Financial Analysis: Understanding Revolut's $2.2B revenue & $540MM+ profits

Higher interest rates have significantly boosted the profitability of leading neobanks.

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We analyze Revolut’s incredible annual results and $544MM in profits. This is discussed in the context of the resurgence of neobanks amid higher interest rates. Notable successes include Nubank, Revolut, Starling, and Monzo, which have seen significant profitability and growth. American neobanks like SoFi and Dave lag due to their reliance on third-party services and inflated SPAC valuations. Revolut's impressive 2023 results highlight its transition to a bank-like entity, despite regulatory hurdles. The comparison with UK peers shows varied strategies and valuations, underscoring the importance of speed and execution in fintech.

Topics: Nubank, Revolut, Starling, Monzo, SoFi, Dave, MoneyLion

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

Long Take

The Neobank resurgence

Higher for longer interest rates have been a gift to fintechs.

If you offer yield on cash, have access to a deposit base, and have some semblance of a banking license, the last few years have worked out well. Covid may have led to an incredible number of new users. However, inflation and higher rates have built out a meaningful value proposition for online banks.

As a result, we have seen profitability and meaningful economic success in many of the neobanks across the world — Nubank trades at $60B in marketcap, Revolut wants to raise at $40B, Starling is looking at $10B, and Monzo has just raised at a $5B+ valuation.

You might look at the American players, and be confused. SoFi, Dave, MoneyLion are all underperforming.

However, this is due to two reasons — (1) the American neobanks aren’t really banks, and rely on third party financial services companies and middleware platforms to glue together services, and (2) these public companies went public at SPAC valuations of 50x revenues, only to re-price to financial multiples of 3-5x. Instead of looking at valuations, look at fundamentals. SoFi is running at $2.5B in revenue and $300M of profit. Dave is generating $300MM of revenue and is also profitable. We expect Chime and Varo to be even larger.

However, Europe is the geography to watch, and its largest champion Revolut has just crushed its 2023 results.

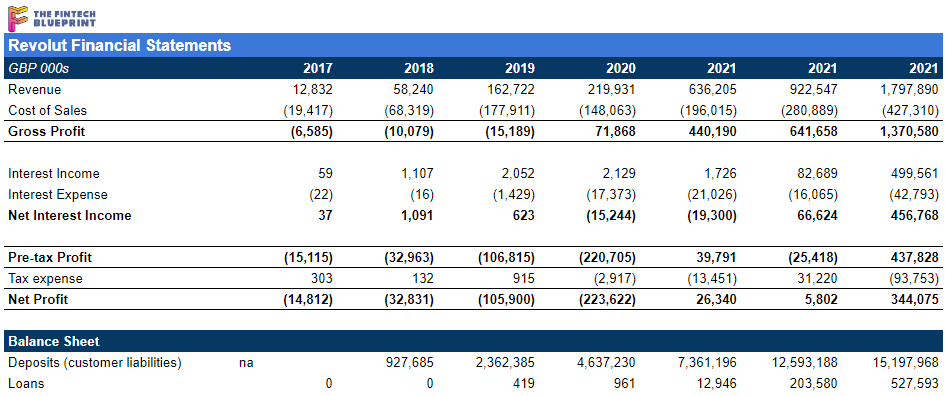

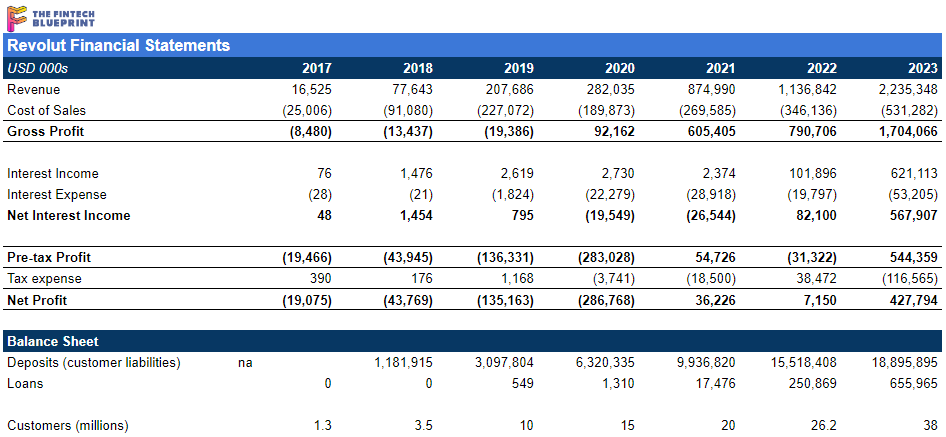

We summarize the P&L below, and convert the numbers from GBP to USD for comparison to our American friends.

Revenues have doubled from over $1.1B in 2022 to $2.2B in 2023. Even more impressive is the growth in pre-tax profit.

Prior to 2020, the company was losing money, and its 2021 result was met with skepticism due to the Covid environment and questions about accounting practices. However, by 2022 the company started to generate $100MM+ in interest income. In 2023 that number had increased 6x to over $600MM.

Now, that’s a real business model. Will that be enough?