Fintech: Will KlarnaUSD save the BNPL lender's falling share price post IPO?

A bumpy shift away from interest free loans

Hi Fintech Futurists —

BNPL lender Klarna recently joined the string of payments giants unveiling their stablecoin plans. The company announced Klarna USD, its own dollar stablecoin issued by Bridge (acq. by Stripe) which will initially be used to manage internal treasury operations.

Today’s agenda below.

FINTECH: Can KlarnaUSD save the BNPL lender’s falling share price?

ANALYSIS: The Rise of Robot Money 🤖💰 (link here)

CURATED UPDATES: Paytech, Neobanks, Lending, Digital Investing

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below (if you haven’t yet).

Our Ecosystem: AI Venture Fund | AI Research | Lex Linkedin & Twitter | Sponsors

Digital Investment & Banking Short Takes

Can KlarnaUSD save the BNPL lender’s falling share price?

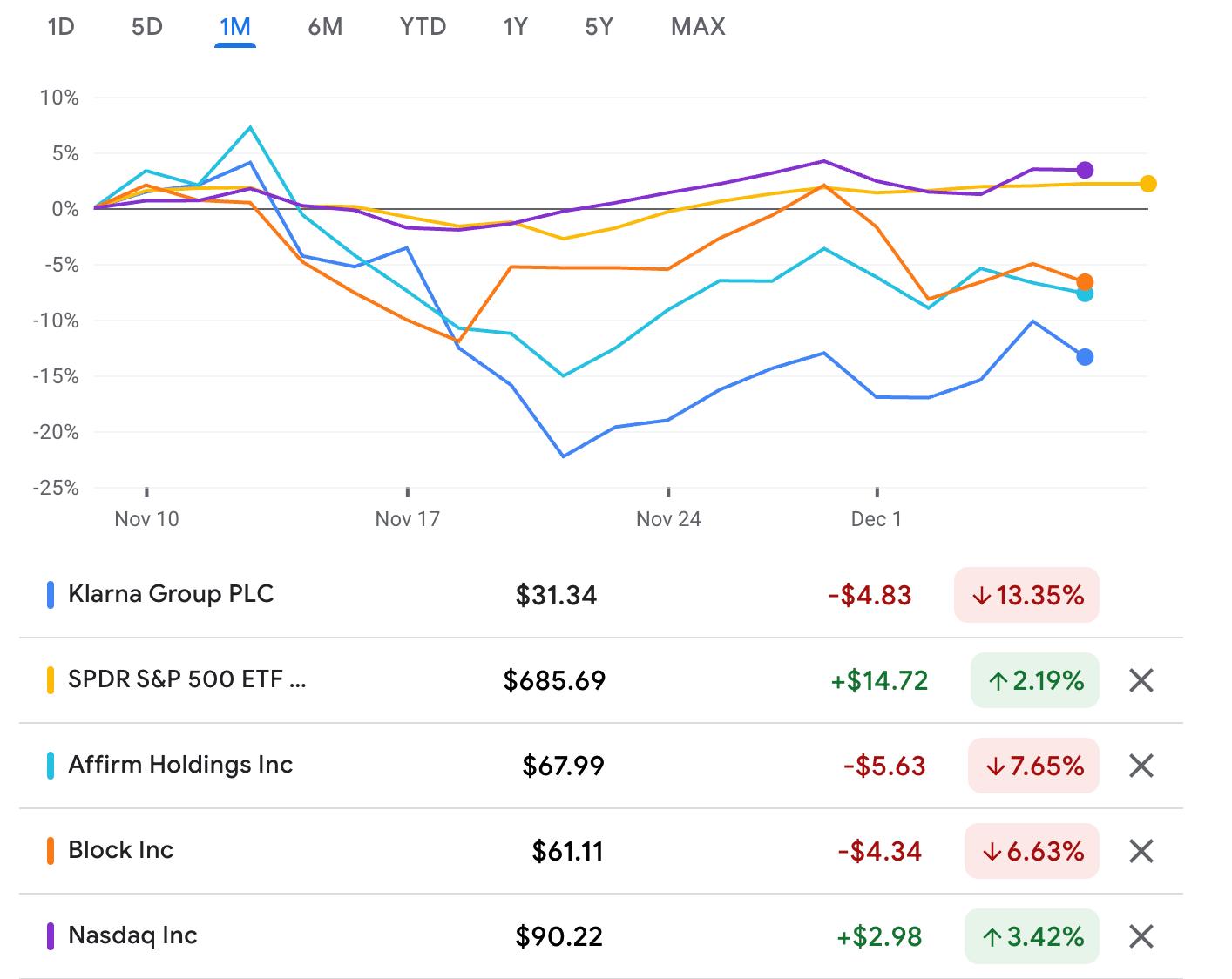

Klarna is fresh off its public listing in September, but the stock has struggled and is down 30% since IPO.

When we last covered Klarna in the Summer, it showed strong revenue growth and profitability, but we warned of higher losses in the US and intensifying competition. This week, we look into what has changed since our previous analysis, what the company’s latest bet on stablecoins represents, and whether we expect a turnaround in the near term.

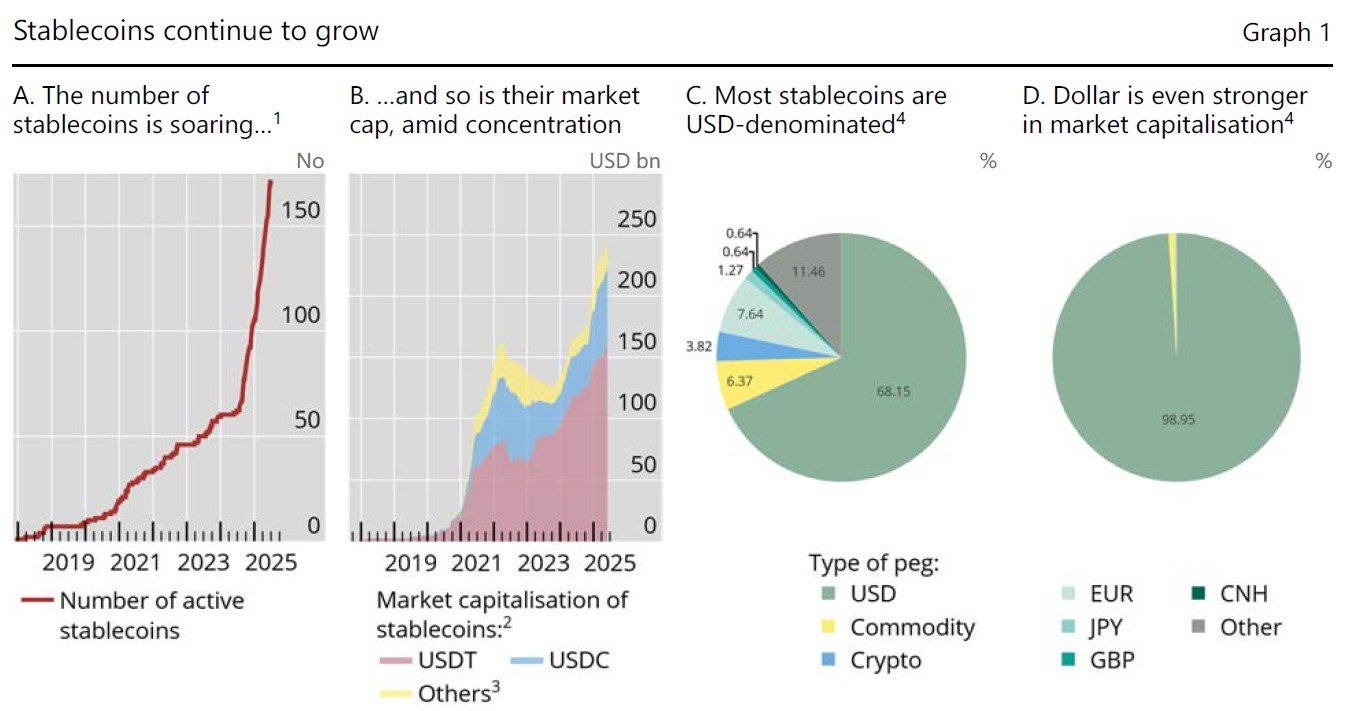

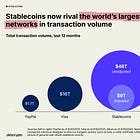

2025 is undoubtedly the year that stablecoins became mainstream. Total supply is up +47% YoY on the back of regulatory clarity and a subsequent spur in institutional adoption. Traditional payments players are dipping their toes into each stage of the stablecoin value chain, from issuance (e.g. Stripe and Bridge) to orchestration middleware (e.g. Mastercard and Zerohash) and plain distribution plays (Paypal’s PYUSD with Paxos).

The below diagram from the BIS summarizes the space well.

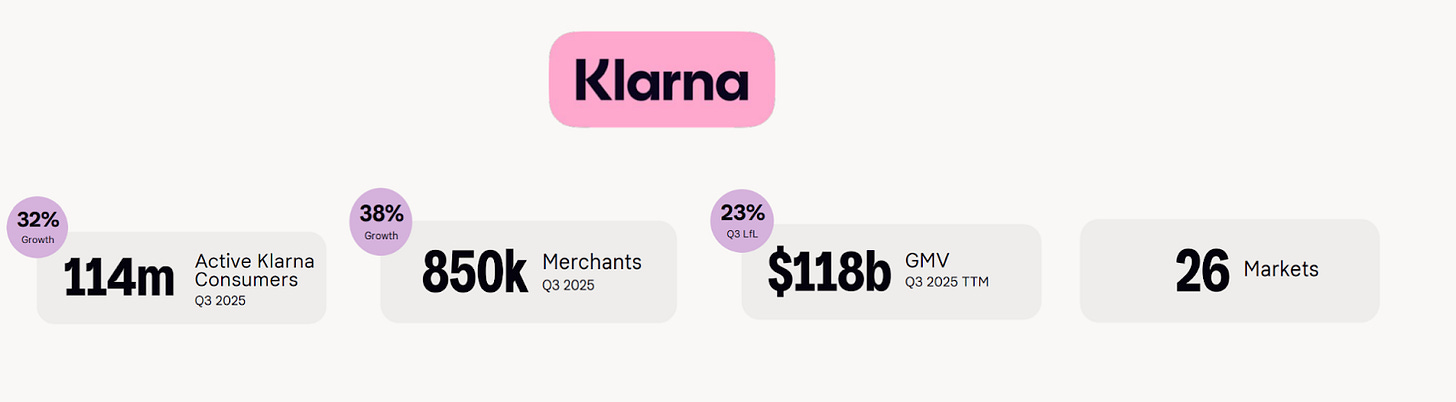

As a result, the number of active stablecoins grew from around ~60 to nearly ~200 this year alone. KlarnaUSD is the most recent example and will be piloted in Klarna’s treasury operations to free up more working capital. As a reminder, the BNPL company specialises in offering short-term, primarily interest-free loans to customers at checkout, enabling merchants to sell more and giving customers a flexible payment option. In its recent Q3 results, Klarna reported an annual $120B GMV from a whopping 120 million customers in over 25 markets worldwide.

Behind the scenes, Klarna’ treasury team frequently moves USD capital between its bank accounts inside the US and abroad to manage liquidity in the most efficient way. This currently relies on SWIFT messages, with those messages eventually reaching US banks that rely on wire transfers between Klarna’s US accounts. This can take 1-5 days to settle compared to near instant settlement with stablecoins, resulting in more working capital being available faster than the status quo.

While currently limited to internal operations, we believe KlarnaUSD will be gradually rolled out across its 850K merchant network, enabling purchases to settle instantly in retailers’ bank accounts. Klarna has built its stablecoin offering in close collaboration with Stripe, which has rapidly built towards a vertically integrated stablecoin stack in the past year, including issuance and the underlying blockchain rails. KlarnaUSD is issued by Bridge (acq. by Stripe) and lives on Stripe’s own new Layer 1 blockchain Tempo. With Klarna already part of Stripe’s checkout suite since 2019, these merchants will be a natural testing ground for stablecoin payments.

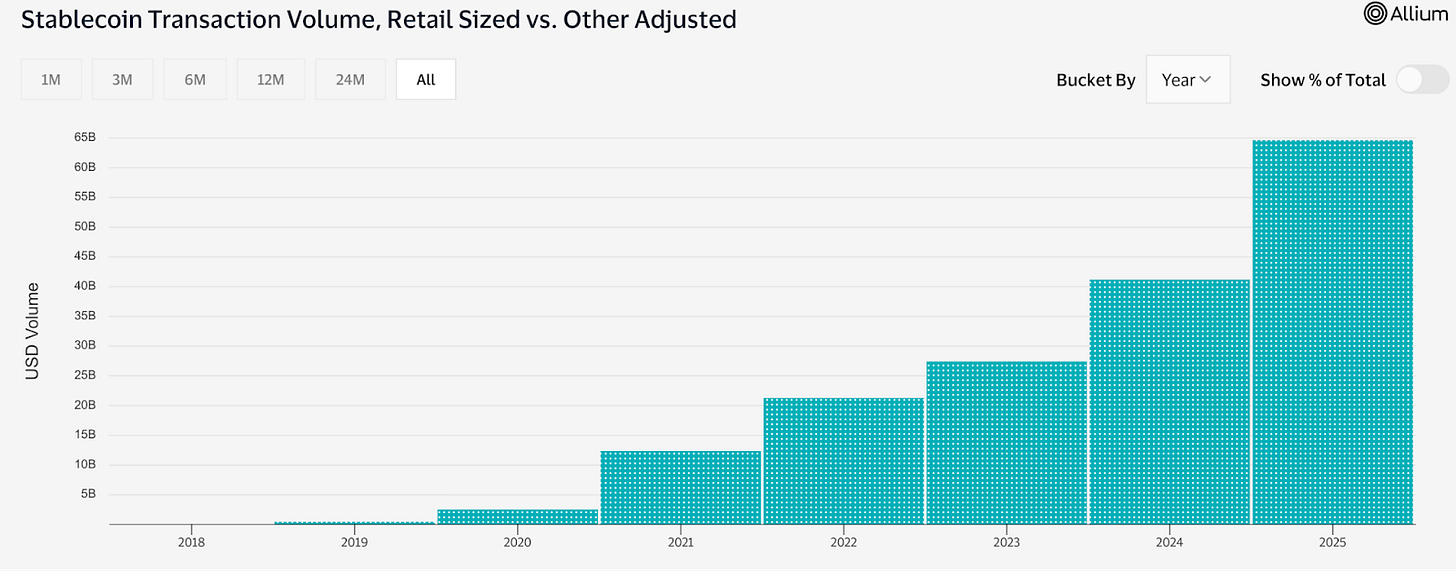

The plumbing appears to be in place, but we are yet to see stablecoins penetrate traditional retail volumes in a meaningful way. Visa estimates annual stablecoin transaction volumes reached $10.6T so far this year, but only $65B (<1%) of those are retail-sized transactions.

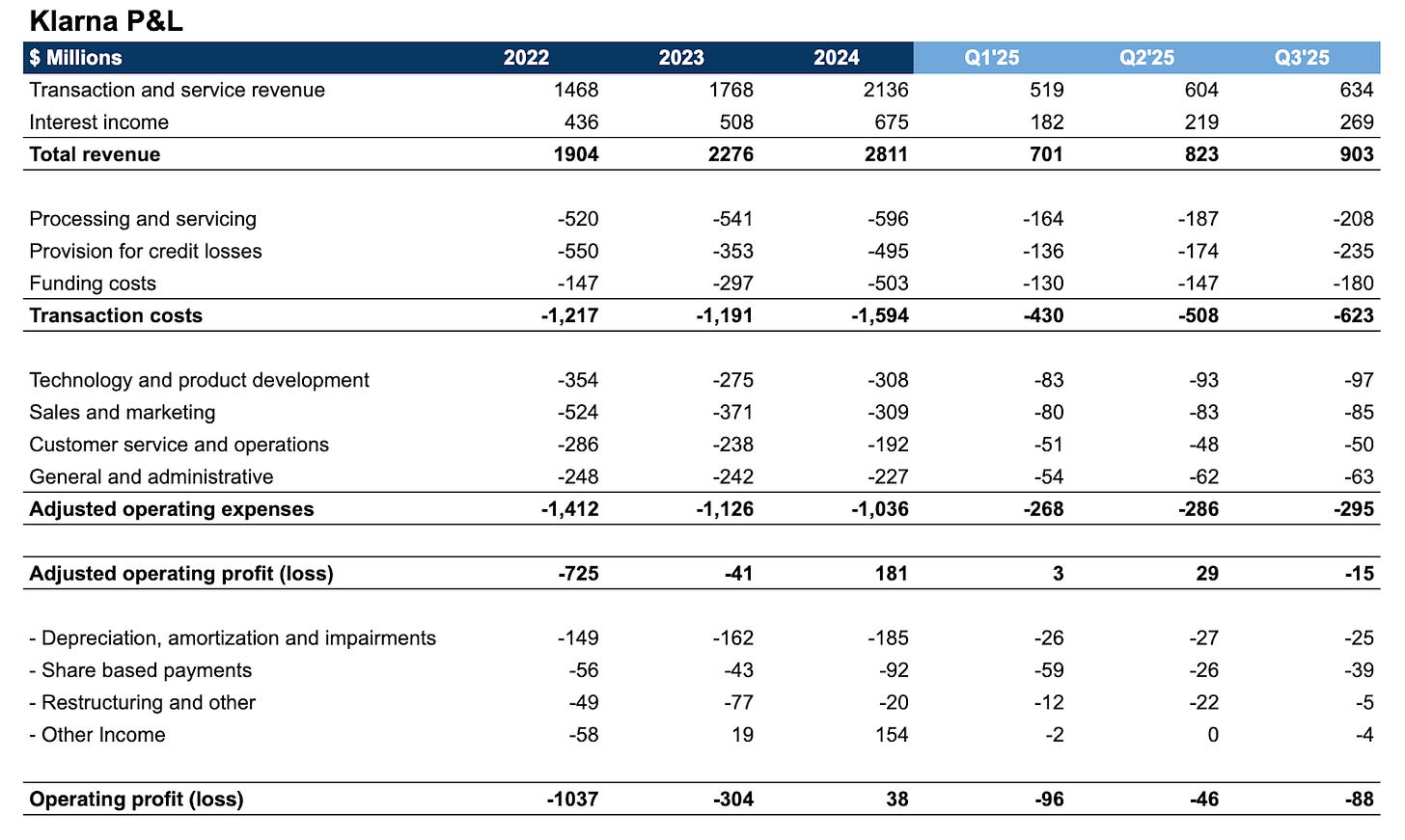

Meanwhile, Klarna’s recent Q3 results revealed it may have more pressing issues in the near term. The company posted a loss of $88MM last quarter, almost doubling from 2Q25, on the back of a hefty provision for credit losses. This offset a 10% QoQ growth in revenues and sent its stock plunging down -10% on the day.

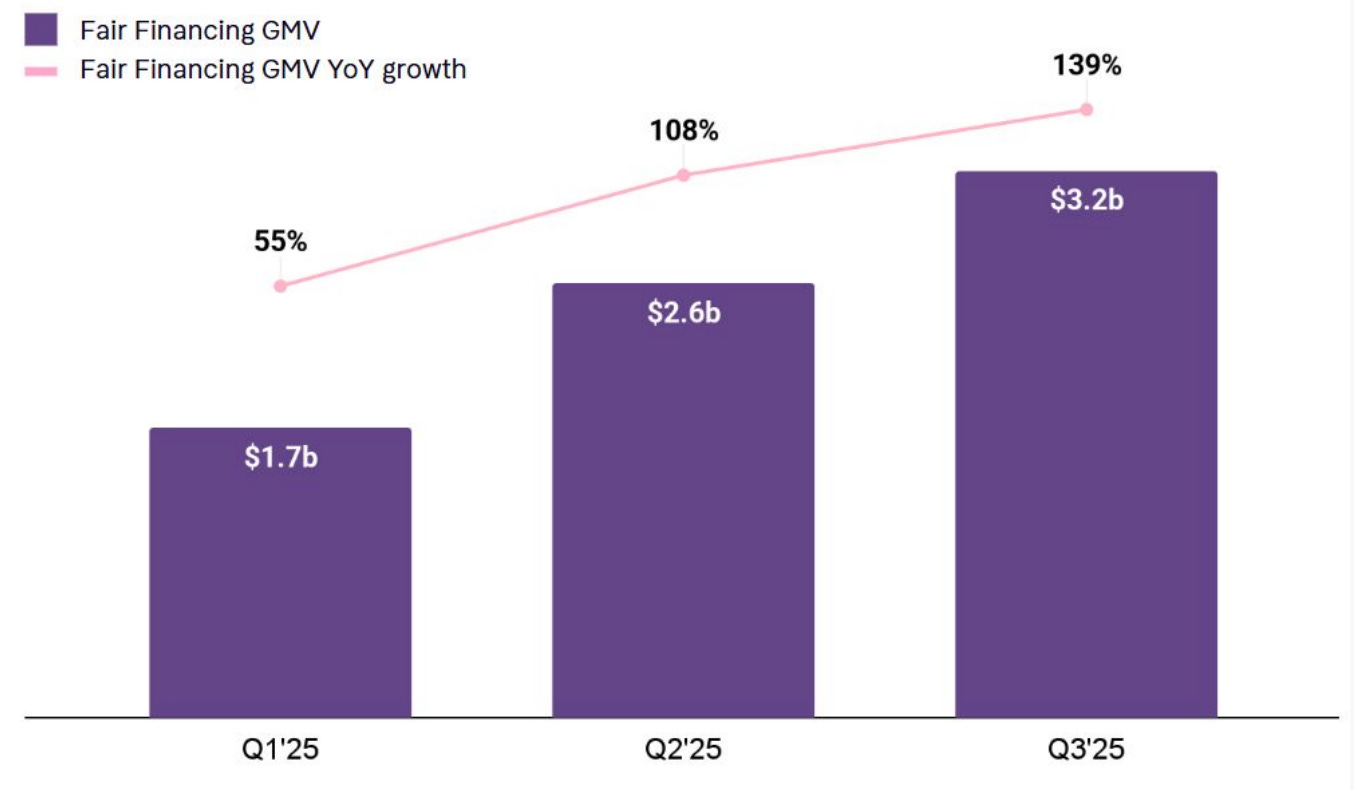

At the root of the issue is the company’s Fair Financing product, enabling customers to take on longer-duration loans while unlocking a new interest income stream for Klarna. Last quarter, 10% of customer volumes were financed via Fair Financing, up from 5% last year. Interest income is up +23% QoQ, but the company also has to provision for the portion of loans it thinks customers won’t pay back.

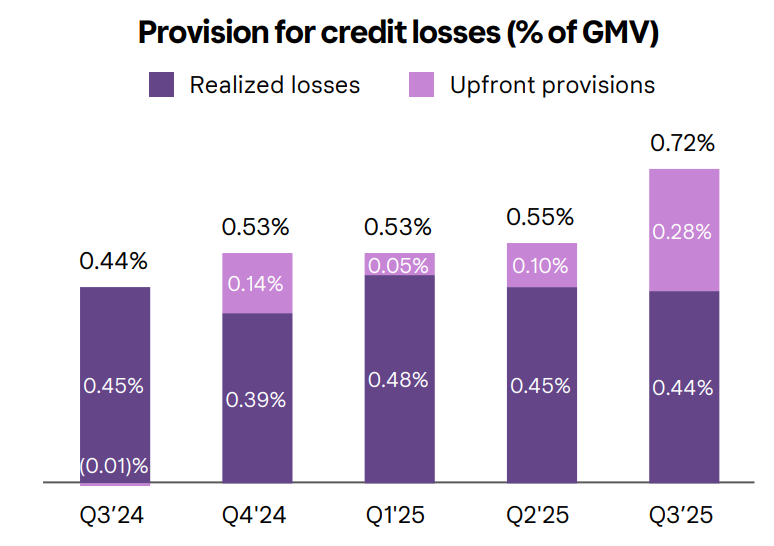

Longer duration loans typically have a higher risk of credit loss, meaning a shift in Klarna’s lending book towards Fair Financing results in larger provisions over time. This chart below shows this dynamic playing out. Last quarter, its provision for credit losses was 0.72% of GMV, up from 0.55% in June. This change of roughly $235MM, directly hits Klarna’s P&L as an expense.

All being well, the new loans Klarna is originating will deliver new interest income over time as customers make their monthly payments, but accounting rules demand that the provision is realised upfront. The company argues that this is what causes the apparent drag on profitability, which should normalise over time as growth becomes more stable.

The risk for investors is that Klarna books larger losses than expected in this relatively newer segment. A longer-duration loan book also makes it more sensitive to economic cycles, in the same way that a 10-year government bond is more sensitive to interest rate expectations than a 30 day one. The market turmoil of the past few weeks may have played into this perception among investors. The stock underperformed most major competitors like Affirm and Block in the last month.

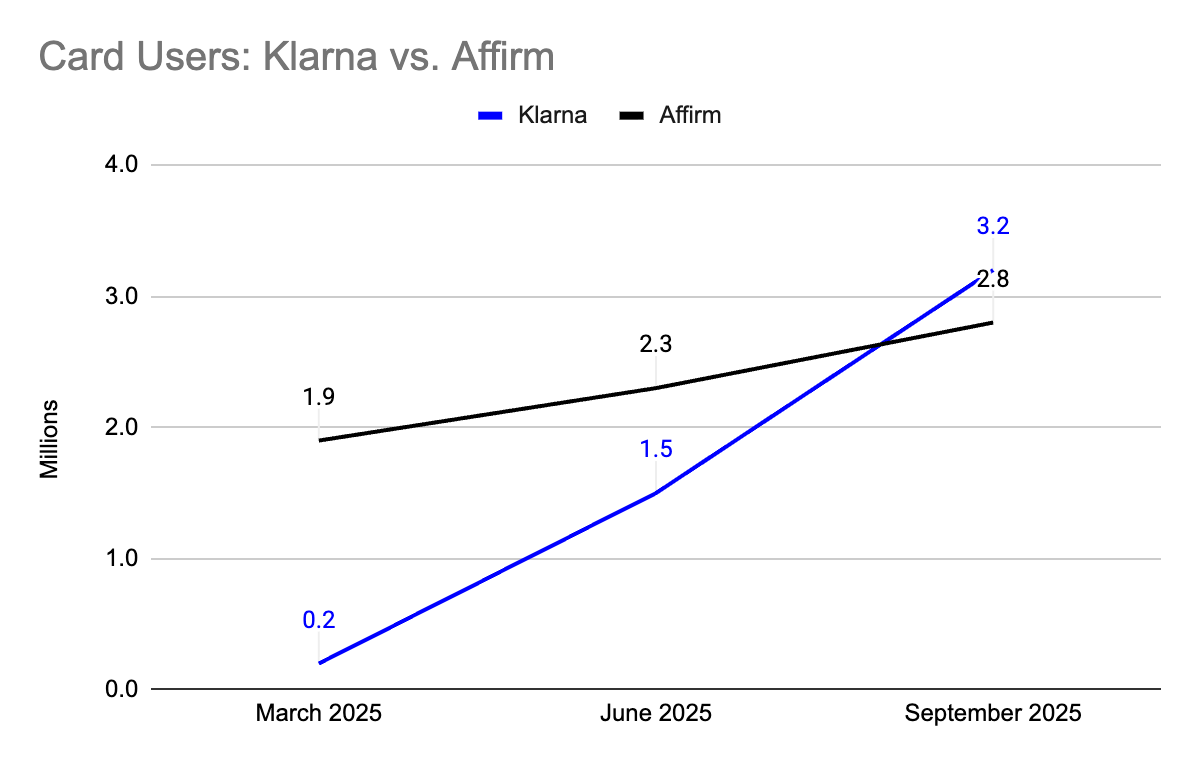

Klarna’s longer-term bet is to turn its mobile shopping app into a fully fledged neobank. The company launched its debit card offering in the US this Summer and has reached 1.4MM customers in under 6 months, bringing total card users to 3.2MM. Affirm has pursued a similar strategy and experienced slower, albeit positive, growth in comparison with total card users at 2.8MM.

Klarna Card made up just 1.7% of total GMV volumes, meaning there is significant room for growth. Converting more users onto its shopping (and now banking) app is compelling because it unlocks growth in new revenue streams like subscriptions and advertising. According to Klarna, its average annual revenue per card user is $130 compared to the $28 across its total users.

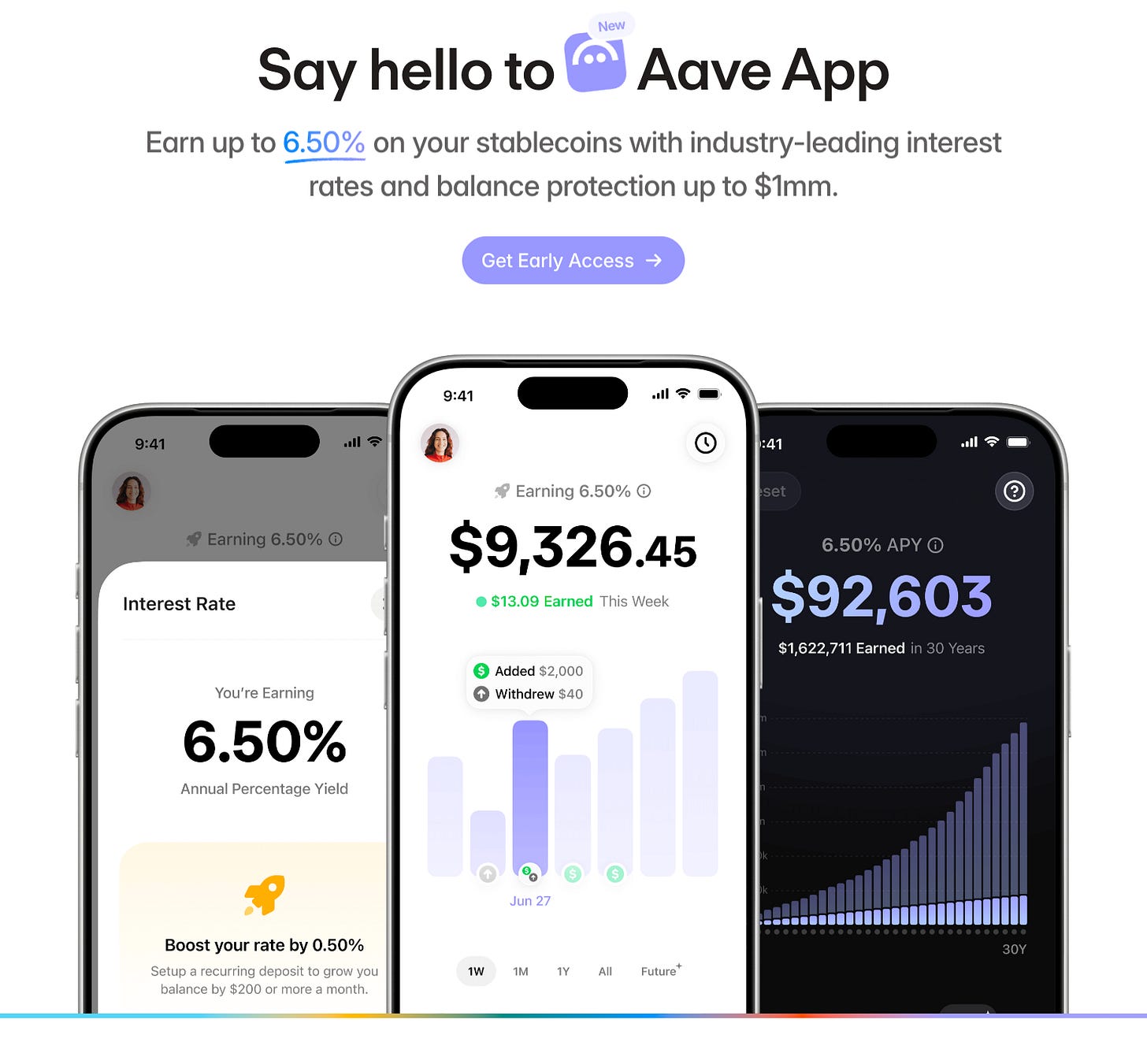

This could also present a future opportunity for Klarna to shift user balances into its new KlarnaUSD stablecoin, potentially providing merchants with faster settlement while enabling access to competitive DeFi products for users. On-chain lending yields often range between 5-12% APY, much higher than typical bank rates and can be accessed instantly. We covered this topic in detail last month but warned that important regulation is still lacking.

The early positioning is valuable nonetheless. Both neobanks and on-chain protocols are starting to build banking experiences that unify traditional and DeFi rails. Revolut and Cash App have both recently introduced free USDC on-ramps for their customer base. Aave, the largest decentralised lending protocol, also launched its own savings app abstracting away a lot of crypto complexity to compete with fintech offerings.

Klarna’s stablecoin strategy is still quite conservative in comparison. Even if it enables users to hold KlarnaUSD, it currently only lives on Stripe’s Tempo blockchain which lacks a large DeFi ecosystem. But this could change quickly if regulation and guidelines improve — as we have seen with stablecoins more broadly this year.

👑 Related Coverage 👑

Long Take: Robot Money

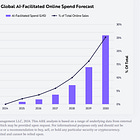

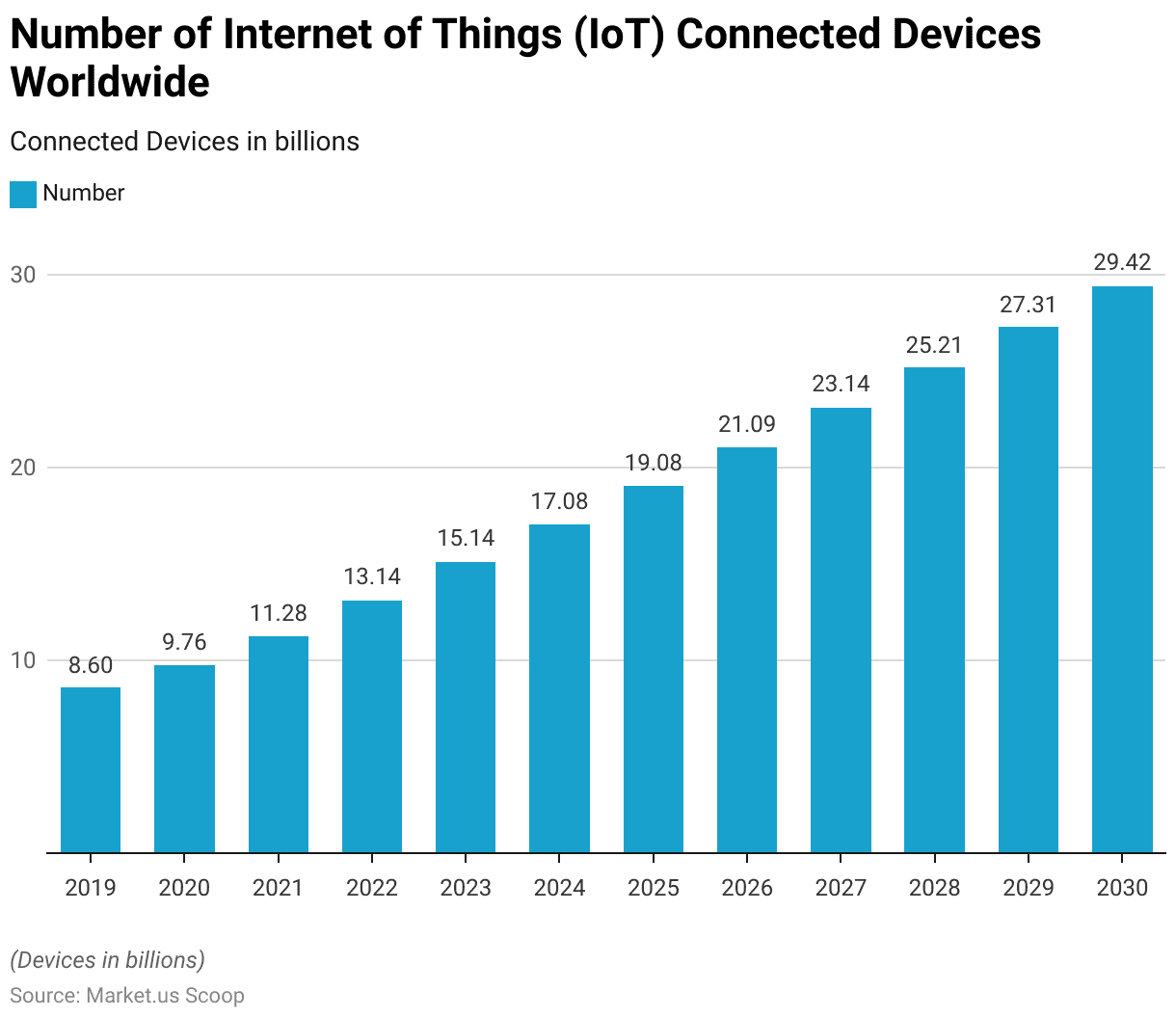

We discuss how the machine economy has already surpassed humanity in scale, with connected devices, AI agents, and automated systems outnumbering and outperforming human labor. We explain that economic value is increasingly accruing to owners of machines and digital capital rather than to human workers, consistent with decades of research on capital–labor dynamics and the observed stagnation in human-driven GDP.

We show that nearly all incremental global enterprise value since 2015 has come from the machine economy: AI mega-caps adding $17T at 20% CAGR, crypto assets adding $3T at 70% CAGR, while major national markets like Germany, France, and the UK produced little new net value.

Ultimately, we argue that robot money, AI agents, and emerging ownership structures for autonomous systems define the frontier — and that whoever owns the robots will rule the world.

Curated Updates

Here are the rest of the updates hitting our radar.

Paytech

⭐ Airwallex raises $330 million at a valuation of $8 billion - Finextra

European banks led by BNP, ING push ahead on euro stablecoin plan - Reuters

Neobanks

Revolut opens waitlist for ultra-premium corporate card - Finextra

Monzo tops 14m customers - Finextra

Kraken to launch debit card for crypto and cash payments - FSTech

Lending

McKinsey Says Bank Profits Face Possible $170 Billion AI Hit- Bloomberg

Coinbase Launches Savings Account in the UK - Coinbase

Digital Investing

⭐ Kraken Acquires Backed Finance in Tokenization Push - Bloomberg

Wealthfront’s IPO Terms Could Send Market Cap Above $2 Billion - MarketWatch

Citi completes live pilot for crypto custody on Ethereum - GlobalCustodian

🚀 Level Up

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career. Get access to Long Takes, archives, and special reports.

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our AI newsletter, the Future Blueprint, 👉 here.

Read our Disclaimer here — this newsletter does not provide investment advice