Fintech: Who will be disrupted by FedNow?; TP24 gets £345MM for SME digital lending

Opinions on FedNow are sharply divided, with some viewing it as a potential threat to freedom, while others hail it as a great technological initiative

Hi Fintech Futurists —

Before we delve into our regular newsletter, we have some exciting news for you:

This Wednesday, July 26th, we will be releasing the 7th edition of our Building Company Playbook.

🚀 In Playbook #7, we will be exploring:

The essential role of an exit strategy in your fintech journey and its impact on your venture's success

How to evaluate and decide between different exit options—sale, merger, or IPO

How to navigate and overcome potential exit obstacles

Insider tips and insights on negotiating an advantageous exit deal

To gain access to this upcoming chapter AND the previous six editions of the Building Company Playbook, upgrade your subscription today:

As always, thanks for your time and attention. Today’s agenda is below.

PAYMENTS: FedNow Is Finally Live In The US (link here)

LENDING: Fintech Lender TP24 Secures £345MM For SME Revolving Credit (link here)

LONG TAKE: Growing financial engagement with messaging in Coinbase Wallet, Venmo, and the super apps (link here)

PODCAST CONVERSATION: How to build an investment fintech with over 3 million members in 3 years, with Public Founder Leif Abraham (link here)

CURATED UPDATES

In Partnership: Webinar on Alternative Credit Data — Real World Results to Reduce Default Rates

Over the past decade, consumer lenders have taken small steps towards incorporating alternative data into their underwriting. Today, we are at a pivotal point where we can redefine how lenders consider creditworthiness. In this session, you will learn what types of data have the most impact, how lenders are incorporating this data into existing credit models, how it is impacting default rates, and more.

👉 Join us on July 26 at 2pm ET by registering below.

Digital Investment & Banking Short Takes

PAYMENTS: FedNow Is Finally Live In The US (link here)

The US banking infrastructure has grappled with the challenge of outdated payment rails for years. Systems like Automated Clearing House (ACH) transfers are notorious for their lengthy processing times. Moreover, many legacy payment systems are limited to operating during fixed “business hours,” the definition of which has been changing since the advent of the internet. On top of that, these payment rails often fail to provide real-time transaction visibility. To address these challenges, the Federal Reserve launched FedNow—a system for instant payments.

Each day, customers (i.e., the banks and credit unions) get their end-of-day balance reports and can access intraday credit during the service's business day. FedNow also provides liquidity management transfers for instant payment services, alongside optional features like fraud prevention tools, request for payment capability, and tools for handling payment inquiries. Unlike private money-transferring services like PayPal or Venmo, FedNow services are not directly offered to consumers. The service has been adopted by 35 banks and credit unions, including JPMorgan Chase and Wells Fargo, along with the US Department of the Treasury's Bureau of the Fiscal Service. Furthermore, 16 service providers, including Finastra, FIS, Jack Henry, and Temenos, are supporting FedNow payment processing. Some speculate this could be an early glimpse of a Central Bank Digital Currency (CBDC) in the making.

The payment systems in the US were set up long before digital payments became the standard. While they have reliably served us for decades, their lack of speed and flexibility no longer align with the demands of today's fast-paced world. Fintech companies have stepped in to breathe new life into these antiquated rails — companies like Stripe and Plaid created new payment rails on top of the existing infrastructure. Industry giants like Visa have partnered with PayPal, which owns Venmo, to facilitate digital payments across different apps. And we've seen an emergence of blockchain-powered stablecoins, like USDC, which can enable cross-border transactions. There are thousands of paytech solutions.

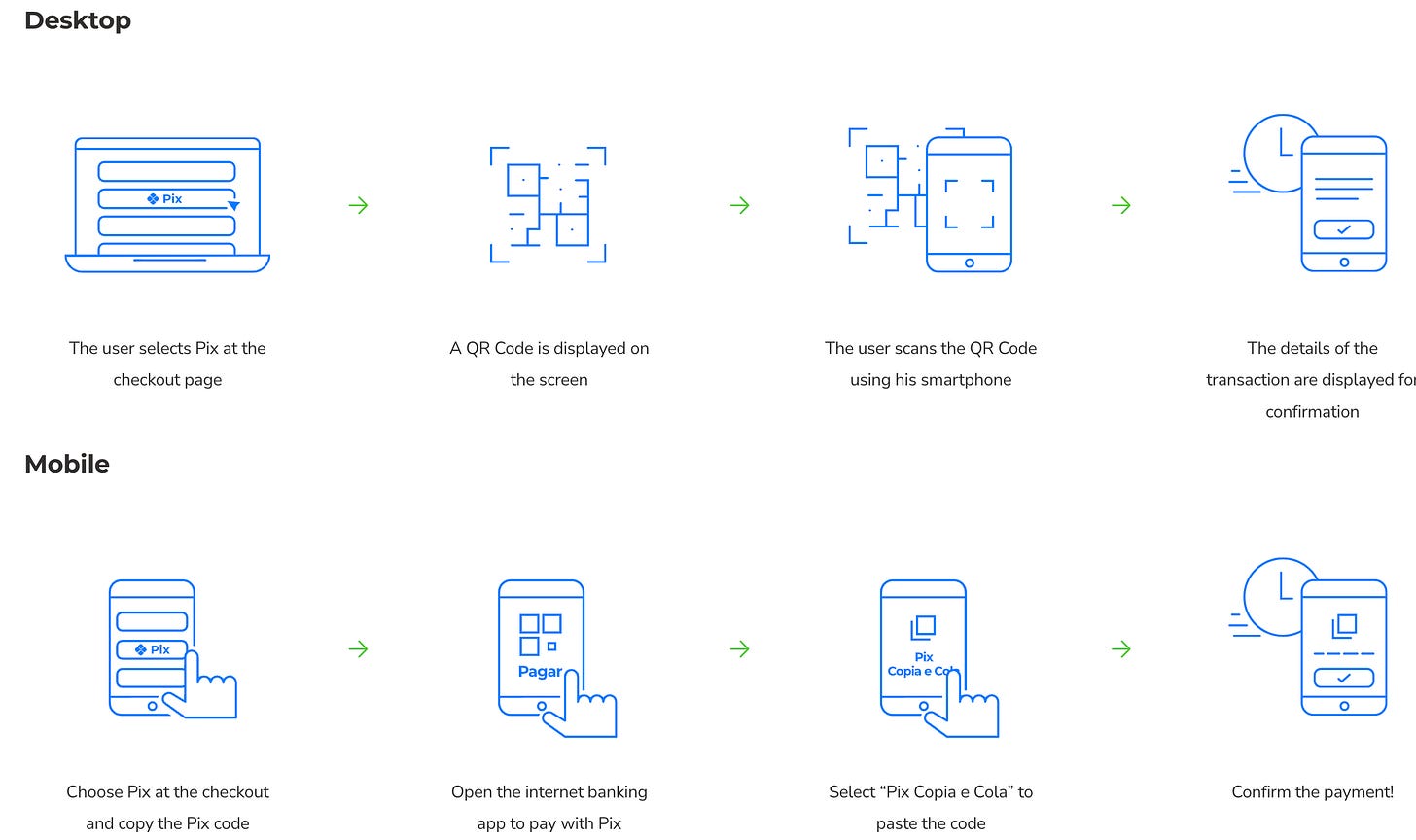

FedNow's grandiose entrance into the deceivingly saturated chasm of the payment industry signals its ambition to become the ultimate all-in-one solution for financial institutions across the US. A similar trend can be observed with Pix in Brazil, a payment method developed by the Central Bank of Brazil that enables transactions to occur in less than 10 seconds, any day, any time.

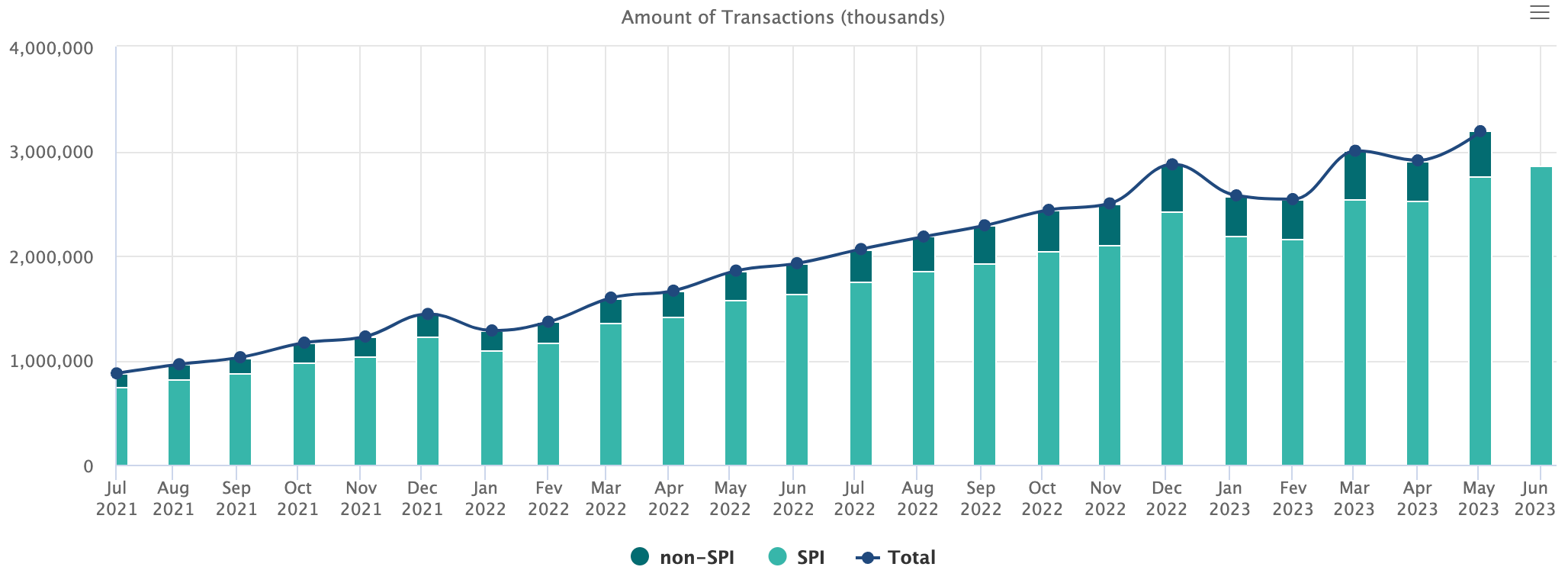

Pix made waves after its launch in November 2020, outperforming debit and credit transactions within one year. Within six months, Pix catered to nearly 120MM consumers, becoming a favorite among 70% of Brazilian adults and 60% of businesses. The platform now handles 3B transactions per month.

In contrast, the US has a different tale. Before FedNow, RTP held the fort for instant payments, but its usage remained relatively low. Despite 300 banks participating, RTP's volume is just 150MM transactions per month, less than 5% of the volume seen in Brazil. Possible reason? The US consumer's strong preference for credit cards and their addictive loyalty programs.

Opinions on FedNow are sharply divided — with some viewing it as a potential threat to freedom, while others hail it as a commendable technological initiative. In Brave New World, the World State wields a state-controlled payment network to regulate and manipulate the populace's behavior and consumption, something that is a fear of CBDC opponents around the world. That’s likely overblown.

We think that this payments infrastructure is a boon to financial services, and sorely needed, helping the US catch up with Pix and open banking across Europe and the UK, as well as WeChat in the East. Most likely, wires and ACH will be in part replaced by instant payments. Card networks may be threatened to some extent where embedded finance integrations are concerned, but long term credit card usage is unlikely to decline. As it relates to crypto, FedNow is not tokenized or programmable money, and to that end does not play in the same arena as stablecoins or protocol currency.

👑Related Coverage👑

LENDING: Fintech Lender TP24 Secures £345MM For SME Revolving Credit (link here)

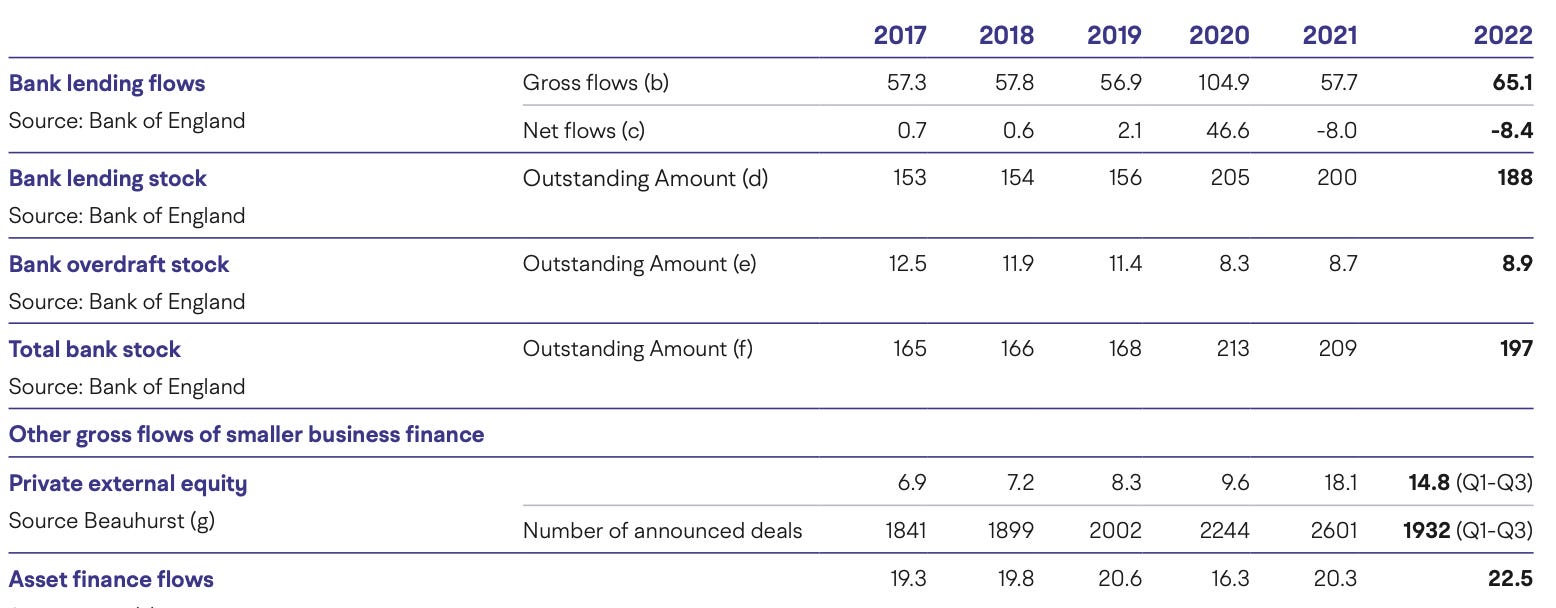

Fintech lender TP24 raised £345MM in debt funding, led by Barclays and M&G Investments, to offer flexible credit solutions to small-and-medium-sized enterprises (SMEs) across the UK, Netherlands, and Australia. The funding package comprises £200MM in warehouse financing from Barclays and £40MM in mezzanine funding from M&G. Moreover, Barclays has allocated an additional £105MM to facilitate lending operations tailored to SMEs in Australia.

TP24's CreditLine offers asset-backed lending for B2B SMEs. Specifically, it allows SMEs to use their receivables as collateral — the revolving line of credit is calculated against an SME's debtor portfolio (B2B invoices), providing working capital. Eligible UK SMEs can access flexible revolving loans from £250,000 to £5MM if they have been operational for three years and have a debtor base of over £350,000.

During times of crisis, smaller companies often need help accessing liquid cash, the lack of which hinders their ability to operate effectively and efficiently. A recent World Economic Forum report on SMEs emphasized that in 2022, the top concerns for SMEs were survival and expansion (67%) and funding and access to capital (24%). In this context, TP24's CreditLine system emerges as a welcome solution for SMEs with limited credit history, offering an alternative to those who do not meet more stringent criteria of traditional bank loans.

While some research suggests that firms accessing P2B (peer-to-business) loans are often “high-quality” firms with access to bank financing, it is useful to remember that banks, including those like Silicon Valley Bank (SVB) that cater to specific sectors, are not immune to macroeconomic fluctuations. The collapse of SVB exposed its specific niche of business customers to external shocks, disrupting their operations and underscoring the importance of alternative financial solutions.

In the UK, fintech lenders like TP24, OakNorth, and iwoca excel in providing swift loan approvals, often taking only 24 hours to process applications. OakNorth provides instant credit analysis and real-time portfolio insights, and iwoca specializes in microlending for small businesses. However, there are trade-offs.

While fintech lenders offer prompt and flexible financing options, they often come with higher interest rates. For instance, iwoca's annual interest rate hovers around 40%. Similarly, TP24 imposes a yearly interest rate, a one-off upfront fee based on the approved credit amount, and a facility fee that on a combined basis can be far in excess of a traditional bank APR. In contrast, traditional players like HSBC and Barclays offer small business loans at lower APRs, 7.1% and 10.4% respectively (albeit for only £25,000). And yet, despite these more competitive rates, 75% of SMEs with working capital needs opt for digital-only banks as their primary financial institution.

New entrants always lean into faster approval times, more permissive lending practices, and alternative data. Sometimes that leads to lower interest rates, like in Krea's collaboration with Klarna Kosma, Klarna's platform for banks and fintechs, where Swedish SMEs received loan offers that were 15% larger and carried a 4% lower interest rate than the market. That said, there are plenty of cautionary tales of fintechs blowing themselves up through poor underwriting and missing a credit cycle (e.g., OnDecK). Only time will tell.

👑Related Coverage👑

Blueprint Deep Dives

LONG TAKE: Growing financial engagement with messaging in Coinbase Wallet, Venmo, and the super apps (link here)

The intersection of finance and technology has led to innovative ways of mixing attention, commerce, and finance, epitomized by entities like Shopify and Venmo. The success of these platforms hinges on understanding how to mix engagement and financial product within their business model. Crucially, financial services are moving beyond being just transactional machines, by increasing user engagement and developing strategies to improve customer retention. The next frontier, as highlighted by Coinbase's integration of the XMTP protocol for messaging, is developing a persistent digital identity for users, emphasizing the growing significance of interoperability and privacy in the evolving world of Web3.

PODCAST CONVERSATION: How to build an investment fintech with over 3 million members, with Public Founder Leif Abraham (link here)

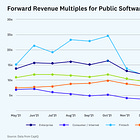

In this conversation, we chat with Leif Abraham - co-CEO and Founder of Public, an investing platform used by millions and valued at over $1.2 billion. Founded in 2019, Public now serves 3+ million customers and has raised hundreds of millions of dollars from Greycroft, Accel, Lake Star, Tiger Global, and many more. The company has quickly risen to become one of the most popular financial applications in the United States by blending stock trading, crypto investing, and community discussions. The recent acquisition of Otis suggests the company will enable fractional investing in assets like cars, art, and NFTs in short order.

Before Public, Leif was the founder and CEO of a business called AND CO, a SaaS platform for freelancers. AND CO was acquired by Fiverr to become Fiverr Marketplace in 2018. To round off the serial nature to Leif’s entrepreneurial journey to date, prior to AND CO, Leif founded ‘Pay With a Tweet’ - a novel software solution that allows users to provide digital content on websites for the price of a social media share - which was acquired by HanseVentures in 2013, and again acquired by Aklamio in 2017.

Curated Updates

Here are the rest of the updates hitting our radar.

Neobanks

⭐ bunq Hits 9MM Users In Europe, Doubles Deposits In Four Months - Altfi & Neobank bunq Launches Cash Back And Savings Interest - PYMNTS

Acquisition Of PAYPT Finance Ltd - GST Technologies

BaFin Extends AML Controls At N26 - Finextra

Myanmar’s Shadow Government Backs Launch Of Crypto-based Bank - Cointelegraph

Payments

⭐ Thunes Extends Its Series C To $72MM With Visa Backing - Altfi

Paytm Revenue Climbs 39% As Mobile Payments Become More Mainstream - PYMNTS

Mondu Partners With Acquired.com To Bring Its B2B Payment Services To More European Businesses - Acquired

Digital Investing

⭐ Allfunds Launches Private Asset Investments Platform - Fund Selector Asia

LendInvest Co-founder Christian Faes Launches US-based “Fix and Flip” Lender - Altfi

FusionIQ Integrates With Wealth Management Platform Blueleaf - Fintech Futures

Savvy Wealth Unveils Fully Integrated, AI-Powered Advisor Platform Designed For Modern Financial Advisors - Businesswire

Kuflink Gets £35MM Institutional Debt Funding - Mortgage Professional America

AI

⭐ Meta and Microsoft Introduce The Next Generation Of Llama - Meta

⭐ Unstructured, Which Offers Tools To Prep Enterprise Data For LLMs, Raises $25MM - TechCrunch

FedML Raises $11.5MM To Combine MLOps Tools With Decentralized AI Compute Network - Medium

Hammerspace Nabs $56MM For Its Data Orchestration Platform - SiliconANGLE

Sam Altman’s Worldcoin Eyeball-scanning Crypto Project Launches - TechCrunch

Shape your Future

Wondering what’s shaping the future of Fintech, Digital Wealth and Web3?

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete in Fintech.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Monday Fintech Short Takes, with weekly coverage of the latest fintech, digital investing, banking, and payments news via expert curation and in-depth analysis

Wednesday Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Thursday DeFi Short Takes, weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Access to the Podcasts with industry leaders on building leading companies in Fintech and DeFi along with value-added data-driven, annotated transcripts

Full library of the weekly in-depth write-ups on 15+ topics and 50+ Fintech and DeFi brands, offering deep, comprehensive, and insightful analysis without shilling or marketing narratives

Exclusive Deep Dive reports into Fintech business models and brands that transform the Fintech and DeFi space

Access to our CEO & Founder focused 'Building Company Playbook' series, offering insider tips and advice on constructing successful fintech ventures.