Facebook's Supreme Court is like Compliance in Banks, or Chinese Communist Party entities in joint ventures; plus 13 short takes on top developments

Hi Fintech futurists --

In the long take this week, I dive into how the governance issues around Facebook's oversight board and WeWork's struggling IPO are leading to the creation of political bodies in private companies. We talk about Chinese Communist party panels as one example of a solution (!), as well as why banks like to call themselves technology companies. Exploring the macro-economic data around inequality provides a nice starting point for thinking about the next decade of story-telling in finance, which I see as increasingly open and free, literally.

The latest short takes on the Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below. Thanks for reading and let me know your thoughts by email or in the comments! Last but not least, these opinions are personal (or maybe made by a robot) and do not reflect any views of ConsenSys or other parties.

Long Take

I've seen a whole bunch of headlines this past week about how Facebook is launching its version of the "Supreme Court", as if that were an app feature. The oversight board is meant to police controversial content decisions, and have the power to overrule Zuck's judgment on political matters. Its charter is drafted as if Facebook's 3 billion users were citizens of an Internet nation. Add to this the insanity over WeWork's failing IPO plans, where the CEO has been personally named in the amended filing documents with clear checks on demonstrated abuses of power. We are drifting into a Twilight Zone episode where modern corporations act as if they were feudal states run by divine kings negotiating with their nobility over a Magna Carta. Which is actually sort of where we are.

So this got me thinking about the broader concept of narrative and the zeitgeist, which got me thinking about our elections and political disasters, which got me thinking about the direction the financial wind is blowing. And the productive conclusion of all this thinking is simple: you can see how the language of business is changing, and what values people are starting to articulate to be relevant in the modern world. These are the values around which finance will coalesce over the next decade. So learn the story now, and spread the word.

But let's step back. I want to point you to two sets of background reading; both I have mentioned before. The first source is Epsilon Theory, which is by far the best blog about macro-economic investing and understanding the Zeitgeist I have come across. To quote liberally: "The zeitgeist is the macro scale of our social lives as investors and as citizens. The zeitgeist is the long-term ecosystem of narrative colonies. It is the spirit of an age, the driving ideas of social interaction, active over decades. Although never seen and hardly felt at the human scale, the zeitgeist is exuded by a society, like placards held up by a stadium crowd."The Zeitgeist is what I believe you believe, and what you believe I believe, and what we each believe everyone else believes we believe. It changes all the time -- if your time scale is centuries or millennia, rather than next quarter's cashflows.

The second source is Wait But Why, again. One of the recent posts discusses how a population within some polity, or some organization, is a collection of humans cohering into a super-organism. This super-organism is subject to evolutionary pressures and therefore must survive through macro competition. We all recognize this as Capitalism -- as Wealthfront vs. Betterment, Goldman vs. JP Morgan, and Apple vs. Google.

But some super organisms have an internal operating system, or a brain -- depending on your preference for a technological or biological analogy -- that allows them to update their values, thinking, and future action. Such dynamic organizations can outcompete static ones. This is true both for corporations fighting with each other for markets, as well as for nation states fighting on the global stage using ideas and soft power (e.g., Hollywood movies, Russian propaganda bots). Below, you can see a visualization of one such political topic arranged as a distribution of the population's preference, shifting over time to modern values. Nothing is sacred -- not even the sacred things.

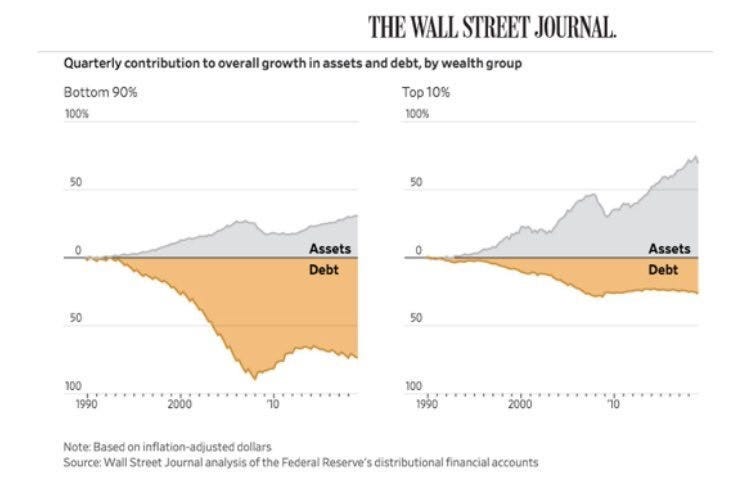

I bring this up to queue up the following: our collective conversation changes in response to underlying symptoms. There are many underlying symptoms that have led to the Trumpian and Brexit outcomes, but let me just highlight the clear economic one. In this case, I quote from Odin River's newsletter. Synthetic interest rate policy -- unnaturally low rates for over a decade -- have led to inflated asset prices and increasing inequality. The fact that over 20% of the global bond market has negative yield was an eye opener.

The math is easy. In a discounted cash flow model, which is the backbone of corporate finance and stock prices, you divide profits by the discount rate to bring the value forward into the present. If your firm makes $100 next year and interest rates are 10%, then today this is worth $100/110%, or about $91. If rates are 1%, then it is worth $99. We just made 9 bucks! And as time horizons get longer and terminal values get bigger (e.g., WeWork), that interest rate sure makes a fat difference. Wealthier people tend to hold more capital market assets, like stocks, and their nest eggs grow even if their income doesn't. Practically, there is also demand for higher rates. As a result, large investors put money into private markets and speculative opportunities. These private opportunities (e.g., WeWork) stay private longer, because there continue to be large investors who want a bite of the apple. Since these opportunities are reserved for accredited investors, and generally people with time and not three jobs, returns naturally accrue to people in the higher wealth bands.

Let's just look at a chart.

Political bodies have reacted by changing the story from a neoliberal narrative of democratic capitalist progress, to one that is re-oriented around global, open, socialist populism vs. nationalist, protectionist, xenophobic populism. The winning political position today is how to benefit the many rather than the few -- with the disagreement being primarily about who counts as the "many".

If you have been in Fintech over the last decade, you actually are complicit in this narrative change! I know, because I did it too. We used to say at NestEgg and AdvisorEngine -- "democratize access to investing". I am sure LendingClub wants to democratize access to lending, and Venmo wants to democratize access to payments, and Revolut wants to democratize access to banking, and Lemonade wants to democratize access to insurance. And of course our friends at Facebook are on the same story train, wanting to democratize access to financial services more broadly.

I am not saying we are all insincere in these aspirations. But I am saying that this positioning comes from a place of current social consciousness, caused by the economic outcomes derived out of the policies of prior governance models. Something though, something is a bit off. The cracks are showing. In his great Techonomy op-ed, David Kirkpatrick links the (structurally caused) endless supply of venture money with both (1) an unrealistic subsidized model of consumer benefits, highlighted by Uber, Airbnb, WeWork and other loss-making giants, and (2) the messed up incentives those companies operate under, creating the feudal outcomes that I described in the beginning of this post. In order to create massive unicorn outcomes to support the asset bubble in which we operate, the "game" of building companies requires management's tranformation into a genius-Steve-Jobs-level-founder. This has catalyzed increasingly sharp behavior on behalf of executives. It is no surprise that sharks emerge out of the Shark Tank.

What *is* somewhat surprising is that tech companies think they are as sovereign as countries. Being motivated by the drive to increase shareholder value, and the heft of your own wallet as a side effect, is not the same thing as governing citizens and thinking about their welfare. So it is alarming when pseudo-governmental entities are formed as appendages. Or that government entities actually see large corporations as such. Take for example the following: ECB executive board member Benoit Coeure says that the arrival of Facebook's putative cryptocurrency Libra has been a "wake up call" for central banks, and that public authorities should step up co-operation on the development of central bank backed digital currencies. Why is the ECB motivated by the top-down implementation from Facebook, but does not care about the bottom-up democratic adoption of Bitcoin and Ethereum? Is it a sovereign greeting its own kind?

I am also reminded of the practice in China to have Communist Party committees as part of the governance framework of private business. Perhaps such symbiosis is actually the correct answer. Imagine if democratically elected and governed political bodies were infused into our largest banks and corporates. This would be the next step after what the global CEO-led business roundtable (previously led by Jamie Dimon of JP Morgan, now led by Walmart) had announced a few months back -- a commitment to include customers, suppliers, employees, and communities as stakeholders, in addition to just maximizing shareholder value. Words are nice, but giving up power makes it real. I mean, I know this isn't the right idea, but at least we should talk about it!

Banks have been saying that they are technology companies wrapped around balance sheets ever since public company valuations for tech became embarassingly better than those in finance. Sorry for pulling up P/E ratios below rather than something more rigorous, but you get the point. Financials are not sexy -- they are utilities and commodities. Silicon Valley tech firms, on the other hand, tell a story that correlates with the growth of software and our attention getting sucked into mobile phones. And we all have mobile phones.

But banks and finance firms are far more like the Communist party example above than the tech companies, because they already have an embedded government appendage called Compliance. This is why, while Facebook is getting beat up for trying to create Libra, JP Morgan, Wells Fargo, and now even the not-so-modern asset manager Franklin Templeton are launching functional crypto currencies without much ado. The only thing that banks have no figured out -- nor have the Fintechs to be honest with you -- is how to tell the story the right way for how our political climate has shifted.

Here is what they need to do in order to outcompete, in the sense of the macro super-organism, the venture-capital backed attention arbitrage machines powered by our data. The answer is simple, and it is rooted in the language of the political debates across the world. Just say this:

We are all aggrieved. Our data has been stolen. Our financial wealth has stagnated. We are victim to mistaken economic policy. Robbed by inequality and monopoly, we now take the power back. We use software that is open source. We contribute to the commons. Financial products are free. Markets are open. Truth is carved into the stone of blockchain. Society's warts are purified in Artificial Intelligence. Shared aspirations are projected into Augmented Reality. This is our song, and we do it for you.

At least it sounds better than "we make money for our clients".

Featured Interviews, Podcasts, and Conferences

#ItzOnWealthTech Ep 25: How Software is Eating Banking with Lex Sokolin, ConsenSys. Had a great podcast conversation with Craig Iskowitz, covering everything from digital wealth, to artificial intelligence, to blockchain based assets and the evolution of banking. Highly recommended!

Introducing the DeFi Score — an open-source methodology to evaluate code and financial risk in DeFi lending. Excited about this initiative.

SIBOS, speaking on the Discovery stage about tokenization and the evolution of finance, on the 23-26th of September in London.

Lendit, speaking on the potential of payments cross with Augmented Reality on the 26th of September in London.

Digital Asset Strategy Summit, I've joined the speaking faculty at this great event for asset allocation and financial advisors docused on blockchain based assets, Ocotober 20-21st in Dallas.

Short Takes

Will Vanguard’s new robo squeeze out smaller players? Vanguard is 10 years late to pure roboadvice, but better than never. Its previous hybrid entry involved a human touch, while this one is fully automated, comes with a $3,000 minimum, is loaded with Vanguard funds, at a 15 bps cost. Between Schwab's free allocation and the continued evolution of the space, I think it will be hard to catch up.

Greenlight Financial Technology , the fintech company on a mission to empower parents to raise a generation of “financially-smart kids,” announced a $54 million Series B round. Really surprised this idea still has legs. The early 2010s saw a large number of digital players trying to to digital wealth for kids, and it was mostly a pipedream. There is a disconnect between what your user likes, and what your buyer likes -- but this company's modern take on a digital allowance (credit card with parental app controls) looks and feels different.

Payments giant Stripe is raising another $250M at a $35B pre-money valuation. If you needed another indicator that the public markets are dead, and are really just a way for venture capitalists and start-up employees to sell their stock to index ETF investors, look no further. I like Stripe, a lot. But it is too bad that the retail investor never got to go on this journey.

How the $20 million Santander STO bond was designed and distributed. The diagram is worth a thousand words, just click the link. Santander did all the bits with internal legal entities, but nothing is really preventing the world from adopting this workflow more broadly.

Stanford Grads’ Crypto Network Hits Half a Million Users in 6 Months. Instead securing the blockchain with cryptographic mining, the nodes are permissioned into the network through social reputation scores. Reminds me of how Ant Financial and other Chinese lenders bootstrapped digital lending in a country with no credit scores.

Cryptokitties creator Dapper Labs raises $11 million and unveils Flow blockchain. I am a big fan of crypto cats, as a tangible example of both (1) digital collectibles and (2) how deeply cats have inflitrated human society. But it seems a mistake to try and build another chain, rather than improving Ethereum and building sweet apps.

Mozilla, Creative Commons Partner With $100M Web Payments Fund. Speaking of more blockchains that maybe we don't want, Interledger (built by former Ripple CTO) is getting off the ground to address microtransactions and the Brave Browser use-case. What else could a browser do to defend its turf?

AI 50: America’s Most Promising Artificial Intelligence Companies. Forbes ranks what they think are the best AI companies. One observation is that these companies are cross-industry, wih auto, health, and finance coming up frequently. The second observation is that everything is AI now. I most enjoyed learning about People.ai, a Sales tool that tells your team what to do next, for its dystopian undertones.

Vianai emerges with $50M seed and a mission to simplify machine learning tech. A company gets a $50 million blank check to build machine learning software to help other companies look for business problems that machine learning software could help solve. Hmm.

Morgan Stanley Robot Learns by Reading Unreadable Muni Documents. Bloomberg paywalled article that talks about AI that reads bond legal documents. Matt Levine summarizes the takeaway as "Higher-quality debt tended to have more references to the financial statement than defaulted or downgraded debt. The more “boring” the documents, the better, the strategists said".

22-Year-Old VR Developer Lands $1M Contract With US Air Force. The software allows people to be trained in aircraft maintenance, without, you know, the aircraft. Interesting example of a commercial use-case for a digital twin, bought by enterprise.

Facebook Strikes Deal with Ray-Ban Parent Company to Design “AR glasses”. So the iPod beat all the other mp3 players of the moment with a great form factor. I have trouble following the same logic for AR glasses, even if they are desined by the best fashion house. Something more fundamental still needs to happen to how we engage with this content.

Autonomous vehicle startup Voyage has completed a $31m Series B round led by Franklin Templeton. Curious; a self driving car software company focused on retirement communities. Also curious; investment in the company came from some insurers who want to build car insurance product for self driving cars, but are getting disintermediated by Tesla, who is going direct. Could you imagine giving away a car for free, so that you can sell insurance?

Looking for more?

Find me on Twitter here for Fintech and here for Digital Art.

Want to send me a note? Reach out here anytime.