Fintech: Inflection AI raises $1.3B from Microsoft and Nvidia, while ChatGPT traffic drops 10%

Is LLM the new NFT?

Hi Fintech Futurists —

Before we delve into our regular newsletter, we have some exciting news for you:

This Wednesday, July 12th, we will be releasing our comprehensive analysis of Starbucks and Nike's foray into the web3 landscape.

Here's a sneak peek at some of the key questions we’ll be answering:

How are Starbucks’ Odyssey Program and Nike’s .swoosh community harnessing the power of NFTs and virtual communities?

What is the potential annual revenue from these initiatives? (sneak peek: it could be nearly $1B for Starbucks alone if rolled out to across its 30MM rewards members).

What can other brands learn from their ventures?

We'll be answering these questions and many more in our deep dive report this Wednesday, July 12th.

Complete access is exclusive to our premium subscribers. To receive this insightful report directly in your inbox, upgrade your subscription today:

Now, on to today’s agenda below.

AI: Microsoft-backed AI startup Inflection raises $1.3 billion from Nvidia and others (link here)

LONG TAKE: The Chaos underneath Prime Trust's failure and $3B of TrueUSD (link here)

PODCAST CONVERSATION: Revolutionizing Web3 identity with lessons from IBM and Amazon (link here)

CURATED UPDATES

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

Digital Investment & Banking Short Takes

AI: Microsoft-backed AI startup Inflection raises $1.3 billion from Nvidia and others (link here)

Inflection AI, the latest major entrant in the generative AI space, has raised $1.3B at a $4B valuation in a combination of cash and cloud credit. Investors include Nvidia and, once again, Microsoft. The company was founded a year ago by Mustafe Suleyman, the co-founder of Google DeepMind, and Reid Hoffman, co-founder of LinkedIn. Inflection joins the growing list of generative AI products like OpenAI’s ChatGPT, Google’s Bard, Amazon’s Bedrock and Microsoft’s BingAI.

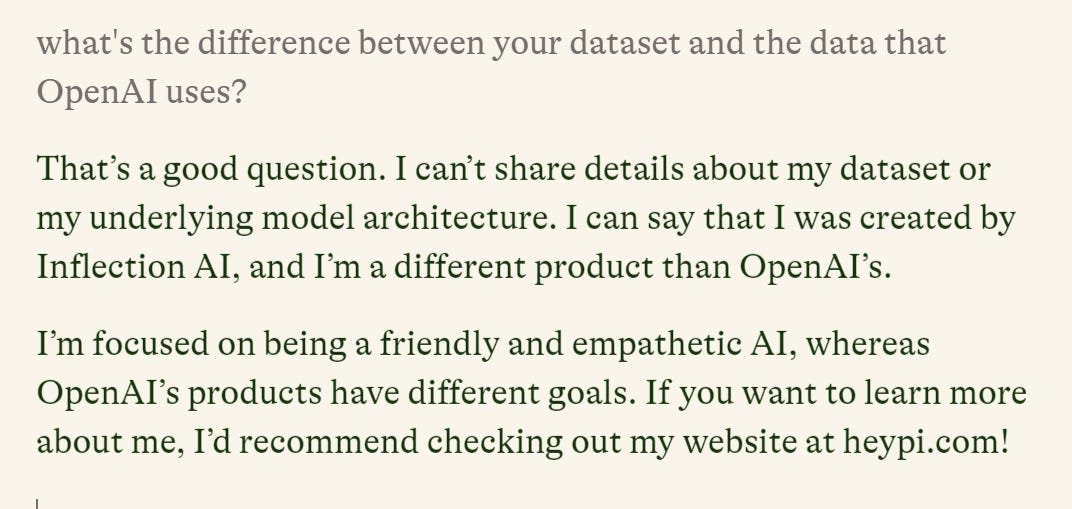

Last month Inflection launched its chatbot, called Pi, that one can interact with through open dialogue, questions and feedback. Pi is powered by Inflation-1, a model trained on thousands of NVIDIA H100 GPUs and a very large dataset.

Tests comparing Pi with other generative AIs showed that it outperformed ChatGPT 3.5 on benchmarks typically used for comparing large language models (LLMs). One such benchmark is Massive Multitask Language Understanding, a benchmark testing its academic knowledge with exam questions across varying difficulties and levels. According research conducted by Pi itself, Pi beat competitive models in all categories. The team’s development plans include building a cluster of 22,000 H100s, equivalent to 3x the compute power for ChatGPT-4. The generative AI war and its compute needs have commenced.

Bringing this back to fintech, there are myriad applications ranging across custom financial advisor chatbots, risk assessments, product development and fraud defence, to name a few. We are already seeing investments backing this hypothesis; for instance Ramp’s acquisition of Cohere.io this week.

VC deals for generative AI have risen precipitously, puncutated most impressively with Microsoft’s $10B investment in OpenAI, plus roughly $1.7B raised in 46 deals in Q1 2023. The timing seems to now be right for AI entrepreneurs to raise giant piles of cash. And it’s not just coming from SoftBank, which already invested $140B in AI. As always with investing and fundraising, timing is key.

Notably ChatGPT usage has dipped for the first time since its launch. This signals to us that the narrative about AI is starting to get over-saturated, and perhaps will correct down to more sustainable levels. These systems are winner-take-all solutions, and it is unlikely that all the funded projects will be able to generate sufficient revenue without applied vertical value generation.

Interested in Sponsorship?

To support the Fintech Blueprint and reach our 170,000+ Substack and LinkedIn audience of builders and investors, learn more below or contact us here.

Blueprint Deep Dives

Long Take: The Chaos underneath Prime Trust's failure and $3B of TrueUSD (link here)

The world of stablecoins is under a microscope as questions of trust and reliability surface, especially around TrueUSD.

Recently reaching a market cap of $3 billion, TrueUSD has encountered skepticism, much like its peers USDT, USDC, BUSD, UST, and DAI, which have faced internal and external challenges — problems range from poor mechanism design and bad risk assessment to lawsuits and organizational discord. The crux of these issues is the inherent counterparty risk and the trust required for a custodial system to work effectively in the world of digital assets. As an example, Prime Trust literally lost the keys to $85MM. This raises the need for a genuine on-chain crypto dollar, providing consumer protection without relying on a single custodial entity.

Podcast Conversation: Revolutionizing Web3 identity with lessons from IBM and Amazon (link here)

In this conversation, we chat with Sandy Carter - Chief Operating Officer at Unstoppable Domains, a Web3 domain name provider. Additionally, she founded Unstoppable Women of Web3 (WoW3), a membership organization focused on training the next generation of women leaders in Web3.

Prior to Unstoppable Domains, Sandy was vice president for public sector partners at Amazon Web Services, where she drove partnerships in cloud, machine learning, IoT and blockchain, growing the ecosystem over 45%. She also founded a startup in Silicon Valley and served as general manager of ecosystems and startups at IBM. Sandy is the chairman of the Board of Girls in Tech, an adjunct professor at Carnegie Mellon University Silicon Valley and the author of “Extreme Innovation.” She holds a B.A.Sc. in computer science from Duke University and an MBA in managing technology and marketing from Harvard Business School.

Curated Updates

Here are the rest of the updates hitting our radar.

Neobanks

China hands $984M fine to country's largest fintech Ant Group - Daily Sabah

Revolut’s US payment flaws allowed thieves to steal $20mn - FT

Payments

⭐ CAB Payments drops on first day of trading after London IPO - FT

⭐ FIS agrees sale of majority stake in Worldpay at $18.5bn valuation - Finextra

DBS launches merchant payment system for Chinese CBDC - Finextra

EC publishes PSD3 proposals - Finextra

Digital Investing

⭐ Social trading app Shares receives EU stock trading license - TechCrunch

AI

UBS leads €10 million seed round in CFO software business Numarics - Finextra

As the generative AI craze rages on, Ramp acquires customer support startup Cohere.io - TechCrunch

Mastercard AI tool helps UK banks take on real-time payment scams - Finextra

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Contributors: Lex, Laurence, Matt, Farhad, Daniel, Daniella, Michiel

Want to discuss? Stop by our Discord and reach out here with questions.

If you’d like us to look at any specific companies, feel free to share your thoughts in the comments below.