Fighting Chinese Artificial Intelligence with lasers and American Crypto with European Central Banks; plus 12 short takes on top developments

Hi Fintech futurists --

In the long take this week, I explore how AI and blockchain technology are double-edged swords, and how the increasing tension between the East and West is leading to different imagined roles for these tools. I look at several examples like (1) how Hong Kong protestors are using lasers to prevent Chinese cameras from identifying them with image recognition, or (2) Bank of England's governor is interested in global stablecoins to counterbalance the US, China, and the tech companies.

The latest short takes on the Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below. Thanks for reading and let me know your thoughts by email or in the comments!

Long Take

Social Identity Theory holds that human beings need groups to build self-esteem, in part to shape who they are, and in part to shape who they are not. Everything from team sports, to national flags, to celebrity worship, are driven by our desire to belong. This desire to belong can bring out the most beautiful selfless actions -- like taking care of your flock. And as with all things in human nature, it can bring out the worst in us -- like war and genocide. Our destructions are first imagined, and only then implemented into social life.

Technology has always been a reflection of that social life, and now more than ever it is being woven into the fabric of our institutions. I've come across a number of interesting symptoms of the emerging break between the East and the West, especially in how that break is manifesting in our technologies. I am not talking about Trump's trade war, though there is certainly ink to spill there for someone with an education in macroeconomics and intellectual property. I am talking about what it means to democratize access to something through technology, lifting people out of being "un-banked" or otherwise underserved by economic structure.

How do the Americans and the Chinese have such different ethical takes on privacy, self-sovereignty, media, and the role of government? We can trace the root cause to the DNA of the macro-organism in which individuals reside, itself built over centuries and millenia from the collective scar tissue of local human experience. But there is more to observe. The technology now being deployed in each jurisdiction -- like social credit, surveillance artificial intelligence, monitored payment rails, and central bank cryptocurrency -- will drive a software architecture into the core of our societies that reflects the current moment. And it will be nearly impossible to change! This is why *how* we democratize access to financial services matters. We must be careful about the form, because we will be stuck with it like Americans are stuck with the core banking systems from the 1970s. But the worry is not inefficiency, it is programmed social strata.

One positive story is that China has become a leader in artificial intelligence, and this is allowing the country to serve its massive population in new ways. Using a combination of social networking, text messaging, human data gathering, and behavioral metrics, the government is able to generate credit scoring for people out of thin air -- instead of waiting for them to create financial histories. Your personal character, rather than your deeds per se, becomes your key to accessing financial services, and this key can be used by third party tech providers.

This access is a clear good, right? Here's another very cool example -- As China turns towards facial recognition payments, are QR codes on their way out? Instead of swiping credit cards or scanning QR codes with phones, buyers can go into regular retail stores and have their face be their payments card. Alibaba has been on a kick outfitting local grocers across the country with such technology as part of the New Retail initiative. And if Alibaba knows your face for payments, you no longer have to carry around wallets or other hardware to get a sandwich.

This democratizing system creates efficiency, ease of use, and access. Everyone has a face! It is much simpler to get a selfie than to learn how to use a new user interface. Yet the democratizing system also captures your image -- mood, emotion, clothes, location -- every time you make a purchase. It wins on customer experience and becomes the default behavior, grooved into cultural stone.

Today, political tumult in Hong Kong is reaching a new high, resisting the Chinese imperative over the territory. As an unintended byproduct, people are afraid to use their payments cards. Instead of tapping modern NFC chips against payment terminals, they avoid digital rails entirely and choose to pay with cash. Instead of using subscription cards for the train, they purchase one-time paper rail tickets. The digital payments infrastructure is enabling not just convenience, but systemic surveillance and tracking of people's political speech, and associated "thought crime". Who built those rails, who has access, and what human rights are embedded into the software matters.

As for facial recognition, how about the concept that protestors are using laser pointers against cameras that can detect their identities, trying to fry the sensors? They are also using scarves, masks, and helmets in order to try and stay anonymous. Here, they are toppling over "smart lamp posts" with cameras that run crowd identification software. Such software, classifying people according to ethnicity and checking against government databases, has reportedly been also used for systemic control of a Chinese Muslim minority population.

I can't help but be reminded of 4Chan's Anonymous, the chaotic trolling hacktivist collective from the mid 2000s epitomized by the Guy Fawkes masks in V for Vendetta. Whether or not you believe the protests are justified, the fact that people are trying to fight machine vision with lasers to protect themselves from sovereign power is unreal. What is even more nuts is that this resistance has now become fashion, with anti-AI masks turning into art objects. You can break the algorithm with uncharacteristic beauty.

My takeaway from these symptoms goes back to the points made in the beginning -- whether you think AI is a liberator or a prison warden depends on the group to which you belong. As a Chinese citizen experiencing prosperity and access to new finance, these are likely interpreted as positive developments. As a Hong Kong protestor, or perhaps an American armchair philosopher, this looks like a fight against the machine. Remember that the gun can point in either direction.

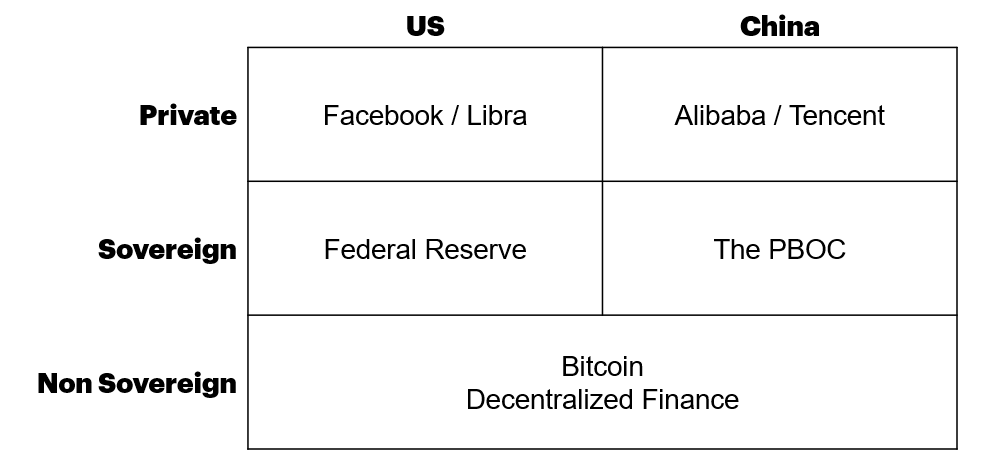

We see a similar story when it comes to digital currencies. We have now left the simple narrative of national central banks fighting Bitcoin, where there are two simple outcomes: (1) Bitcoin perseveres and wins, and (2) Bitcoin is shut down through economic or deadly force. Instead, there is a global "Us vs. Them" dynamic that has developed between the US and China, resulting in international Fintech warfare. In response to non-sovereign digital assets, like BTC and those of Decentralized Finance, private companies like Facebook moved to internalize the benefits of new financial infrastructure. Ant Financial has been at it for almost a decade. It is a competitive advantage to be first to platform, and Facebook is now asking for permission to bend (or maybe break) the tradititonal rules of financial regulation for the benefit of the whole American group.

We might not want Facebook to be in charge of our digital moneys, goes the argument, but we might not want the PBOC to do it even more. Of course the PBOC is moving ahead with a central bank digital currency, one that is being built in response to Bitcoin and ICOs. It will come with mandatory KYC and modern mobile wallets -- features that will likely save many Chinese consumers from falling prey to pyramid schemes and p2p lending frauds. It will also, inadvertendly, come with the ability to disenfranchise mobile wallet users from using their assets if the government so decides. All the while, the US Federal Reserve is still trying to get Faster Payments off the ground, without mentioning the word "blockchain" even once.

Bank of England governor Mark Carney takes it one step further. From the perspective of Europe, caught between the Dollar, the Yuan, and the capitalist rocket engines of Google and Facebook, a synthetic multi-currency digital stablecoin is becoming an interesting choice. What if the world's reserve currency were to be structured like Libra, with participating parties contributing assets and running software nodes to maintain network access and security? What if the United States didn't see artitificial financial demand for the dollar, as governments and businesses manage their foreign exchange risks with a global digital currency?

You might start with an answer that looks like a publicly administered form of Libra, but I am guessing you'd actually end up with something a lot like Bitcoin. Nations do not want to give up economic advantage relative to each other, and the only thing more powerful than wanting to pursue your own benefit (i.e., Us) is the fear that your competitor (i.e., Them) is pursuing their benefit faster and better. Someone mathematically-inclined may want to model this out as a robust game theoretical model. My intuition is that there is a Prisoner's Dilemma structure in this global competition for digital assets, and that the equilibrium sits with the consumer benefitting as governments and private parties try to prevent each other from winning.

Short Takes

Capital One Acquires FinTech Robo-Adviser United Income. This one caught my eye for a few reasons. United Income is a great idea -- a roboadvisor for Baby Boomers. This seems an underserved and important demographic. Second, the founder had previously built and sold HelloWallet to Morningstar for about $50 million -- a nice base hit. Last, Capital One used to be an early owner of Sharebuilder, a very early roboadvisor, which they messed up and sold to eTrade because it was "non strategic". So all in, this acquisition makes no sense to me, other than to say maybe the model didn't work? Another head scratcher here: Wealthfront buys financial planning startup Grove.

Better.com Raises $160M Series C At $600M+ Valuation To Speed Up Mortgage Lending. Stuff like this just signals to me that much of the blue ocean in B2C fintech opportunity is over, and there have emerged vertical winners in nearly all product categories. Also, their revenue run-rate is over $100 million, which also tells me it is easier to start a business giving out money (e.g., lending by Better) than taking other people's money (e.g., investment management by Betterment).

How insurers should think about digital in distribution. I found the points in this McKinsey piece relevant. It touches on how trust is shifting from banks, who sold insurance through a bankassurance model, to mobile devices. Engagement on these devices, and the data they collect, can be triggers to understand customer life events, and trigger related product sales. In lightly related news, AmeriLife just bought up a $2B+ Turnkey Asset Management Platform, Brookstone, to enable their agents to become wealth managers.

The Exclusive Inside Story Of The Fall Of Overstock’s Mad King, Patrick Byrne. This, this you got to read. The details about Byrne are pretty incredible -- from a romantic relationship with a Russian spy now doing jail time, to feuding with Wall Street for imagined short selling, to the grandiose vision swing of tZero. What stuck out at me was that the tZero CEO took home about $5 million last year, and the CTO about $2 million. That's not a big number when the WeWork name alone is somehow worth $5 million, but still.

Ethereum Poised to Be First Public Blockchain in Hyperledger Consortium. Pretty excited about this one. Pantheon, an enterprise-grade deployment of Ethereum, is likely going to be part of open-source consortium Hyperledger. Enterprise doesn't need to miss out on the potential of DeFi and the growing innovation on public chains.

Coindesk's In Berlin, A ‘DAO Renaissance’ Begins, and Totle's How to mix and match the tools in decentralized finance to make new products and services, and ConsenSys' Tachyon III: The Opportunity for Open Finance, and Coinbase's Use dapps on any desktop browser with Coinbase Wallet’s WalletLink. If you are not building something around decentralized programmable organizations today, you will kick yourself in five years.

H2O raises $72.5 million to simplify enterprise AI deployment. This company provides a neat looking front-end and testing environment to automate the creation of AI algorithms. Seems like Data Robot to me, but with perhaps an easier way to plug in your data. They also open sourced a meaningful part of the code, which in a world of Google, Facebook, and Amazon is increasingly appealing.

Amazon Forecast hits general availability. This is an Artificial Intelligence service from Amazon to predict consumer demand, improve forecasting, and figure out human resourcing. The software runs on Amazon's cloud, and is aimed at large enterprises using massive contextual data sets, like seasonality. Can't wait for a ML model to tell big public companies how many people to hire and fire. More out of the box AI isn't necessarilly a good thing.

George Keeps You Healthy. But some AI isn't just capitalist profit optimization! Check out BlueDot, which predicts disease outbreaks (like Zika) and saves lives. It also helps insurers pay out less in claims.

The Incumbent’s Advantage in the Internet of Things. The BCG treatment on the topic of "Who will win in IoT"? Their answer is incumbents (think heavy industry, agriculture, or smart cities), because they have the customers, the data, and the scale. One interesting discussion is the path to monetization for the expensive investment this requires: (1) charge more for connected devices, (2) charge for the IoT software itself, (3) make money on ecosystems. But we do know that in finance, when you connect something up, it becomes less expensive -- not more.

The Smart Augmented Reality Glasses Market Is Poised for Rapid Growth, with Global Shipments to Reach 19.7 Million Units by 2025, According to Tractica. The report is behind a paywall, so I'll save you the click. In 2018, barely 100,000 AR glasses had been sold -- lagging far behind the millions of dedicated VR headsets, and dozens of millions of AR enabled phones. But that may change if enterprises start to deploy these devices to their workforces, who then become de facto cyborgs.

Are You Ready for Augmented Reality in your Car? So one silly question is whether AR or AI will be the first to own the car. The AI car talks to you, and you talk back. Amazon's Alexa powers the operating system. The AR car uses the windshield as a holographic display to launch integrated visual apps for humans to navigate. The answer could be both -- but these are slightly different visions.

Featured

Four videos / podcasts for your this week:

Had a blast doing a livecast with Will Beeson of Rebank. Give us some feedback on how to make these better!

Hour long dive into blockchain and DeFi with Tom Federman. Definitely check this one out.

Great conversation with Steve Sanduski about the future of financial advice, the rebundling of Fintech verticals, and how to win on being human.

Quick interview with BlockTV about what to expect at the ConsenSys Ethereal conference in Tel Aviv.

Looking for more?

Find me on Twitter here for Fintech and here for Digital Art.

Want to send me a note? Reach out here anytime.