 13-14, New York

🇺🇸 Boston Fintech Week - Boston Fintech Week, September 27-29, Massachusetts

🇺🇸 Crypto Wealth Summit - Eaglebrook Advisors, October 10-12, Florida

Shape your Future

Wondering what’s shaping the future of Fintech and Digital Wealth? At the Fintech Blueprint, we go down the rabbit hole to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.