Financial Analysis: Dissecting Monzo’s new $5B valuation and 9MM UK customers

Breaking down the path to growth in the UK and overseas

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: UK neobank Monzo announced a new funding round at a $5B valuation. The news comes as the company recently reached 9MM UK customers, placing it as the 7th largest bank in the country by users. But it is also the first among its competitors to raise funding in nearly two years, amidst a 34% decline in venture capital deployed in the fintech sector. This week, we review the investment case for Monzo, benchmarking its new valuation against competitors and the broader fintech space. We analyze the firm’s recent performance, new products, and its expected path to growth.

Topics: Neobanks, Valuations, Regulation, Monzo, Revolut, Chime, SoFi

Special thanks to Michiel for this fantastic analysis

If you got value from this article, let us know your thoughts! And to recommend new topics and companies for coverage, leave a note below.

Long Take

Becoming Monzo

Monzo Bank was founded in London by Tom Blofield, a fintech entrepreneur and ex-CTO of competitor Starling Bank, which launched in 2014. In 2015, alongside an entourage of former colleagues and senior managers from Starling, Blofield jumped ship to form his own neobank.

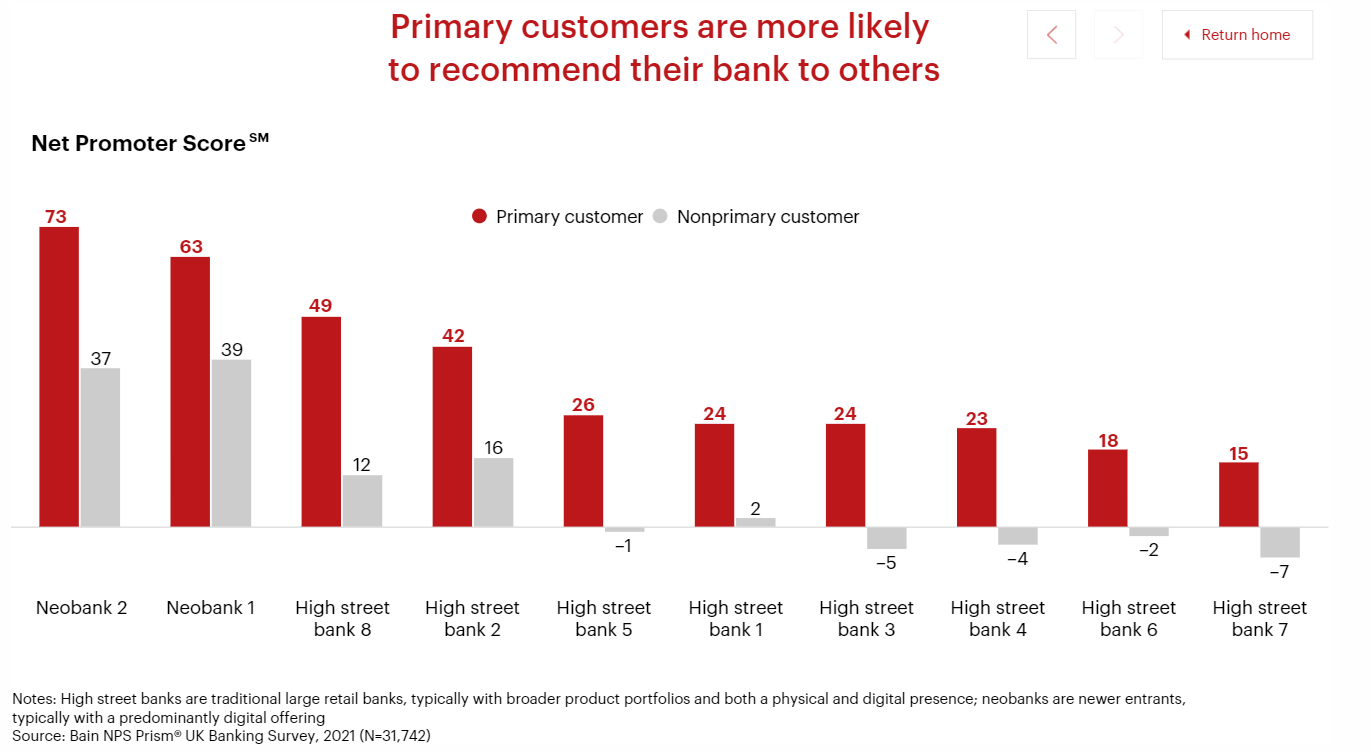

Like many fintechs, Monzo launched with the aim of providing transparent and convenient banking. At the time, customers were increasingly dissatisfied with the opaque pricing models and clunky digital experiences offered by incumbents — a problem that still hasn’t been fully solved. Research by Bain shows high street bank customers remain 3x less likely to recommend their bank to others compared to neobank clients.

With that in mind, the company engaged customers early-on with hackathons, community meetups, and user suggestion forums to help shape their initial app-based banking product. In fact, the name Monzo itself came as a result of a naming suggestion contest. The firm launched with prepaid spending cards and budgeting features before being granted a UK banking license in 2017.

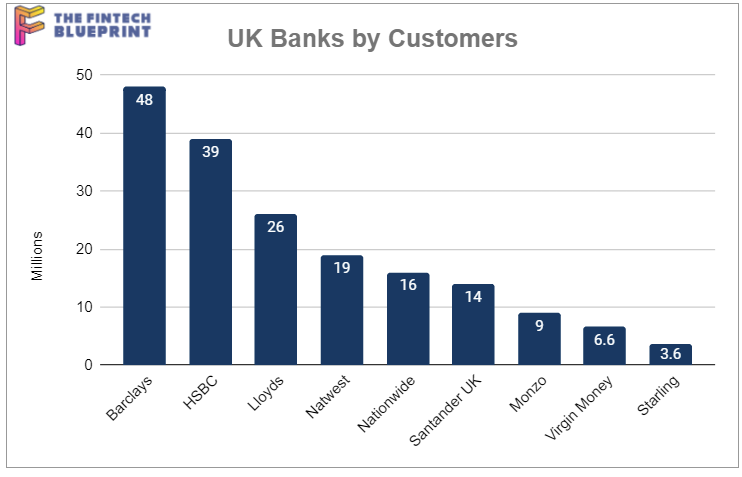

The bank license led to the rollout of a wider suite of products spanning current and savings accounts, unsecured lending, BNPL, and most recently passive investments. Today, Monzo serves 9MM customers in the UK with 400,000 business accounts, placing it as the 7th largest UK bank by number of users.

Valuation & Financials

Its latest $430MM funding round values Monzo at $5B, a 19x multiple on 2022 revenues. Investors are valuing the company higher than other publicly listed fintechs, which currently trade at a median of 5x trailing 12-month revenue. Monzo’s previous round in 2021, at the height of the pandemic funding frenzy, raised at a 56x multiple compared to the 25x of listed competitors.

This is impressive, since growth capital for fintechs has been scarce, particularly at elevated valuations. Higher interest rates and economic uncertainty have led to a 75% decrease in fintech funding compared to 2021. In fact, Monzo is among the first of its competitors to raise in this environment.

What are investors betting on? For one, Monzo posted strong numbers