Facebook and Bitfinex both want $1 Billion for Crypto Stablecoins, plus 15 short takes on top developments

Hi Fintech futurists --

Today, a longer take on the recent developments with Facebook and Bitfinex, and how to think about their expensive projects. The latest short takes on the Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below.

Thanks for reading and let me know your thoughts by email or in the comments!

Long Take: The Difference Between a $1 Billion Payments Rail and a $1 Billion Cash Equivalent, Facebook vs Bitfinex edition

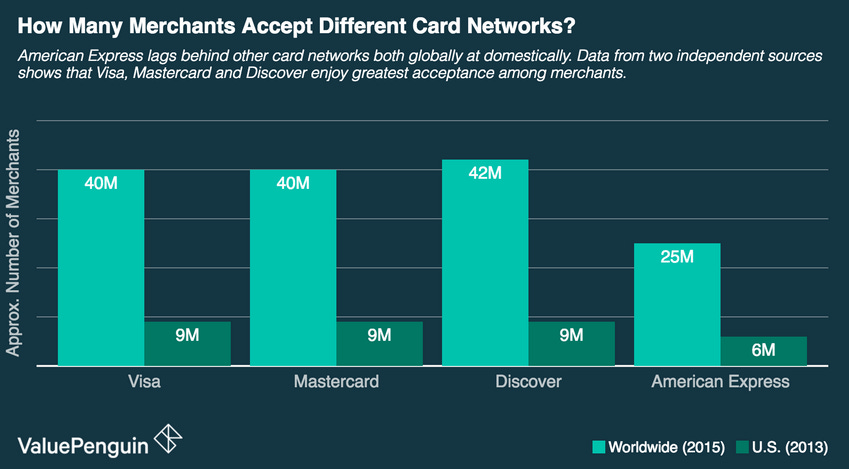

There is poetry in the symmetry of this situation. Bitfinex is looking to raise $1 billion in capital to support the most popular stablecoin Tether, which it controls. Facebook is reportedly looking to raise $1 billion in capital from First Data, Visa and Mastercard and other payments companies to shore up its own stablecoin asset. Poetry is where the similarities end, and all these devils are in the details.

You probably know this. If you don't, enjoy the dumpster fire. Tether (or USDT) has functioned as a "cash-sweep" or "money market fund" in the crypto ecosystem for years, and has amassed about $2.8 billion of market capitalization as a result. It has held a peg to the dollar by claiming that its parent organization, which has overlapping ownership with crypto-exchange Bitfinex, actually had the cash for a 1-to1 exchange. Just call up Tether and get your collateral! There have been obfuscating gymnastics and rumors about insolvency for years, but this did not matter because a cash equivalent is a must-have for brokerage businesses. You cannot efficiently function on barter, and BTC is rarely used as a unit of account. The world needed some sort of Tether, and as in Neil Gaiman's American Gods, belief is what sustains the Deity. Further, it seem that USDT functioned as an on-ramp for Chinese investors trying to avoid the regulatory ban. What of course surprises me, is that many other stablecoins experienced successful attacks trying to break their peg, but not Tether.

A variety of wild details, like comingled customer and corporate moneys, a lack of contracts between legal entities handling billions of dollars, and shady banks has emerged. In the most positive spin on the events, the lack of a traditional bank willing to open an account for Tether's reserves led them to use an unproven entity called Crypto Capital, which resulted in a lock-down of about $850 million. So best case, the stable-coin is backed by a claim on seized assets. To silence the naysayers, Bitfinex is planning to offer a $1 billion Initial Exchange Offering. If you've been purposefully trying to avoid learning what an IEO is -- sorry! It's just like an ICO, except instead of being open to everyone on the internet, it is placed by the "exchange" to its network of exchange investors. In other words, this is the highly regulated book-building and brokerage work of an investment banker. Purportedly, there is already $500 million of demand. The success of Binance in a similar endeavor is the most bullish argument. That this token has equity convertible rights would also make it the largest STO offering to date -- if properly registered (ha!). This mess, folks, is why we have regulation separating proprietary financial products, broker/dealers, and capital markets exchanges.

On the other side of the coin, there's Facebook. I've written about the social network's approach to blockchain and crypto assets before several times, but we've now got more dirt courtesy of the Wall Street Journal and the Block. Their project, named Libra, seeks to work with Visa, MasterCard, First Data, and likely other payments giants to create a new set of payments rails for the industry. It may hit on a couple other ideas: (1) consumer-to-business transactions in an underlying crypto asset that is backed by a currency reserve, (2) eliminate various processing fees, which range from 20 bps to 3%, from e-commerce, and (3) tie the advertising engine into the equation, by incentivizing commercial transactions that originate from ads through discounts and loyalty points. You can think of this as a Frankenstein of stablecoins, a payments network, and the Basic Attention Token. In other words, all the stuff I hoped Facebook wouldn't do.

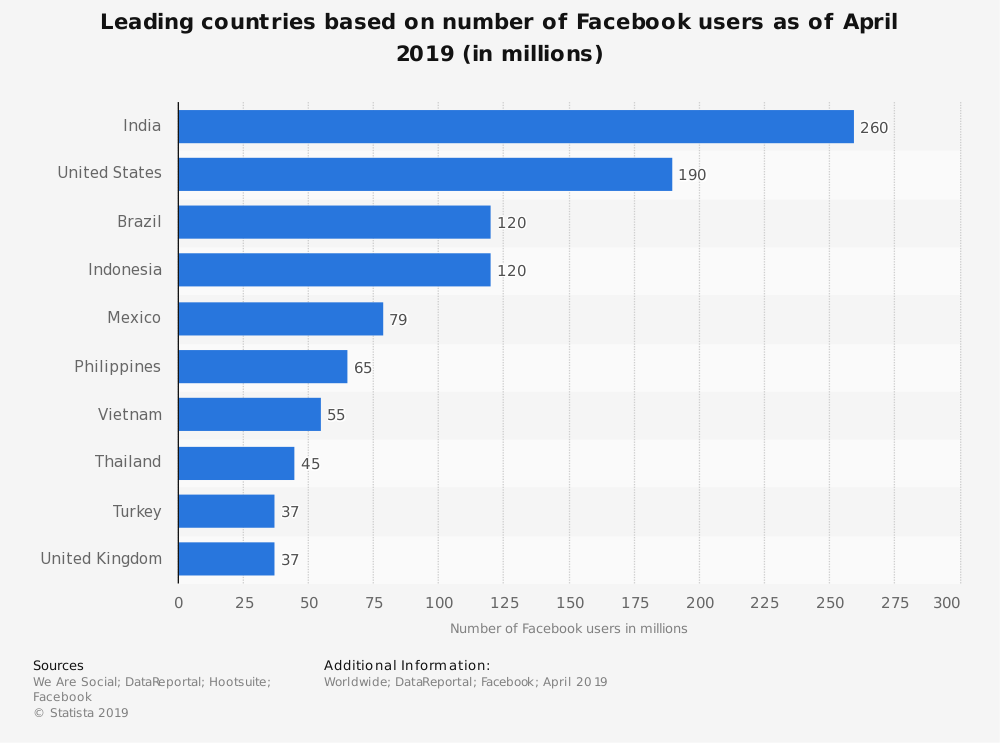

Regardless, the company is seeking $1 billion upfront to create the collateral to run its currency. There are some very reasonable, positive things to say about the effort. First, Visa and MasterCard are spectacular businesses with massive network effects. They are in nearly every consumer's wallet and every merchant's point-of-sale terminal. Those network effects are impossible for a start-up to challenge -- unless you have Facebook's 2.5 billion users and 50-100 million business pages. Challenging an open-loop payments network's reach with a social network's reach is a beautiful feint, and could compel the card companies to cede strategic ground. Second, the important part is not the stablecoin. People, the asset is boring and doesn't matter! A dollar is going to equal a dollar, in the best case. What matters are the rails to move the asset around, and what you can do if you travel on those rails.

As an example, with Tether, the best I can do is move it to some subset of crypto exchanges to buy other meme coins. It is a Capital Markets placeholder, subsidizing speculation and perhaps worse. With Facebook's effort, if successful, you will be able to use a fiat currency to transact in the real world. Your use case will be commerce -- an endless set of products and services. That such a currency is unlikely to be as decentralized as Bitcoin or as private as Zcash does not matter strategically; it can still win the use case, because Facebook already lives in the phones of half the world. In retrospect, we shouldn't be surprised. The dude running the effort ran PayPal. PayPal isn't money -- it's a means of payment. Alipay and WeChat have shown obvious, clear success in combining payments with messaging. If I were Stripe, Square, or Ripple, I'd be sweating bullets. Stripe can counter with Stellar/Chain, Square can counter with Bitcoin/Twitter, and Ripple can ... maybe run an Initial Exchange Offering.

Short Takes

Why the Apple Card Is the Gleaming Future of Money from Wired, Amazon Pay launches peer-to-peer payments in India and from TechCrunch, Tech's raid on the banks from the Economist. And of course the long take above about Facebook. I can't imagine what possible other evidence you could need.

Venmo has digital user base putting heat on Square and banks, but no plan to profit from it. Interesting stats -- 40 million annual active users for Venmo, 15 million monthly active users for Square's Cash. $300 million in revenue. Don't care about profits yet, good to be PayPal.

Most steer clear of in-school loans. This fintech wants in. The key point is that digital lenders are going to go after originating new student loans and competing with the Department of Education (smaller loans, worse credit), rather than just refinancing things. Important to think about this from a customer acquisition and lifetime value perspective.

First, Fire All The Brokers: How Lemonade, A Millennial-Loved Fintech Unicorn, Is Disrupting The Insurance Business. Interesting look into the numbers for these guys, with $57 million in premiums.

Marsh to Begin Rollout of Proof of Insurance Blockchain Platform, and Inside State Farm's blockchain journey. The days of "no production blockchain software" are coming to an end. Here you have to large insurance incumbents pushing towards mutualizing their infrastructure. A start-up won't be enough, but these cats will.

Samsung Developing Ethereum-Based Blockchain, May Issue Own Token. If you believe in public crypto assets, then hardware adoption and interoperability is one of your best bets. Being the default choice creates a lot of traction. I do wish they weren't forking Ethereum and instead contributed to the community more directly. Temptation too high!

With BTC Emphasis, Genesis Capital Reports $425 Million Originations in Q1. If you're wondering who is making money in crypto today, the answer is still the same. Broker/Dealers and the people enabling institutional trading. Lending is shorting by another name.

Microsoft launches a drag-and-drop machine learning tool. This is a big step towards more casual developers using machine learning in their apps. Upload the data, play around with some toggles, and artificial intelligence! Companies like DataRobot would be the ones to lose.

The New York Times Can Now Predict Your Emotions and Motivations After Reading a Story. The company tracks about 20 different emotions, and can pitch advertisers on connecting products to those feelings. Interesting idea for both distributing financial products better than just through keyword matching, as well as manufacturing feelings in your readers.

AI tech generates entire bodies of people who don't exist. As a creative professional, generative neural networks should make you think twice about automation of your job.

How Regions Bank Uses AI to Up Its CX Game (And Boost Revenue). I like this one. Regions used IBM to built two separate platforms: (1) internal next-best-action knowledge engine that guides customer interactions, and (2) a Watson-based call center routing software. Apparently paid for itself.

Confronting the risks of artificial intelligence. A pretty good job by McKinsey in laying out how to manage business risks created by AI deployments. Interesting to see this becoming a consulting practice product.

Magic Leap Raises $280M from Japanese Telecom NTT DOCOMO. Unlike the iPhone (ARkit), Oculus (games) and Hololens (military), I have no idea why Magic Leap is worth it's salt. But hey, Japanese conglomerates are maybe good at funding the future -- think SoftBank. On that note, if you don't want to hold the bag, just sell it! SoftBank is planning an IPO of its $100 billion Vision Fund: WSJ

Microsoft Shows Off Haptic VR Controller, Simulates Grabbing With Thumb & Two Fingers. Neat instantiation of rendered objects, making you literally feel the object. Long term, when we shop at Walmart through telepresence robots, this will help.

Oculus proved VR is too important to trust to Facebook. Interesting editorial on the danger of having an amoral company owning virtual representations of billions of people, with the ability to simulate various things they like and do. Echoes the concerns about deep-fakes. Certainly hoping that such digital identities will have strong regulatory protections, many of which already reside in IP law. And perhaps, these identities are permissioned and controlled by their progenitors.

Looking for more?

Get this writing directly in your Inbox by subscribing here

Fully updated website here, and LinkedIn over here.

Find me on Twitter here for Fintech and here for Digital Art.

Want to send me a note? Reach out here anytime.